- Home

- »

- Pharmaceuticals

- »

-

Immune Health Supplements Market Size Report, 2030GVR Report cover

![Immune Health Supplements Market Size, Share & Trends Report]()

Immune Health Supplements Market Size, Share & Trends Analysis Report By Product, By Form, By Application, By Mode Of Medication, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-548-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Immune Health Supplements Market Trends

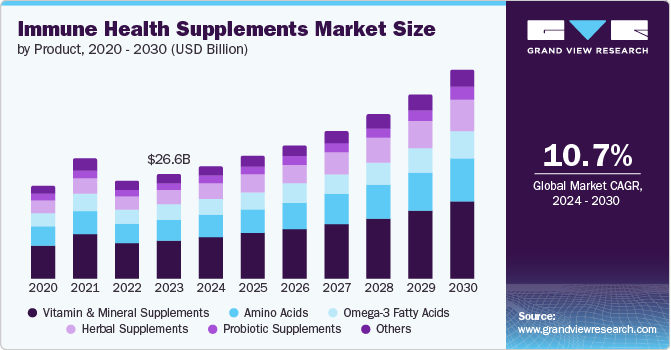

The global immune health supplements market size was estimated at USD 26.60 billion in 2023 and is projected to grow at a CAGR of 10.72% from 2024 to 2030. The key factors driving market growth include the increasing prevalence of infectious diseases, diabetes, and several other disorders due to lack of immunity. In recent years, there is a constant trend observed about the increase in supplement usage to improve the body's immunity all over the globe.

The COVID19 outbreak has had a positive impact on market growth. The regions, such as North America, Europe, and the Asia Pacific, have been highly affected due to the COVID19 pandemic. The countries, such as the U.S., UK, India, Russia, France, having the highest number of COVID19 cases. A large population and the increasing adoption of supplements to increase the body's immune system in these regions are anticipated to drive the market over the forecast years.

Due to the COVID19 pandemic, there is significant consumer interest in the use of immune health supplements. In 2019, according to the Council for Responsible Nutrition (CRN), about 73% of Americans consume dietary supplements and from that, about 32% are consuming the dietary supplements to improve their immune health. Increasing consumer awareness to maintain and improve immune health and wellbeing is expected to drive the market over the forecast years.

Moreover, supplement products, such as vitamins, minerals, herbal products, and probiotics, for boosting immunity have witnessed a high demand in recent years. Population across the globe is now more conscious about their immune health and quality of life. The rising aging population and the growing awareness among adult individuals to boost the body's immunity have increased the demand for immune health supplements that support market growth.

In addition, immune health supplements have a significant impact on enhancing the body's immune system and aid in the protection from various infectious diseases. Several studies show that diabetes has a direct correlation with the occurrence of chronic diseases. It also increases the risk of infectious disease. Hence, there is a growing interest in the consumption of supplements among diabetic patients to improve their immune system, which can provide a significant value to combat infectious diseases.

Furthermore, several manufacturers are now increasing their manufacturing capacity to fulfill the rising demand for immunity-boosting supplements. Manufacturers are also investing more towards the development of new immune health supplements to attract consumers. In 2019, Swisse Wellness, an Australian manufacturer, introduced an Immune Support Jelly contains Zinc, Elderberry, Selenium and Manuka Honey in an Orange Passionfruit flavor to boost healthy immune function.

Market Concentration & Characteristics

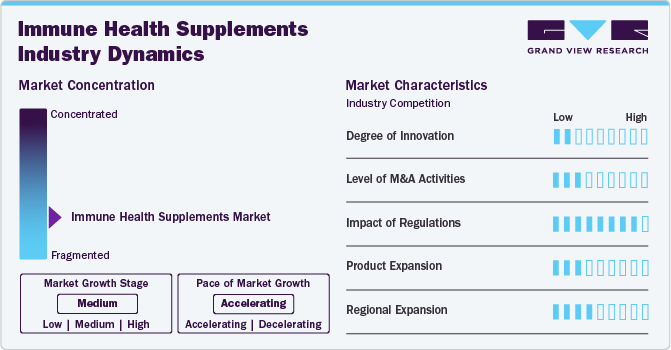

The industry is anticipated to experience a medium degree of innovation in the immune health supplements owing to several factors. Ongoing research and development efforts are leading to the introduction of new and improved formulations, including the incorporation of advanced delivery systems and novel ingredients. However, the pace of innovation may be moderated by stringent regulatory requirements and the need for extensive clinical testing to ensure product safety and efficacy.

The immune health supplements industry has seen a low level of merger and acquisition activity. This trend can be attributed to several factors, including the market's fragmentation and the presence of numerous small to mid-sized players, which makes large-scale consolidations less common.

Stringent regulatory frameworks ensure that products meet high standards of safety, quality, and efficacy, which is crucial for maintaining consumer trust and market credibility. Regulatory bodies often require extensive clinical testing and documentation to substantiate health claims, which can be time-consuming and costly for manufacturers.

The immune health supplements industry has been experiencing relatively low growth in terms of product expansion. One primary reason is the market saturation with a wide range of existing products, making it challenging for new offerings to differentiate. In addition, stringent regulatory requirements and the high cost of clinical trials needed to validate new product claims can deter companies from launching new products.

Regional expansion efforts are ongoing in the immune health supplements industry, at a moderate level owing to several factors. Companies are actively seeking to tap into emerging markets where health awareness is increasing and creating new opportunities for growth. However, the pace of expansion is moderated by the need to navigate diverse regulatory environments, which can be complex and time-consuming.

Product Insights

The vitamin & mineral supplement segment dominated the market and accounted for the largest revenue share of 37.44% in 2023. Increasing preference for supplements among consumers across the globe to boost their immunity is driving the segment. The proven health benefits and wide availability of vitamin C, D, B complex, multivitamins, and the minerals, such as zinc and selenium, in supporting the immune system propelling the segment growth. Vitamin C sales seem to be higher after the COVID-19 pandemic all over the globe. Due to the increasing awareness towards using preventive measures by the individuals is expected to accelerate the segment growth during forecast periods.

The herbal supplement segment is expected to witness a CAGR of over 11.80% during the forecast period. High demand among consumers to use herbal supplements over nutraceuticals to enhance the body’s immune health without any side effects driving the segment. Besides the rise in the vegan population is also anticipated to drive the segment over the forecast years.

Formulation Insights

The capsules segment dominated the market and accounted for the largest revenue share of 32.25% in 2023. This dominance is attributed to several factors, including their convenience, ease of consumption, precise dosage, and longer shelf life compared to other forms such as powders and liquids. Consumers often prefer capsules for their portability and the ability to mask the taste of certain ingredients. Thereby impelling the growth of the segment over the forecast period.

The tablets segment is expected to exhibit the fastest CAGR of 11.33% over the forecast period. Tablets offer precise dosing and are cost-effective to produce, making them an attractive option for both manufacturers and consumers. This is anticipated to propel the demand for the tablets over the forecast period.

Source Type Insights

The synthetic segment dominated the market and accounted for the largest revenue share in 2023. This is attributed primarily due to its cost-effectiveness, consistency in quality, and scalability in production. Synthetic supplements offer precise formulations and standardized dosages, making them a preferred choice for both consumers and manufacturers seeking reliable and affordable options. Thus, impelling the growth of the segment over the forecast period.

The natural segment is expected to exhibit the fastest CAGR over the forecast period. Increasing awareness of the potential health benefits and reduced side effects associated with natural supplements is driving demand. In addition, the rise in health consciousness and the desire for products free from synthetic additives are contributing to the segment's rapid growth.

Mode of Medication Insights

The self-medication segment dominated the market and accounted for the largest revenue share in 2023. The growing availability of information on health and wellness, coupled with easier access to a wide variety of supplements through online and offline channels, empowers consumers to make informed choices about their health. Thereby impelling the growth of the segment over the forecast period.

The prescription-based segment is expected to exhibit the fastest CAGR over the forecast period. Increasing awareness about the benefits of tailored and medically supervised supplementation is driving demand for prescription-based immune health supplements. Healthcare professionals are increasingly recommending these supplements to patients with specific health conditions or deficiencies, ensuring a more targeted and effective approach to boosting immune health. These factors are expected to boost the segmental growth over the forecast period.

Distribution Channel Insights

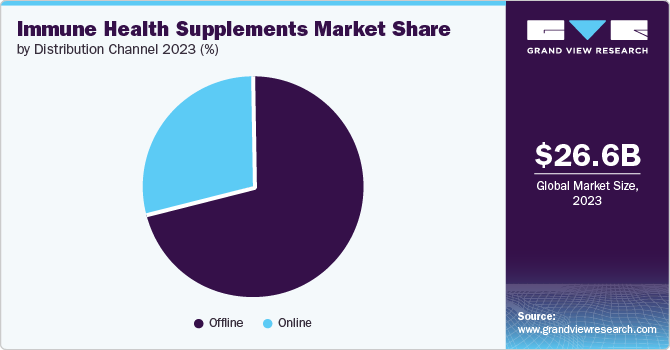

The offline segment dominated the market and accounted for the largest revenue share in 2023. Among offline segment, the pharmacies/drug stores segment dominated the market and accounted for the largest revenue share of 54.86% in 2023. Rising consumer preference and availability of a wide variety of products is expected to augment the highest sale of the products in pharmacies or drug stores. The supermarket/hypermarkets held significant revenue share in 2023 owing to high discounts and the availability of a wide range of products in North America and Europe regions. Besides, an increasing number of supermarkets in developing countries is also anticipated to drive the growth of the segment during the forecast years

The online segment is expected to witness a CAGR of 11.82% over the forecast period owing to the growing usage of e-commerce channels to purchase supplements. Furthermore, a rapid increase in the number of e-commerce vendors due to the COVID-19 pandemic is also expected to drive the segment over the forecast period.

Regional Insights

North America holds a significant the market and accounted for a 28.78% share in 2023. The region's high awareness of health and wellness, coupled with a strong focus on preventive healthcare, has led to increased consumption of immune health supplements. In addition, the presence of key market players, robust distribution channels, and a well-established regulatory framework for dietary supplements contribute to the market's growth. The rising prevalence of chronic diseases and an aging population further fuel demand, as consumers seek to enhance their immune systems to maintain overall health and well-being. These factors collectively are anticipated to propel market growth for immune health supplements over the forecast period.

U.S. Immune Health Supplements Market Trends

The immune health supplements market in the U.S. is expected to grow over the forecast period Increasing health awareness and the growing trend of preventive healthcare have led to higher demand for immune-boosting products.

Europe Immune Health Supplements Market Trends

Europe immune health supplements market was identified as a lucrative region in this industry. High consumer awareness about health and wellness, along with a strong focus on preventive healthcare, has driven demand for immune health supplements. The region's advanced healthcare infrastructure and stringent regulatory standards ensure the quality and safety of supplements, enhancing consumer trust.

The immune health supplements market in the UK is expected to grow over the forecast period. The rising prevalence of lifestyle-related health issues and an aging population are also contributing to the growth, as more people seek preventive health measures.

France immune health supplements market is anticipated to grow over the forecast period. Increasing consumer awareness about the benefits of immune health supplements, coupled with a rising interest in preventive healthcare, is driving demand.

The immune health supplements market in Germany is expected to grow over the forecast period driven by the aging population and the rise in lifestyle-related health issues. Furthermore, increasing health consciousness and a strong focus on preventive healthcare among consumers are major contributors to this growth.

Asia Pacific Immune Health Supplements Market Trends

Asia Pacific immune health supplements market dominated the market and is anticipated to continue grow at fastest rate of 11.40% from 2024 to 2030. This growth is driven by several factors, including increasing health awareness and a rising focus on preventive healthcare among consumers in the region. The growing middle-class population, along with higher disposable incomes, is also contributing to the increased spending on health supplements. In addition, rapid urbanization and the adoption of Western lifestyles have led to a higher prevalence of lifestyle-related diseases, prompting a greater emphasis on immune health. The market is further bolstered by advancements in supplement formulations and the growing popularity of natural and traditional remedies, which resonate well with consumers in the Asia Pacific region.

The immune health supplements market in China is expected to grow over the forecast period. the Chinese government's initiatives to promote health and wellness, along with favorable regulatory policies, are supporting market growth. The rapid expansion of e-commerce and improved distribution networks are making these supplements more accessible to a wider audience. Thus, propelling the demand for immune health supplements over the forecast period.

Japan immune health supplements market is anticipated to grow at a significant CAGR over the forecast period. The aging population in Japan is also a major factor, as older adults seek supplements to support their immune systems and overall health.

The immune health supplements market in India is anticipated to grow at a rapid rate over the forecast period. The prevalence of lifestyle-related diseases and a young, health-conscious population are driving demand for immune-boosting products.

Middle East and Africa Immune Health Supplements Market Trends

The immune health supplements market in the Middle East and Africa is expected to grow significantly owing to the increasing health consciousness and rising demand for preventive healthcare in the region. The growing prevalence of chronic diseases and an aging population are driving consumers to seek supplements that enhance their immune systems.

The immune health supplements market in Saudi Arabia is expected to grow over the forecast period. Increasing health awareness and a rising focus on preventive healthcare are driving demand for immune-boosting products.

Kuwait immune health supplements market is anticipated to witness growth over the forecast period. The growing prevalence of lifestyle-related diseases, such as diabetes and cardiovascular conditions, is driving more individuals to seek preventive health measures, including immune health supplements.

Key Immune Health Supplements Company Insights

Key players operating in the immune health supplements market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Immune Health Supplements Companies:

The following are the leading companies in the immune health supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Nature's Way

- NOW Foods

- Garden of Life

- Thorne Research

- Nordic Naturals

- Solaray

- Pure Encapsulations

- MegaFood

- Jarrow Formulas

- Life Extension

- Metagenics

- Xymogen

- Designs for Health

- Douglas Laboratories

- Bayer AG

- Standard Process

- Klaire Labs

- Integrative Therapeutics

- The Nature's Bounty Co.

- Amway, Co.

Recent Developments

-

In July 2024, Bayer announced the addition of One A Day Age Factor Cell Defense to its multivitamin and supplement range. This new product helps defend against cellular aging from the inside, supporting cell health and resilience as cells become less effective at managing everyday stressors throughout aging.

-

In May 2024, Bowmar Nutrition announces the launch of new supplements designed to support the immune system and overall health.

-

In October 2022, Bayer's consumer health division announced the launch of Supradyn Immuno+, a daily immunity booster that extends the Supradyn multivitamin supplement brand, offering properties that enhance both daily and long-term immunity needs.

Immune Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.67 billion

Revenue forecast in 2030

USD 52.81 billion

Growth rate

CAGR of 10.72% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, source type, mode of medication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Nature's Way; NOW Foods; Garden of Life; Thorne Research; Nordic Naturals; Solaray; Pure Encapsulations; MegaFood; Jarrow Formulas; Life Extension; Metagenics; Xymogen; Designs for Health; Douglas Laboratories; Bayer AG; Standard Process; Klaire Labs; Integrative Therapeutics; The Nature's Bounty Co.; Amway, Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immune Health Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global immune health supplements market report based on product, formulation, source type, mode of medication, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin & Mineral Supplements

-

Vitamin C Supplements

-

Vitamin D Supplements

-

Vitamin B complex Supplements

-

Multivitamins

-

Selenium Supplements

-

Zinc Supplements

-

Others

-

-

Amino Acids

-

Omega-3 Fatty Acids

-

Herbal Supplements

-

Probiotic Supplements

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Tablets

-

Powder

-

Liquid

-

Softgels

-

Others

-

-

Source Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Mode of Medication Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription-based

-

Self-medication

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Pharmacies & Drug Stores

-

Hypermarkets/Supermarkets

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global immune health supplements market size was estimated at USD 26.60 billion in 2023 and is expected to reach USD 28.67 billion in 2024.

b. The global immune health supplements market is expected to grow at a compound annual growth rate of 10.72% from 2024 to 2028 to reach USD 52.81 billion by 2030.

b. Asia Pacific dominated the immune health supplements market with a share of 35.23% in 2023. This is attributable to the highest consumer base for immunity supplements and growing awareness among individuals.

b. Some key players operating in the immune health supplements market include Nature's Way, NOW Foods, Garden of Life, Thorne Research, Nordic Naturals, Solaray, Pure Encapsulations, and MegaFood, among others.

b. Key factors that are driving the immune health supplements market growth include the rising prevalence of infectious disease, new product innovation by the manufacturers, shifting trend towards consumption of immunity-boosting products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."