- Home

- »

- Pharmaceuticals

- »

-

India Large Volume Parenteral Market Size Report, 2030GVR Report cover

![India Large Volume Parenteral Market Size, Share & Trends Report]()

India Large Volume Parenteral Market Size, Share & Trends Analysis Report By Application (Therapeutic Injections, Fluid Balance Injections, Nutritious Injections), By Volume, By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-480-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

India Large Volume Parenteral Market Trends

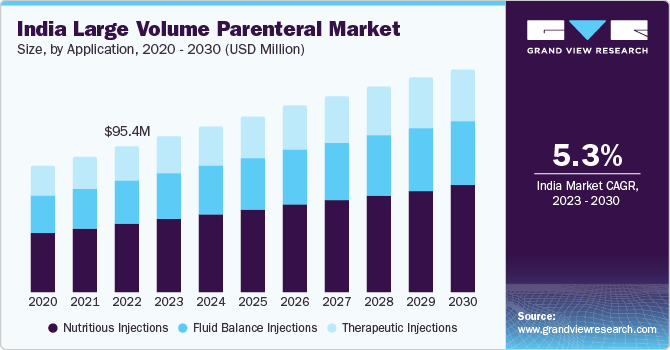

The India large volume parenteral market size was valued at USD 95.4 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. An increase in local manufacturing of Large Volume Parenteral (LVP) is contributing to the growth of the market in India. The presence of many malnourished children, high natality, increasing rate of premature births, growing prevalence of cancer, and rising adoption of LVP formulations in various healthcare and home care settings for chronically ill geriatric patients are factors expected to drive the market.

Diseases such as Crohn’s, esophageal cancer, ulcerative colitis, gastric cancer, head and neck cancer, and laryngeal cancer can affect the oral intake of food in patients. Their growing prevalence is, in turn, expected to drive the demand for the parenteral mode of drug administration, aiding the growth of the market for large volume parenteral. For instance, according to the Global Cancer Observatory (GLOBCON) 2020 report, India had 60,222 new cases of gastric cancer, and it caused around 53,253 deaths.

The benefits offered by parenteral formulations, including lower postoperative inflammatory response, lower infection rates, improved postsurgical immune competence, adequate nutrient supply, and shorter hospital stays, positively impact market growth. LVPs provide a faster method for drug administration for patients during surgery or while recovering in the hospital. Growing physician preference for single-dose administration of vaccines and drugs to treat chronic diseases is further driving the demand for LVPs. The market is expanding due to an increase in the number of surgeries performed and the growing number of patients with chronic and lifestyle diseases that require hospitalization. For instance, according to the Department of Biotechnology of the Government of India (GOI), non-communicable diseases are responsible for 53% of overall deaths and 44% of disability-adjusted life years lost in the country. Moreover, India has around 77 million people living with diabetes, which is estimated to reach 134 million by 2045.

The COVID-19 pandemic has positively impacted market growth owing to an increase in the adoption of LVPs for various applications and an increase in physician’s preference towards single-dose drug administration for improving drug absorption and faster and safer patient recovery. In addition, the rising prevalence of chronic diseases and malnutrition and rapid growth in the geriatric population are driving the adoption of LVPs. For instance, according to Feeding India, in December 2022, India is the largest contributor to malnutrition globally with around 194.4 million people being undernourished. Moreover, India has the highest rate of child malnutrition, as 1 in every 3 malnourished children in the world is Indian. In addition, the increasing number of surgical procedures and the presence of critically ill patients with hampered physiological functioning of the enteral route are additional factors surging the adoption of parenteral nutrition as an alternate route of administration.

Severe malnutrition in pregnant women is associated with intrauterine growth restriction, preterm delivery, congenital malformations, low birth weight, and perinatal mortality. Parenteral nutrition is advisable for pregnant women whose nutritional requirements are not fulfilled by enteral intake. Moreover, the adoption of LVPs as part of total parenteral nutrition is increasing for pregnant women to help maintain or restore optimal nutritional status for the mother as well as the fetus when caloric intake by oral or enteral routes is not sufficient. In addition, it provides necessary nutritional requirements for fulfilling metabolic and anabolic needs without increasing the overall risk of complications. Thus, the country's high natality and birth rate are further expected to propel the market growth. According to the United Nations (UN) World Population Prospect 2019, India has the highest number of births globally, with around 24 million births every year.

The Indian government has undertaken many steps to reduce medical costs and healthcare expenditures. The rapid introduction of generic drugs in the market for large-volume parenteral has remained a major focus and is expected to benefit Indian pharmaceutical companies. The companies are adopting new business models and introducing innovative ideas to meet consumer expectations. Indian pharma companies may continue to grow organically and inorganically through acquisitions and partnerships, which, in turn, drive the market. For instance, in November 2020, Grifols and B Braun SE formed an alliance to enhance therapy safety and pharmacy production output. Grifols’ Kiro and B Braun SE’s Safe Infusion Systems will be combined to provide solutions for safe automated drug mixtures and delivery systems.

Application Insights

The nutritious injections segment dominated the market for large volume parenteral and held the largest revenue share of over 45% in 2022. Its growth is attributed to increased demand for these formulations to fulfill adequate nutrition requirements and improve drug absorption for faster and more effective results. Different combinations of nutrients are available at different concentrations for different requirements. Parenteral nutrition is selected when a patient experiences short bowel syndrome, extensive Crohn’s disease, high-output gastrointestinal fistula, intractable vomiting, radiation enteritis, and mucositis after chemotherapy. Nutritious injections also reduce risks associated with the treatment of chronic diseases and ensure smoother therapy.

The therapeutic injections application segment is anticipated to grow at the fastest CAGR of 5.7% over the forecast period owing to the increasing prevalence of life-threatening diseases and growing demand for safer, faster, and more effective methods of drug administration in patients undergoing surgical procedures. The COVID-19 pandemic and the surging demand for these formulations owing to the rising patient population suffering from low immunity levels and prone to the incidence of neurological diseases, cardiac problems, cancers, and spinal injuries, to meet adequate nutritional requirements when enteral nutrition mode is insufficient, not possible, or contraindicated, has positively impacted the company sales and overall market growth.

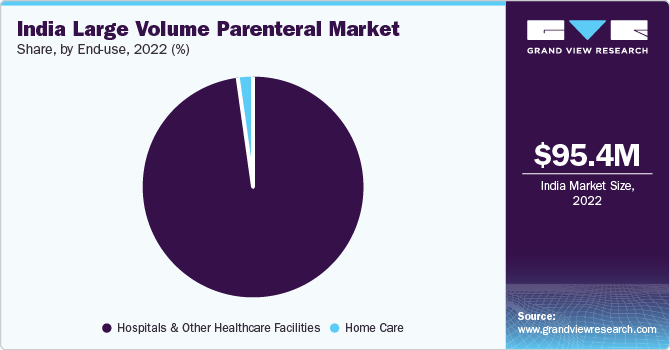

End-use Insights

The hospitals and other healthcare facilities segment dominated the market for large volume parenteral and accounted for the largest revenue share of over 95% in 2022 and it is expected to grow at the fastest CAGR of 5.3% over the forecast period. The growth can be attributed to the increase in demand for these formulations among patients during surgery or while recovering in the hospital, as well as growing physician preferences for single-dose administration. In India, the prevalence of malnutrition has increased over the past few years. According to the 2018 State of Food Security and Nutrition in the World report, 195.9 million people are undernourished in India. Total Parenteral Nutrition (TPN) is an essential preparation for malnutrition, used in hospitalized patients where enteral feeding is not feasible or for critical care patients with compromised gastrointestinal tract function.

The homecare facilities segment is expected to register significant growth during the forecast period owing to the growing geriatric population and increasing consumer interests in the adoption of at-home care. According to a report, Elderly in India 2021, published by the National Statistical Office (NSO), the elderly population of India aged 60 years or above is estimated to increase by 56 million and reach 194 million by the year 2031 from 138 million in the year 2021. Similarly, according to an article published by Economic Times in April 2019, the share of the older population-those aged 60 years or above-in India is projected to increase to around 20% in 2050. This has resulted in an increased number of home care services that can manage dose administration in the geriatric population. Moreover, benefits offered by formulations such as high bioavailability and delivery of safer and faster drug absorption, are likely to boost segment growth.

Volume Insights

The 500 ml segment had a significant share in India large volume parenteral market in 2022. Growing awareness among healthcare professionals about hospital-associated malnutrition, rising number of surgeries, increasing preference for single-dose administration of vaccines and drugs, growing need for a faster route of drug administration to avoid complications, and an increase in local manufacturing are factors expected to drive the demand for LVP, which, in turn, can boost this segment. Moreover, rising demand for LVP formulations among critically ill patients, an increasing number of ICU admissions, and growing prevalence of various chronic disorders such as cancer and diabetes, are additional factors expected to propel market growth.

The 100 ml injectable segment is anticipated to register a significant growth rate during the forecast period. The increasing prevalence of chronic diseases and growing demand for LVP formulations for fulfilling adequate nutrition requirements, correcting electrolyte and fluid balance disturbances, and as a vehicle for administration of other drugs are key factors expected to drive this segment. For instance, patients weighing more than 50 kg and with no additional risk factors for hepatotoxicity, paracetamol infusion in 100 mL quantity is suggested for treating fever or pain, especially in post-surgery, when other means of administering medicine are not feasible or when the IV method is clinically suggested to urgently treat hyperthermia or pain. This, in turn, is anticipated to positively impact the growth of the segment.

Key Companies & Market Share Insights

Increasing investments in R&D, collaborations with other industry players, geographic expansions, and product differentiation are among the key strategies adopted by these companies for gaining a competitive edge in the market for large volume parenteral. In July 2022, Akums, a contract manufacturing company in India, received EU Good Manufacturing Practice (GMP) certification for its manufacturing facility in Haridwar, India, which has large volume parenteral manufacturing capacity.

For instance, in July 2017, Baxter acquired 100.0% of Claris Injectables, a division of Claris Lifesciences. This added to Baxter’s production capabilities for generic injectables and intravenous solutions, along with bags, vials, and ampoules.

Key India Large Volume Parenteral Companies:

- B. Braun SE

- Fresenius Kabi AG

- Baxter

- Otsuka Pharmaceutical Co., Ltd.

- Sichuan Kelun

- Albert David Ltd.

- BML Parenteral Drugs

India Large Volume Parenteral Market Report Scope

Report Attributes

Details

Market size value in 2023

USD 101.7 million

Revenue forecast in 2030

USD 146.2 million

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, volume, end-use

Country scope

India

Key companies profiled

B. Braun SE; Fresenius Kabi AG; Baxter; Otsuka Pharmaceutical Co., Ltd.; Sichuan Kelun; Albert David Ltd.; BML Parenteral Drugs

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Large Volume Parenteral Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the India large volume parenteral market report on the basis of application, volume, and end use:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Injections

-

Fluid Balance Injections

-

Nutritious Injections

-

-

Volume Outlook (Revenue, USD Million, 2018 - 2030)

-

100 ml

-

250 ml

-

500 ml

-

1,000 ml

-

2,000 ml

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Other Healthcare Facilities

-

Home Care

-

Frequently Asked Questions About This Report

b. The India large volume parenteral market size was estimated at USD 95.4 million in 2022 and is expected to reach USD 101.72 million in 2023.

b. The India large volume parenteral market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 146.2 million by 2030.

b. Hospitals & other healthcare facilities segment dominated the India large volume parenteral market with a share of 97.7% in 2022. This is attributable to the policies implemented by the Indian government to promote healthcare and increase its accessibility evenly in all parts of the country.

b. Some key players operating in the India LVP market include Fresenius Kabi AG, Albert David Ltd., Baxter, Otsuka Pharmaceutical Co., Ltd., and Sichuan Kelun Pharmaceutical Co., Ltd.

b. Key factors that are driving the market growth include increased local manufacturing of large volume parenteral (LVP) in the country along with the growing prevalence of chronic diseases.

b. In 2022, the nutritious injections application segment dominated the LVP market in India and held the largest revenue share of 47.3%.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."