- Home

- »

- HVAC & Construction

- »

-

Light Gauge Steel Framing Market Size & Share Report 2030GVR Report cover

![Light Gauge Steel Framing Market Size, Share & Trends Report]()

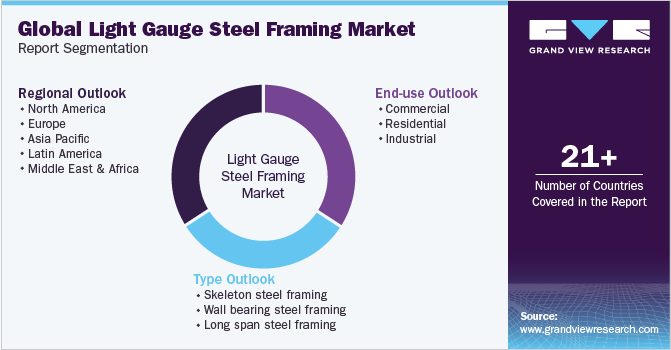

Light Gauge Steel Framing Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Skeleton Steel Framing, Wall Bearing Steel Framing), By End-use (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-522-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Light Gauge Steel Framing Market Summary

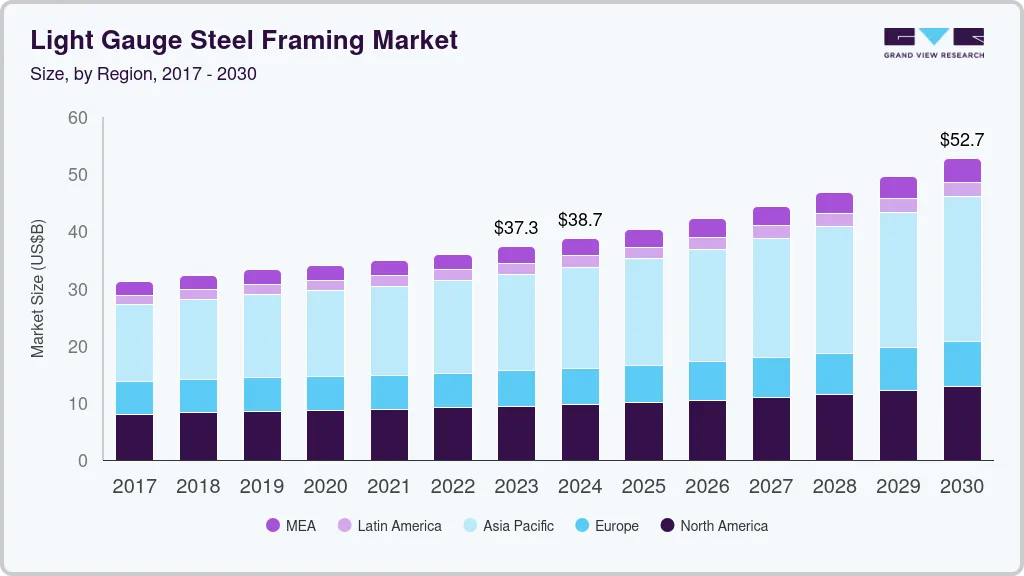

The global light gauge steel framing market size was estimated at USD 36.01 billion in 2022 and is projected to reach USD 57.23 billion by 2030, growing at a CAGR of 5.1% from 2023 to 2030. A remarkable rise in construction activities in developed as well as developing nations is estimated to drive the demand for light gauge steel framing.

Key Market Trends & Insights

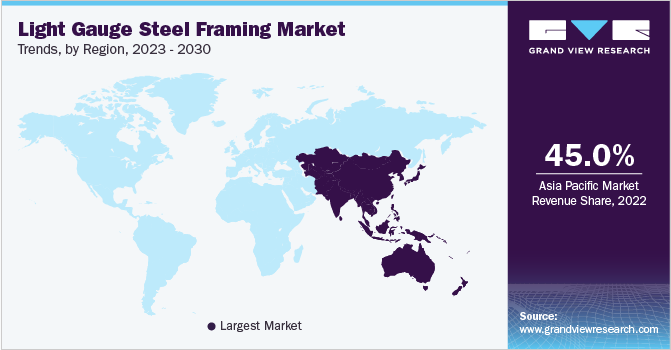

- In terms of region, Asia Pacific accounted for the major market revenue share of about 45% in 2022.

- The Middle East and Africa region is expected to register impressive growth from 2023 to 2030.

- On the basis of type, The wall bearing framing segment accounted for the largest market share of about 46% in 2022.

- On the basis of end-use, The commercial end-use is expected to register the fastest CAGR of 5.7% during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 36.01 Billion

- 2030 Projected Market Size: USD 57.23 Billion

- CAGR (2023 - 2030): 5.1%

- Asia Pacific: Largest market in 2022

Implementation of several housing schemes by the governments of several developing nations, such as India and China, is also expected to support the global market growth over the forecast years. Several housing schemes implemented by the Indian government and state governments include Pradhan Mantri Awas Yojana (PMAY) (Urban), Pradhan Mantri Gramin Awas Yojana, Maharashtra Housing and Area Development Authority Lottery Scheme, and Delhi Development Authority Housing Scheme.The construction industry witnesses stringent timeline constraints from customers for the completion of projects. The use of light gauge framing has led to a considerable decrease in the completion time of a project due to easy installation, leading to the fulfillment of customers’ demands. Moreover, steel framing technology has been widely adopted in construction projects such as multistorey buildings and skyscrapers in the recent past, owing to the advantages of the technology. Light gauge frames are flexible and do not crack under excess pressure. Moreover, steel frames perform better during earthquakes as they deform slowly, providing ample time for the residents to escape. Thus, light gauge frames are expected to be adopted more rapidly in construction in earthquake-prone countries such as Japan and Indonesia.

However, the high thermal conductivity of steel is the major factor restraining the industry's growth. Additionally, the availability of several alternatives to light gauge steel framing, such as lumber framing and traditional/RCC construction, further restrains the market growth over the forecast period. Light gauge steel framing is galvanized to enhance their insulation against fire, effectively reducing the risk of fire outbreaks, and is thus preferred over alternative construction methods. Light gauge farming is recommended for quick turnaround, cost-efficiency, high resistance to termite attacks, and flexibility.

COVID-19 Insights

The slower growth in the construction and real estate industry spending, coupled with the lower demand for buying homes and offices, led to moderate growth of the light gauge framing products during the peak of the pandemic. However, light gauge steel framing was used to build emergency infrastructure for COVID-19 patients, such as temporary hospitals, vaccination centers, and supportive housing. With the ease of restrictions in 2021 and 2022, the construction sector resumed operations. Moreover, the government released economic relief packages, allowing several vital sectors, such as construction and manufacturing, to resume their operations with limited workforces by the end of 2020, thus aiding the recovery of the target market. For instance, the U.S. federal government released approximately USD 1 trillion in economic relief packages in 2020. The package helped the country to recover from the economic slowdown.

Type Insights

On the basis of type, the market is bifurcated into wall bearing steel framing, skeleton steel framing, and long span steel framing. The wall bearing framing segment accounted for the largest market share of about 46% in 2022 and is expected to dominate the market during the forecast period. Wall bearing frame structures are extensively used for residential applications. They support the floor or roof loads of the building and are primarily suitable for low-rise structures. These frames are required to be strong enough to resist any horizontal load. Since the bearing size has to increase to withstand the loads exerted by multi-story buildings, the wall bearing frames are generally unsuitable for multi-story buildings.

The long span steel framing is anticipated to grow at a significant rate during the forecast period, owing to its extensive adoption in multi-story buildings. Long span framing is used for large clearance requirements in commercial and industrial buildings. Furthermore, long span frames are used to construct aesthetically pleasing structures and are commonly used in the construction of churches, gymnasiums, and shopping centers, among other buildings. Trusses, girders, arches, and rigid frames are different types of long span framing categories.

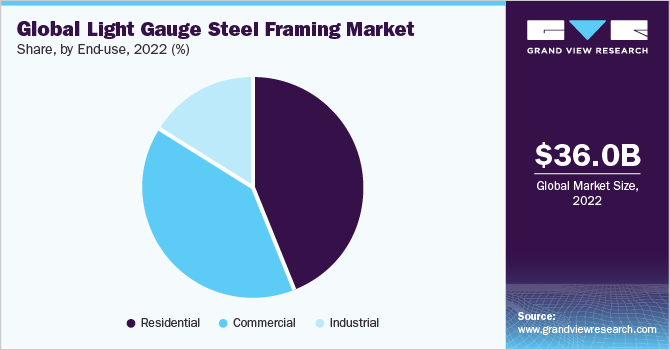

End-use Insights

On the basis of end-use, the market has been segmented into industrial, commercial, and residential. The commercial end-use is expected to register the fastest CAGR of 5.7% during the forecast period. The commercial end-use segment has been further bifurcated into hospitals, malls, educational institutes, and others. Light gauge framing is expected to be largely used by hospitals, followed by malls among the commercial building types. The cost-effectiveness, high safety standards, and fire resistance offered by the frames are the major driving factors contributing to the rise in demand for the construction of commercial buildings.

The industrial end-use segment is expected to mark an increased adoption of light gauge steel framing during the forecast years. Continuous technological advances have improved the fire-resistance and acoustic performance of light gauge steel framing, which has led to its increasing adoption in the construction of industrial applications such as airport hangars, warehouses, and manufacturing facilities. Long span steel frames and skeleton steel frames are majorly used for the construction of industrial buildings.

Regional Insights

Asia Pacific accounted for the major market revenue share of about 45% in 2022 and is estimated to expand at a significant CAGR from 2023 to 2030. The growth of the regional market is attributed to the increasing construction activities in the region, especially of commercial and industrial buildings. China, India, and Southeast Asian countries are among the major markets in the region. The high public and private investments made in these countries in the infrastructure development and construction of commercial spaces are significantly contributing to the growth of the regional market.

The Middle East and Africa region is expected to register impressive growth from 2023 to 2030. The Middle East is also expected to remain an important market on account of its vast construction sector and several upcoming important construction projects in the region. The region is likely to benefit from growing government participation and increasing investments in sectors such as healthcare, education, and infrastructure in order to diversify the country’s economy & shift away from traditional oil activities to support economic growth.

Key Players & Market Share Insights

Major players operating in the global light gauge steel framing market utilize a variety of organic and inorganic growth tactics, such as partnership & collaborations, mergers and acquisitions, joint ventures, and product development. For instance, in April 2020, CEMCO partnered with Spacecon Specialty Contractors and Phase 2 Company to temporarily build 2,200 beds in several 10’ x 10’ rooms at the Denver Convention Center, Denver, Colorado, for low-risk patients discharged from local hospitals. Additionally, in April 2021, The Steel Network, Inc. completed a modern project of the Ferrell Hospital, Illinois, worth USD 34 million. The hospital center was modernized by the light steel framing provided by The Steel Network, Inc. Some of the prominent players in the global light gauge steel framing market include:

-

Arkitech Advanced Construction Technologies

-

Tata BlueScope Steel

-

CEMCO

-

ClarkDietrich Building Systems

-

Hadley Group

-

Genesis Manazil Steel Framing

-

Precision Walls Inc.

-

QSI Interiors Ltd.

-

Metek U.K. Limited

-

Intelligent Steel Solutions Ltd

-

Steel Frame Solutions

-

WARE Industries, Inc.

-

SCAFCO Steel Stud Company

-

The Steel Network Inc

-

Craco Manufacturing, Inc

Light Gauge Steel Framing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 37.27 billion

Revenue forecast in 2030

USD 52.73 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Arkitech Advanced Construction Technologies; Tata BlueScope Steel; CEMCO; ClarkDietrich Building Systems; Hadley Group; Genesis Manazil Steel Framing; Precision Walls Inc.; QSI Interiors Ltd.; Metek U.K. Limited; Intelligent Steel Solutions Ltd; Steel Frame Solutions; WARE Industries, Inc.; SCAFCO Steel Stud Company; The Steel Network Inc; Craco Manufacturing, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Light Gauge Steel Framing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global light gauge steel framing market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Skeleton steel framing

-

Wall bearing steel framing

-

Long span steel framing

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Hospitals

-

Malls

-

Educational Institutes

-

Others

-

-

Residential

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global light gauge steel framing market size was estimated at USD 36.01 billion in 2022 and is expected to reach USD 37.27 billion in 2023.

b. The global light gauge steel framing market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 57.23 billion by 2030.

b. The wall-bearing product type segment led the global market for light gauge steel framing in 2022, accounting for the highest share of over 46%. However, the skeleton product type segment is expected to register the fastest CAGR during the forecast period owing to the increasing penetration of these products in commercial buildings.

b. The residential end-use segment accounted for the largest revenue share of over 44% of the global light gauge steel framing market in 2022. The product is extensively used in commercial and residential buildings for structural support.

b. Asia Pacific dominated the light gauge steel framing market in 2022 with a revenue share of about 45%. The regional market is expected to expand further at the fastest CAGR of 6.0% from 2023 to 2030.

b. Some key players operating in the light gauge steel framing market include Clarkwestern Dietrich Building Systems LLC; Precision Walls Inc.; Arkitech Advanced Construction Technologies; Intelligent Steel Solutions Ltd.; Hadley Group; Metek UK Limited; and QSI Interiors Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.