- Home

- »

- Medical Devices

- »

-

India Home Healthcare Market Size & Share Report, 2030GVR Report cover

![India Home Healthcare Market Size, Share & Trends Report]()

India Home Healthcare Market (2023 - 2030) Size, Share & Trends Analysis Report By Equipment (Therapeutic, Diagnostic, Mobility Assist Equipment) By Services (Skilled Home Care, Unskilled Home Care), And Segment Forecasts

- Report ID: GVR-4-68038-605-9

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

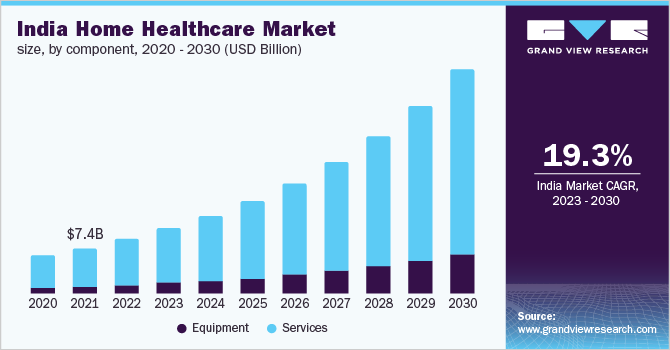

The India home healthcare market size was valued at USD 8.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 19.29% from 2023 to 2030. The increasing need for better quality postoperative & primary care, advancement in technologies, rising disposable income, the shift of trend from communicable to lifestyle diseases, and the increasing availability of improved home care services with the technology-enabled platform are expected to drive the market growth. The growing geriatric population & dependency ratio in India is expected to drive the demand for home healthcare. According to the Economic and Social Commission for Asia and the Pacific, the aging population of India is expected to reach 298 million by 2051, accounting for 17% of the national population. With the introduction of advanced home healthcare services in the country, high-quality healthcare can now be delivered in the comfort of one's own home.

The rising prevalence of chronic diseases among the elderly, combined with the need for better primary and postoperative care, is expected to drive the country's home care services market. According to Union History's aging study of India, approximately 70% of seniors in India have chronic diseases. Such a population necessitates the use of nursing homes, hospices, and home healthcare services.

With the help of home healthcare services, patients can save 10% to 25% on their overall medical treatment costs. Modern networking has enabled physicians to access patient data from remote locations and provide immediate consultation. For Instance, staying in an ICU in a hospital can cost between USD 450 and USD 650 per day, whereas setting up an ICU facility at home with equipment and medical expertise can cost between USD 95 and USD 125 per day.

COVID-19 India home healthcare market impact: 19.1% growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

During the pandemic, hospital facilities were constrained, leading to chronic patients seeking home healthcare. In India, hospitals were inundated with COVID-19 patients, preventing them from treating patients with non-COVID-19 symptoms. As a result, for unmet patient demand, home healthcare became the ideal alternative.

The demand for home healthcare is expected to be a high post-COVID-19 pandemic. Home healthcare services will continue to be the best alternative for the dependent geriatric population due to their convenience & efficiency. Home chronic care is expected to reduce hospital visits making it easier for health care providers to give the best services.

The pandemic propelled rapid advancements in technology. The adoption of telehealth applications, remote patient monitoring, home ICU, infusion, equipment, and others in India are driving the market growth. As per the Future Health Index report, 94% of leading healthcare providers in India are looking forward to invest in artificial intelligence to boost the use of the latest technologies in India.

Post COVID-19, healthcare in India is expected to be more robust. The investment of companies in AI is expected to result in the availability of the best home health technologies in India boosting the market growth. Home healthcare equipment is expected to witness higher demand as healthcare providers find them ideal for the initial diagnosis & treatment of acute & moderate cases.

The Indian government has recently launched new initiatives to promote home healthcare in India. For example, in January 2022, the Healthcare Federation of India released Home Healthcare 2.0, which incorporated perspectives from industry stakeholders as well as government recommendations for creating significant growth opportunities for home healthcare services in India

In India, the market for home healthcare services is gaining increasing attention with many private insurance providers expanding their coverage to include these services. Home care services prescribed by a doctor are covered by Max Bupa Health Insurance for senior citizens. Under domiciliary treatment, the company covers home healthcare services. Religare Health Insurance pays about 10% of the sum insured for in-home care.

Equipment Insights

The therapeutic equipment segment held the largest market share of 42.57% in 2022. In the therapeutic segment, home respiratory equipment had the largest share. Home respiratory therapy equipment is used to treat and assess cardiopulmonary disorders like bronchitis, asthma, COPD, and others. C-PAP, Bi-PAP, ventilators, and nebulizers are examples of the equipment. The rising prevalence of chronic diseases such as COPD is expected to drive the home respiratory therapy equipment market.

The diagnostic equipment segment is expected to register the fastest CAGR of 20.27% during the forecast period. The diagnostic equipment segment is expected to grow due to technologically advanced products that enable accurate and timely diagnosis, such as strapless heart rate monitors, iPhone heart-rate monitors, and TQR heart rate watches. Furthermore, rising patient awareness and health consciousness are expected to drive segment growth. Diabetic care units & blood pressure monitors are getting increased attention owing to changing lifestyles such as tobacco, alcohol, physical inactivity, and high salt intake all contributing to severe chronic problems.

Basic mobility is provided by mobility assistive equipment. Wheelchairs had the highest market share in the mobility assistive equipment segment. The rising incidence of mobility impairments, trauma, or disabilities, as well as the aging population and the introduction of technologically advanced products, are driving the demand for wheelchairs.

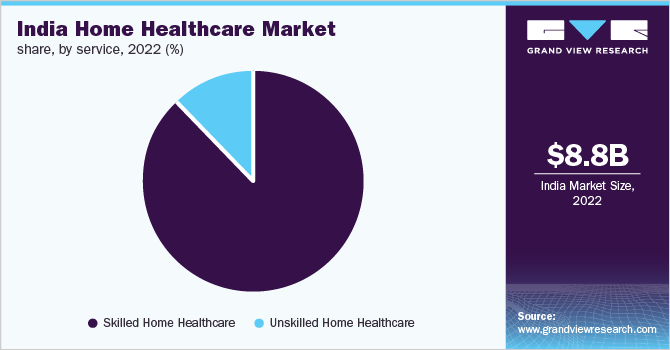

Service Insights

The skilled home healthcare segment accounted for the highest market share of 87.70% in 2022 and is expected to register the fastest CAGR of 19.21% during the forecast period owing to the increased incidence of lifestyle diseases and the growing demand for high-quality, low-cost care. Furthermore, the rising prevalence of lifestyle diseases in India has increased the demand for home-bound patients recovering from an acute injury or illness to receive continuous and coordinated care

Physical, occupational, and/or speech therapy accounted for the highest share in the skilled home care segment. These services assist patients in regaining physical, mental, and cognitive abilities aiming at improving patients' quality of life and helping them live a normal or near-normal life. These services are widely used because they improve patient compliance and medication adherence, reduce relapse, and increase attendance and support. All of these factors can be attributed to this segment's significant market share.

Unskilled home care services include grooming, bathing, dressing, personal care, and other daily living aids at home. It also involves homemaker tasks such as laundry, dinner preparation, and house cleaning. These services are expanding rapidly as they fill gaps and satisfy unmet needs that are not met by skilled care. Furthermore, increased disposable income and the growing need for tailored treatment are expected to contribute to segment growth.

Key Companies & Market Share Insights

The market in India is highly fragmented in nature owing to the presence of several local and national players. Portea Medical, Apollo Homecare, Nightingales Home Health Services, and India Home Health Care are some of the prominent companies in this market (IHHC). Companies are extending their operations in response to rising demand. Nightingales Home Health Services, for example, just began operations in Chennai. Portea Medical is expanding its service offerings by providing at-home COVID-19 testing. Furthermore, due to the unregulated nature of the market, it may result in unfair competition and hostile takeovers.

Key players are involved in expanding their services across India by implementing cutting-edge technologies and engaging in partnerships, mergers, and acquisitions. For example, Human Life Management, a Japanese home medical care provider, acquired Care24 in January 2022 to expand its medical service capabilities in India. Some of the prominent players in the India home healthcare market include:

-

Apollo Homecare

-

Portea Medical

-

India Home Health Care

-

Healthcare atHome

-

Care24

-

Nightingales Home Health Services

-

Bharat Home Medicare

-

Grand World Elder Care

-

Medfind

-

Swarg Community Care

-

Suburban Diagnostics

India Home Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.5 billion

Revenue forecast in 2030

USD 36.1 billion

Growth Rate

CAGR of 19.29% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, services

Country scope

India

Key companies profiled

Apollo Homecare; Portea Medical; India Home Health Care; Healthcare atHome; Care24; Nightingales Home Health Services; Bharat Home Medicare; Grand World Elder Care; Medfind; Swarg Community Care; Suburban Diagnostics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Home Healthcare Market Segmentation

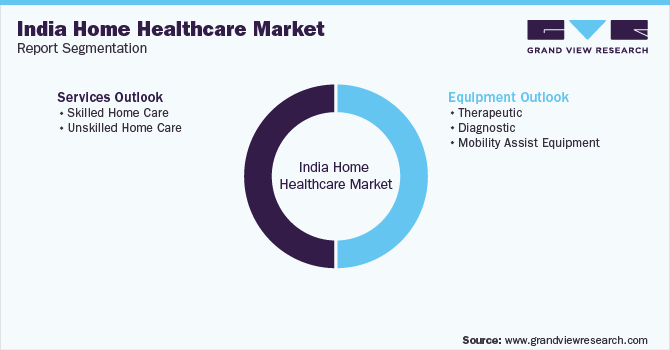

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the India home healthcare market report based on equipment and services:

-

Equipment Outlook (Revenue, USD Million, 2017 - 2030)

-

Therapeutic

-

Home Respiratory Therapy

-

Insulin Delivery

-

Home Intravenous Pumps

-

Home Dialysis Equipment

-

Other Therapeutic Equipment

-

-

Diagnostic

-

Diabetic Care Unit

-

Blood Pressure Monitors

-

Multi-Parameter Diagnostic Monitors

-

Home Pregnancy and Fertility Kits

-

Other Self-Monitoring Equipment

-

Apnea and Sleep Monitors

-

Holter Monitors

-

Heart Rate Meters

-

Other Diagnostic Equipment

-

-

Mobility Assist Equipment

-

Wheelchair

-

Home Medical Furniture

-

Walking Assist Devices

-

-

-

Services Outlook (Revenue, USD Million, 2017 - 2030)

-

Skilled Home Care

-

Physician/Primary Care

-

Nursing Care

-

Physical, Occupational, and/or Speech Therapy

-

Nutritional Support

-

Hospice & Palliative Care

-

Other Skilled Home Care Services

-

-

Unskilled Home Care

-

Frequently Asked Questions About This Report

b. The India home healthcare market size was established at USD 8.8 billion in 2022 and is expected to reach USD 10.5 billion in 2023.

b. The India home healthcare market is expected to grow at a compound annual growth rate of 19.29% from 2023 to 2030 to reach USD 36.1 billion by 2030.

b. The skilled home healthcare segment accounted for the highest market share of 87.70% in 2022 This is attributed to the increasing demand for post-operative & primary care and the growing geriatric population.

b. Some key players operating in the India home healthcare market include Portea Medical, Apollo Homecare, Nightingales Home Health Services, and India Home Health Care (IHHC), Grand World Elder Care, Healthcare atHOME, Medical, Bharath Home Medicare, Care24, MedFind, Swarg Community Care, and Suburban Diagnostics.

b. Key factors that are driving the India home healthcare market growth include increasing prevalence of lifestyle diseases, growing disposable income, advancement in technology to offer home care services, and cost-effective alternative to hospital stays.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.