- Home

- »

- Biotechnology

- »

-

Immunoprecipitation Market Size And Share Report, 2030GVR Report cover

![Immunoprecipitation Market Size, Share & Trends Report]()

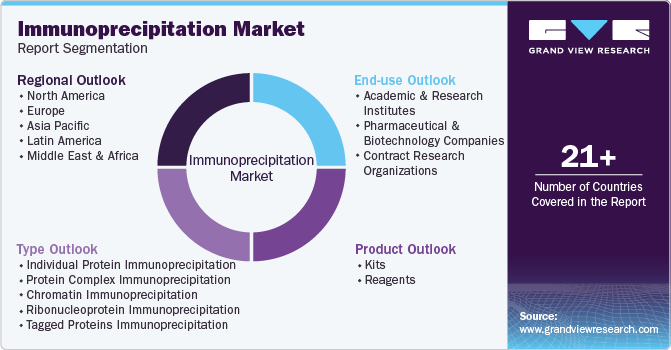

Immunoprecipitation Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Kits, Reagents), By Type, By End-use (Academic & Research Institutes, Pharma & Biotech Companies, CROs), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-017-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Immunoprecipitation Market Size & Trends

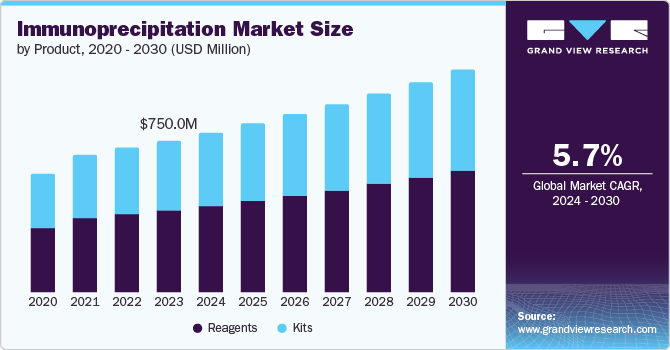

The global immunoprecipitation market size was valued at USD 750.0 million in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The increasing treatment of immunoprecipitation testing in central nervous disorders, cancer, and cardiovascular diseases has a positive influence on the immunoprecipitation testing market. In addition, the emerging trends in funding and investments by the government and private institutions for the research and development of next-generation DNA sequencing and genomics are driving market growth.

The steady increase in the incidence of cancers, tumors, and cardiovascular diseases are the primary factors driving the immunoprecipitation market growth. The need for antigen kits and vaccines as well as therapeutics is driving this expansion. Governments have also permitted the innovation of medical instruments, testing kits, and reagents during the pandemic, further fueling market growth.

The market is being driven by the rising investment in research and development in academia, pharmaceuticals, and biotechnology companies. Scientists and healthcare professionals are seeking to understand the underlying processes of various diseases by examining tissues and molecular pathways more accurately. This has led to advancements in genetics and targeted biological treatments, as well as increased spending on biopharmaceutical R&D activities.

Government regulations and initiatives are also having a positive impact on the immunoprecipitation market. With a focus on genomics, immunotherapy, and drug discovery, the market is poised for continued growth. As a result, immunoprecipitation is becoming an increasingly important tool for scientists and healthcare professionals working to develop new treatments and therapies for a range of diseases.

Product Insights

The reagents product segment dominated the immunoprecipitation market with a revenue share of 53.9% in 2023. The reagents segment is dominated by antibodies, which are used extensively for various immunoprecipitation techniques. The versatility of antibodies and the increasing adoption of immunoprecipitation methods for purifying antigen particles are key growth drivers. This variety allows researchers to select products tailored to their specific experiment requirements, enhancing the quality of their results.

The kits product segment is expected to register rapid growth between 2024 and 2030. The demand for immunoprecipitation kits is rising due to their ease of use, efficiency, and growing demand for advanced protein analysis in research and clinical settings. These kits simplify complex procedures, reducing the need for extensive training. Their ability to identify and separate specific proteins from complex mixtures drives demand, fueled by investments in life sciences R&D and technological advancements.

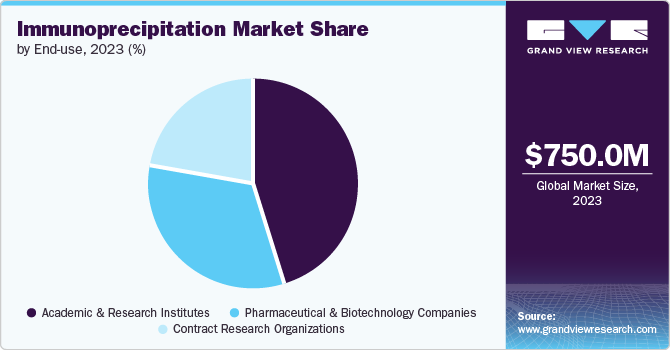

End-use Insights

The academic & research institutes segment dominated the immunoprecipitation market with a revenue share of 45.1% in 2023, fueled by increased R&D investments and funding from government grants, donations, and private organizations. Universities and colleges are utilizing these resources to acquire and develop cutting-edge technologies, including immunoprecipitation. This influx of funding enables them to advance research topics, driving innovation and expansion in the market.

The contract research organizations (CROs) are expected to register the fastest CAGR of 8.0% during the forecast period. CROs typically excel in various methods, including immunoprecipitation. With expertise in handling complex protein interactions, they can tailor procedures to optimize protein isolation. Outsourcing immunoprecipitation services to CROs can be a cost-effective solution for companies and research institutions, as it eliminates the need to establish an in-house laboratory and allows them to focus on core competencies.

Type Insights

The individual protein immunoprecipitation type segment dominated the immunoprecipitation market with a revenue share of 28.6% in 2023. Individual protein immunoprecipitation (IP) is a precise technique for isolating target proteins from complex solutions, enabling researchers to analyze protein interactions with high specificity. This technique’s adaptability allows for customization to meet experiment requirements, making it a popular choice for studies requiring precise control over protein isolation. Its precision and flexibility drive its widespread adoption in research applications.

The tagged protein’s immunoprecipitation is expected to register the fastest CAGR of 10.1% during the forecast period. This type enables researchers to achieve high specificity and selectivity in protein purification. By targeting and purifying the tagged receptor site, only the desired protein is isolated, resulting in high efficiency and accuracy. This technique’s versatility drives growth in the segment, making it a preferred method for researchers seeking precise protein analysis.

Regional Insights

North America immunoprecipitation market dominated the global immunoprecipitation market with a revenue share of 36.7% in 2023. This dominance can be attributed to factors such as increased expenditure by governments and the pharma and biotech firms in R&D and emergent trends including the personalization of medicines, coupled with the enhancement of the research partnerships between the industry players and the leading academic institutions.

U.S. Immunoprecipitation Market Trends

The immunoprecipitation market in the U.S. dominated the North America immunoprecipitation market with a revenue share of 71.8% in 2023. The U.S. is a world center for the development of biomedical research. The growing significance of research institutions, academic facilities, and biotech businesses in the locality makes the demand for better research tools such as immunoprecipitation reagents and kits higher.

Europe Immunoprecipitation Market Trends

Europe immunoprecipitation market was identified as a lucrative region in the global immunoprecipitation market in 2023. Europe has been the most aggressive in investing in biotechnology research including new immunoprecipitation technologies. The region emphasizes the scientific and technological aspects, which has resulted in the production of advanced solutions in the area of life sciences. European countries have encouraged the formation of networks and partnerships between universities, research institutions, and other players in the commercial market.

The immunoprecipitation market in the UK is expected to grow rapidly in the coming years due to government support and funding, strong academic and research institutes, market awareness, and adoption. Continuous advancements and heightened understanding of the immunoprecipitation techniques needed for protein purification and analysis there has been a realization among the biochemical researchers and the biopharmaceutical firms located in the UK.

Germany immunoprecipitation market held a substantial market share in 2023 owing to the emphasis on emerging technological infrastructure, successful partnership with manufacturers, compliance with certification standards, and vast industry knowledge. In Germany, the companies have a great understanding and awareness of the market force and the customers’ needs in the immunoprecipitation business and any other related trends.

Asia Pacific Immunoprecipitation Market Trends

The immunoprecipitation market in Asia Pacific is expected to register the fastest CAGR of 7.4% in the global immunoprecipitation market over the forecast period, owing to the rising government expenditure on life science research, primarily in the pharma and biopharma industries, along with the inclined population towards individualized treatments and advanced healthcare facilities in the Asia Pacific.

China immunoprecipitation market is expected to grow rapidly in the coming years due to rising funds of R&D, and rising demand for biopharmaceuticals. Moreover, the increasing use of immunoprecipitation in laboratories associated with the research and development of biopharmaceuticals has further impacted the growth of this market in China positively

Immunoprecipitation market in India has a significant growth in the forecast period. Positive government regulations regarding the R&D programs, drive the country to build its scientific research mechanization, there has been an increase in demand for innovative techniques such as immunoprecipitation which is an edge-cutting technique and is applicable in proteomics and genomics among other specialized fields.

Key Immunoprecipitation Company Insights

Some key companies in the immunoprecipitation market include Thermo Fisher Scientific Inc.; Abcam Limited; BioLegend, Inc.; Bio-Rad Laboratories, Inc.; and others. Companies in the industry are driving innovation through strategic partnerships, mergers, and acquisitions. Leading vendors focus on competitive enhancement, while demand for user-friendly kits grows due to ease of use, efficiency, and standardized protocols.

-

BioLegend is a leading provider of biological reagents and gear that assist life science discovery from studies to cures. The company specializes in presenting world-class quality products in diverse industry areas along with immunology, neuroscience, cancer, stem cells, and cell biology. BioLegend’s reagents are known as advanced quality and are backed utilizing an authorized first-rate control machine.

-

Thermo Fisher Scientific Inc. serves as a global provider of numerous services and products, including analytical devices, medical development solutions, areaof expertise diagnostics, laboratory equipment, pharmaceutical services, and biotechnology offerings.

Key Immunoprecipitation Companies:

The following are the leading companies in the immunoprecipitation market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Abcam Limited

- BioLegend, Inc.

- Bio-Rad Laboratories, Inc.

- GenScript

- Merck KGaA

- Novus Biologicals

- Takara Bio Inc.

- Biologics International Corp

Recent Developments

-

In May 2024, Merck KGaA announced its intention to acquire Mirus Bio, a US-based life science company. Merck KGaA’s strategic goals of expanding its presence in the life sciences sector and strengthening its capabilities in gene delivery and gene expression technologies.

-

In November 2023, Abcam Limited was acquired by Danaher Corporation. This acquisition provides Danaher with access to Abcam’s extensive product offerings and customer base, enhancing its position as a leading provider of solutions for life science research.

Immunoprecipitation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 790.2 million

Revenue forecast in 2030

USD 1.1 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; South Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Abcam Limited; BioLegend, Inc.; Bio-Rad Laboratories, Inc.; GenScript; Merck KGaA; Novus Biologicals; Takara Bio Inc.; Biologics International Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immunoprecipitation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global immunoprecipitation market report based on product, type, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits

-

Reagents

-

Antibodies

-

Beads

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual Protein Immunoprecipitation

-

Protein Complex Immunoprecipitation

-

Chromatin Immunoprecipitation

-

Ribonucleoprotein Immunoprecipitation

-

Tagged Proteins Immunoprecipitation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.