- Home

- »

- Electronic Security

- »

-

Incident And Emergency Management Market Report, 2033GVR Report cover

![Incident And Emergency Management Market Size, Share & Trends Report]()

Incident And Emergency Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By System Type, By Deployment Mode (On-premise, Cloud-based), By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-659-6

- Number of Report Pages: 128

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Incident And Emergency Management Market Summary

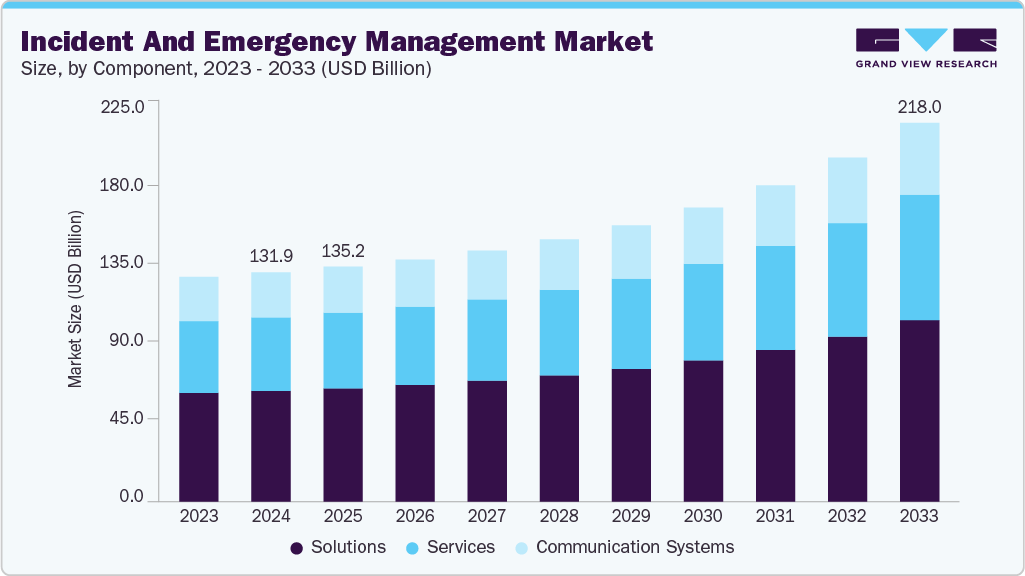

The global incident and emergency management market size was estimated at USD 131.92 billion in 2024, and is projected to reach USD 218.04 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The growth is attributed to the increasing number of natural disasters, terrorist threats, industrial accidents, and public health emergencies.

Key Market Trends & Insights

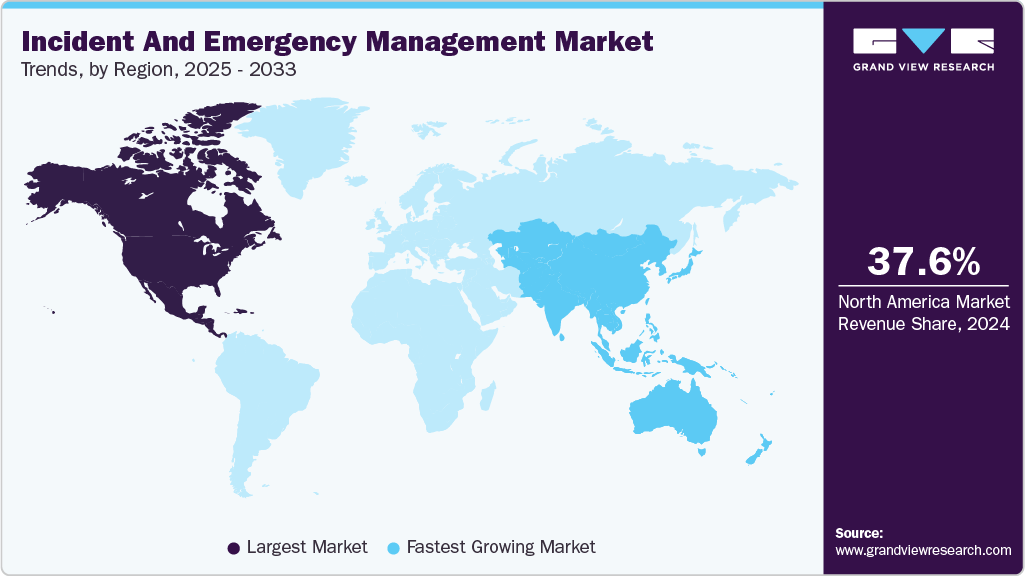

- The North America incident and emergency management market accounted for a 37.6% revenue share in 2024.

- The incident and emergency management industry in the U.S. held a dominant position in 2024.

- By component, the solutions segment accounted for the largest revenue share of 48.3% in 2024.

- By system type, the emergency/mass notification systems segment held the largest revenue share in 2024.

- By deployment mode, the on-premise segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 131.92 Billion

- 2033 Projected Market Size: USD 218.04 Billion

- CAGR (2025-2033): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Governments and organizations are prioritizing the development of resilient infrastructures and disaster response strategies to minimize casualties and economic disruption. Rising urbanization, climate change, and geopolitical instability further contribute to the demand for robust emergency preparedness and response systems across the public and private sectors. Technological advancements are transforming the landscape of emergency management. Key trends include the integration of artificial intelligence (AI), machine learning, geospatial tools, and IoT sensors to enable real-time situational awareness and decision-making. Cloud-based emergency management platforms are gaining popularity for their scalability, accessibility, and integration capabilities. Mobile-based alert systems and wearable technologies are also being used increasingly to support field responders and ensure rapid communication during emergencies. Furthermore, AI-powered surveillance and predictive analytics are helping organizations detect, assess, and respond to incidents proactively.

Investments in this sector are rising globally, both from government agencies and private enterprises. Countries are allocating substantial budgets for disaster risk reduction, homeland security, and public health response systems. Smart city projects, particularly in regions such as Asia Pacific and the Middle East, are embedding emergency management systems as a core component of urban planning. Meanwhile, enterprises across sectors such as healthcare, energy, and transportation are investing in risk and incident management tools to ensure operational resilience and compliance with safety standards.

The regulatory landscape plays a crucial role in shaping the incident and emergency management market. Governments and international bodies have introduced strict guidelines related to emergency preparedness, data protection, occupational safety, and disaster recovery. Standards such as ISO 22320 (Emergency Management) and OSHA regulations mandate organizations to establish and test emergency response protocols. In addition, public safety initiatives such as FEMA guidelines in the U.S. and the EU Civil Protection Mechanism in Europe further enforce the deployment of compliant emergency systems.

Despite strong growth potential, the incident and emergency management industry faces several restraints. High implementation costs, particularly for small and medium enterprises, limit widespread adoption. Integration challenges with legacy systems, lack of trained personnel, and data privacy concerns related to surveillance and mass notification systems also pose significant hurdles. Moreover, in some developing regions, limited infrastructure and insufficient funding further impede the effective deployment of comprehensive emergency management solutions. These challenges highlight the need for scalable, cost-effective, and user-friendly systems to broaden market reach.

Component Insights

The solutions segment accounted for the largest revenue share of 48.3% in 2024. The increasing number and intensity of natural disasters such as hurricanes, wildfires, floods, and earthquakes drive the segment growth. These events have resulted in significant human and economic losses across the globe. Governments, emergency response agencies, and enterprises are investing heavily in incident and emergency management solutions to improve disaster preparedness, response coordination, and recovery efforts.

The services segment is expected to grow at the fastest CAGR during the forecast period. The shift toward outsourced and managed emergency services fuels the segment's growth. Many organizations, especially mid-sized enterprises and municipalities, lack the internal expertise or resources to develop and manage comprehensive emergency plans. This has led to a growing trend toward outsourcing emergency management functions to specialized service providers. Managed services offer 24/7 monitoring, real-time incident response, and expert-led planning, allowing clients to focus on core operations.

System Type Insights

The emergency/mass notification systems segment held the dominant share of the incident and emergency management industry in 2024. The growing need for instant, reliable communication during emergencies fuels the segment's growth. In crises, such as natural disasters, active shooter events, industrial accidents, or public health outbreaks, timely alerts can save lives. EMNS solutions enable organizations and governments to disseminate information across multiple channels (SMS, email, voice, apps, and digital signage) simultaneously and reach large populations within seconds.

The web-based emergency management systems segment is expected to grow at a significant CAGR during the forecast period. The need for centralized, scalable platforms that can coordinate responses across multiple agencies, departments, or geographic locations drives the segment’s growth. These systems allow stakeholders, such as emergency services, government bodies, and private enterprises, to access real-time data and make coordinated decisions from anywhere via the web.

Deployment Mode Insights

The on-premise segment dominated the incident and emergency management market in 2024. The need for maximum data security, privacy, and control drives the segment’s growth. Critical industries such as defense, government, healthcare, and energy often handle sensitive information that cannot be entrusted to external cloud environments due to national security, legal, or operational reasons. On-premise systems allow these organizations to retain full control over data storage, access, and encryption protocols, reducing the risk of unauthorized access or breaches, particularly important for highly classified or regulated environments.

The cloud-based segment is projected to grow at the fastest CAGR over the forecast period. Cost efficiency and lower capital investment fuel the growth of the cloud-based segment. Unlike on-premise solutions, cloud deployments do not require expensive hardware infrastructure, long installation times, or dedicated IT staff for maintenance. With subscription-based models, organizations, especially small and mid-sized municipalities or businesses, can access advanced emergency management tools at a lower total cost of ownership.

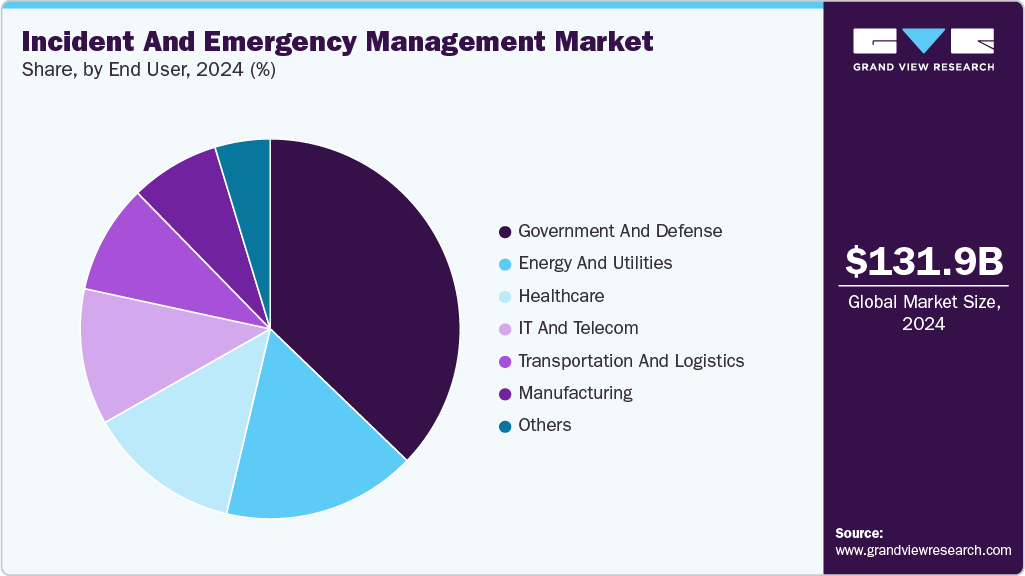

End User Insights

The government and defense segment dominated the incident and emergency management industry in 2024. Governments and defense agencies prioritize incident and emergency management to safeguard national security, particularly in the face of rising geopolitical tensions, terrorism, and cyber warfare. Emergency management systems enable real-time threat detection, risk assessment, and rapid response coordination.

The healthcare segment is expected to register the fastest CAGR over the forecast period, driven by a rise in public health emergencies, such as pandemics, epidemics, and bioterrorism threats. Hospitals, clinics, and public health agencies are now required to implement preparedness and response plans that ensure continuity of care, protect patients and staff, and maintain supply chains. This has driven investments in emergency communication systems, outbreak monitoring tools, and medical surge response services.

Regional Insights

The North America incident and emergency management market accounted for a 37.6% revenue share in 2024. The growth of the market in the region is attributed to robust investments in homeland security, disaster preparedness, and critical infrastructure protection. The presence of leading technology providers and strong government frameworks, such as FEMA in the U.S. and Public Safety Canada, characterizes the region.

U.S. Incident and Emergency Management Market Trends

The U.S. incident and emergency management industry held a dominant position in 2024, driven by its advanced public safety infrastructure, federal funding initiatives, and strict regulatory requirements. Agencies such as the Department of Homeland Security (DHS) and the Centers for Disease Control and Prevention (CDC) continue to invest in emergency preparedness, surveillance systems, and mass notification technologies.

Europe Incident and Emergency Management Market Trends

The Europe incident and emergency management industry was identified as a lucrative region in 2024. Strong regulatory frameworks and cross-border cooperation in disaster response support the growth in the region. The European Union’s Civil Protection Mechanism plays a critical role in driving regional preparedness and interoperability among member states.

The UK incident and emergency management market is expected to grow rapidly in the coming years, driven by increased investments in national security, emergency healthcare response, and infrastructure resilience. Agencies such as the National Health Service (NHS) and the Cabinet Office are implementing digital command and control systems to streamline crisis management efforts.

Asia Pacific Incident and Emergency Management Market Trends

The Asia Pacific incident and emergency management industry is expected to grow at the fastest CAGR of 7.0% over the forecast period. Asia Pacific is emerging as a high-growth region in the market, fueled by rapid urbanization, increasing disaster vulnerability, and rising public safety concerns. Countries in the region are making significant investments in early warning systems, emergency communication networks, and command center modernization.

The Japan incident and emergency management market is expected to grow rapidly in the coming years due to its high exposure to natural disasters such as earthquakes, tsunamis, and typhoons. The government consistently invests in advanced technologies, including real-time seismic monitoring, automated warning systems, and AI-driven evacuation planning.

The incident and emergency management market in China held a substantial market share in 2024 due to its emergency management capabilities in response to frequent natural disasters, public health emergencies, and industrial accidents. The government has established a centralized Ministry of Emergency Management, which has accelerated the development and deployment of incident response platforms across provinces.

Key Incident And Emergency Management Company Insights

Some of the key companies in the incident and emergency management market include Honeywell International Inc.; Motorola Solutions, Inc.; Siemens; NEC Corporation; and Hexagon AB. Organizations are focusing on increasing their customer base to gain a competitive edge. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

NEC Corporation is a provider of advanced solutions in incident and emergency management, supporting public safety agencies, urban authorities, and disaster response organizations worldwide. NEC’s portfolio includes integrated control room platforms, such as ControlWorks and Vision, which unify data, mapping, resource management, and communication channels to enable rapid, informed decision-making during emergencies. These solutions streamline incident response workflows, provide real-time updates to first responders, and significantly reduce response times, ultimately saving lives.

-

Hexagon AB specializes in the integration of sensors, software, and autonomous technologies to enable smarter, safer, and more resilient societies. In the context of incident and emergency management, Hexagon’s Safety, Infrastructure & Geospatial division provides comprehensive solutions that transform complex data about people, places, and assets into actionable intelligence for rapid and effective decision-making. Their flagship HxGN OnCall Planning & Response platform is a web-based application designed to manage the entire lifecycle of major incidents and events.

Key Incident And Emergency Management Companies:

The following are the leading companies in the incident and emergency management market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc

- Motorola Solutions, Inc.

- Siemens

- International Business Machines Corporation

- NEC Corporation

- Hexagon AB

- Everbridge

- Collins Aerospace

- BlackBerry Limited

- Esri

Recent Developments

-

In March 2025, MIT Lincoln Laboratory developed the Next-Generation Incident Command System (NICS), a web-based software platform designed to improve and streamline emergency response coordination across multiple jurisdictions, agencies, and countries. Developed to help U.S. firefighters manage wildfires, NICS has evolved into an open-source operational tool widely used worldwide for various emergencies, including natural disasters, search-and-rescue missions, public health crises, and security events.

-

In January 2025, CENTEGIX, a provider of wearable safety technology, announced a strategic partnership with SaferWatch, a prominent safety and security app provider, to enhance emergency response efforts across the U.S. By integrating CENTEGIX’s CrisisAlert wearable panic button system with SaferWatch’s emergency communication platform, the collaboration aims to deliver faster and more accurate responses during campus-wide emergencies, especially in K-12 schools, healthcare facilities, higher education institutions, and government buildings.

Incident and Emergency Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 135.20 billion

Revenue forecast in 2033

USD 218.04 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, system type, deployment mode, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Honeywell International Inc; Motorola Solutions, Inc.; Siemens; International Business Machines Corporation; NEC Corporation; Hexagon AB; Everbridge; Collins Aerospace; BlackBerry Limited; Esri

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Incident And Emergency Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global incident and emergency management market report based on component, system type, deployment mode, end user, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Services

-

Communication Systems

-

-

System Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Web-based Emergency Management Systems

-

Emergency/Mass Notification Systems

-

Surveillance Systems

-

Traffic Management Systems

-

Safety Management Systems

-

Mobile Emergency Communication Systems

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premise

-

Cloud-based

-

-

End User Outlook (Revenue, USD Billion, 2021 - 2033)

-

Government and Defense

-

Energy and Utilities

-

Healthcare

-

IT and Telecom

-

Transportation and Logistics

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global incident and emergency management market size was estimated at USD 131.92 billion in 2024 and is expected to reach USD 135.20 billion in 2025.

b. The global incident and emergency management market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 218.04 billion by 2033.

b. North America dominated the incident and emergency management market with a share of 37.6% in 2024. The growth of the market in the region is attributed to robust investments in homeland security, disaster preparedness, and critical infrastructure protection.

b. Some key players operating in the incident and emergency management market include HHoneywell International Inc; Motorola Solutions, Inc.; Siemens; International Business Machines Corporation; NEC Corporation; Hexagon AB; Everbridge; Collins Aerospace; BlackBerry Limited; Esri

b. The growth of the market is attributed to the increasing number of natural disasters, terrorist threats, industrial accidents, and public health emergencies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.