- Home

- »

- Clinical Diagnostics

- »

-

IVD In Cardiology And Neurology Market Size Report, 2030GVR Report cover

![IVD In Cardiology And Neurology Market Size, Share & Trends Report]()

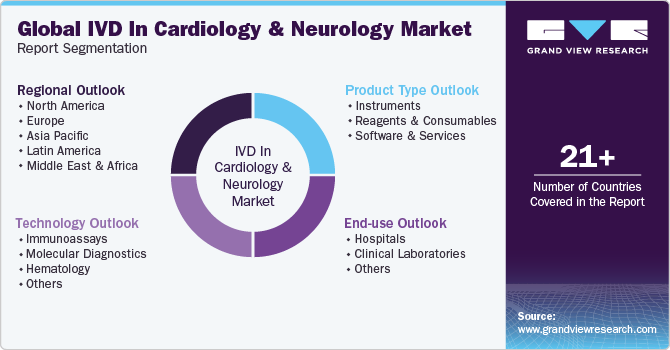

IVD In Cardiology And Neurology Market Size, Share & Trends Analysis Report By Product Type (Instruments, Reagents & Consumables), By Technology, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-204-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

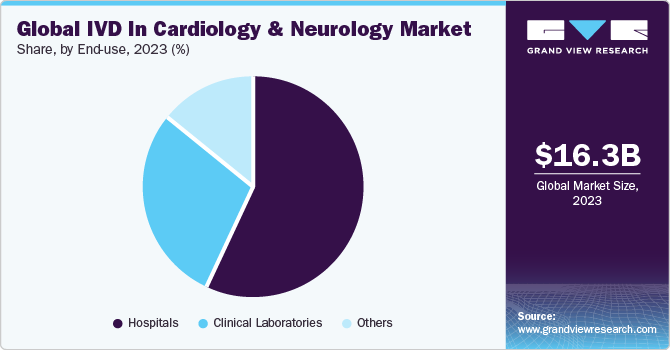

The global IVD in cardiology and neurology market size was estimated at USD 16.29 billion in 2023 and is projected to grow at a CAGR of 9.44% from 2024 to 2030. The market growth can be attributed to the rising prevalence of cardiovascular & neurological disorders, technological advancement in clinical diagnostics, and an increasing focus on research for the development of novel diagnostics in the market. Moreover, increasing investment by public and private organizations is further propelling growth. For example, Acute Coronary Syndrome (ACS) poses an immense economic and social burden as a result of the high global incidence. ACS encompasses clinical symptoms of varied conditions, including coronary artery disease (CAD), Unstable Angina (UA), and Myocardial Infarction (MI).

The disease has a widespread prevalence due to the growing geriatric population. Moreover, a rise in the prevalence of Alzheimer’s disease, coupled with awareness of the disease, is expected to drive market growth. Alzheimer’s disease mostly occurs in people aged 65 years and above. According to the Alzheimer’s Association, globally, approximately 55 million individuals are living with dementia, which is anticipated to rise to 78 million by 2030 and around 139 million by 2050. In vitro diagnostics solutions help in detecting the presence of biomarkers, facilitating rapid diagnosis of target diseases. An increasing demand for these kits is due to quick diagnosis and fast results obtained through them, which reduces the diagnostic time involved, expediting the treatment process.

Furthermore, the implementation of the Affordable Care Act (ACA) in the U.S. has favored the development of personalized medicine and diagnostics, which has led to a significant increase in demand for Point-of-Care (PoC) testing kits. The rising adoption of biomarkers and subsequent funding associated with the development of biomarkers is also anticipated to drive market growth. For instance, the University of North Texas Health Science Center (HSC) was granted about USD 45 million as funding from the National Institutes of Health (NIH) to support research regarding health disparities in Alzheimer's and brain aging. The NIH is also offering funds for research on biomarkers—Health and Aging Brain Among Latino Elders (HABLE) study.

Moreover, the National Institute of Neurological Disorders and Stroke provides funding opportunities, such as cooperative agreements & development grants for researchers conducting studies related to clinical validation, analytical validation, & biomarker discovery. However, factors, such as lack of awareness about such diagnostic products, high costs of these products, and limited availability or absence of neurologists & cardiologists, especially in developing & underdeveloped countries, affect the adoption of IVD-based diagnostic solutions. Moreover, the lack of adequate reimbursement for In Vitro diagnostics (IVD) tests, especially neurological and cardiovascular disease testing, is one of the major factors restraining market growth.

Market Concentration & Characteristics

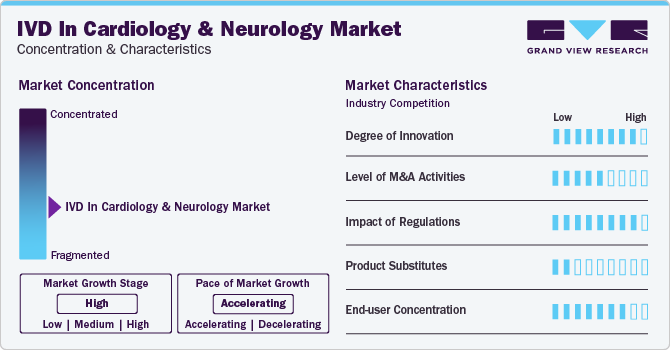

The degree of innovation is high in the market characterized by a growing level of research and development, such as the use of antigen-antibody binding techniques to help diagnose Parkinson’s disease (PD). For example, according to an article by NCBI in 2022, the diagnosis of neurological disorders (PD) requires immunoblotting analysis for investigation of the inhibitory effect of P450 inhibition assay, which shows that the assay can discriminate sera between PD patients and healthy individuals

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in July 2021, Myriad Genetics, Inc. acquired Rules-Based Medicine, a Q2 Solutions company and a wholly-owned subsidiary of IQVIA. This acquisition strengthened Rules-Based Medicine’s neuroscience biomarkers portfolio

The regulatory framework for product approvals has always been one of the major restraining factors in the pharmaceutical, biotechnology, and medical technology industries. The regulatory framework for the diagnostic sector is very stringent in countries where the in vitro diagnostics market has a high potential to grow due to the availability of a large patient pool

The level of substitution is generally low for the market owing to the lack of highly specific and accurate diagnostics solutions for cardiology and neurology

In the past, the use of IVD was limited to the clinical settings of laboratories and hospitals. However, the use and demand of point-of-care tests and devices are rising owing to increased demand for rapid identification of diseases to facilitate faster decision-making. This trend is pushing manufacturers to launch small, transportable, fast, and easy-to-use instruments, making use of these instruments easier in non-laboratory settings

Product Type Insights

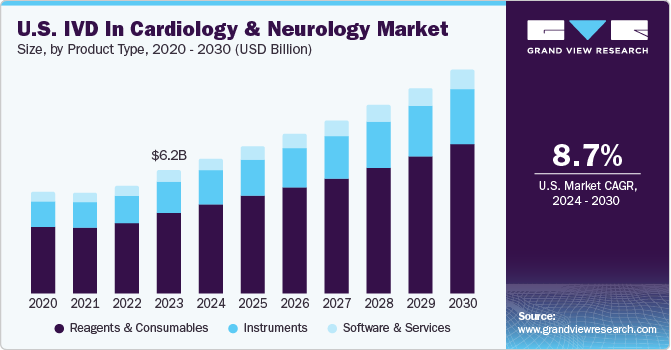

The reagents and consumables segment led the in vitro diagnostics (IVD) in cardiology and neurology market and accounted for 65.88% of the global revenue in 2023 and is anticipated to grow at the fastest CAGR from 2024 to 2030. Reagents, such as fluorescent tags, washing buffers, specific antibodies, and protein biomarkers, are used in immunochemistry assays. Various chemicals, such as dNTP mix, primer mix, and salts or magnesium chloride, are used to perform PCR tests. Fluorescent-labeled nucleotides and primers are the primary and most frequently used reagents in molecular diagnostic techniques. The key players providing reagents include Abbott; Illumina, Inc.; and Roche Diagnostics. The segment's growth is attributed to extensive R&D initiatives undertaken by major players to develop novel biomarker kits. Furthermore, the introduction and commercialization of new reagents are expected to drive market growth.

The instruments segment is anticipated to grow at a significant CAGR from 2024 to 2030. Equipment & machines that assist in automating the diagnosis process and bringing reagents & samples together are referred to as analytical instruments. Increasing technological advancements, such as the introduction of portable instruments, such as the h 232 POC system developed by Roche Diagnostics, are anticipated to fuel market growth. In addition, the increasing use of these systems to develop new tests that can detect target diseases and rising focus of players in aligning their product launches in line with the increasing genetic test requirement globally is expected to propel market growth.

Technology Insights

The immunoassays segment led the market with a share of 37.41% in 2023. Immunology involves the study of molecular mechanisms to understand various functions of the immune system. It majorly includes an assessment of the mechanism of action of antibodies, antigens, and their interactions.Companies are focusing on the development and commercialization of immunoassays. For instance, in December 2022, the FDA cleared Roche’s beta-Amyloid CSF and Phospho-Tau Alzheimer Disease Assays, which utilize a ratio of pTau181/Abeta42 when used with cobas fully automated immunoassay analyzers for clinical biomarker testing. Such initiatives are likely to increase the adoption of immunoassays in clinical laboratories and drive market growth.

The molecular diagnostics segment is anticipated to register the fastest CAGR from 2024 to 2030. The use of molecular diagnostic technologies in cardiovascular diseases enables the identification of gene aberrations and lipid gene expression implicated in vascular disorders. The wide range of molecular diagnostic techniques with their increased ability to identify mutations associated with cardiovascular and neurological disorders helps in providing growth opportunities for immunoassays.Moreover, industry players are focused on collaborations, new product developments, and partnerships to expand their geographic presence and global reach.

End-use Insights

The hospitals segment led the market with a share of 56.80% in 2023. The segment growth is attributed to a rise in hospitalization, as doctors require diagnostic interpretation for further treatment. Most often, diagnostic centers operate in collaboration with hospitals; hence, hospitals have their own diagnostic setup. Furthermore, ongoing development of healthcare infrastructure is anticipated to enhance the existing hospital facilities. Thus, the demand for hospital-based IVD tests is increasing. Most of the IVD devices are purchased by hospitals and are used in significant volumes.

The others segment is projected to witness the fastest CAGR from 2024 to 2030. Other end-users of IVDs are other healthcare settings, ambulatory care services, and schools & academic institutions, especially in emergency cases and research institutes. These healthcare institutions mostly perform POC tests for monitoring or detecting diseases. High adoption of these tests by the abovementioned organizations due to lower costs and quick results is expected to fuel market growth.

Regional Insights

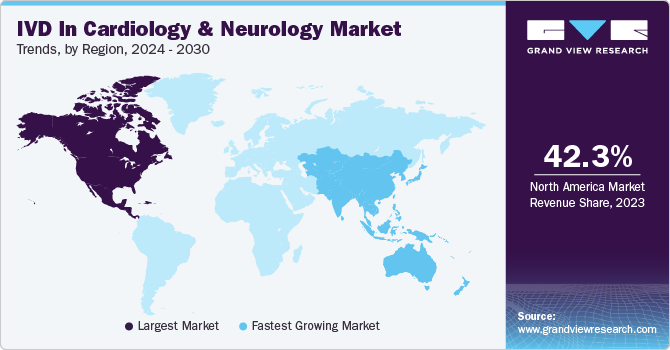

North America accounted for a share of 42.28% share in 2023 owing to factors, such as rising burden of neurological and cardiovascular disorders and an increasing number of favorable government initiatives. Increasing product launches and funding for R&D of novel biomarkers is further expected to drive market growth.The improving adoption of IVDs in risk stratification and diagnosis of acute coronary syndrome is impelling regional demand. Moreover, unhealthy lifestyles are driving the prevalence of acute coronary syndrome and myocardial infarction. Moreover, high adoption of PoC diagnostics is driving regional innovation, making the use of in vitro diagnostics easier.

U.S. IVD in Cardiology And Neurology Market Trends

The U.S. market is expected to grow over the forecast period due to frequent approvals and novel diagnostics launches aided by the increasing investment in advancement of diagnostic solutions.

Europe IVD in Cardiology And Neurology Market Trends

Europe is a lucrative regional market due to an increasing prevalence of cardiovascular diseases aided by a rise in research funding and a strong presence of key players in this region.

The IVD in cardiology and neurology market in the UK is expected to grow over the forecast period due to the presence of well-established healthcare infrastructure, high disposable income, and rising awareness about early disease diagnosis.

The France IVD in cardiology and neurology market is expected to grow over the forecast period on account of the launch of novel IVD tests in the country for cardiovascular and neurological disorders.

The IVD in cardiology and neurology market in Germany is expected to grow over the forecast period due to the rising number of initiatives undertaken by the government to help spread awareness regarding diagnosis and innovative diagnostic solutions.

Asia Pacific IVD in Cardiology And Neurology Market Trends

Asia Pacific is anticipated to witness the fastest CAGR from 2024 to 2030 due to the presence of a large target population, high unmet clinical needs, and developing healthcare infrastructure. Major players operating in the region are constantly focusing on the development of novel IVD solutions owing to the growing aging population and prevalence of neurological disorders. Moreover, there is a high focus on geographic expansion with the launch of new manufacturing facilities in this region. For instance, in June 2022, MiRXES Pte. Ltd. announced the opening of Asia’s first industry 4.0 IVD manufacturing facility. The company has opened this manufacturing facility with a major focus on the development of multi-cancer early detection tests, cardiovascular disease tests, and pulmonary tests.

The IVD in cardiology and neurology market in China is expected to grow over the forecast period due to the growing focus on improving healthcare R&D aided by the development of novel technologies.

The Japan IVD in cardiology and neurology market is expected to grow significantly due to the presence of a well-established healthcare system and high adoption of advanced diagnosis tests & therapies for effective diagnosis & management of target diseases.

Latin America IVD in Cardiology And Neurology Market Trends

The market in Latin America was identified as a lucrative region in this industry. Technological advancements and increasing awareness regarding IVD devices in the region are anticipated to fuel market growth.

The IVD in cardiology and neurology market in Brazil is expected to grow over the forecast period due to the rising prevalence of target diseases aided by the rising use of POC diagnostics.

MEA IVD in Cardiology And Neurology Market Trends

The MEA regional market is expected to witness considerable growth in the years to come. The MEA market growth is driven by the high prevalence of neurological and cardiovascular diseases, aided by improvements in healthcare infrastructure.

The Saudi Arabia IVD in cardiology and neurology market is expected to grow over the forecast period owing to the need for better diagnostics and improvements in treatment options due to the rising prevalence of target diseases.

Key IVD in Cardiology and Neurology Company Insights

Some of the leading players operating in the in vitro diagnostics (IVD) in cardiology and neurology market include Siemens Healthineers AG, Abbott, and Beckman Coulter, Inc. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Randox Laboratories, Creative Diagnostics, and Life Diagnostics are some of the emerging market participants in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key IVD in Cardiology And Neurology Companies:

The following are the leading companies in the IVD in cardiology and neurology market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Sysmex Corporation

- Siemens Healthineers AG

- Quest Diagnostics Incorporated

- Abbott

- BD

- Bio-Rad Laboratories, Inc.

- Beckman Coulter, Inc.

Recent Developments

-

In July 2023,Beckman Coulter, Inc. entered into a partnership withFujirebio to enhance patients’ access to blood-based Alzheimer’s disease tests. The partnership aims to combine the company's immunoassay strengths to support.

-

In March 2023, Fujirebio announced the expansion of its assay product portfolio in the field of neurodegenerative disorders with the launch of fully automated Lumipulse G NfL Blood and Lumipulse G NfL CSF tests.

-

In March 2022, Siemens Healthineers AG received breakthrough device designation from the FDA for the sNfL test used for the diagnosis of multiple sclerosis. The test is used to measure the NfL in human plasma and serum which serves as a biomarker for nerve cell injuries measured in blood and cerebral spinal fluid.

In Vitro Diagnostics (IVD) In Cardiology And Neurology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.77 billion

Revenue forecast in 2030

USD 30.53 billion

Growth rate

CAGR of 9.44% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, technology, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd.; Sysmex Corp.; Siemens Healthineers AG; Quest Diagnostics Inc.; Abbott; BD; Bio-Rad Laboratories, Inc.; Beckman Coulter, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IVD In Cardiology And Neurology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented theGlobal IVD in cardiology and neurology market report based on product type, technology, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents & Consumables

-

Software and Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

Molecular Diagnostics

-

Hematology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global in vitro diagnostics in cardiology and neurology market size was estimated at USD 16.29 billion in 2023 and is expected to reach USD 17.77 billion in 2024.

b. The global IVD in cardiology and neurology market is expected to grow at a compound annual growth rate of 9.44% from 2024 to 2030 to reach USD 30.53 billion by 2030.

b. North America dominated the IVD in cardiology and neurology market with a share of 42.28% in 2023. This is attributable to factors such as the rising burden of neurological and cardiovascular disorders and the increasing number of favorable government initiatives.

b. Some key players operating in the in vitro diagnostics (IVD) in cardiology and neurology market include Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Sysmex Corporation, Siemens Healthineers AG, Quest Diagnostics Incorporated, Abbott, BD, Bio-Rad Laboratories, Inc., Beckman Coulter, Inc.

b. Key factors that are driving the market growth include rising prevalence of cardiovascular and neurological disorders, technological advancement in clinical diagnostics, and an increasing focus on research for development of novel diagnostics in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."