- Home

- »

- Clinical Diagnostics

- »

-

In-vitro Colorectal Cancer Screening Tests Market Report 2030GVR Report cover

![In-vitro Colorectal Cancer Screening Tests Market Size, Share & Trends Report]()

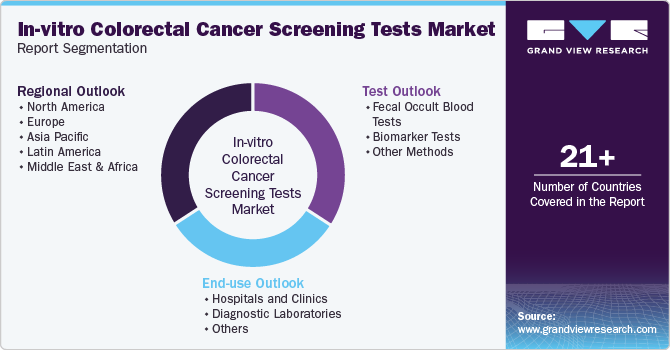

In-vitro Colorectal Cancer Screening Tests Market Size, Share & Trends Analysis Report By Test (Fecal Occult Blood Tests, Biomarker Tests), By End-use (Hospitals & Clinics, Diagnostic Laboratories),By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-438-3

- Number of Report Pages: 129

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

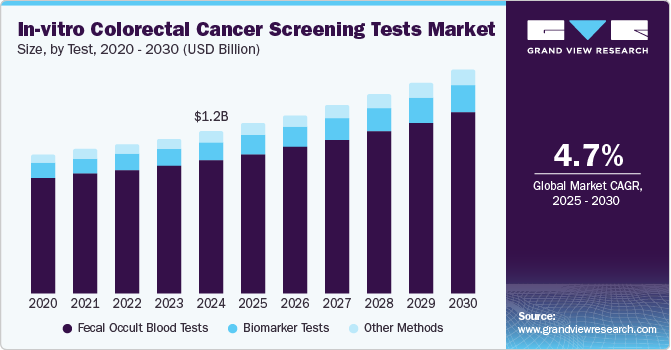

The global in-vitro colorectal cancer screening tests market size was valued at USD 1.2 billion in 2024 and is expected to grow at a CAGR of 4.7% from 2025 to 2030.The increasing prevalence of colon and rectal cancer and the growing demand for effective genetic testing are the key factors propelling market growth. According to data published by the American Cancer Society in 2023, it is estimated that there will be 153,020 new cases of colon and rectum malignancies in the U.S. Among these cases, 106,970 are expected to be colon tumors, while 46,050 are expected to be rectum malignancies. Additionally, data from the same source indicates that 151,030 colon and rectum malignance cases were detected in 2022, and 149,500 cases were detected in 2021. These statistics highlight the high prevalence of colon and rectum cancers in the country, which is expected to drive the growth of the market.

The increasing prevalence of CRC is a significant driver of the market. A study published in the Chinese Medical Journal in March 2022 highlighted the rising incidence of cancer in China, with approximately 4,820,000 new cases reported in 2022. Among these, 592,232 individuals were diagnosed with CRC. This higher incidence has resulted in an increased demand for screening tests and treatments for tumors.

Furthermore, according to a study published by MDPI in April 2022, CRC is recognized as one of the most prevalent in Canada, with an estimated 24,800 cases diagnosed in 2021. While CRC cases in adults under the age of 50 account for approximately 8% of all cases in Canada, recent research revealed a significant increase in its incidence among younger individuals. This rise in the prevalence of colon cancer, particularly among the younger population, is projected to have a positive impact on market growth. The abovementioned factors are expected to drive the need for effective screening and treatment options to address this emerging public health concern.

Furthermore, the early and accurate detection of colon cancer through in-vitro screening tests is crucial for reducing the burden of the disease and improving mortality rates. Regular screening enables the early identification of CRC, which has been associated with a potential 60% reduction in CRC-related deaths. In-vitro screening tests are expected to improve the average 5-year survival rate from 46% to 73% with regular annual screening. These screening tests play a significant role in the early detection and management of CRC, ultimately leading to better patient outcomes and increased survival rates.

Test Insights

The fecal occult blood tests segment dominated the in-vitro colorectal cancer screening tests industry, with the largest revenue share of 82.3% in 2024. The Fecal Occult Blood Tests (FOBTs) detect blood in stool, a common early indicator of CRC, making it an essential screening tool. Its widespread adoption in routine checkups, particularly in high-risk populations, has driven segment growth. In addition, FOBTs are recommended as a first-line screening method by medical guidelines, further enhancing their market dominance in CRC detection and prevention.

The presence of blood in the stool can indicate various conditions, including colorectal cancer, polyps, ulcers, or hemorrhoids. The fecal occult blood test is a commonly preferred screening test due to its high effectiveness in detecting bowel malignancies. Factors such as the increasing prevalence of colorectal cancer and the growing utilization of fecal occult blood tests are anticipated to drive the growth of this segment. The segment growth is further driven by the advancements made by market players, which have led to increased usage of their products. For instance, in June 2022, W.H.P.M., Inc. obtained 510(k) marketing approval from the U.S. FDA for their Hemosure Accu-Reader A100, Fecal Occult Blood Test. These developments, coupled with the rising prevalence of colorectal cancer, are anticipated to contribute to the growth of the market.

The biomarker tests segment is anticipated to emerge as the fastest-growing segment and grow at a CAGR of 5.8% from 2025 to 2030, owing to its advanced ability to detect early-stage cancer with high precision. These tests identify specific genetic markers and molecular changes associated with CRC, enabling targeted and personalized screening. The growing demand for noninvasive, accurate, reliable diagnostic methods drives the adoption of biomarker-based tests. With ongoing advancements in technology and research, biomarker tests are positioned to revolutionize CRC screening, offering enhanced detection and improved patient outcomes.

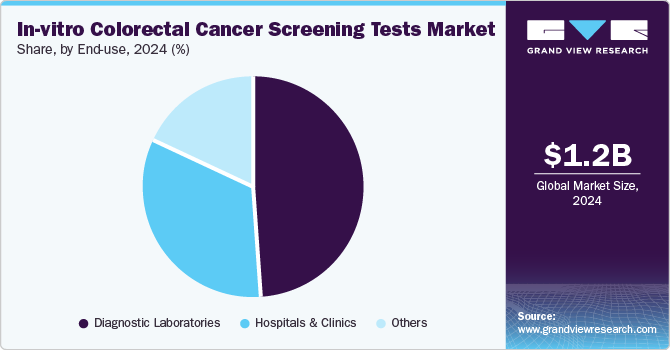

End-use Insights

The diagnostic laboratories segment held the largest revenue share in 2024, attributed to their advanced technology, high accuracy, and comprehensive testing capabilities. These laboratories are equipped with state-of-the-art equipment to perform various screening tests, including fecal occult blood tests and biomarker assays, ensuring precise results. With experienced professionals and the ability to handle large volumes of tests, diagnostic laboratories play a crucial role in the early detection of CRC. Their extensive network and reliability make them the preferred choice for CRC screening, driving their market dominance.

The hospitals and clinics segment is expected to grow at a significant pace during the forecast period, fueled by the increasing demand for early diagnosis and noninvasive testing options. Healthcare facilities are increasingly focused on improving patient outcomes and providing cost-effective solutions, making in-vitro tests an attractive alternative to traditional methods. Hospitals and clinics are adopting these tests for their accuracy, ease of use, and ability to detect colorectal cancer at early stages. This growing preference for advanced screening technologies drives the segment in the in-vitro colorectal cancer screening tests industry.

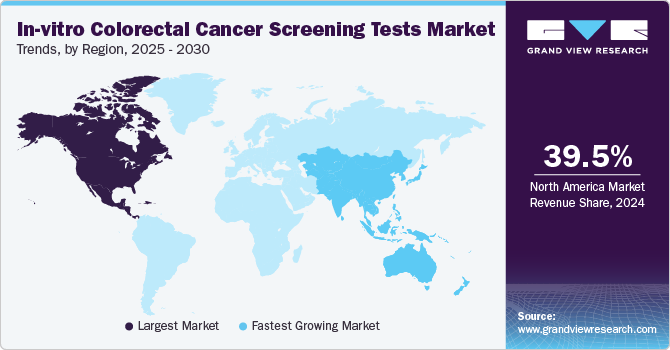

Regional Insights

North America in-vitro colorectal cancer screening tests market dominated the global market with the largest revenue share of 39.5% in 2024. This share is attributable tothegrowing preference for home-based testing and personalized medicine. Consumers increasingly seek convenience, leading to the popularity of at-home screening kits, such as fecal occult blood tests and DNA-based tests, which can be easily used in privacy. Moreover, the rise of personalized medicine, offering tailored testing based on genetic profiles, enhances the accuracy of CRC detection. These trends provide more accessible, effective, and targeted screening options, fueling the regional market growth.

U.S. In-vitro Colorectal Cancer Screening Tests Market Trends

The U.S. in-vitro colorectal cancer screening tests market held the largest share in 2024. The region's growth is expected to be fueled by the rising prevalence of colon malignancy, advancements in technology, and increasing initiatives focused on malignancy prevention. The U.S. is projected to hold a significant share of the market in North America due to its advanced healthcare infrastructure for screening and the increasing burden of colorectal malignancy.

Advancements in liquid biopsies and the shift toward noninvasive testing options significantly drive the U.S. market. Liquid biopsies, which analyze blood or stool samples for cancer biomarkers, offer a less invasive and highly accurate alternative to traditional methods. This innovation has enhanced early detection and provided a more convenient patient screening experience. With the increasing demand for less intrusive, faster, and more precise diagnostic tools, the adoption of liquid biopsies is projected to accelerate the growth of the in-vitro colorectal cancer screening tests industry, offering significant growth opportunities.

Europe In-vitro Colorectal Cancer Screening Tests Market Trends

Europe in-vitro colorectal cancer screening tests market is set to witness significant expansion over the forecast period. The rise of biomarker tests and the integration of advanced diagnostics are projected to drive regional growth. Biomarker-based tests enhance detection accuracy and early diagnosis, allowing for more personalized and effective treatment options. Advanced diagnostics, including molecular testing, offer deeper insights into cancer progression and help identify at-risk individuals more efficiently. These innovations drive the need for in-vitro screening as healthcare providers seek noninvasive, precise methods for early detection, ultimately contributing to the market growth across Europe.

Asia Pacific In-vitro Colorectal Cancer Screening Tests Market Trends

Asia Pacific in-vitro colorectal cancer screening tests market is set to expand at the fastest CAGR of 5.2% from 2025 to 2030. The rising incidence of CRC in the Asia Pacific region, fueled by lifestyle changes and an aging population, is expected to drive the demand for in-vitro CRC screening tests significantly. The growing need for early detection compels healthcare systems to adopt advanced diagnostic technologies. However, disparities in healthcare infrastructure across the region, with some areas lacking access to high-quality screening, highlight the need for scalable, cost-effective in-vitro tests. This demand for accessible solutions is anticipated to boost in-vitro CRC screening tests industry growth, driving investments and innovations in CRC screening technologies.

Japan in-vitro colorectal cancer screening tests market held the highest share of the regional market in 2024, driven by the growing adoption of biomarker and DNA-based screening methods in Japan. These advanced technologies offer high accuracy and early detection, improving patient outcomes.

Key In-vitro Colorectal Cancer Screening Tests Company Insights

Some of the key companies in the in-vitro colorectal cancer screening tests industry includeAbbott; Epigenomics AG;Beckman Coulter, Inc.; Eiken Chemical Co., Ltd.; Sysmex Corporation; Siemens Healthineers AG; Quest Diagnostics Incorporated;Oncocyte Corporation;Merck KGaA;Immunostics Inc.;Kyowa Kirin Co., Ltd.;Randox Laboratories Ltd.; and R-Biopharm AG.

-

Abbottoffers a wide range of healthcare products and solutions, including diagnostic tools, medical devices, nutrition products, and branded generic medicines. Its innovations aim to improve patient outcomes and enhance quality of life across various medical conditions.

-

Siemens Healthineers AG provides cutting-edge healthcare solutions, including diagnostic imaging, laboratory diagnostics, molecular testing, and digital health services. The company focuses on enhancing patient care, improving clinical outcomes, and advancing medical technology through innovation.

Key In-vitro Colorectal Cancer Screening Tests Companies:

The following are the leading companies in the in-vitro colorectal cancer screening tests market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Epigenomics AG

- Beckman Coulter, Inc.

- Eiken Chemical Co., Ltd.

- Sysmex Corporation

- Siemens Healthineers AG

- Quest Diagnostics Incorporated

- Oncocyte Corporation

- Merck KGaA

- Immunostics Inc.

- Kyowa Kirin Co., Ltd.

- Randox Laboratories Ltd.

- R-Biopharm AG

Recent Developments

-

In January 2025, Tempus AI, Inc. launched its FDA-approved, NGS-based in vitro diagnostic device, xT CDx, in the U.S. Clinicians nationwide can now order this cutting-edge diagnostic tool to aid patient care.

-

In July 2024, the FDA approved Guardant's innovative blood test-Shield-for colorectal cancer screening. This approval represents a major step forward in offering a noninvasive, efficient method for early detection of colorectal cancer.

In-vitro Colorectal Cancer Screening Tests Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.3 billion

Revenue forecast in 2030

USD 1.7 billion

Growth Rate

CAGR of 4.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Spain; France; Italy; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Epigenomics AG;Beckman Coulter, Inc.; Eiken Chemical Co., Ltd.; Sysmex Corporation; Siemens Healthineers AG; Quest Diagnostics Incorporated;Oncocyte Corporation;Merck KGaA;Immunostics Inc.;Kyowa Kirin Co., Ltd.;Randox Laboratories Ltd.; and R-Biopharm AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In-vitro Colorectal Cancer Screening Tests Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global in-vitro colorectal cancer screening tests market report on the basis of test, end-use, and region:

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Fecal Occult Blood Tests

-

Guaiac FOB Stool Test

-

Immuno-FOB Agglutination Test

-

Lateral Flow Immuno-FOB Test

-

Immuno-FOB ELISA Test

-

-

Biomarker Tests

-

Other Methods

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."