- Home

- »

- Medical Devices

- »

-

India Condom Market Size & Share, Industry Report, 2030GVR Report cover

![India Condom Market Size, Share & Trends Report]()

India Condom Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type (Latex, Non-latex), By Product (Male Condom, Female Condom), By Distribution Channel (Mass Merchandizers), And Segment Forecasts

- Report ID: GVR-4-68040-311-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Condom Market Size & Trends

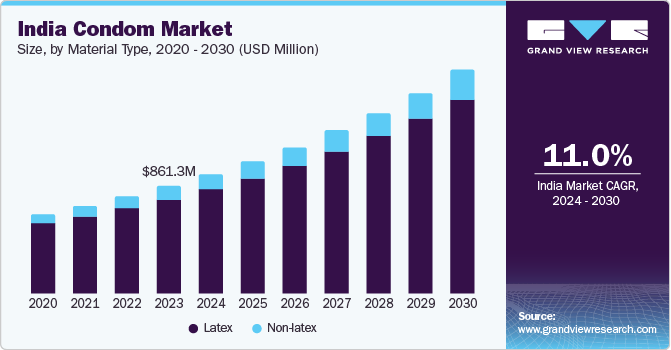

The India condom market size was estimated at USD 861.3 million in 2023 and is projected to grow at a CAGR of 11.0% from 2024 to 2030. The high percentage of the middle-aged population, the prevalence of HIV, increasing awareness regarding sexual health, and increasing efforts by private and public players to promote the usage of contraceptives and birth control products are major drivers for the market’s growth. For instance, the Mission Parivar Vikas (MPV) introduced by the government of India aims at increasing access of people to contraceptives and family planning services.

The country also has a high prevalence of HIV and other sexually transmitted diseases. For instance, according to the 2021 fact sheet published by the National AIDS Control Organization, approximately 24.01 lakh people in India had HIV. The role of condoms in preventing these infections is driving their demand in the country. According to an article published by the World Health Organization (WHO) in February 2024, condoms have been an effective tool in decreasing transmission of HIV globally.

The rising population and prevalence of HIV in the country have also led the government to promote safety and birth control measures such as the usage of condoms. For instance, under the Condom Promotion Program, the Ministry of Health and Family Welfare procures free condoms, which are distributed by NACO to the high-risk groups in the country. Such measures help in improving the awareness and accessibility of condoms in the country, further driving market growth.

India accounts for approximately 7.4% of the global condom market. The increasing efforts by the public and private players in the country to promote the usage of condoms are likely to foster market growth in India. For instance, in December 2023, Manforce Condoms collaborated with SAATHII NGO to launch #SafeTiesToSaveLives campaign in support of the country’s efforts to eliminate HIV/AIDS by 2030.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The Indian condom industry is characterized by a high degree of innovation owing to increasing technological advancements and product differentiation. For instance, in November 2023, an Indian condom company, Bombae Condoms, launched a new product, BOMBAE SILK, to expand product portfolio and add innovation to it. In addition, the emphasis on veganism in India has led to the emergence of vegan condoms in the country, such as Bleü.

The condom industry is also characterized by a low level of merger and acquisition (M&A) activity by the market players. However, recently the market witnessed M&A activities due to several factors, such as the desire to expand their portfolio and gain access to differentiated products. For instance, in May 2023, Sirona Hygiene Private Limited, a personal hygiene company in India, acquired Bleü, the sexual wellness brand that was also India’s first vegan condom brand. The company offers condoms made with natural latex, which are non-toxic and paraben-free. The emergence of such brands and products is expected to promote sustainability and increase customer base in the market.

The condom market in India is also subject to regulatory scrutiny by Indian regulatory authorities. Condoms are considered medical devices in India, which are regulated by the Central Drugs Standard Control Organization (CDSCO). The authority regulates quality, safety, and efficacy of medical devices in the country. In addition, the sale, packaging, and promotion of condoms are also regulated in the country. For instance, the Information and Broadcasting Ministry in India has restricted all TV channels to broadcast advertisements during the daytime and allows them to be aired only between 10 pm and 6 am.

Regional expansion is an important factor in the India condom market due to its increasing acceptance across the country. This provides opportunities for the market players to expand their market by creating campaigns and introducing products to untapped regions of the country. For instance, in June 2022, Manforce started targeting non-metro markets in the country by publishing regional content on online mediums.

Material Type Insights

Latex dominated the market and accounted for a share of 87.9% in 2023. The material used in the latex condoms is derived from the sap of rubber trees which makes it more durable and elastic. Latex condoms are also considered useful in preventing pregnancy and protecting against HIV and other sexually transmitted infections (STIs). Therefore, the increasing focus on reducing the prevalence of these diseases is expected to drive the demand for latex condoms in India.

Non-latex condoms are expected to grow at the fastest CAGR over the forecast period. Non-latex condoms are made from materials such as polyurethane, and polyisoprenehe. The increasing emphasis on product differentiation and the launch of new and innovative products is expected to drive the segment growth. For instance, in March 2023, Durex launched their first range of non-latex condoms, Durex Real Feel. The launch is expected to help company in diversifying company’s portfolio and increase its customer base.

Product Insights

Male condoms accounted for the largest market revenue share in 2023. This growth can be attributed to the increasing acceptability & awareness about the use of condoms, the availability of varieties, and cheaper products compared to female condoms. For instance, according to a study published by the National Library of Medicine in September 2022, a pack of ten male condoms can cost around USD 2.40, while a pack of only two female condoms can cost around USD 1.30.

Female condoms are expected to grow at the fastest CAGR over the forecast period. The increasing efforts by public and private organizations to create awareness regarding female health & women empowerment, combined with the launch of new products, is expected to drive market growth. For instance, in January 2021, Pee Safe (Redcliffe Hygiene Private Limited) introduced female condoms in India through the launch of a new category. This is expected to increase awareness regarding female condoms and drive market growth in the country.

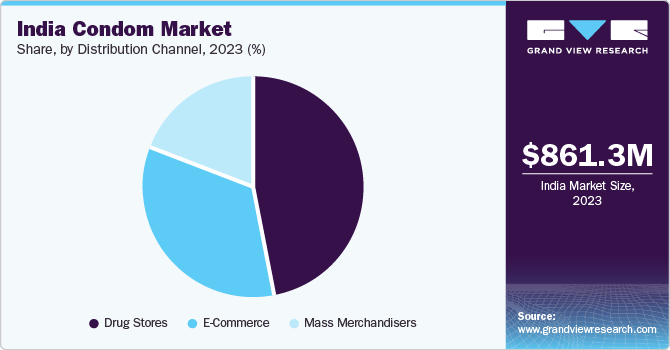

Distribution Channel Insights

Drug stores accounted for the largest market share in 2023. This can be attributed to easy accessibility and the availability of multiple options. In addition, the presence of a high middle-aged population and the role of pharmacies in creating awareness regarding the use of condoms are expected to add to the segment's growth. For instance, in January 2023, the Drugs Control Department in Karnataka, India, instructed pharmacists to counsel minors who were purchasing condoms to create awareness regarding the same.

The e-commerce segment is expected to grow at the fastest CAGR over the forecast period. The increasing digitization, improvement in internet connectivity, and growing penetration of e-commerce in the country are expected to add to the growth of this segment. In addition, the e-commerce platforms provide privacy to people, which in turn helps maintain anonymity while buying condoms, thus increasing their demand on e-commerce platforms. For instance, according to an article published by the ETRetail.com, in December 2019, Snapdeal registered a 56% increase in condom orders from tier-3 cities in India, driven by the availability of varieties and hesitancy to buy condoms from stores.

Key India Condom Company Insights

Some of the key companies operating in the India condom market include Mankind Pharma, Reckitt Benckiser Group PLC, Godrej Consumer Products Limited, TTK, HLL Lifecare Limited, Karex Berhad, Redcliffe Hygiene Pvt Ltd., Sirona Hygiene Private Limited, and Okamoto Industries, Inc. The companies are engaged in the new product launches, mergers & acquisitions, and launch of campaigns to create awareness regarding their products and increase their market share.

-

Mankind Pharma is a pharmaceutical company that offers a range of sexual wellness products to address the sexual health concerns of both men and women. Manforce is a key brand of the company that offers a variety of condoms in the Indian market.

-

Reckitt Benckiser Group PLC is a global company engaged in the consumer goods sector. The company's sexual wellness brand, Durex, offers a variety of products under this brand, such as condoms and lubricants.

Key India Condom Companies:

- Mankind Pharma

- Reckitt Benckiser Group PLC

- Godrej Consumer Products Limited

- TTK

- HLL Lifecare Limited

- Krex Berhad

- Redcliffe Hygiene Pvt Ltd.

- Sirona Hygiene Private Limited

- Okamoto Industries, Inc.

Recent Developments

-

In April 2023, Raymond sold its sexual wellness brand Kamasutra to Godrej Consumer Products Limited along with other consumer care brands, including Park Avenue. The deal is expected to help Godrej Consumer Products Limited enhance its business portfolio and improve its market presence.

-

In March 2023, TTK introduced its sexual pleasure brand, MsChief, for women, offering products such as condoms, lubricants, and others. The brand is expected to help the company establish itself in the female sexual health industry in India.

-

In January 2022, SKORE, a sexual wellness brand of TTK, introduced India’s thinnest flavored condom ‘NOTHINGH20. The launch helped the company enhance its portfolio and increase its customer base.

India Condom Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.8 billion

Growth rate

CAGR of 11.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, product, distribution Channels

Country scope

India

Key companies profiled

Mankind Pharma; Reckitt Benckiser Group PLC; Godrej Consumer Products Limited; TTK; HLL Lifecare Limited; Karex Berhad; Redcliffe Hygiene Pvt Ltd.; Sirona Hygiene Private Limited; Okamoto Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

India Condom Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India condom market report based on material type, product, and distribution channel.

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Latex

-

Non-latex

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Male Condoms

-

Female Condoms

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass Merchandisers

-

Drug Stores

-

E-Commerce

-

Frequently Asked Questions About This Report

b. The India condom market size was valued at USD 861.3 million in 2023.

b. The India condom market is projected to grow at a compound annual growth rate (CAGR) of 11.0% from 2024 to 2030 to reach USD 1.8 billion by 2030.

b. Latex dominated the market and accounted for a share of 87.9% in 2023. The material used in the latex condoms is derived from the sap of rubber trees which makes it more durable and elastic. Latex condoms are also considered useful in preventing pregnancy and protecting against HIV and other sexually transmitted infections (STIs).

b. Some of the key companies operating in the India condom market include Mankind Pharma, Reckitt Benckiser Group PLC, Godrej Consumer Products Limited, TTK, HLL Lifecare Limited, Karex Berhad, Redcliffe Hygiene Pvt Ltd., Sirona Hygiene Private Limited, and Okamoto Industries, Inc.

b. The high percentage of middle-aged population, prevalence of HIV, increasing awareness regarding sexual health, and increasing efforts by private and public players to promote the usage of contraceptives and birth control are major drivers for the growth of this market. For instance, the Mission Parivar Vikas (MPV) introduced by the government of India aims at increasing access of people to contraceptives and family planning services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.