- Home

- »

- Plastics, Polymers & Resins

- »

-

In Vitro Diagnostic Packaging Market, Industry Report, 2030GVR Report cover

![In Vitro Diagnostic Packaging Market Size, Share & Trends Report]()

In Vitro Diagnostic Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Bottles and Vials, Tubes, Petri Dishes, Labels & Stickers, Others), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-593-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In Vitro Diagnostic Packaging Market Summary

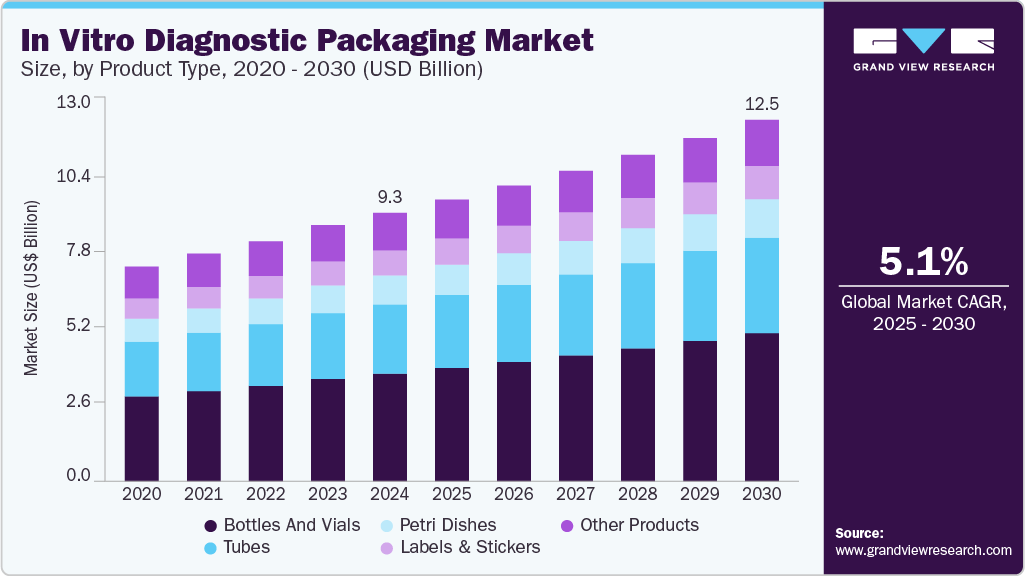

The global in vitro diagnostic packaging market size valued at USD 9.30 billion in 2024 and projected to reach USD 12.53 billion by 2030, growing at a CAGR of 5.1% from 2025 to 2030. The rising penetration of multi-featured human-machine interface (HMI) devices, increasing adoption of the Industrial Internet of Things (IIoT), and proliferation of smart industrial displays are some of the factors contributing to market growth.

Market Size & Trends:

- Asia Pacific dominated the market and accounted for the largest revenue share of over 36.0% in 2024.

- The China IVD packaging market is growing due to its massive diagnostics industry, government support, and increasing healthcare expenditure.

- In terms of product type segment, bottles and vials recorded the largest market revenue share of over 40.0% in 2024.

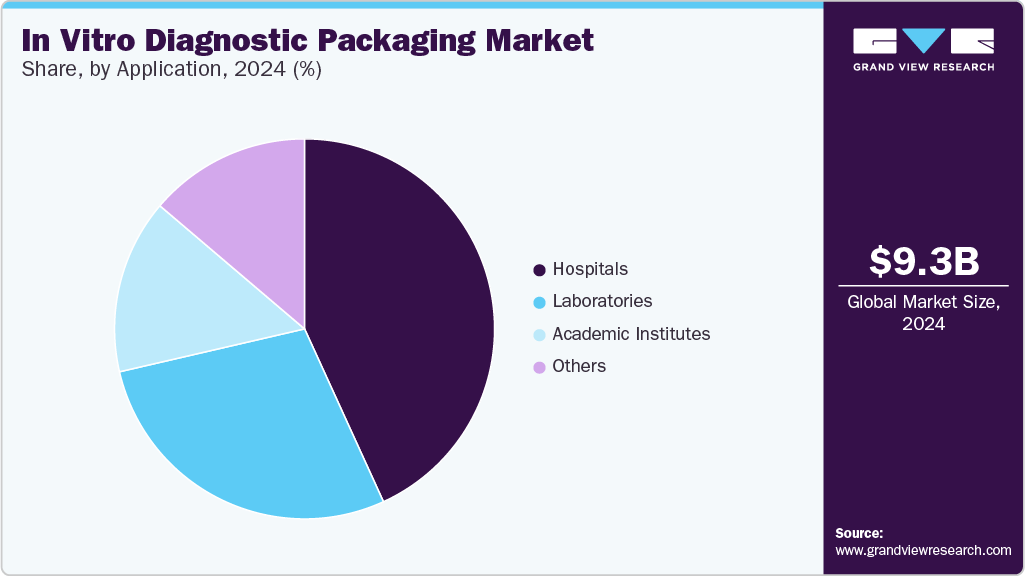

- In terms of the application segment, hospitals recorded the largest market share at over 43.0% in 2024.

Key Market Statistics:

- 2024 Market Size: $9.30 Billion

- 2030 Estimated Market Size: $12.53 Billion

- CAGR: 5.1% (2025-2030)

- Asia Pacific: Largest market in 2024 and fastest growing region during the forecast period.

Additionally, stringent regulatory requirements for safe sample handling and transportation further fuel market growth. The in vitro diagnostic (IVD) packaging industry is driven by the expanding demand for diagnostic testing, especially due to global health concerns such as the COVID-19 pandemic. The rising incidence of infectious diseases, chronic illnesses, and the growing emphasis on preventive healthcare are prompting increased investments in diagnostics. As test volumes surge, manufacturers are scaling up production of diagnostic kits and reagents, necessitating reliable, contamination-proof, and easy-to-use packaging solutions. For example, during the COVID-19 pandemic, the rapid development and deployment of PCR and antigen test kits required innovative packaging that could support mass distribution while maintaining sample integrity.

The increasing trend toward point-of-care (POC) testing and home diagnostics also contributes to the market growth. These applications require compact, intuitive packaging formats that support user-friendly handling without professional supervision. This pushes packaging companies to innovate in tamper-evident seals, sterile blister packs, and smart labels that provide usage instructions or track product authenticity. For instance, IVD tests for diabetes (like blood glucose monitoring kits) are increasingly being packaged in convenient, travel-ready formats that appeal to healthcare professionals and patients.

Regulatory compliance and safety considerations also significantly influence packaging requirements in the IVD sector. Packaging must ensure chemical stability, protect against contamination, and meet labeling mandates. This has led to a rise in high-barrier materials such as multilayer films and medical-grade plastics. In regions like the U.S. and EU, strict regulatory environments, such as the FDA's 21 CFR and the EU's IVDR, demand packaging that ensures traceability and minimizes the risk of diagnostic errors. As a result, IVD packaging has evolved to integrate serialized barcodes and RFID tags to facilitate tracking and compliance.

Moreover, sustainability concerns are shaping the future of IVD packaging. Medical waste management is scrutinized, and healthcare providers seek environmentally responsible solutions. This encourages the development of recyclable, biodegradable, or reusable packaging components without compromising sterility. For example, some companies are piloting recyclable PCR tube trays and using plant-based polymers for packaging blister cards. This shift toward sustainable practices is becoming a competitive differentiator for packaging providers in the IVD space, particularly as hospitals and labs seek to align with global sustainability goals.

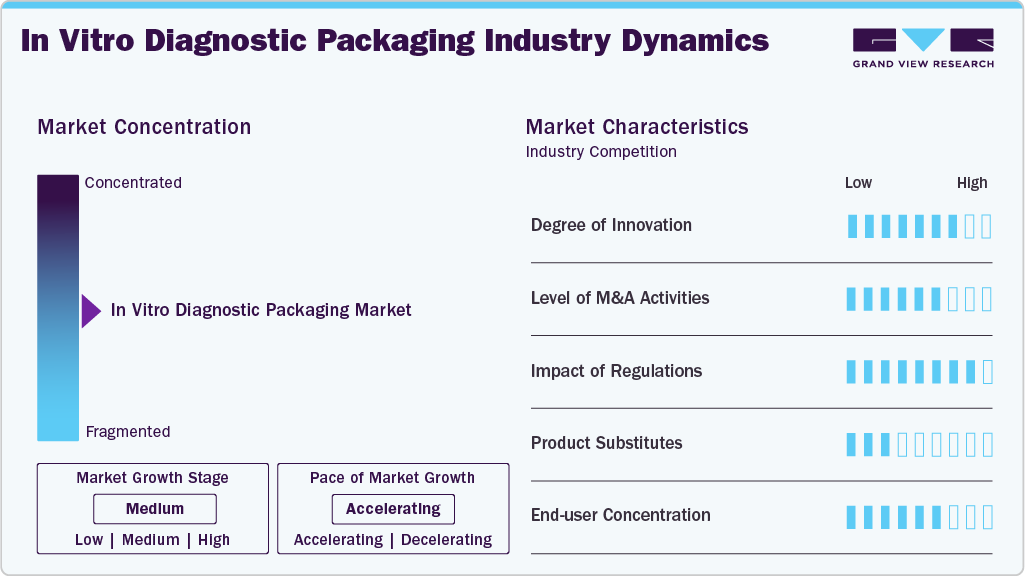

Market Concentration & Characteristics

The market exhibits several defining industry characteristics reflecting its integration with the broader healthcare system and specialized packaging technologies. One of the primary characteristics is its high regulatory oversight. Since IVD products directly impact patient diagnosis and treatment, packaging must comply with stringent medical standards concerning sterility, traceability, and labeling. Agencies such as the U.S. FDA, European Medicines Agency (EMA), and the International Organization for Standardization (ISO) govern materials used, shelf-life claims, and tamper-evidence features. As such, manufacturers in this space operate in a compliance-intensive environment, which is a significant entry barrier for new players.

Another key characteristic is the link between packaging innovation and diagnostic technology development. Packaging must evolve to accommodate more delicate and complex components as diagnostic tools become more sophisticated, especially with the rise of molecular diagnostics, microfluidics, and lab-on-a-chip systems. This creates a high demand for customized, often single-use, packaging solutions that can support automation, preserve sample integrity, and offer user-friendly formats. As a result, there is a strong emphasis on R&D, with collaboration between diagnostic device manufacturers and specialized packaging suppliers being a common industry practice.

Moreover, the industry demonstrates strong global interconnectivity, with supply chains often stretching across continents. Raw materials such as medical-grade polymers, foils, and adhesives are sourced globally, while manufacturing and packaging operations occur in different regions. This global footprint is both a strength and a vulnerability; it enables cost efficiencies and scalability and exposes the market to geopolitical instability, shipping disruptions, or pandemics. Companies that invest in supply chain resilience and regional diversification often gain a competitive edge in the IVD packaging market.

Product Type Insights

The bottles and vials segment recorded the largest market revenue share of over 40.0% in 2024 and is projected to grow at the fastest CAGR of 5.5% during the forecast period. Bottles and vials are essential primary packaging components that contain reagents, specimens, and solutions required for IVD testing. They are typically made of glass or plastic and designed to ensure the chemical stability of their contents. These packaging types offer airtight sealing, sterility, and precise volumetric control, which are critical for accurate diagnostics. The rising demand for liquid-based diagnostic reagents and sample preservation drives the use of bottles and vials.

Tubes are commonly used in IVD settings for blood collection, centrifugation, sample storage, and reagent handling. Depending on the application, these may include vacuum blood collection or PCR tubes. Tubes come in various capacities and closures to maintain sample integrity during testing and transport. The growing number of diagnostic procedures involving blood or biological fluids, such as blood glucose, cholesterol, and infectious disease tests, drives demand for tubes. Increased healthcare expenditure, especially in preventive diagnostics, and expanding clinical laboratories further stimulate the market for IVD tubes.

Application Insights

The hospital segment recorded the largest market share at over 43.0% in 2024. Hospitals use various diagnostic tests for patient monitoring, disease detection, and emergency diagnostics. These institutions require sterile, tamper-evident, and durable packaging to ensure safety and reliability in test kits and reagents. The growth in hospital-based diagnostics is driven by rising chronic disease prevalence, increasing hospital admissions, and the integration of diagnostic services into treatment workflows. Additionally, growing investments in hospital infrastructure in emerging economies support demand for high-quality IVD packaging.

The academic institutes segment is projected to grow at the fastest CAGR of 5.4% during the forecast period. Universities and research institutions rely on IVD packaging for experimental diagnostics, teaching purposes, and research applications. They require flexible, often small-batch packaging solutions that ensure sample integrity and reproducibility of results. The key drivers for academic institutes include increased funding for biomedical research, collaborations with industry for R&D, and growing interest in molecular biology and genomics. These institutions often pilot next-generation diagnostics, stimulating demand for innovative packaging formats.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 36.0% in 2024. It is anticipated to grow at the fastest CAGR of 5.5% over the forecast period. This dominance can be attributed to its rapidly expanding healthcare infrastructure, increasing diagnostic testing demand, and growing biotechnology investments. Countries such as China, India, and Japan are leading due to rising chronic diseases, government initiatives to improve healthcare access, and the expansion of diagnostic laboratories. For example, China’s 14th Five-Year Plan emphasizes strengthening its domestic IVD industry, boosting demand for high-quality packaging solutions.

China In Vitro Diagnostic Packaging Market Trends

The China IVD packaging market is growing due to its massive diagnostics industry, government support, and increasing healthcare expenditure. The country’s focus on local manufacturing (Made in China 2025) has reduced import dependency, fostering growth in domestic IVD packaging suppliers. The post-pandemic demand for PCR and rapid antigen tests has also driven innovations in lightweight and durable packaging to meet global supply chain needs.

North America In Vitro Diagnostic Packaging Market Trends

The region’s growth in the IVD Packaging market is primarily due to its advanced healthcare systems, stringent regulatory standards, and high adoption of innovative diagnostic technologies. The U.S. and Canada have well-established IVD industries that strongly focus on automation and sustainable packaging solutions. For instance, the FDA’s strict regulations on IVD packaging ensure high barrier protection and sterility, pushing companies to develop advanced materials like high-performance films and tamper-evident seals. The rise of personalized medicine and point-of-care testing (POCT) also fuels demand.

Europe In Vitro Diagnostic Packaging Market Trends

Europe’s growth in the IVD packaging market is driven by strict EU regulations, an aging population, and increasing diagnostic testing. Countries such as Germany, France, and the UK lead due to their strong medical device industries and emphasis on sustainable packaging solutions. The European In Vitro Diagnostic Regulation (IVDR) mandates high safety standards, pushing manufacturers to adopt recyclable and biocompatible materials. For example, Germany’s Roche Diagnostics and Siemens Healthineers use advanced polymer-based packaging to ensure product integrity. The growing prevalence of chronic and infectious diseases has also increased demand for IVD tests, further boosting the packaging sector.

Key In Vitro Diagnostic Packaging Company Insights

The IVD packaging market has a competitive environment characterized by several global and regional players striving to meet stringent regulatory standards, ensure product safety, and enhance user convenience. Key players compete on innovation, quality, and sustainability of primary and secondary packaging materials. The market is moderately consolidated, with companies investing in eco-friendly packaging solutions, tamper-evident features, and advanced barrier properties to cater to the growing demand for reliable diagnostics, particularly in point-of-care and molecular testing. Strategic partnerships, mergers, and acquisitions are also prevalent, as firms seek to expand their geographic reach and technological capabilities in an evolving healthcare landscape.

-

In October 2024, Nipro launched its innovative D2F (Direct-to-Fill) glass vials featuring Stevanato Group’s advanced EZ-fill technology, providing a high-quality ready-to-use (RTU) solution for the pharmaceutical industry. These vials are washed, depyrogenated, sterilized, and packaged in nest and tub formats that prevent glass-to-glass contact, reducing breakage, cosmetic defects, and particulate generation during handling and transport. This collaboration underscores Stevanato Group’s technological leadership and strengthens Nipro’s position in delivering premium primary pharma packaging solutions.

-

In February 2024, SGD Pharma launched a new range of high-quality Type I injectable vials made from tubular glass, featuring an external low-friction coating developed in partnership with Corning called Velocity Vial technology. This innovative coating significantly reduces friction caused by glass-to-glass and glass-to-metal contact during pharmaceutical filling processes, which helps prevent vial tip-overs, jams, and breakages, thereby improving filling line efficiency by 20-50%.

Key In Vitro Diagnostic Packaging Companies:

The following are the leading companies in the in vitro diagnostic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- AptarGroup Incorporated

- Thermo Fisher Scientific Incorporated

- Corning Incorporated

- Greiner Holding AG

- COMAR, LLC

- WS Packaging Group

- DWK Life Sciences

- SCHOTT Poonawalla

- SGD Pharma

- Stevanato

In Vitro Diagnostic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.76 billion

Revenue forecast in 2030

USD 12.53 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Amcor plc; AptarGroup Incorporated; Thermo Fisher Scientific Incorporated; Corning Incorporated; Greiner Holding AG; COMAR, LLC; WS Packaging Group; DWK Life Sciences; SCHOTT Poonawalla; SGD Pharma; Stevanato

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

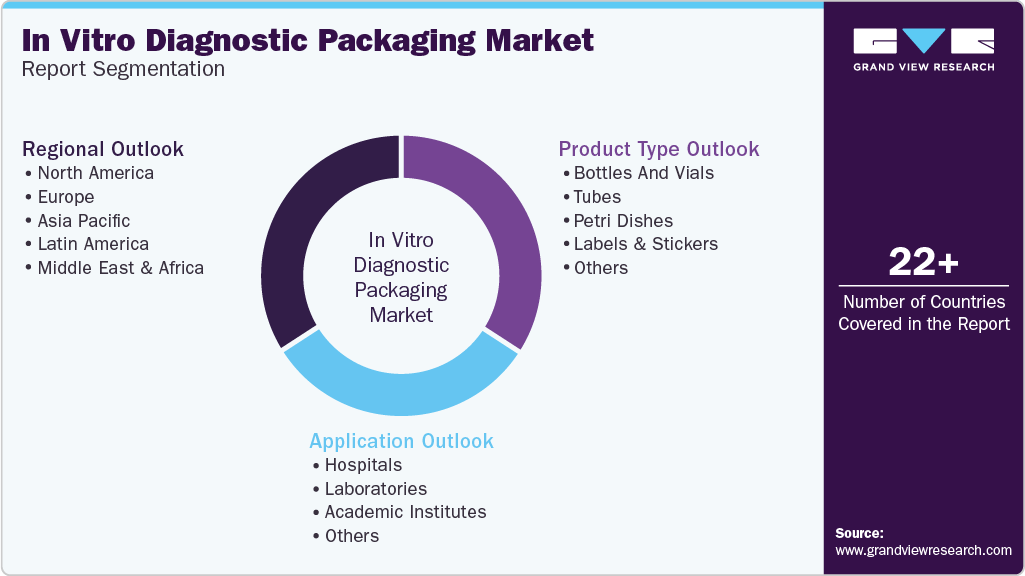

Global In Vitro Diagnostic Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in vitro diagnostic (IVD) packaging market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles and Vials

-

Tubes

-

Petri Dishes

-

Labels & Stickers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Academic institutes

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global n vitro diagnostic packaging market was estimated at around USD 9.30 billion in the year 2024 and is expected to reach around USD 9.76 billion in 2025.

b. The global in vitro diagnostic packaging market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach around USD 12.53 billion by 2030.

b. Asia Pacific dominated the in vitro diagnostic (IVD) packaging market in 2024 with over 36.0% value share due to rapidly expanding healthcare infrastructure, increasing demand for diagnostic testing, and growing investments in biotechnology.

b. The key players in the IVD packaging market include Amcor plc; AptarGroup Incorporated; Thermo Fisher Scientific Incorporated; Corning Incorporated; Greiner Holding AG; COMAR, LLC; WS Packaging Group; DWK Life Sciences; SCHOTT Poonawalla; SGD Pharma; and Stevanato.

b. The in vitro diagnostic (IVD) packaging market is driven by the rising demand for rapid diagnostic testing and the increasing prevalence of chronic and infectious diseases. Additionally, stringent regulatory requirements for safe sample handling and transportation further fuel market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.