- Home

- »

- HVAC & Construction

- »

-

India Light Gauge Steel Framing Market Size Report, 2030GVR Report cover

![India Light Gauge Steel Framing Market Size, Share & Trends Report]()

India Light Gauge Steel Framing Market Size, Share & Trends Analysis Report By Type (Skeleton Steel Framing, Wall Bearing Steel Framing, Long Span Steel Framing), By End-use (Commercial, Residential, Industrial), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-062-6

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

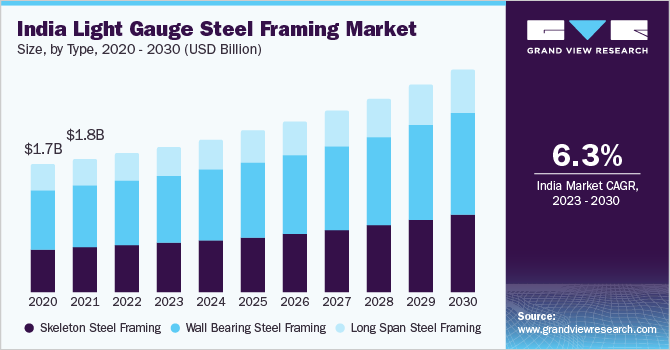

The India light gauge steel framing market size was valued at USD 1,887.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. The major factors attributing to the growth of the market are urbanization accelerating the adoption of modern construction techniques; the rising population leading to the increasing demand for housing. In addition, the aspects such as the increasing demand for green and sustainable buildings is further bolstering the growth of the market. The implementation of government housing schemes on a large scale is expected to positively impact the growth of the target market in the country owing to announcements made by India's central and state governments.

Furthermore, improved insulation techniques for light gauge steel frames have reduced the risk of fire outbreaks in the recent past, improving the structural safety of buildings. Additionally, the use of long-span frames has proven beneficial in industrial building applications owing to the immense stability provided by the light gauge steel structures, which is expected to drive market growth over the forecast years. The Bureau of Indian Standards (BIS) has formulated standards regarding the load, design, and earthquake resistance parameters for building construction materials. Majority of the key players provide target products that conform to not only Indian standards but also international standards such as International Organization for Standardization (ISO).

However, the high thermal conductivity of steel is a major factor restraining the industry's growth. The high thermal conductivity largely affects a building's performance during summer, resulting in increased use of air-conditioning equipment and power consumption to maintain comfortable temperatures, thereby impacting sustainability as increased power consumption creates a negative environmental impact. Additionally, the availability of several alternatives to light gauge steel framing, such as traditional/RCC construction, restrains the market growth over the forecast period.

COVID-19 Insights

The slower growth in the construction and real estate industry spending, coupled with the lower demand for buying homes and offices, led to moderate growth of the light gauge steel framing products during the peak of the pandemic. However, light gauge steel framing was utilized to build emergency infrastructure for COVID-19 patients, such as temporary hospitals, vaccination centers, and supportive housing. With the ease of restrictions in 2021 and 2022, the construction sector resumed operations. Moreover, the government released economic relief packages, allowing several key sectors such as construction and manufacturing to resume their operations with limited workforces by the end of 2020, thus aiding the recovery of the target market.

Type Insights

On the basis of type, the market is bifurcated into long-span steel framing, wall bearing steel framing, and skeleton steel framing. The wall bearing steel framing segment accounted for the largest market share of about 46% in 2022 and is expected to dominate the market during the forecast period. Wall bearing frame structures support the floor or roof loads of the building and are mostly suitable for low-rise structures, thereby extensively used for residential applications. These frames are required to be strong enough to resist any horizontal load. The wall-bearing frames are generally unsuitable for multi-story buildings, as the bearing size has to increase to withstand the loads exerted by multi-story buildings.

The skeleton steel framing is anticipated to expand with the highest CAGR of 6.7% during the forecast period, owing to its extensive adoption in multi-story residential buildings and commercial and industrial projects. Due to continuous technological advances, skeleton framing can be used as structural support, even for buildings with irregular surfaces and different shapes. The skeleton framing is made of a system of columns and beams to support the building’s exterior walls and interior floors, and it carries the load to the foundation.

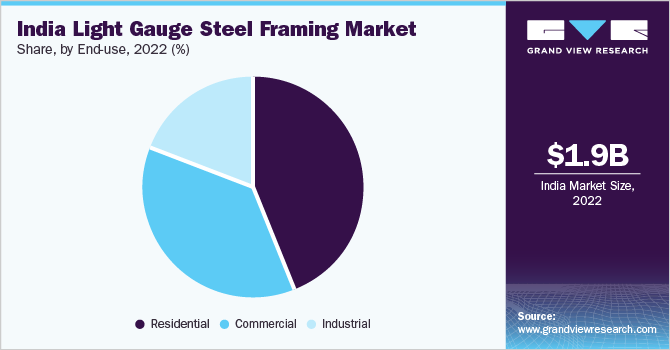

End-use Insights

On the basis of end-use, the market has been segmented into residential, commercial, and industrial. The residential end-use segment dominated with a market share of about 44% in 2022. Light gauge framing is anticipated to be extensively adopted in the residential sector due to the growing inclination of people toward sustainable construction materials. Furthermore, India is implementing light gauge steel framing structures in residential buildings in government-funded housing schemes. The Pradhan Mantri Awas Yojana (PMAY) initiative has provided a significant boost to the adoption of light gauge steel framing in India.

The commercial end-use is expected to register the fastest CAGR of 6.8% during the forecast period. Commercial buildings extensively use long-span and skeleton frames due to their structural stability and aesthetic appeal. Light gauge framing is extensively utilized in the construction of commercial buildings such as hotels, shopping complexes, offices, hospitals, and educational institutes, owing to the cost-effectiveness, high safety standards, and fire resistance offered by the frames. The shorter installation time also contributes significantly to the increased adoption of light gauge steel framing in commercial building construction.

Key Companies & Market Share Insights

Major players operating in the target market include Tata BlueScope Steel Limited (Tata Group), Stratus Steel, EPACK Prefab, Mitsumi Housing Private Limited, Nipani Infra & Industries Pvt. Ltd., MGI Infra Pvt Ltd., Steelion, and Volta Green Structures. New certifications, new product launches, and partnerships & collaborations are the key strategies adopted by the India light gauge steel framing market players. Additionally, key companies are focused on expanding manufacturing capacity to expand their presence across different regions in the country, thereby expanding their market share. For instance, in February 2023, EPACK Prefab announced an investment of about USD 25 million for a greenfield manufacturing unit of pre-engineered buildings in Tirupati, Andhra Pradesh. The investment was aimed at expanding the company’s presence in South India and catering to the increasing demand for pre-engineered buildings in India.

India Light Gauge Steel Framing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,977.7 million

Revenue forecast in 2030

USD 3.03 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, end-use

Key companies profiled

Tata Group; EPACK Prefab; Steel Authority of India (SAIL); MGI Infra Pvt Ltd.; Mitsumi Housing Private Limited; Steelion; Nipani Infra & Industries Pvt. Ltd; Volta Green Structures; Jadro Steel LLP; Stratus Steel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Light Gauge Steel Framing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the segments from 2017 to 2030. For this study, Grand View Research has segmented the India light gauge steel framing market report based on type, and end use:

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Skeleton Steel Framing

-

Wall Bearing Steel Framing

-

Long Span Steel Framing

-

-

End-Use Outlook (Revenue, USD Million; 2017 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Frequently Asked Questions About This Report

b. The India light gauge steel framing market size was estimated at USD 1,887.5 million in 2022 and is expected to reach USD 1,977.7 million in 2023.

b. The India light gauge steel framing market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 3.03 billion by 2030.

b. Residential end-use segment dominated the India light gauge steel framing market with a market share of about 44% in 2022. This is attributable to the growing inclination of people toward sustainable construction materials.

b. Some key players operating in the India light gauge steel framing market include Tata Group, EPACK Prefab, Steel Authority of India (SAIL), MGI Infra Pvt Ltd., Mitsumi Housing Private Limited, Steelion, Nipani Infra & Industries Pvt. Ltd, Volta Green Structures, Jadro Steel LLP, and Stratus Steel.

b. Key factors that are driving the India light gauge steel framing market growth include rising population in the country and consequent increase in demand for affordable housing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."