- Home

- »

- Medical Devices

- »

-

In Vitro Fertilization Market Size And Share Report, 2030GVR Report cover

![In Vitro Fertilization Market Size, Share & Trends Report]()

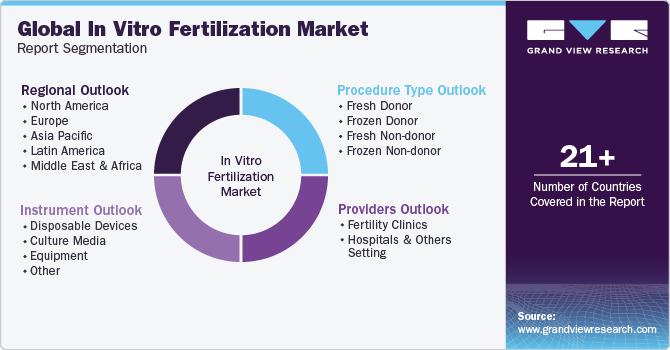

In Vitro Fertilization Market Size, Share & Trends Analysis Report By Instrument (Equipment, Disposable Devices, Culture Media), By Procedure Type (Fresh Nondonor, Frozen Nondonor), By Providers, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-823-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

In Vitro Fertilization Market Size & Trends

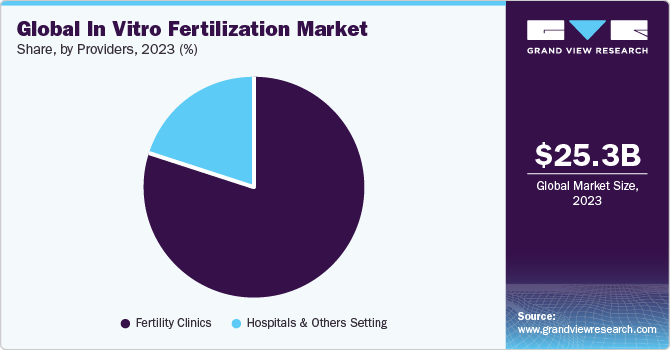

The global In vitro fertilization market size was valued at USD 25.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.54% from 2024 to 2030. Rising reproductive tourism and increasing cases of male & female infertility are key factors driving the market growth. Infertility is one of the major health concerns faced by individuals globally. According to WHO, around 17.5% of the adult population worldwide experiences infertility. This shows necessity to enhance accessibility to affordable and top-notch fertility care globally.

The American Pregnancy Association states that male infertility constitutes 30% of overall infertility cases and contributes to approximately one-fifth of all infertility instances in the U.S. The average age at which individuals are getting married and having their first child is increasing. This trend has increased number of women seeking IVF treatment. Moreover, to focus on their career, many women freeze their eggs to have child at a later stage. Rising dependence on fertility treatments is expected to aid market growth. The availability of funds is leading to a rise in adoption of in vitro fertilization (IVF) procedures.

To increase success rate of IVF, techniques, such as egg/sperm freezing, vitrification, assisted hatching, Percutaneous Epidydimal Sperm Aspiration & Testicular Sperm Extraction (PESA and TESE), are being introduced along with development of new products. In May 2023, AIVF Ltd., a company based in field of AI-based solutions for IVF clinics, joined forces with Genea Biomedx, a medical device provider for IVF laboratories, to create a comprehensive and cost-effective integrated systems solution for personalized IVF. The collaboration brought together Genea Biomedx’s Geri time-lapse incubator and AIVF Ltd.’s EMA AI platform, creating a powerful suite that offers widespread access to personalized and optimized IVF treatments.

To compete in modern business environment, all organizations (manufacturers, clinics, and hospitals) must develop their virtual presence to increase awareness about infertility treatment, and their services. As infertility is a sensitive issue, people are reluctant to discuss it openly, particularly in developing countries. Hence, developing authenticity and trust through digital platforms is a key challenge for service providers. The providers can take an initial step to gain a center’s or manufacturer’s trust by displaying hospital’s or approval committee’s certificates, introducing doctors or scientists, and sharing their coordinates to establish & authenticate their identity.

Market Concentration & Characteristics

The degree of innovation is high in the market. Over the years, there have been many advancements and innovations in the field of IVF. The companies are constantly innovating to offer advanced procedures to improve success rates of IVF. For instance, a major innovation has been the use of pre-implantation genetic testing (PGT) to screen embryos for genetic abnormalities before they are transferred to the uterus. In recent years, the use of time-lapse imaging and artificial intelligence (AI) in IVF has also shown promising results in improving success rates. These advancements have made IVF more accessible and effective for couples struggling with infertility. For instance, in May 2023, Genea Biomedx and AIVF partnered to launch an integrated solution for personalized IVF care at a low cost. The integrated suite was built based on the Geri time-lapse incubator of Genea Biomedx and the EMA AI platform of AIVF.

The impact of regulations on the market is high due to stringent regulations in developed and many developing countries. For instance, the U.S. FDA regulates drugs and devices used in IVF, followed by the implementation of the Fertility Clinic Success Rate and Certification Act by the CDC. Moreover, semen analysis and sperm function tests are high-complexity tests regulated by the Clinical Laboratory Improvement Amendments of 1988 (CLIA '88) in the U.S. Strict compliance with standards and on-site inspections are essential.

The level of merger and acquisition activity in the IVF market has been low over the past few years. Mergers and acquisitions are expected to continue as the IVF market continues to grow and evolve. This can be attributed to the increasing competition among IVF clinics and the need for economies of scale to remain competitive. For instance, in August 2023, Reproductive Medicine Associates (RMA) acquired Conceptions Reproductive Associates of Colorado (Conceptions). As a part of the acquisition, Conceptions four fertility clinics in Colorado will be part of RMA.

The level of product & service expansion in the market is expected to remain moderate. The major service providers and equipment manufacturers in the market are heavily investing in product & service innovations and expanding their portfolios to offer diverse, technologically advanced & innovative solutions to end-users. For instance, in May 2023, CNY Fertility launched a program offering a combination of IVF or Egg Freezing treatment and the medications required in discounted packages.

The regional expansion is currently low in the market; however, the market is expected to witness a high degree of regional expansion owing to the growing adoption of multilocation models to extend their services to underserved areas and cater to diverse patient demographics. Moreover, operating multiple IVF clinics at different geographical locations yields economies of scale and could improve operational efficiency.

Instrument Insights

The culture media segment dominated the market with the largest revenue share of 40.9 % in 2023. This can be attributed to factors such as availability of funding and an increase in research activities to improve culture media. In July 2022, FUJIFILM Irvine Scientific launched a mineral oil for embryo culture, Heavy Oil for Embryo Culture. It is a sterile mineral oil that addresses major concerns in IVF procedures, including pH, osmolality changes, and media preservation, owing to its ideal weight viscosity.

Disposable devices segment is expected to grow at the fastest CAGR during forecast years. The growth of this segment is owing to industry players introducing disposable devices, such as slides, needles, and chambers, to meet sterility and regulatory requirements. Such developments are expected to increase adoption of disposable IVF devices. Disposable slides for sperm counting, an imaging-based tracking system to isolate best motile sperm, and use of disposable microchips are some of innovations witnessed by the market in recent years.

Procedure Type Insights

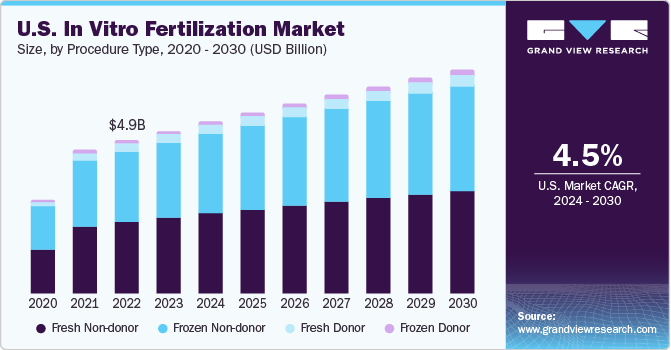

Frozen non-donor segment dominated the market with largest revenue share in 2023 and is expected to witness fastest growth over the forecast period. Certain factors contributing to high share are cost-effectiveness as compared to fresh nondonor and less invasive nature of procedure. The fresh donor segment is expected to grow significantly over forecast period. As per the 2020 National ART Summary report, around 1,477 ART cycles were performed using fresh donors, with around 53.9% of transfers resulting in live-birth deliveries in the U.S.

Although some centers offer risk-sharing plans and refunds only for three cycles, Advanced Fertility Center of Chicago has designed IVF reimbursement plan to provide a 100% refund for up to four cycles with fresh embryos. The Human Fertilization and Embryology Act 1990 does not cover fresh sperm donation, and hence, there is rising concern about sperm donors not being screened before donation. HEFA does not guarantee sperm donation services, which are unlicensed. Hence, HEFA has revised its guidelines, wherein fresh sperm must be quarantined for 180 days for HIV screening. NHS funds a smaller proportion of fertility treatment using donated gametes to homosexuals and single parents.

Providers Insights

Fertility clinics segment dominated the market with largest revenue share in 2023 and is expected to witness fastest growth over the forecast period. This can be attributed to a rise in demand for ART treatments; number of fertility clinics and ART centers is increasing considerably. Factors, such as cost-effectiveness, availability of specialists, and minimal or no chances of Hospital-Acquired Infections (HAIs), are anticipated to drive the growth of fertility clinics segment. IVF treatments are also performed in hospitals.

Hospitals and other settings segments is expected to grow at a significant CAGR over the forecast period. Numerous multispecialty hospitals provide infertility treatments, including In-vitro Fertilization (IVF). Growing accessibility and availability of these treatments have contributed to a greater inclination toward hospitals for infertility care. However, hospital IVF treatments cost more than fertility clinics. This is partly due to need for highly skilled physicians and staff to perform these intricate procedures. Consequently, having a dedicated IVF staff in hospitals is considered a less favored approach due to expenses related to their employment, remuneration, and training. These costs can be particularly high in developed countries like the U.S. and UK.

Regional Insights

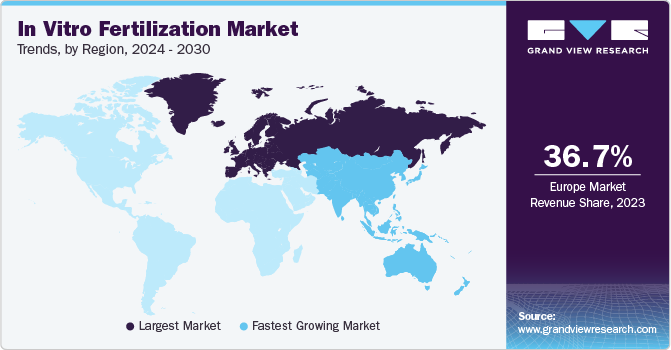

Europe dominated the market with largest revenue share of 36.7% in 2023. This can be attributed to factors, such as a noticeable surge in medical tourism, with an increasing number of Americans choosing to travel to Czech Republic for more cost-effective IVF treatments. Moreover, individuals who cannot afford to travel abroad are now seeking IVF treatments within the United States at around one-third of the cost charged by clinics in the country. In July 2022, Fairtility obtained approval from the European Union to use AI for embryo assessment. EU's new medical device regulation standards have enabled development of a commercially available AI tool, which holds potential to boost success rate of IVF procedures.

North America is also expected to witness increasing demand for fertility treatment in coming years. Lifestyle changes, including insufficient nutrition, stress, increased obesity, improper eating habits, rise in pollution, lack of exercise, and prevalence of medical conditions like diabetes, have led to a higher incidence of infertility in the region. The growth of can be attributed to several factors such as standardization of procedures through regulatory reforms, automation, government funding for egg/sperm storage, and introduction of more IVF treatments by industry players.

U.S. IVF Market

Growth of the U.S. IVF services market is driven by various factors, with one significant factor being the notable increase in infertility rates. Infertility affects a considerable number of couples in the U.S., with approximately one in eight couples experiencing difficulties in conceiving.

The demand for IVF treatments is expected to increase in Asia Pacific region owing to the growth in fertility tourism, increase in the number of international companies trying to penetrate economically developing countries, and change in the regulatory landscape in APAC. The Asia Pacific Initiative on Reproduction (ASPIRE) is a task force of clinicians & scientists engaged in the management of fertility & ART. This promotes awareness regarding infertility & ART and enhances infertility-related services in the region. According to OECD, in 2022, birth rate in Asia Pacific has fallen to population replacement rate of 2.1 born children per woman. Decrease in birth rate and increase in the geriatric population are among the key factors expected to propel market growth.

India IVF Market

India experienced a remarkable increase in the demand for IVF services. This surge can be attributed to several factors, including delayed marriages, a rise in the average age of pregnancy, an increase in infertility rates, higher disposable income levels, and awareness about the availability of infertility treatments. The average cost of IVF services in India range from USD 1,000 to USD 3,000.

Key Companies & Market Share Insights

The market is moving towards maturation phase with strong growth momentum with the increasing demand and supply chain capabilities in developing countries. Geographical expansions, mergers, and product innovations & commercialization are key strategies adopted by the market players. For instance, in June 2023, Progyny, Inc. and Quantum Health, Inc. entered a partnership to introduce Quantum Health’s Comprehensive Care Solutions platform for family building and fertility solutions.

Key Suppliers in In Vitro Fertilization Companies:

- Bayer AG

- Cook Medical LLC

- EMD Serono, Inc.

- Ferring B.V.

- FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation)

- Genea Biomedx

- EMD Serono, Inc. (Merck KGaA)

- Merck & Co., Inc.

- The Cooper Companies, Inc.

- Thermo Fisher Scientific, Inc.

- Vitrolife

Key Service Providers in In Vitro Fertilization Companies:

- Boston IVF

- Nova IVF

- RMA Network (Reproductive Medicine Associates)

- TFP Thames Valley Fertility

- Fortis Healthcare

- U.S. Fertility

Recent Developments

-

In June 2023, FUJIFILM Irvine Scientific, Inc. expanded its Presagen’s Life Whisperer platform capabilities to help with clinical decision-making in IVF.

-

In May 2023, Merck KGaA introduced Fertility Counts to address societal, economic, and social challenges associated with low birth rates in the Asia Pacific (APAC) region.

-

In May 2023, Ovation Fertility combined with US Fertility to created fertility platform offering advanced fertility care and IVF services in the U.S.

-

In April 2023, Boston IVF signed 3 years supply chain solutions agreement with Cryoport, Inc. to support the reproductive material shipment across the U.S.

In Vitro Fertilization Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.1 billion

Revenue forecast in 2030

USD 37.4 billion

Growth rate

CAGR of 5.54% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Instrument, procedure type, providers, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; France; Germany; Italy; Spain; UK; Belgium; Netherlands; Switzerland; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Bayer AG; Cook Medical LLC; EMD Serono, Inc.; Ferring B.V.; FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation); Genea Biomedx; EMD Serono, Inc. (Merck KGaA); Merck & Co., Inc.; The Cooper Companies, Inc.; Thermo Fisher Scientific, Inc.; Vitrolife; Boston IVF; Nova IVF; RMA Network (Reproductive Medicine Associates); TFP Thames Valley Fertility; Fortis Healthcare; U.S. Fertility

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In Vitro Fertilization Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global in vitro fertilization market report on the basis of instrument, procedure type, providers, and region:

-

Instrument Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Devices

-

Culture Media

-

Cryopreservation Media

-

Embryo Culture Media

-

Ovum Processing Media

-

Sperm Processing Media

-

-

Equipment

-

Sperm Analyzer Systems

-

Imaging Systems

-

Ovum Aspiration Pumps

-

Micromanipulator Systems

-

Incubators

-

Gas Analyzers

-

Laser Systems

-

Cryosystems

-

Sperm Separation Devices

-

IVF Cabinets

-

Anti-vibration Tables

-

Witness Systems

-

Other

-

-

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-donor

-

Frozen Non-donor

-

-

Providers Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertility Clinics

-

Hospitals & Others Setting

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

Belgium

-

Netherlands

-

Switzerland

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global in vitro fertilization market is expected to grow at a compound annual growth rate of 5.54% from 2024 to 2030 to reach USD 37.4 billion by 2030.

b. Europe dominated the IVF market with a share of 36.7% in 2023. This is attributable to it being the first region to come up with the in-vitro fertilization procedure, to remove the title experimental from cryopreservation of eggs, and the first one to legally approve the three parent’s IVF or the mitochondrial transfer technique.

b. Some key players operating in the IVF market include OvaScience; EMD Serono Inc.; Vitrolife AB; Irvine Scientific; Cook Medical Inc.; Cooper Surgical Inc.; Genea Biomedx; Thermo Fisher Scientific Inc.; Progyny, Inc.; and Boston IVF.

b. Key factors that are driving the in vitro fertilization market growth include an increase in cases of infertility and the development of advanced technologies such as lensless imaging of the sperms.

b. The global in vitro fertilization market size was estimated at USD 25.3 billion in 2023 and is expected to reach USD 27.1 billion in 2024.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation

1.2. Market Definitions

1.2.1. Procedure Type

1.2.2. Providers

1.2.3. Instrument

1.2.4. Region

1.3. Estimates and Forecast Timeline

1.4. Research Methodology

1.4.1. Information procurement

1.4.2. Purchased Database

1.4.3. GVR's Internal Database

1.4.4. Secondary Sources

1.4.5. Primary Research

1.4.6. Details of Primary Research

1.5. Information or Data Analysis

1.5.1. Data Analysis Models

1.6. Market Formulation & Validation

1.6.1. Volume Price Analysis

1.6.2. Commodity Flow Analysis

1.7. List of Secondary Sources

1.8. List of Abbreviations

1.9. Research Objectives

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.2.1. Procedure Type

2.2.2. End-Use

2.2.3. Instrument

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.2. Market Segmentation

3.3. User Perspective Analysis

3.3.1. Consumer Behavior Analysis

3.3.2. Market Influencer Analysis

3.4. IVF Procedure Pricing Analysis

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.1.1. Rising reprotourism

3.5.1.2. Technological advancements in IVF

3.5.1.3. Favorable government funding

3.5.1.4. Late initiation of family

3.5.1.5. Increasing incidence rate of male and female infertility

3.5.1.6. Mergers and acquisitions (M&A)

3.5.2. Market Restraint Analysis

3.5.2.1. High cost of IVF treatment

3.5.2.2. Lack of regulatory framework and uniform regulations

3.5.2.3. Vulnerability of women depending on cross-border reprotourism

3.6. Industry Analysis Tools

3.6.1. Porter's Five Forces Analysis

3.6.2. PESTLE Analysis

3.6.3. Qualitative Analysis: Impact of COVID-19 on IVF Market

Chapter 4. In Vitro Fertilization Market: Procedure Type Analysis

4.1. In Vitro Fertilization by Procedure Type Market Share Analysis, 2023 & 2030

4.2. Segment Dashboard

4.3. Global In Vitro Fertilization Procedures Market, by Type, 2018 - 20302018 - 20302018 - 2030

4.4. Market Size and Forecasts and Trend Analysis, 2018 - 20302018 - 20302018 - 2030 for the Procedure Type

4.4.1. Fresh Nondonor

4.4.1.1. Fresh nondonor market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

4.4.2. Frozen Nondonor

4.4.2.1. Frozen nondonor market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

4.4.3. Fresh Donor

4.4.3.1. Fresh donor market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

4.4.4. Frozen Donor

4.4.4.1. Frozen donor market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

Chapter 5. In Vitro Fertilization Market: Providers Analysis

5.1. In Vitro Fertilization Market: Providers Market Share Analysis, 2023 & 2030

5.2. Segment Dashboard

5.3. Market Size and Forecasts and Trend Analysis, 2018 - 20302018 - 20302018 - 2030 for the following Providers

5.3.1. Fertility Clinics

5.3.1.1. Fertility clinics market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

5.3.2. Hospitals and Other Settings

5.3.2.1. Hospitals and other settings market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

Chapter 6. In Vitro Fertilization Market: Instrument Analysis

6.1. In Vitro Fertilization (IVF) Market Share Analysis, 2023 & 2030

6.2. Segment Dashboard

6.3. Global IVF Market, by Instrument, 2023 to 2030

6.4. Market Size & Forecasts and Trend Analysis, 2018 to 2030 for the Instrument

6.4.1. Culture Media

6.4.1.1. Culture media market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.1.2. Cryopreservation Media

6.4.1.2.1. Cryopreservation market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.1.3. Embryo Culture Media

6.4.1.3.1. Embryo culture media market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.1.4. Ovum Processing Media

6.4.1.4.1. Ovum processing media market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.1.5. Sperm Processing Media

6.4.1.5.1. Sperm processing media market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.2. Disposable Devices

6.4.2.1. Disposable devices market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3. Equipment

6.4.3.1. Equipment market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.2. Sperm Analyzer Systems Media

6.4.3.2.1. Sperm analyzer systems market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.3. Imaging Systems

6.4.3.3.1. Imaging systems market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.4. Ovum Aspiration Pumps

6.4.3.4.1. Ovum aspiration pumps market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.5. Micromanipulator Systems

6.4.3.5.1. Micromanipulator systems market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.6. Incubators

6.4.3.6.1. Incubators market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.7. Gas Analyzers

6.4.3.7.1. Gas analyzers market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.8. Laser Systems

6.4.3.8.1. Laser systems market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.9. Cryosystems

6.4.3.9.1. Cryosystems market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.10. Sperm Separation Devices

6.4.3.10.1. Sperm separation devices market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.11. IVF Cabinets

6.4.3.11.1. IVF cabinets market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.12. Anti-vibration Tables

6.4.3.12.1. Anti-vibration tables market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.13. Witness Systems

6.4.3.13.1. Witness systems market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

6.4.3.14. Others

6.4.3.14.1. Others market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

Chapter 7. Regional Outlook

7.1. IVF Market by Region: Key Marketplace Takeaway

7.2. North America

7.2.1. North America IVF market, 2018 - 2030 (USD Million)

7.2.2. U.S.

7.2.2.1. U.S. estimated fertility rate, 2018 - 2030 (%)

7.2.2.2. Regulatory framework

7.2.2.3. Reimbursement scenario

7.2.2.4. Competitive scenario

7.2.2.5. U.S. IVF market, 2018 - 2030 (USD Million)

7.2.3. Canada

7.2.3.1. Canada estimated fertility rate, 2018 - 2030 (%)

7.2.3.2. Regulatory framework

7.2.3.3. Reimbursement scenario

7.2.3.4. Competitive scenario

7.2.3.5. Canada IVF market, 2018 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe IVF market, 2018 - 2030 (USD Million)

7.3.2. France

7.3.2.1. France estimated fertility rate, 2018 - 2030 (%)

7.3.2.2. Regulatory framework

7.3.2.3. Reimbursement scenario

7.3.2.4. Competitive scenario

7.3.2.5. France IVF market, 2018 - 2030 (USD Million)

7.3.3. Germany

7.3.3.1. Germany estimated fertility rate, 2018 - 2030 (%)

7.3.3.2. Regulatory framework

7.3.3.3. Reimbursement Scenario

7.3.3.4. Competitive scenario

7.3.3.5. Germany IVF market, 2018 - 2030 (USD Million)

7.3.4. Italy

7.3.4.1. Italy estimated fertility rate, 2018 - 2030 (%)

7.3.4.2. Regulatory framework

7.3.4.3. Reimbursement scenario

7.3.4.4. Competitive scenario

7.3.4.5. Italy IVF market, 2018 - 2030 (USD Million)

7.3.5. Spain

7.3.5.1. Spain estimated fertility rate, 2018 - 2030 (%)

7.3.5.2. Regulatory framework

7.3.5.3. Reimbursement scenario

7.3.5.4. Competitive scenario

7.3.5.5. Spain IVF market, 2018 - 2030 (USD Million)

7.3.6. UK

7.3.6.1. UK estimated fertility rate, 2018 - 2030 (%)

7.3.6.2. Regulatory framework

7.3.6.3. Reimbursement scenario

7.3.6.4. Competitive scenario

7.3.6.5. UK IVF market, 2018 - 2030 (USD Million)

7.3.7. Belgium

7.3.7.1. Belgium estimated fertility rate, 2018 - 2030 (%)

7.3.7.2. Regulatory framework

7.3.7.3. Reimbursement scenario

7.3.7.4. Competitive scenario

7.3.7.5. Belgium IVF market, 2018 - 2030 (USD Million)

7.3.8. Netherlands

7.3.8.1. Netherlands estimated fertility rate, 2018 - 2030 (%)

7.3.8.2. Regulatory framework

7.3.8.3. Reimbursement scenario

7.3.8.4. Competitive scenario

7.3.8.5. Netherlands IVF market, 2018 - 2030 (USD Million)

7.3.9. Switzerland

7.3.9.1. Switzerland estimated fertility rate, 2018 - 2030 (%)

7.3.9.2. Regulatory framework

7.3.9.3. Reimbursement scenario

7.3.9.4. Competitive scenario

7.3.9.5. Switzerland IVF market, 2018 - 2030 (USD Million)

7.3.10. Sweden

7.3.10.1. Sweden estimated fertility rate, 2018 - 2030 (%)

7.3.10.2. Regulatory framework

7.3.10.3. Reimbursement scenario

7.3.10.4. Competitive scenario

7.3.10.5. Sweden IVF market, 2018 - 2030 (USD Million)

7.3.11. Denmark

7.3.11.1. Denmark estimated fertility rate, 2018 - 2030 (%)

7.3.11.2. Regulatory framework

7.3.11.3. Reimbursement scenario

7.3.11.4. Competitive scenario

7.3.11.5. Denmark IVF market, 2018 - 2030 (USD Million)

7.3.12. Norway

7.3.12.1. Norway estimated fertility rate, 2018 - 2030 (%)

7.3.12.2. Regulatory framework

7.3.12.3. Reimbursement scenario

7.3.12.4. Competitive scenario

7.3.12.5. Norway IVF market, 2018 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific IVF market, 2018 - 2030 (USD Million)

7.4.2. Japan

7.4.2.1. Japan estimated fertility rate, 2018 - 2030 (%)

7.4.2.2. Regulatory framework

7.4.2.3. Reimbursement scenario

7.4.2.4. Competitive scenario

7.4.2.5. Japan IVF market, 2018 - 2030 (USD Million)

7.4.3. China

7.4.3.1. China estimated fertility rate, 2018 - 2030 (%)

7.4.3.2. Regulatory framework

7.4.3.3. Reimbursement scenario

7.4.3.4. Competitive scenario

7.4.3.5. China IVF market, 2018 - 2030 (USD Million)

7.4.4. India

7.4.4.1. India estimated fertility rate, 2018 - 2030 (%)

7.4.4.2. Regulatory framework

7.4.4.3. Reimbursement scenario

7.4.4.4. Competitive scenario

7.4.4.5. India IVF market, 2018 - 2030 (USD Million)

7.4.5. Australia

7.4.5.1. Australia estimated fertility rate, 2018 - 2030 (%)

7.4.5.2. Regulatory framework

7.4.5.3. Reimbursement scenario

7.4.5.4. Competitive scenario

7.4.5.5. Australia IVF market, 2018 - 2030 (USD Million)

7.4.6. South Korea

7.4.6.1. South Korea estimated fertility rate, 2018 - 2030 (%)

7.4.6.2. Regulatory framework

7.4.6.3. Reimbursement scenario

7.4.6.4. Competitive scenario

7.4.6.5. South Korea IVF market, 2018 - 2030 (USD Million)

7.4.7. Thailand

7.4.7.1. Thailand estimated fertility rate, 2018 - 2030 (%)

7.4.7.2. Regulatory framework

7.4.7.3. Reimbursement scenario

7.4.7.4. Competitive scenario

7.4.7.5. Thailand IVF market, 2018 - 2030 (USD Million)

7.5. Latin America

7.5.1. Latin America IVF market, 2018 - 2030 (USD Million)

7.5.2. Brazil

7.5.2.1. Brazil estimated fertility rate, 2018 - 2030 (%)

7.5.2.2. Regulatory framework

7.5.2.3. Reimbursement scenario

7.5.2.4. Competitive scenario

7.5.2.5. Brazil IVF market, 2018 - 2030 (USD Million)

7.5.3. Mexico

7.5.3.1. Mexico estimated fertility rate, 2018 - 2030 (%)

7.5.3.2. Regulatory framework

7.5.3.3. Reimbursement scenario

7.5.3.4. Competitive scenario

7.5.3.5. Mexico IVF market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

7.5.4. Argentina

7.5.4.1. Argentina estimated fertility rate, 2018 - 2030 (%)

7.5.4.2. Regulatory framework

7.5.4.3. Reimbursement scenario

7.5.4.4. Competitive scenario

7.5.4.5. Argentina IVF market, 2018 - 20302018 - 20302018 - 2030 (USD Million)

7.6. Middle East & Africa

7.6.1. MEA IVF market, 2018 - 2030 (USD Million)

7.6.2. South Africa

7.6.2.1. South Africa estimated fertility rate, 2018 - 2030 (%)

7.6.2.2. Regulatory framework

7.6.2.3. Reimbursement scenario

7.6.2.4. Competitive scenario

7.6.2.5. South Africa IVF market, 2018 - 2030 (USD Million)

7.6.3. Saudi Arabia

7.6.3.1. Saudi Arabia estimated fertility rate, 2018 - 2030 (%)

7.6.3.2. Regulatory framework

7.6.3.3. Reimbursement scenario

7.6.3.4. Competitive scenario

7.6.3.5. Saudi Arabia IVF market, 2018 - 2030 (USD Million)

7.6.4. UAE

7.6.4.1. UAE estimated fertility rate, 2018 - 2030 (%)

7.6.4.2. Regulatory framework

7.6.4.3. Reimbursement scenario

7.6.4.4. Competitive scenario

7.6.4.5. UAE IVF market, 2018 - 2030(USD Million)

Chapter 8. Competitive Analysis

8.1. Company Profiles

8.1.1. Suppliers

8.1.1.1. Vitrolife

8.1.1.1.1. Overview

8.1.1.1.2. Financial Performance

8.1.1.1.3. Product Benchmarking

8.1.1.1.4. Strategic Initiatives

8.1.1.2. Emd Serono, Inc.

8.1.1.2.1. Overview

8.1.1.2.2. Financial Performance

8.1.1.2.3. Product Benchmarking

8.1.1.2.4. Strategic Initiatives

8.1.1.3. FUJIFILM Irvine Scientific

8.1.1.3.1. Overview

8.1.1.3.2. Financial Performance

8.1.1.3.3. Product Benchmarking

8.1.1.3.4. Strategic Initiatives

8.1.1.4. The Cooper Companies, Inc.

8.1.1.4.1. Overview

8.1.1.4.2. Financial Performance

8.1.1.4.3. Product Benchmarking

8.1.1.4.4. Strategic Initiatives

8.1.1.5. Thermo Fisher Scientific, Inc.

8.1.1.5.1. Overview

8.1.1.5.2. Financial Performance

8.1.1.5.3. Product Benchmarking

8.1.1.5.4. Strategic Initiatives

8.1.1.6. Bayer AG

8.1.1.6.1. Overview

8.1.1.6.2. Financial Performance

8.1.1.6.3. Product Benchmarking

8.1.1.6.4. Strategic Initiatives

8.1.1.7. Merck & Co., Inc.

8.1.1.7.1. Overview

8.1.1.7.2. Financial Performance

8.1.1.7.3. Product Benchmarking

8.1.1.7.4. Strategic Initiatives

8.1.1.8. Cook Medical LLC (Cook Group)

8.1.1.8.1. Overview

8.1.1.8.2. Financial Performance

8.1.1.8.3. Product Benchmarking

8.1.1.8.4. Strategic Initiatives

8.1.1.9. Genea Biomedx

8.1.1.9.1. Overview

8.1.1.9.2. Financial Performance

8.1.1.9.3. Product Benchmarking

8.1.1.9.4. Strategic Initiatives

8.1.1.10. Ferring Pharmaceutical B.V.

8.1.1.10.1. Overview

8.1.1.10.2. Financial Performance

8.1.1.10.3. Product Benchmarking

8.1.1.10.4. Strategic Initiatives

8.1.2. Service Providers

8.1.2.1. Nova IVF

8.1.2.1.1. Overview

8.1.2.1.2. Financial Performance

8.1.2.1.3. Service Benchmarking

8.1.2.1.4. Strategic Initiatives

8.1.2.2. Boston IVF

8.1.2.2.1. Overview

8.1.2.2.2. Financial Performance

8.1.2.2.3. Service Benchmarking

8.1.2.2.4. Strategic Initiatives

8.1.2.3. RMA Network (Reproductive Medicine Associates)

8.1.2.3.1. Overview

8.1.2.3.2. Financial Performance

8.1.2.3.3. Service Benchmarking

8.1.2.3.4. Strategic Initiatives

8.1.2.4. TFP Thames Valley Fertility

8.1.2.4.1. Overview

8.1.2.4.2. Financial Performance

8.1.2.4.3. Service Benchmarking

8.1.2.4.4. Strategic Initiatives

8.1.2.5. Fortis Healthcare

8.1.2.5.1. Overview

8.1.2.5.2. Financial Performance

8.1.2.5.3. Service Benchmarking

8.1.2.5.4. Strategic Initiatives

8.1.2.6. U.S. Fertility

8.1.2.6.1. Overview

8.1.2.6.2. Financial Performance

8.1.2.6.3. Service Benchmarking

8.1.2.6.4. Strategic Initiatives

8.2. Company Categorization

8.3. Company Market Position Analysis

8.4. Strategy Mapping

Chapter 9. Recommendations/Key Market Insights

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviation

Table 3 Comparison Between the Fresh and Frozen Donor Treatment (U.S.)

Table 4 Canadian Law on ART

Table 5 Status Of Public Funding for IVF in Canada

Table 6 Global In-Vitro Fertilization Market, by Region, 2018 - 2030 (USD Million)

Table 7 Global In-Vitro Fertilization Market, by Procedure Type, 2018 - 2030 (USD Million)

Table 8 Global In-Vitro Fertilization Market, by Providers, 2018 - 2030 (USD Million)

Table 9 Global In-Vitro Fertilization Instruments Market, by Region, 2018 - 2030 (USD Million)

Table 10 Global In-Vitro Fertilization Instruments Market, by Type, 2018 - 2030 (USD Million)

Table 11 North America In Vitro Fertilization, by Country, 2018 - 2030 (USD Million)

Table 12 North America In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 13 North America In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 14 North America In-vitro Fertilization (IVF) Instrument Market, by Country, 2018 - 2030 (USD Million)

Table 15 North America In-vitro Fertilization (IVF) Instrument Market, by Type, 2018 - 2030 (USD Million)

Table 16 U.S. In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 17 U.S. In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 18 U.S. In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 19 Canada In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 20 Canada In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 21 Canada In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 22 Europe In-vitro Fertilization (IVF) Market, by Country, 2018 - 2030 (USD Million)

Table 23 Europe In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 24 Europe In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 25 Europe In-vitro Fertilization (IVF) Instrument Market, by Country, 2018 - 2030 (USD Million)

Table 26 Europe In-vitro Fertilization (IVF) Instrument Market, by Type, 2018 - 2030 (USD Million)

Table 27 France In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 28 France In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 29 France In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 30 Germany In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 31 Germany In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 32 Germany In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 33 Italy In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 34 Italy In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 35 Italy In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 36 Spain In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 37 Spain In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 38 Spain In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 39 UK In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 40 UK In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 41 UK In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 42 Belgium In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 43 Belgium In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 44 Belgium In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 45 The Netherlands In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 46 The Netherlands In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 47 The Netherlands In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 48 Switzerland In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 49 Switzerland In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 50 Switzerland In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 51 Sweden In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 52 Sweden In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 53 Sweden In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 54 Denmark In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 55 Denmark In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 56 Denmark In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 57 Sweden In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 58 Sweden In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 59 Sweden In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 60 Asia Pacific In-vitro Fertilization (IVF) Market, by Country, 2018 - 2030 (USD Million)

Table 61 Asia Pacific In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 62 Asia Pacific In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 63 Asia Pacific In-vitro Fertilization (IVF) Instrument Market, by Country, 2018 - 2030 (USD Million)

Table 64 Asia Pacific In-vitro Fertilization (IVF) Instrument Market, by Type, 2018 - 2030 (USD Million)

Table 65 Japan In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 66 Japan In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 67 Japan In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 68 China In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 69 China In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 70 China In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 71 India In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 72 India In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 73 India In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 74 Australia In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 75 Australia In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 76 Australia In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 77 South Korea In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 78 South Korea In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 79 South Korea In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 80 Thailand In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 81 Thailand In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 82 Thailand In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 83 Latin America In-vitro Fertilization (IVF) Market, by Country, 2018 - 2030 (USD Million)

Table 84 Latin America In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 85 Latin America In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 86 Latin America In-vitro Fertilization (IVF) Instrument Market, by Country, 2018 - 2030 (USD Million)

Table 87 Latin America In-vitro Fertilization (IVF) Instrument Market, by Type, 2018 - 2030 (USD Million)

Table 88 Brazil In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 89 Brazil In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 90 Brazil In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 91 Mexico In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 92 Mexico In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 93 Mexico In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 94 Argentina In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 95 Argentina In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 96 Argentina In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 97 MEA In-vitro Fertilization (IVF) Market, by Country, 2018 - 2030 (USD Million)

Table 98 MEA In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 99 MEA In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 100 MEA In-vitro Fertilization (IVF) Instrument Market, by Country, 2018 - 2030 (USD Million)

Table 101 MEA In-vitro Fertilization (IVF) Instrument Market, by Type, 2018 - 2030 (USD Million)

Table 102 South Africa In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 103 South Africa In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 104 South Africa In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 105 Saudi Arabia In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 106 Saudi Arabia In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 107 Saudi Arabia In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

Table 108 UAE In-vitro Fertilization (IVF) Market, By Procedure Type, 2018 - 2030 (USD Million)

Table 109 UAE In-vitro Fertilization (IVF) Market, By Providers, 2018 - 2030 (USD Million)

Table 110 UAE In-vitro Fertilization (IVF) Instrument Market, By Type, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value chain-based sizing & forecasting

Fig. 6 Market formulation & validation

Fig. 7 In vitro fertilization market segmentation

Fig. 8 Market snapshot, 2023

Fig. 9 Segment snapshot

Fig. 10 Competitive landscape snapshot

Fig. 11 Market trends & outlook

Fig. 12 Market driver relevance analysis (current & future impact)

Fig. 13 Market restraint relevance analysis (current & future impact)

Fig. 14 PESTLE analysis

Fig. 15 Porter’s five forces analysis

Fig. 16 In vitro fertilization market: Instrument outlook and key takeaways

Fig. 17 In vitro fertilization market: Instrument movement analysis

Fig. 18 Culture media market revenue, 2018 - 2030 (USD Million)

Fig. 19 Cryopreservation media market revenue, 2018 - 2030 (USD Million)

Fig. 20 Embryo culture media market revenue, 2018 - 2030 (USD Million)

Fig. 21 Ovum processing media market revenue, 2018 - 2030 (USD Million)

Fig. 22 Sperm processing media market revenue, 2018 - 2030 (USD Million)

Fig. 23 Equipment market revenue, 2018 - 2030 (USD Million)

Fig. 24 Sperm analyzer systems market revenue, 2018 - 2030 (USD Million)

Fig. 25 Imaging systems market revenue, 2018 - 2030 (USD Million)

Fig. 26 Ovum aspiration pumps market revenue, 2018 - 2030 (USD Million)

Fig. 27 Micromanipulator systems market revenue, 2018 - 2030 (USD Million)

Fig. 28 Incubators market revenue, 2018 - 2030 (USD Million)

Fig. 29 Gas analyzers market revenue, 2018 - 2030 (USD Million)

Fig. 30 Laser systems market revenue, 2018 - 2030 (USD Million)

Fig. 31 Cryosystems market revenue, 2018 - 2030 (USD Million)

Fig. 32 Sperm separation devices market revenue, 2018 - 2030 (USD Million)

Fig. 33 IVF cabinets market revenue, 2018 - 2030 (USD Million)

Fig. 34 Anti-vibration tables market revenue, 2018 - 2030 (USD Million)

Fig. 35 Witness systems market revenue, 2018 - 2030 (USD Million)

Fig. 36 Others market revenue, 2018 - 2030 (USD Million)

Fig. 37 Disposable devices market revenue, 2018 - 2030 (USD Million)

Fig. 38 In vitro fertilization market: Procedure type outlook and key takeaways

Fig. 39 In vitro fertilization market: Procedure type movement analysis

Fig. 40 Fresh Donor market revenue, 2018 - 2030 (USD Million)

Fig. 41 Frozen Donor market revenue, 2018 - 2030 (USD Million)

Fig. 42 Fresh Non-donor market revenue, 2018 - 2030 (USD Million)

Fig. 43 Frozen Non-donor market revenue, 2018 - 2030 (USD Million)

Fig. 44 In vitro fertilization market: Providers outlook and key takeaways

Fig. 45 In vitro fertilization market: Providers movement analysis

Fig. 46 Fertility clinics market revenue, 2018 - 2030 (USD Million)

Fig. 47 Hospitals & others setting market revenue, 2018 - 2030 (USD Million)

Fig. 48 Regional marketplace: key takeaways

Fig. 49 Regional outlook, 2023 & 2030

Fig. 50 In vitro fertilization market: Region movement analysis

Fig. 51 North America IVF market, 2018-2030 (USD Million)

Fig. 52 U.S. estimated fertility rate, 2018 - 2030 (%)

Fig. 53 U.S. IVF market, 2018-2030 (USD Million)

Fig. 54 U.S. IVF instrument market, 2018 - 2030 (USD Million)

Fig. 55 Canada estimated fertility rate, 2018 - 2030 (%)

Fig. 56 Canada IVF instrument market, 2018 - 2030 (USD Million)

Fig. 57 Canada IVF market, 2018-2030 (USD Million)

Fig. 58 Europe estimated fertility rate, 2018 - 2030 (%)

Fig. 59 Europe IVF instrument market, 2018 - 2030 (USD Million)

Fig. 60 Europe IVF market, 2018-2030 (USD Million)

Fig. 61 Germany estimated fertility rate, 2018 - 2030 (%)

Fig. 62 Germany IVF instrument market, 2018 - 2030 (USD Million)

Fig. 63 Germany IVF market, 2018-2030 (USD Million)

Fig. 64 UK estimated fertility rate, 2018 - 2030 (%)

Fig. 65 UK IVF instrument market, 2018 - 2030 (USD Million)

Fig. 66 UK IVF market, 2018-2030 (USD Million)

Fig. 67 France estimated fertility rate, 2018 - 2030 (%)

Fig. 68 France IVF instrument market, 2018 - 2030 (USD Million)

Fig. 69 France IVF Market, 2018-2030 (USD Million)

Fig. 70 Italy estimated fertility rate, 2018 - 2030 (%)

Fig. 71 Italy IVF instrument market, 2018 - 2030 (USD Million)

Fig. 72 Italy IVF market, 2018-2030 (USD Million)

Fig. 73 Spain estimated fertility rate, 2018 - 2030 (%)

Fig. 74 Spain IVF instrument market, 2018 - 2030 (USD Million)

Fig. 75 Spain IVF Market, 2018-2030 (USD Million)

Fig. 76 Sweden estimated fertility rate, 2018 - 2030 (%)

Fig. 77 Sweden IVF instrument market, 2018 - 2030 (USD Million)

Fig. 78 Sweden IVF Market, 2018-2030 (USD Million)

Fig. 79 Norway estimated fertility rate, 2018 - 2030 (%)

Fig. 80 Norway IVF instrument market, 2018 - 2030 (USD Million)

Fig. 81 Norway IVF market, 2018-2030 (USD Million)

Fig. 82 Denmark estimated fertility rate, 2018 - 2030 (%)

Fig. 83 Denmark IVF instrument market, 2018 - 2030 (USD Million)

Fig. 84 Denmark IVF market, 2018-2030 (USD Million)

Fig. 85 Belgium estimated fertility rate, 2018 - 2030 (%)

Fig. 86 Belgium IVF instrument market, 2018 - 2030 (USD Million)

Fig. 87 Belgium IVF market, 2018-2030 (USD Million)

Fig. 88 The Netherlands estimated fertility rate, 2018 - 2030 (%)

Fig. 89 The Netherlands IVF instrument market, 2018 - 2030 (USD Million)

Fig. 90 The Netherlands IVF market, 2018-2030 (USD Million)

Fig. 91 Switzerland estimated fertility rate, 2018 - 2030 (%)

Fig. 92 Switzerland IVF instrument market, 2018 - 2030 (USD Million)

Fig. 93 Switzerland IVF market, 2018-2030 (USD Million)

Fig. 94 Asia Pacific estimated fertility rate, 2018 - 2030 (%)

Fig. 95 Asia Pacific IVF instrument market, 2018 - 2030 (USD Million)

Fig. 96 Asia Pacific IVF market, 2018-2030 (USD Million)

Fig. 97 China estimated fertility rate, 2018 - 2030 (%)

Fig. 98 China IVF instrument market, 2018 - 2030 (USD Million)

Fig. 99 China IVF Market, 2018-2030 (USD Million)

Fig. 100 Japan estimated fertility rate, 2018 - 2030 (%)

Fig. 101 Japan IVF instrument market, 2018 - 2030 (USD Million)

Fig. 102 Japan IVF Market, 2018-2030 (USD Million)

Fig. 103 India estimated fertility rate, 2018 - 2030 (%)

Fig. 104 India IVF instrument market, 2018 - 2030 (USD Million)

Fig. 105 India IVF market, 2018-2030 (USD Million)

Fig. 106 Australia estimated fertility rate, 2018 - 2030 (%)

Fig. 107 Australia IVF instrument market, 2018 - 2030 (USD Million)

Fig. 108 Australia IVF market, 2018-2030 (USD Million)

Fig. 109 South Korea estimated fertility rate, 2018 - 2030 (%)

Fig. 110 South Korea IVF instrument market, 2018 - 2030 (USD Million)

Fig. 111 South Korea IVF market, 2018-2030 (USD Million)

Fig. 112 Thailand estimated fertility rate, 2018 - 2030 (%)

Fig. 113 Thailand IVF instrument market, 2018 - 2030 (USD Million)

Fig. 114 Thailand IVF market, 2018-2030 (USD Million)

Fig. 115 Latin America estimated fertility rate, 2018 - 2030 (%)

Fig. 116 Latin America IVF instrument market, 2018 - 2030 (USD Million)

Fig. 117 Latin America IVF market, 2018-2030 (USD Million)

Fig. 118 Brazil estimated fertility rate, 2018 - 2030 (%)

Fig. 119 Brazil IVF instrument market, 2018 - 2030 (USD Million)

Fig. 120 Brazil IVF market, 2018-2030 (USD Million)

Fig. 121 Mexico estimated fertility rate, 2018 - 2030 (%)

Fig. 122 Mexico IVF instrument market, 2018 - 2030 (USD Million)

Fig. 123 Mexico IVF market, 2018-2030 (USD Million)

Fig. 124 Argentina estimated fertility rate, 2018 - 2030 (%)

Fig. 125 Argentina IVF instrument market, 2018 - 2030 (USD Million)

Fig. 126 Argentina IVF market, 2018-2030 (USD Million)

Fig. 127 Middle East and Africa estimated fertility rate, 2018 - 2030 (%)

Fig. 128 Middle East and Africa IVF instrument market, 2018 - 2030 (USD Million)

Fig. 129 Middle East and Africa IVF market, 2018-2030 (USD Million)

Fig. 130 South Africa estimated fertility rate, 2018 - 2030 (%)

Fig. 131 South Africa IVF instrument market, 2018 - 2030 (USD Million)

Fig. 132 South Africa IVF market, 2018-2030 (USD Million)

Fig. 133 Saudi Arabia estimated fertility rate, 2018 - 2030 (%)

Fig. 134 Saudi Arabia IVF instrument market, 2018 - 2030 (USD Million)

Fig. 135 Saudi Arabia IVF market, 2018-2030 (USD Million)

Fig. 136 UAE estimated fertility rate, 2018 - 2030 (%)

Fig. 137 UAE IVF instrument market, 2018 - 2030 (USD Million)

Fig. 138 UAE IVF market, 2018-2030 (USD Million)

Fig. 139 Company categorization

Fig. 140 Strategy mapping

Fig. 141 Company market position analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- In Vitro Fertilization Instrument Outlook (Revenue, USD Million, 2018 - 2030)

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- In Vitro Fertilization Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- In Vitro Fertilization Providers Outlook (Revenue, USD Million, 2018 - 2030)

- Fertility Clinics

- Hospitals & Others Setting

- In Vitro Fertilization Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- North America In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- North America In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- U.S.

- U.S. In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- U.S. In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- U.S. In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- U.S. In Vitro Fertilization Market, By Instrument

- Canada

- Canada In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Canada In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Canada In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Canada In Vitro Fertilization Market, By Instrument

- North America In Vitro Fertilization Market, By Instrument

- Europe

- Europe In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Europe In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Europe In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- France

- France In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- France In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- France In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- France In Vitro Fertilization Market, By Instrument

- Germany

- Germany In Vitro Fertilization Market, By InstrumentGermany In Vitro Fertilization Market, By Procedure Type

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Germany In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Germany In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Germany In Vitro Fertilization Market, By InstrumentGermany In Vitro Fertilization Market, By Procedure Type

- Italy

- Italy In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Italy In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Italy In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Italy In Vitro Fertilization Market, By Instrument

- Spain

- Spain In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Spain In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Spain In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Spain In Vitro Fertilization Market, By Instrument

- UK

- UK In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- UK In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- UK In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- UK In Vitro Fertilization Market, By Instrument

- Belgium

- Belgium In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Belgium In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Belgium In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Belgium In Vitro Fertilization Market, By Instrument

- The Netherlands

- The Netherlands In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- The Netherlands In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- The Netherlands In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- The Netherlands In Vitro Fertilization Market, By Instrument

- Switzerland

- Switzerland In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Switzerland In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Switzerland In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Switzerland In Vitro Fertilization Market, By Instrument

- Norway

- Norway In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Norway In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Norway In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Norway In Vitro Fertilization Market, By Instrument

- Sweden

- Sweden In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Sweden In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Sweden In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Sweden In Vitro Fertilization Market, By Instrument

- Denmark

- Sweden In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Denmark In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Denmark In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Sweden In Vitro Fertilization Market, By Instrument

- Europe In Vitro Fertilization Market, By Instrument

- Asia Pacific

- Asia Pacific In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Asia Pacific In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Asia Pacific In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Japan

- Japan In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Japan In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Japan In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Japan In Vitro Fertilization Market, By Instrument

- China

- China In Vitro Fertilization Market, By InstrumentChina In Vitro Fertilization Market, By Procedure Type

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- China In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- China In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- China In Vitro Fertilization Market, By InstrumentChina In Vitro Fertilization Market, By Procedure Type

- India

- India In Vitro Fertilization Market, By InstrumentIndia In Vitro Fertilization Market, By Procedure Type

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- India In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- India In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- India In Vitro Fertilization Market, By InstrumentIndia In Vitro Fertilization Market, By Procedure Type

- Australia

- Australia In Vitro Fertilization Market, By InstrumentAustralia In Vitro Fertilization Market, By Procedure Type

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Australia In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Australia In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Australia In Vitro Fertilization Market, By InstrumentAustralia In Vitro Fertilization Market, By Procedure Type

- South Korea

- South Korea In Vitro Fertilization Market, By InstrumentSouth Korea In Vitro Fertilization Market, By Procedure Type

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- South Korea In Vitro Fertilization Market, By Procedure Typ

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- South Korea In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- South Korea In Vitro Fertilization Market, By InstrumentSouth Korea In Vitro Fertilization Market, By Procedure Type

- Thailand

- Thailand In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Thailand In Vitro Fertilization Market, By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

- Thailand In Vitro Fertilization Market, By Providers

- Fertility Clinics

- Hospitals & Others Setting

- Thailand In Vitro Fertilization Market, By Instrument

- Asia Pacific In Vitro Fertilization Market, By Instrument

- Latin America

- Latin America In Vitro Fertilization Market, By Instrument

- Disposable Devices

- Culture Media

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

- Equipment

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

- Latin America In Vitro Fertilization Market, By Procedure Type

- Fresh Donor