- Home

- »

- Automotive & Transportation

- »

-

In-car Infotainment Market Size, Share, Industry Report 2030GVR Report cover

![In-car Infotainment Market Size, Share & Trends Report]()

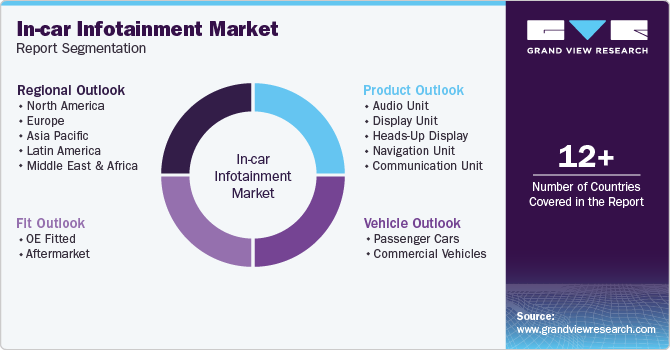

In-car Infotainment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Audio Unit, Display Unit, Navigation Unit, Heads-Up Display, Communication Unit), By Fit, By Vehicle, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-257-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In-car Infotainment Market Summary

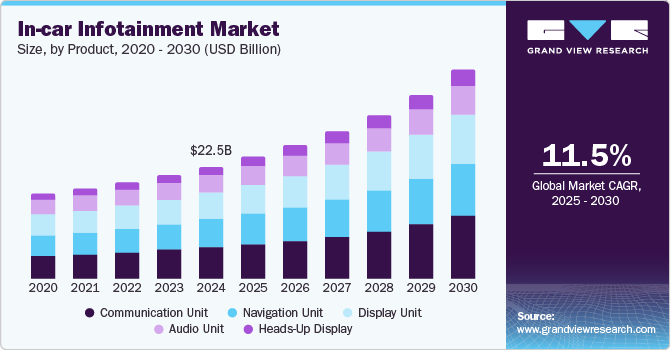

The global in-car infotainment market size was valued at USD 22.49 billion in 2024 and is projected to reach USD 42.19 billion by 2030, growing at a CAGR of 11.5% from 2025 to 2030. This growth is attributable to the increasing demand for integrated technology within vehicles, as consumers seek enhanced connectivity and entertainment options while driving.

Key Market Trends & Insights

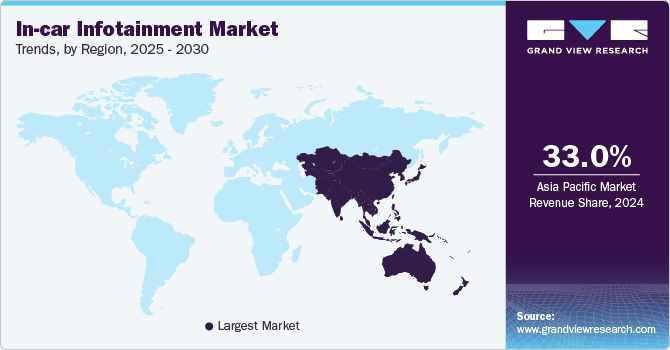

- The Asia Pacific in-car infotainment market dominated the global market with the largest revenue share of 33.0% in 2024.

- The China in-car infotainment market dominated the regional market in 2024.

- By product, the communication unit segment dominated the in-car infotainment industry.

- By fit, the OE fitted segment dominated the in-car infotainment market with the largest revenue share in 2024.

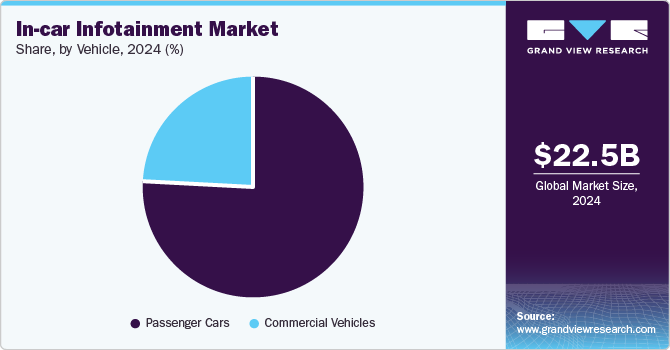

- By vehicle, the passenger cars segment dominated the in-car infotainment industry with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22.49 Billion

- 2030 Projected Market Size: USD 42.19 Billion

- CAGR (2025-2030): 11.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rise in smartphone usage has also played a crucial role, as drivers desire seamless connectivity between their devices and vehicle systems, which enables functions such as navigation, music streaming, and hands-free communication.Technological advancements have further expanded the in-car infotainment industry. Innovations such as voice recognition, Artificial Intelligence (AI), and augmented reality are being incorporated into infotainment systems to improve user experience and safety. For instance, the growing adoption of AI-driven voice assistants allows drivers to access information and control various functions without taking their hands off the wheel or eyes off the road, thereby enhancing overall driving safety.

Moreover, the automotive industry's shift toward Electric Vehicles (EVs) and autonomous driving technologies is further propelling market growth. As manufacturers develop more advanced vehicles equipped with sophisticated infotainment systems, there is a growing need for features that cater to the unique demands of EV users, such as real-time charging station locators and energy consumption analytics. This shift enhances the driving experience and aligns with global sustainability goals.

Furthermore, there is a growing preference for luxury and comfort in vehicles, including high-quality infotainment systems. The demand for features such as high-resolution displays, customizable interfaces, and multimedia capabilities is growing. For instance, luxury car brands increasingly incorporate large touchscreens and immersive sound systems to create an entertainment hub within the vehicle, appealing to tech-savvy consumers who prioritize in-car entertainment and connectivity.

Product Insights

The communication unit segment dominated the in-car infotainment industry, with the largest revenue share of 27.7% in 2024 due to the growing demand for seamless connectivity and advanced communication features in vehicles. As consumers increasingly rely on smartphones and other devices for navigation, entertainment, and communication, automakers prioritize integrating robust communication systems in their vehicles. Systems enabling hands-free calling, real-time traffic updates, and access to various apps through voice commands enhance both convenience and safety and have boosted the market. For instance, many modern vehicles now come equipped with Apple Carplay and Android Auto, allowing drivers to connect their smartphones easily and access essential functions without distraction.

The heads-up display segment is expected to grow at the highest CAGR over the forecast period due to the increasing demand for enhanced safety features in vehicles. As consumers become more aware of road safety, automakers are integrating Heads-up Displays (HUDs) to project critical information directly onto the driver’s line of sight, minimizing distractions and improving reaction time. This technology allows drivers to access navigation, speed, and warning alerts without diverting their attention from the road. For instance, luxury brands such as Mercedes-Benz incorporate HUDs in their EVs, providing real-time data that enhances safety and user experience.

Fit Insights

The OE fitted segment dominated the in-car infotainment market with the largest revenue share in 2024 due to its seamless integration into vehicles, which enhances user experience and functionality. Original Equipment (OE) systems are designed and installed by manufacturers, ensuring compatibility with the vehicle's architecture and providing a more reliable performance compared to aftermarket alternatives. These systems also come with manufacturer warranties, offering consumers peace of mind regarding maintenance and support.

The aftermarket segment is expected to grow at a significant CAGR over the forecast period due to the increasing consumer preference for customization and cost-effective solutions in in-car infotainment systems. Many vehicle owners seek to upgrade their existing systems to enhance functionality and entertainment options without the high costs associated with OE systems. Aftermarket infotainment systems often provide advanced features such as smartphone integration, navigation, and multimedia capabilities at a lower price point, making them attractive to budget-conscious consumers.

Vehicle Insights

The passenger cars segment dominated the in-car infotainment industry with the largest revenue share in 2024 due to the increasing production and sales of passenger vehicles globally. With growing urbanization, more consumers are purchasing personal vehicles for convenience and mobility, which drives demand for advanced infotainment systems that enhance the driving experience. In addition, modern passenger cars are equipped with sophisticated technologies that integrate navigation, entertainment, and connectivity features, making them more appealing to buyers.

The commercial vehicles segment is expected to grow at the fastest CAGR over the forecast period due to the increasing demand for efficient fleet management and advanced connectivity solutions. As logistics and transportation industries expand, fleet operators seek infotainment systems that enhance vehicle communication, enabling real-time data sharing and improved operational efficiency. For instance, the integration of Vehicle-To-Vehicle (V2V) communication systems allows commercial vehicles to share critical information, such as traffic conditions and route optimization, which can significantly reduce delivery time and cost.

Regional Insights

The North America in-car infotainment market is expected to grow significantly over the forecast period due to the increasing demand for advanced connectivity features and enhanced user experience in vehicles. As consumers prioritize seamless integration of their smartphones with in-car systems, automakers are responding by equipping vehicles with sophisticated infotainment technologies that support advanced features. In addition, the growth of EVs is driving innovation in infotainment systems as manufacturers seek to provide comprehensive digital experiences that meet the expectations of tech-savvy consumers.

U.S. In-car Infotainment Market Trends

The U.S. in-car infotainment market dominated North America in 2024, with the largest revenue share, driven by the rapid adoption of advanced technology and the demand for enhanced connectivity. As consumers increasingly prioritize seamless integration of their devices with vehicle systems, automakers respond by equipping cars with state-of-the-art infotainment technologies that support navigation, music streaming, and voice commands. For instance, Ford's recent collaboration with Google to develop a voice-enabled infotainment system showcases the focus on improving user experience through innovative solutions.

Europe In-car Infotainment Market Trends

The Europe in-car infotainment market is expected to grow significantly over the forecast period due to the increasing demand for advanced connectivity and enhanced user experience in vehicles. Major European brands, such as Volkswagen and Renault, are adopting Google's Android OS in their infotainment systems, facilitating better connectivity and app integration. This focus on connectivity and a robust automotive industry characterized by strong competition among manufacturers positions the European in-car infotainment industry for substantial growth in the coming years.

Asia Pacific In-car Infotainment Market Trends

The Asia Pacific in-car infotainment market dominated the global market with the largest revenue share of 33.0% in 2024, owing to the growing demand for advanced automotive technology. Rapid urbanization and increasing disposable income in countries such as China and India have led to a growth in vehicle ownership, prompting consumers to seek vehicles equipped with sophisticated infotainment systems. In addition, the growing trend of smartphone integration and high-speed internet connectivity has heightened expectations for seamless connectivity and enhanced user experience. For instance, the development of rear-seat infotainment systems in China is driven by the competitive taxi industry and the increasing popularity of ride-sharing services, where passengers expect entertainment options during their journey.

The China in-car infotainment market dominated the regional market in 2024 with the largest revenue share, driven by the rapid expansion of the automotive industry and increasing demand for advanced technology in vehicles. As the largest vehicle manufacturing country, China significantly boosts the need for sophisticated infotainment systems. For instance, CHJ Automotive's ONE smart electric luxury SUV features a four-screen infotainment system that integrates voice control and multiple functionalities, catering to tech-savvy consumers. Furthermore, automakers are increasingly incorporating Advanced Driver Assistance Systems (ADAS) alongside infotainment features, further enhancing the appeal of modern vehicles.

Key In-car Infotainment Company Insights

Some key players in the in-car infotainment industry are Continental AG, Panasonic Corporation, Aptiv, and Pioneer Corporation. These companies focus on integrating advanced technologies to enhance user experience, often emphasizing seamless connectivity and multimedia capabilities. They adopt strategies such as launching innovative systems that support smartphone adoption, navigation, and real-time information access. In addition, there is a growing emphasis on developing user-friendly interfaces and cloud-based solutions to meet the demand for personalized and interactive in-car experiences while ensuring compliance with safety regulations.

-

Panasonic Corporation specializes in developing cutting-edge in-car infotainment systems that combine audio, video, and connectivity features to create an immersive driving experience. The company leverages its expertise in electronics to provide integrated solutions that enhance vehicle safety and entertainment.

-

Pioneer Corporation is renowned for its innovative approach to in-car infotainment. It offers advanced audio and multimedia systems tailored to enhance the driving experience. The company integrates features such as smartphone connectivity, voice recognition, and high-quality audio output into its products.

Key In-Car Infotainment Companies:

The following are the leading companies in the in-car infotainment market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- HARMAN International.

- Panasonic Corporation

- ALPS ALPINE CO., LTD.

- DENSO CORPORATION.

- Pioneer Corporation.

- Visteon Corporation

- Clarion

- Aptiv

- JVCKENWOOD Corporation

Recent Developments

-

In April 2024, Tata Motors enhanced its in-car infotainment systems by integrating the HARMAN Ignite Store into its popular Nexon.ev and Punch.ev models. This initiative is aimed at providing customers with a seamless digital experience while driving. The HARMAN Ignite Store complies with Android Automotive Operating System standards, offering a secure platform for various applications that enhance connectivity and entertainment during commutes. Notable features include popular apps, including Gaana and Jio Saavn, as well as interactive entertainment options, such as Beach Buggy Racing.

-

In June 2023, Continental AG unveiled its innovative Smart Cockpit High-Performance Computer (HPC), revolutionizing in-car infotainment by integrating instrumentation, infotainment, and Advanced Driver Assistance Systems (ADAS) into a single unit. This solution is designed for Original Equipment Manufacturers (OEMs) and aims to streamline vehicle architecture by reducing the number of required control units and wiring harnesses. The Smart Cockpit HPC operates on the Android operating system, providing functionalities such as radio, phone connectivity, mirroring, and navigation, all while supporting a dual display configuration and optional heads-up display units.

In-car Infotainment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.51 billion

Revenue forecast in 2030

USD 42.19 billion

Growth Rate

CAGR of 11.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

March 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Fit, Vehicle, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, UAE, Saudi Arabia

Key companies profiled

Continental AG; HARMAN International; Panasonic Corporation; ALPS ALPINE CO. LTD; DENSO CORPORATION; Pioneer Corporation; Visteon Corporation; Clarion; Aptiv; JVCKENWOOD Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In-car Infotainment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-car infotainment market report based on product, fit, vehicle, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio unit

-

Display unit

-

Heads-Up display

-

Navigation unit

-

Communication unit

-

-

Fit Outlook (Revenue, USD Million, 2018 - 2030)

-

OE Fitted

-

Aftermarket

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.