India Container Market Size & Trends

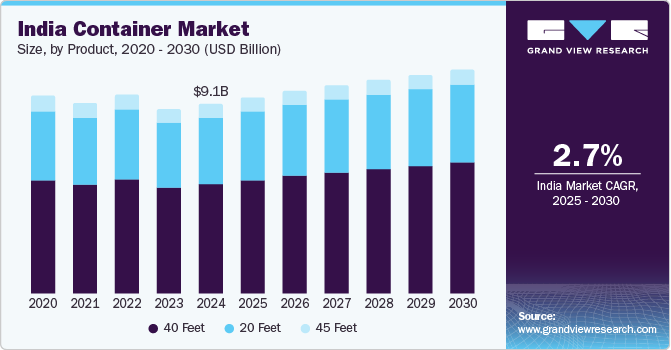

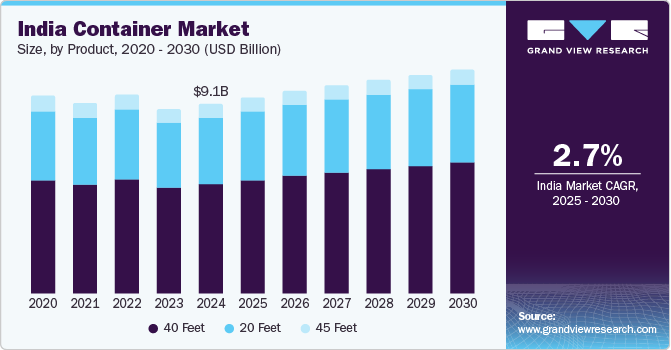

The India container market size was valued at USD 9.12 billion in 2024 and is projected to grow at a CAGR of 2.7% from 2025 to 2030, driven by increasing international trade, rapid growth of e-commerce, and significant government initiatives aimed at enhancing port infrastructure. As India's role in global supply chains expands, the volume of exports and imports is rising, necessitating efficient logistics solutions such as containerized shipping.

As India continues to integrate into international supply chains, the volume of exports and imports is rising. This increase necessitates efficient logistics solutions, particularly containerized shipping, which allows for the safe and effective transport of goods across borders. The government's focus on trade agreements and partnerships with other countries further supports this growth, as it creates more opportunities for Indian businesses to access global markets. For instance, In FY23, India's exports reached USD 295.21 billion across key commodities such as engineering goods, petroleum products, and pharmaceuticals. This surge is attributed to India's strategic partnerships and trade agreements with countries such as the UAE and the US, enhancing access to global markets.

Moreover, the rapid growth of e-commerce in India fundamentally transforms logistics and distribution channels. With millions of consumers shopping online, there is a pressing need for efficient delivery systems that can handle high volumes of orders. Containerized shipping provides the necessary flexibility and efficiency to meet these demands, as it allows logistics companies to optimize their operations and manage inventory effectively. As e-commerce continues to thrive, the demand for containers to facilitate the movement of goods from warehouses to consumers will only increase.

Furthermore, the Indian government has launched several initiatives aimed at enhancing port infrastructure and overall logistics capabilities. For instance, to enhance capacity and accommodate ultra large container ships, the Maritime India Vision (MIV) 2030 outlines initiatives for developing world class mega ports and transshipment hubs, with estimated investments ranging from approximately USD 12 billion to USD 15 billion. Improved infrastructure not only enhances operational efficiency but also reduces turnaround times, making container transportation more attractive for businesses involved in trade and logistics.

Product Insights

The 40 feet segment dominated the market with a 57.7% revenue share in 2024, owing to its increased durability and larger capacity, making it suitable for a variety of applications. With their high capacity, 40 feet containers accommodate larger volumes of cargo compared to smaller units, making them ideal for bulk shipments and industrial goods. This capacity translates to economies of scale, making 40 feet containers a more economical choice for businesses engaged in international trade. In addition, their versatility in handling various types of cargo and suitability for intermodal transport further enhance their demand, driving higher adoption rates across multiple industries.

The 20 feet segment is expected to grow at a significant CAGR over the forecast period due to its suitability for smaller shipments and flexibility in handling shipments that are less than container load (LCL). As e-commerce continues to thrive in India, businesses increasingly require efficient delivery systems that can accommodate smaller quantities of goods without incurring high shipping costs associated with larger containers. The adaptability of 20 feet containers makes them an ideal choice for small and medium enterprises (SMEs) that are entering international trade markets and need scalable shipping solutions. For instance, companies such as Rivigo and Delhivery utilize these smaller containers to handle frequent shipments for SMEs entering international markets.

End Use Insights

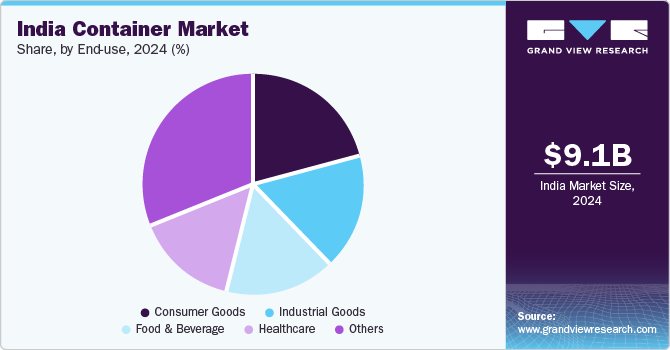

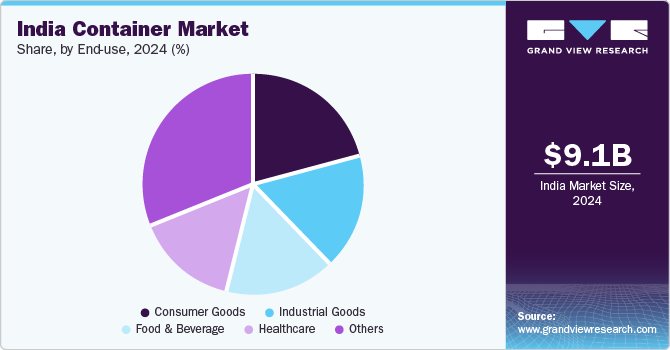

The consumer goods segment registered a substantial market revenue share in 2024 due to the increasing urbanization and rising consumer spending in India. As more people move to urban areas, there is a growing demand for various consumer products, including personal care items, household goods, and electronics. This trend is further supported by the expansion of retail channels, including e-commerce platforms, which have made these products more accessible to consumers across different regions. The strong performance of the consumer goods sector is also sustained by effective marketing strategies and brand loyalty, which encourage repeat purchases.

The food & beverage segment is expected to grow at the fastest CAGR during the forecast period. Increasing disposable income among consumers is driving higher spending on premium and healthier food options, reflecting a shift toward quality and nutrition. Additionally, evolving consumer preferences for convenience and ready-to-eat meals are significantly boosting demand in this sector. According to CRISIL, the food and beverage industry is expected to grow by 8-9%, supported by improved distribution channels and greater access to rural markets, alongside government initiatives aimed at enhancing agricultural productivity and rural infrastructure.

Key India Container Company Insights

The India container market is characterized by several key players that influence its dynamics and market share. Notable manufacturers include DCM Hyundai Ltd, a joint venture known for producing a variety of container types. Other prominent manufacturers are Braithwaite & Co. Ltd and AB Sea Container Private Limited, both of which contribute to the growing domestic production capacity aimed at reducing reliance on imports from other countries.

-

AB Sea Container Private Limited specializes in the manufacturing and leasing of shipping containers in India. The company offers a variety of products, including customized modular containers and prefabricated shelters, catering to diverse industries. It provides comprehensive logistics solutions, including container leasing and transportation services. AB Sea Container is committed to meeting the growing demand for containerized solutions in the Indian market.

-

DCM Hyundai Ltd is a leading manufacturer of shipping containers in India, known for producing high-quality dry freight and refrigerated containers. The company emphasizes innovation and quality in its manufacturing processes to meet international standards. DCM Hyundai plays a vital role in supporting India's logistics needs by providing durable container solutions. It continues to expand its product offerings to adapt to the evolving demands of the shipping industry.

Key India Container Companies:

- A.P. Moller - Maersk

- COSCO SHIPPING Development Co,. Ltd.

- China International Marine Containers (Group) Co., Ltd.

- CXIC Group

- Singamas Container Holdings Limited

- Hapag-Lloyd AG

- Evergreen Marine Corporation

- MSC Mediterranean Shipping Company S.A.

- Yang Ming

- ZIM Integrated Shipping Services Ltd.

- DCM Hyundai Ltd.

- J.K. Technologies Pvt. Ltd.

- AB Sea Container Pvt. Ltd.

Recent Development

-

In October 2023, JSW Steel announced its consideration of entering the container manufacturing sector as part of its Maritime Vision 2030 initiative. This strategic move aims to strengthen India's maritime capabilities and meet the growing demand for containers driven by rising trade and logistics needs. By diversifying into container manufacturing, JSW Steel seeks to enhance the country's self-reliance in the shipping industry.

India Container Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 9.42 billion

|

|

Revenue forecast in 2030

|

USD 10.74 billion

|

|

Growth rate

|

CAGR of 2.7% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, end use

|

|

Key companies profiled

|

A.P. Moller - Maersk; COSCO SHIPPING Development Co,. Ltd.; China International Marine Containers (Group) Co., Ltd.; CXIC Group; Singamas Container Holdings Limited; Hapag-Lloyd AG; Evergreen Marine Corporation; MSC Mediterranean Shipping Company S.A.; Yang Ming; ZIM Integrated Shipping Services Ltd.; DCM Hyundai Ltd.; J.K. Technologies Pvt. Ltd.; AB Sea Container Pvt. Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

India Container Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India container market report based on product, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Consumer Goods

-

Industrial Goods

-

Healthcare

-

Others