- Home

- »

- Medical Devices

- »

-

Implantable Medical Devices Market Size Report, 2030GVR Report cover

![Implantable Medical Devices Market Size, Share & Trends Report]()

Implantable Medical Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cardiovascular, Orthopedic, Aesthetic, Dental, Ophthalmology, Neurology), By Biomaterial, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-364-2

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Implantable Medical Devices Market Summary

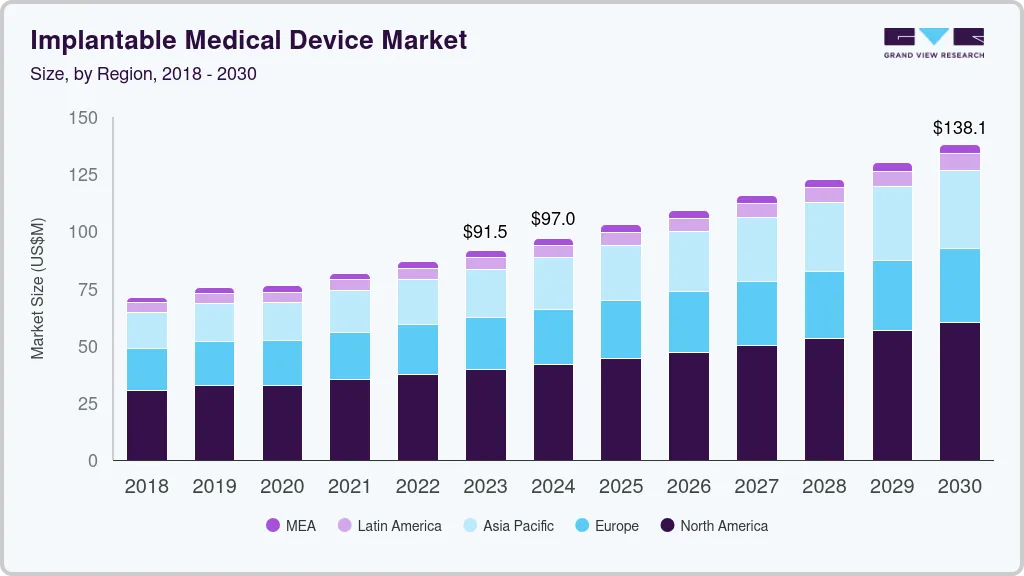

The global implantable medical device market size was estimated at USD 91.5 billion in 2023 and is projected to reach USD 138.1 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. Advancements in surgical techniques, particularly minimally invasive procedures, have expanded the application of implantable medical devices.

Key Market Trends & Insights

- North America dominated the implantable medical devices market with a revenue share of 43.15% in 2023.

- The implantable medical devices market in the U.S. is driven robust healthcare infrastructure.

- By product, the cardiovascular implants segment led the market with the largest revenue share of 30.5% in 2023.

- Based on biomaterial, the metallic segment led the market with the largest revenue share of 48.80% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 91.5 Billion

- 2030 Projected Market Size: 138.1 Billion

- CAGR (2024-2030): 6.1%

- North America: Largest market in 2023

For instance, in January 2024, Accelus, a US-based medical technology company, introduced a modular-cortical system for spinal implant surgeries. The system allows surgeons to place screw shanks early and customize the construct. The system is available in open and cortical sets, catering to different surgical approaches.

Technological innovation plays a pivotal role in driving the market growth. Advances in materials science, miniaturization, biocompatibility, and sensor technology have revolutionized the design and functionality of implantable devices. For instance, the development of advanced biomaterials such as titanium alloys and bioresorbable polymers has enhanced the durability, biocompatibility, and integration of implants within the body. These materials reduce the risk of rejection, promote tissue regeneration, and improve long-term outcomes for patients.

Moreover, sensor technology and wireless connectivity have enabled implantable devices to collect real-time data on physiological parameters and transmit this information to healthcare providers remotely. This capability supports remote monitoring, early detection of complications, and timely intervention. For example, implantable cardiac monitors can continuously monitor heart rhythms and detect arrhythmias, allowing physicians to intervene promptly and prevent adverse cardiac events.

The rising prevalence of chronic diseases such as cardiovascular diseases, diabetes, and orthopedic conditions drives the demand for implantable medical devices. According to the World Health Organization (WHO), around 422 million people worldwide, primarily in low- and middle-income countries, are affected by diabetes, which causes 1.5 million deaths annually, with the number of cases and prevalence increasing steadily in recent decades.

Implantable medical devices play a critical role in managing chronic conditions, improving patient mobility, and enhancing quality of life. For instance, orthopedic implants such as hip and knee replacements restore joint function and alleviate pain in patients with osteoarthritis, enabling them to maintain an active lifestyle. In addition, implantable devices are increasingly used in the treatment of neurological disorders such as Parkinson's disease and epilepsy. According to Parkinson's Foundation article published in 2022-23, nearly 90,000 people in the U.S. are diagnosed yearly for Parkinson condition. Moreover, around 1 million people in the country are living with the condition. Neurostimulation devices deliver electrical impulses to targeted areas of the brain or nerves, reducing symptoms such as tremors or seizures and improving patients' daily functioning and quality of life.

Product Insights

The cardiovascular implants segment led the market with the largest revenue share of 30.5% in 2023, due to its critical role in managing and treating cardiovascular diseases globally. This segment includes devices such as pacemakers, implantable cardioverter defibrillators (ICDs), cardiac stents, and cardiac monitors, among others.Cardiovascular diseases, including coronary artery disease, heart failure, and arrhythmias, are leading causes of morbidity and mortality worldwide. According to the various secondary sources & GVR analysis, heart failure affects more than 84 million people globally. The increasing prevalence of these conditions necessitates the use of implantable devices for effective management and treatment. For instance, in July 2023, Abbott received FDA approval for its AVEIR dual chamber leadless pacemaker system, the world's first dual chamber pacing system for treating abnormal or slow heart rhythms.

The dental implants segment is expected to grow at the fastest CAGR of 9.8% during the forecast period, owing to the rising trend globally towards cosmetic and cosmetic enhancements. The dental implant segment is poised for substantial growth driven by its expanding applications across various therapeutic areas and the increasing demand for prosthetics. Dental implants offer not only functional benefits but also enhance a person's appearance and overall quality of life. Notably, developed countries like the United States have been at the forefront of this growth, with millions of dental implant procedures performed annually, as evidenced by the American Dental Association's data

Biomaterial Insights

Based on biomaterial, the metallic segment led the market with the largest revenue share of 48.80% in 2023. Metals such as titanium alloys, stainless steel, and cobalt-chromium alloys are preferred for their mechanical strength, biocompatibility, and durability, making them ideal for implants that require long-term functionality within the human body. They can be fabricated into complex shapes and sizes, allowing for customization according to patient-specific anatomical requirements. This versatility supports the development of personalized implants that optimize fit and functionality. These characteristics make metallic implants indispensable in orthopedics, cardiovascular interventions, and other medical specialties, driving innovation and improving patient outcomes globally.

The natural biomaterial segment is expected to grow at the fastest CAGR of 6.6% during the forecast period. There is a growing preference among patients for natural or biocompatible materials in medical implants due to their perceived safety and reduced risk of adverse reactions or complications. Ongoing advancements in biomaterials and manufacturing techniques have enabled the development of more sophisticated natural implants that offer better integration with the body and improved long-term outcomes. Favorable regulatory policies and approvals for natural implants, ensuring their safety and efficacy, encourage healthcare providers and patients to adopt these devices more readily.

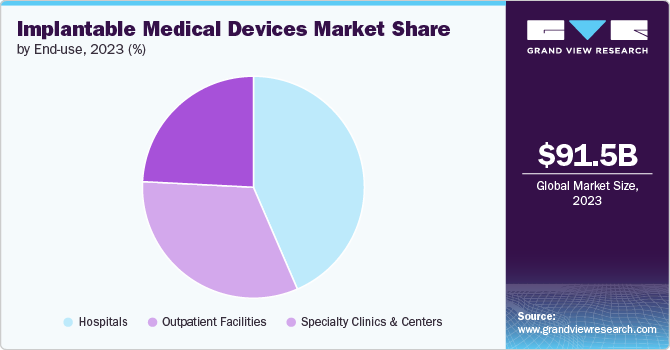

End Use Insights

Based on end use, the hospitals segment led the market with the largest revenue share of 43.52% in 2023. Hospitals serve as primary centers for complex medical procedures, including surgeries requiring implantable medical devices. They offer specialized departments like cardiology, orthopedics, neurology, and oncology, where implantable devices are routinely used. Hospitals provide comprehensive healthcare services, access to advanced technologies, multidisciplinary care teams, inpatient monitoring capabilities, and a foundation for research and innovation, enabling high-quality, specialized care that improves patient outcomes and advances global medical knowledge.

The outpatient facilities segment is expected to grow at the fastest CAGR of 6.2% during the forecast period, owing to the increasing demand for outpatient procedures and patient preference for less invasive treatments. Outpatient facilities align with the growing preference for patient-centric care models, where convenience and minimized disruption to daily life are prioritized. Patients prefer outpatient procedures because they typically involve shorter wait times, reduced hospital stays, and lower costs compared to inpatient care. In lieu of these trends, more than 23 million procedures are performed in ambulatory surgery centers (ASCs) within U.S. annually. In addition, the number of ASCs increased to 6,223 in 2024 within the country, from 6,109 in 2023.

Regional Insights

North America dominated the implantable medical devices market with a revenue share of 43.15% in 2023, owing to the advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on technological innovation. The region benefits from a large patient pool with a high prevalence of chronic diseases, driving demand for devices such as cardiac implants, orthopedic implants, and neurostimulators. Moreover, collaborations between healthcare providers, research institutions, and industry players promote continuous advancements in biomaterials and surgical techniques. The shift towards outpatient settings for minimally invasive procedures further supports market expansion, offering cost-effective and patient-centric care options.

U.S. Implantable Medical Devices Market Trends

The implantable medical devices market in the U.S. is driven robust healthcare infrastructure. Regulatory frameworks like FDA in the U.S. ensure rigorous standards for safety and efficacy, facilitating market growth. Academic and research institutions collaborate with industry leaders to drive technological advancements and improve patient outcomes, positioning the U.S. as a leader in the global market. For instance, in September 2023, CelestRay Biotech Company, LLC secured FDA 510(k) clearance for its synthetic membrane implant, aiding in tendon repair healing.

Europe Implantable Medical Devices Market Trends

The implantable medical devices market in the Europe is characterized by a strong regulatory environment, technological innovation, and increasing healthcare expenditures. The region benefits from universal healthcare systems in many countries, ensuring broad access to advanced medical treatments including implantable devices. For instance, In February 2024, King's College London inaugurated MAISI, a cutting-edge facility situated at St Thomas' Hospital. This facility marks a significant step forward in the production of active implants and surgical instruments. Its primary objective is to facilitate the seamless transition of healthcare engineering research into clinical applications. MAISI also addresses the critical need for dedicated, compliant manufacturing facilities within healthcare environments. High prevalence of aging population and chronic diseases drives demand for various implants.

Asia Pacific Implantable Medical Devices Market Trends

The implantable medical devices market in Asia Pacific is anticipated to witness at a significant CAGR of 7.2% over the forecast period. The Asia Pacific market is rapidly expanding due to increasing healthcare infrastructure development, rising healthcare expenditure, and growing prevalence of chronic diseases. Countries like China, Japan, and India are major contributors to market growth, driven by large patient populations and improving access to advanced medical technologies. Aging populations, urbanization, and lifestyle changes contribute to increased demand for cardiac implants and orthopedic implants. For instance, more than 29.1% of the Japan’s population is aged 65 and older.

Key Implantable Medical Company Insights

The competitive landscape of the global market features key players such as Medtronic, Abbott Laboratories, and Boston Scientific Corporation. These industry leaders are actively engaged in strategic initiatives, including mergers and acquisitions, to strengthen their market positions.

Key Implantable Medical Companies:

The following are the leading companies in the implantable medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Abbott Laboratories

- Johnson and Johnson

- Boston Scientific Corporation

- Smith & Nephew plc

- Stryker

- Cochlear Limited

- Integra LifeSciences

- LivaNova PLC

- Biotronik SE and Co. KG

Recent Developments

-

In June 2024, BioHorizons, a dental implant company launched Tapered Pro Conical, which utilizes a tapered body and thread to provide stability. In addition, this implant can be used for single tooth and full arch dental implants

-

In June 2024, Royal Philips implanted the Duo Venous Stent System, an advanced medical device crafted to address symptomatic venous outflow obstruction in individuals suffering from chronic venous insufficiency. This achievement follows the device's premarket approval by the U.S. Food and Drug Administration, marking a significant advancement in treatment options for affected patients

-

In November 2023, Medtronic received FDA approval for its Symplicity Spyral renal denervation system, for treating hypertension. The minimally invasive procedure uses radiofrequency energy to calm overactive kidney nerves, which can contribute to high blood pressure

Implantable Medical Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 97.0 billion

Revenue forecast in 2030

USD 138.1 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Product, biomaterial, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Abbott Laboratories; Johnson and Johnson; Boston Scientific Corporation; Smith & Nephew plc; Stryker; Cochlear Limited; Integra LifeSciences; LivaNova PLC; Biotronik SE and Co. KG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Implantable Medical Devices Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global implantable medical devices market report based on product, biomaterial, end use, and regions:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Implants

-

Orthopedic Implants

-

Ophthalmology Implants

-

Dental Implants

-

Aesthetic Implants

-

Neurology Implants

-

-

Biomaterial Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramic

-

Metallic

-

Polymers

-

Natural

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Specialty Clinics & Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global implantable medical devices market size was estimated at USD 91.5 billion in 2023 and is expected to reach USD 97 billion in 2024.

b. The global implantable medical devices market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 138.1 billion by 2030.

b. The cardiovascular implants segment held the largest market share of 30.5% in 2023 due to its critical role in managing and treating cardiovascular diseases globally. This segment includes devices such as pacemakers, implantable cardioverter defibrillators (ICDs), cardiac stents, and cardiac monitors, among others

b. Some of the key players in implantable medical devices market are Medtronic; Abbott Laboratories; Johnson and Johnson; Boston Scientific Corporation; Smith & Nephew plc; Stryker; Cochlear Limited; Integra LifeSciences; LivaNova PLC; Biotronik SE and Co. KG.

b. Advancements in technology, increasing prevalence of chronic diseases, and growing demand for minimally invasive surgical procedures are some of the key market driver. Furthermore, advancements in surgical techniques, particularly minimally invasive procedures, have expanded the application of implantable medical devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.