- Home

- »

- Healthcare IT

- »

-

India Clinical Trials Market Size, Share, Industry Report, 2030GVR Report cover

![India Clinical Trials Market Size, Share & Trends Report]()

India Clinical Trials Market (2025 - 2030) Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design, By Indication, By Service Type, By Sponsor, And Segment Forecasts

- Report ID: GVR-2-68038-676-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Clinical Trials Market Size & Trends

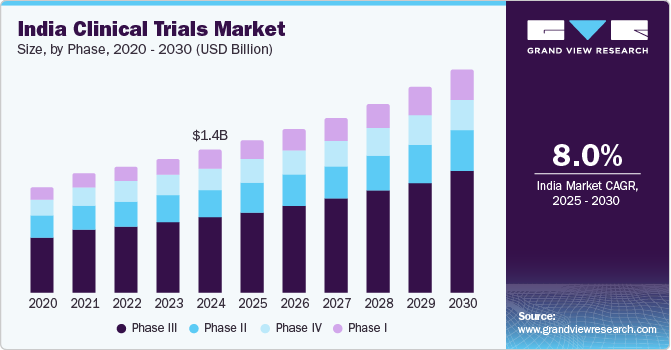

The India clinical trials market is valued at USD 1.42 billion in 2024 and is expected to grow at a CAGR of 8.0% from 2025 to 2030, driven by the expanding pharmaceutical and biotechnology sectors. India has become a key hub for research and development due to its diverse population, which offers a unique genetic pool critical for clinical trials. The government has introduced supportive regulatory frameworks, simplifying and accelerating the approval processes. This makes India an attractive location for global companies seeking faster and cost-effective clinical research solutions. The country’s growing healthcare infrastructure and skilled workforce further strengthen its position in the clinical trials market. As a result, India is increasingly becoming a preferred destination for clinical studies worldwide.

In addition, the India clinical trials industry is the cost-effectiveness of conducting trials compared to Western industry. The costs associated with clinical research in India are nearly half those incurred in the U.S. and Europe, making it an appealing option for global pharmaceutical companies looking to optimize their research budgets. In addition, India boasts a growing pool of skilled medical professionals, including scientists, doctors, and researchers, who ensure the high-quality execution of clinical trials.

Furthermore, the availability of digital platforms and technologies such as AI has streamlined clinical trial management, enhanced data accuracy, and sped up patient recruitment and data collection. Increased patient awareness and a focus on ethical practices have also boosted participation, improving trial efficiency and effectiveness. These factors make India clinical trials industry an increasingly favorable destination for clinical research.

Phase Insights

The phase III segment dominated the India clinical trials industry, with a revenue share of 53.3% in 2024, driven by the vital role of phase III trials in validating new treatments before they reach the market. These trials involve larger patient populations, enhancing results reliability and providing comprehensive insights into the efficacy and safety of new therapies across diverse demographics. The increasing number of investigational drugs advancing to this phase reflects a robust pipeline in pharmaceutical development, encouraging significant investments. As companies recognize the importance of thorough testing to ensure patient safety and treatment effectiveness, the demand for Phase III trials continues to rise, solidifying its dominant position in the India clinical trials industry.

Phase I segment is projected to witness the fastest CAGR of 9.7% over the forecast period, attributed to increasing emphasis on early-stage drug development. This encourages pharmaceutical and biotechnology companies to invest more in Phase I trials and recognize their essential role in establishing safety and dosage parameters for new therapies. As the demand for innovative treatments rises, particularly in areas such as oncology and rare diseases, more investigational drugs are entering this phase, expanding the India clinical trials industry. This growing focus on early clinical research accelerates drug development and positions Phase I trials as a vital component of the clinical research landscape.

Study Design Insights

The interventional trials segment dominated the market with the largest revenue share in 2024, driven by the widespread adoption of interventional trials recognized for their effectiveness in evaluating the safety and efficacy of new drugs and therapies. These trials typically involve large randomized studies that provide robust data, minimizing confounding variables and enhancing the reliability of results. For instance, The Central Drugs Standard Control Organization (CDSCO) in India has established Clinical Trials Rules (CTR), introduced in 2019, a framework for interventional trials, ensuring safety and efficacy.

The observational trials segment is projected to grow at the fastest CAGR over the forecast period, fueled by the increasing focus on Real-World Evidence (RWE) and the rising demand for less invasive and more cost-effective research methods. Observational studies are becoming increasingly popular, requiring fewer resources than interventional trials, making them more feasible in emerging markets. In addition, the growth of chronic diseases and the need for long-term data on treatment outcomes drive the adoption of observational trials. With regulatory agencies emphasizing the importance of RWE, India is becoming a hub for such studies. Therefore, this trend is anticipated to accelerate the growth of observational trials over the coming years.

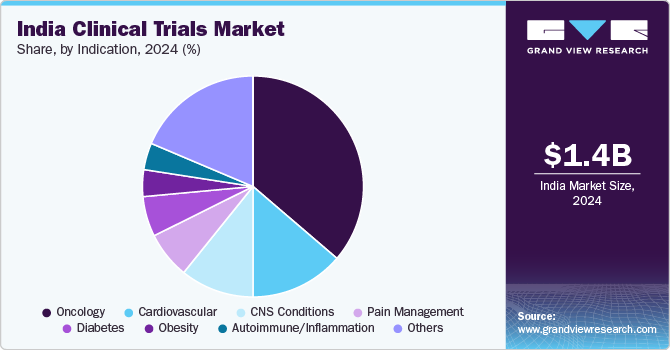

Indication Insights

The oncology segment dominated the market, with the largest revenue share in 2024, and is projected to witness the fastest CAGR over the forecast period, attributed to lifestyle changes and an aging population, which has significantly increased the demand for effective treatment options. The demand is further fueled by advancements in targeted therapies and personalized medicine, which focus on tailoring treatments based on the specific genetic and molecular characteristics of tumors, leading to improved patient outcomes. For instance, according to the Indian Council of Medical Research (ICMR) report published in September 2020, cancer was projected to affect approximately 2 million people in India by 2040, which emphasizes the urgent need for innovative therapies.

The autoimmune/inflammation segment is projected to witness a significant CAGR over the forecast period, attributed to the increasing prevalence of autoimmune and inflammatory disorders in India, such as rheumatoid arthritis, lupus, and inflammatory bowel diseases. Advances in biological therapies and targeted treatments are contributing to the growth of this segment. In addition, developing innovative medicines, including small molecule inhibitors and gene editing techniques such as CRISPR, enhances treatment efficacy and provides new avenues for managing these complex disorders. These factors create a favorable environment for growth in the autoimmune/inflammation segment within the India clinical trials industry.

Service Type Insights

The laboratory services segment dominated the market with the largest revenue share in 2024, driven by the increasing demand for accurate, reliable, and high-quality diagnostic services in India clinical trials. As clinical trials become more complex, the need for specialized laboratory services, including biomarker testing, genetic testing, and safety monitoring, has grown significantly. In addition, the rise of precision medicine and personalized therapies, which require advanced laboratory testing, is accelerating the need for specialized diagnostic support. Integrating advanced technologies such as automated lab systems and digital health tools enhances laboratory service efficiency and accuracy. For instance, the National Cancer Registry Programme highlights the necessity of specialized laboratory services, including biomarker testing and genetic testing, to support cancer research and improve diagnostic accuracy.

The patient recruitment segment is projected to grow at the fastest CAGR over the forecast period, fueled by the increasing number of clinical trials conducted in India, particularly in areas such as oncology, autoimmune diseases, and rare disorders. The country’s large and diverse population provides a rich pool of potential candidates, making it an attractive location for global pharmaceutical companies seeking to recruit trial participants. The availability of advancements in digital health technologies improves patient registration processes. Furthermore, streamlined regulatory processes and enhanced recruitment strategies, such as remote or virtual trials, reduce barriers and improve patient access. These factors combined are expected to accelerate patient recruitment growth over the forecast period.

Sponsor Insights

The pharmaceutical & biopharmaceutical companies segment dominated the market, with the largest revenue share in 2024, and is projected to witness the fastest CAGR over the forecast period. The segment growth can be attributed to the increasing focus on developing new drugs, biologics, and vaccines which can be driven by the rising of chronic diseases, cancer, and infectious diseases in India. The rising rates of chronic diseases, cancer, and autoimmune disorders which result in increasing demand for novel therapies. These factors fuel a surge in clinical trials by pharmaceutical and biopharmaceutical companies.

The medical device companies segment is projected to witness significant CAGR over the forecast period, attributed to the increasing availability of advanced medical technologies, such as diagnostic devices, imaging equipment, surgical instruments, and wearable health monitoring devices. The rise in chronic diseases and the aging population in India are increasing the demand for specialized medical devices. Regulatory improvements and faster approval processes for medical devices are encouraging more companies to conduct trials in India. Therefore, these factors expected to contribute to the growth of the medical device segment in India clinical trials industry.

Key India Clinical Trials Company Insights

Some key companies operating in the market include IQVIA, Parexel International (MA) Corporation, Thermo Fisher Scientific Inc, Charles River Laboratories, and ICON PLC. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches to expand their market presence and address the evolving healthcare demands through medical device validation and verification.

-

IQVIA Holdings Inc. offers clinical development, data analytics, patient recruitment, and regulatory consulting. It also includes clinical trial management services, RWE solutions, and advanced analytics platforms powered by AI and machine learning. In addition, it provides software for data management, monitoring, and biostatistics.

-

Parexel International (MA) Corporation offers clinical research, regulatory affairs, and patient recruitment solutions. It also includes drug development services, clinical trial management, biostatistics, RWE, and pharmacovigilance. In addition, it provides regulatory consulting, market access strategies, and commercialization services.

Key India Clinical Trials Companies:

- IQVIA

- Parexel International (MA) Corporation

- Thermo Fisher Scientific Inc

- Charles River Laboratories

- ICON PLC

- Aurigene Oncology

- Aragen Life Sciences Ltd

- Syneos Health

- SGS Société Générale de Surveillance SA.

- Syngene International Limited.

Recent Developments

-

In June 2024, IQVIA launched a new technology platform, One Home for Sites, designed to streamline clinical trial management for research sites. This platform consolidates multiple software applications into a single dashboard. One Home for Sites aims to enhance site capacity and efficiency, addressing the challenges of technology overload in clinical research.

-

In April 2024, Parexel International Corporation announced expanding collaboration with Palantir Technologies to enhance clinical data delivery and improve patient outcomes. This multi-year strategic partnership will leverage Palantir's Foundry and Artificial Intelligence Platform (AIP) to optimize Parexel's clinical data platform, focusing on increasing trial efficiency while ensuring safety and regulatory compliance. By integrating advanced AI capabilities, the collaboration aims to streamline clinical trial processes and provide real-time access to high-quality validated data for biopharmaceutical clients.

India Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.51 billion

Revenue forecast in 2030

USD 2.22 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Phase, study design, indication, service type, sponsor

Key companies profiled

IQVIA.; Parexel International (MA) Corporation; Thermo Fisher Scientific Inc; Charles River Laboratories; ICON PLC; Aurigene Oncology.; Aragen Life Sciences Ltd.; Syneos Health.; SGS Société Générale de Surveillance SA; Syngene International Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Clinical Trials Market Report Segmentation

This report forecasts country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the India clinical trials market report based on phase, study design, indication, service type, sponsor, and region:

-

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Billion, 2018 - 2030)

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Autoimmune/Inflammation

-

Rheumatoid Arthritis

-

Multiple Sclerosis

-

Osteoarthritis

-

Irritable Bowel Syndrome (IBS)

-

Others

-

-

Pain Management

-

Chronic Pain

-

Acute Pain

-

-

Oncology

-

Blood Cancer

-

Solid Tumors

-

Other

-

-

CNS Conditions

-

Epilepsy

-

Parkinson's Disease (PD)

-

Huntington's Disease

-

Stroke

-

Traumatic Brain Injury (TBI)

-

Amyotrophic Lateral Sclerosis (ALS)

-

Muscle Regeneration

-

Others

-

-

Diabetes

-

Obesity

-

Cardiovascular

-

Others

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Protocol Designing

-

Site Identification

-

Patient Recruitment

-

Laboratory Services

-

Bioanalytical Testing Services

-

Clinical Trial Data Management Services

-

Others

-

-

Sponsor Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.