India Malaria Diagnostics Market Trends

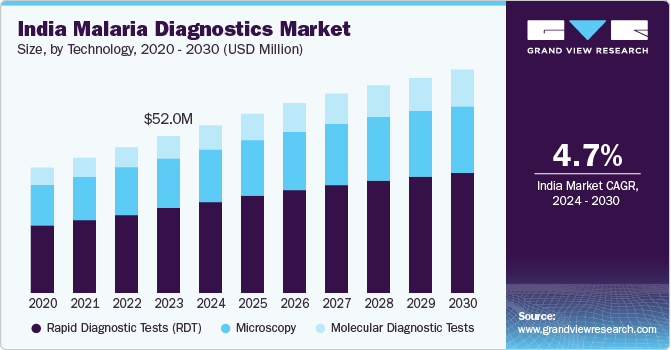

The India malaria diagnostics market size was valued at USD 52.0 million in 2023 and is projected to grow at a CAGR of 4.73% from 2024 to 2030. This growth is driven by the increasing public health burden of malaria across various regions of India. According to the National Center for Vector Borne Diseases Control (NCVBDC), approximately 95% of the Indian population resides in malaria-endemic areas, with 80% of malaria cases concentrated within 20% of the population inhabiting hilly and tribal regions.

The accessibility to healthcare in these areas poses a significant challenge, further contributing to the malaria burden. Moreover, the latest WHO estimates that India has taken a global malaria burden with 3% of the cases and is making progress with reduced death rates, thus showing the government's interest in the malaria issue.

The Government of India's initiatives to improve malaria diagnosis have positively shaped the market in recent years. According to WHO reports, the Government of India launched the National Strategic Plan (NSP) 2017-2022 with the assistance of WHO India and is finalizing the plan for 2023-2027 with the goal of achieving zero malaria cases by 2027. This provides opportunities for strengthening surveillance, ensuring quality treatment, and enhancing diagnosis programs.

Furthermore, technological advancements have been a major driving force for market growth. Innovations such as the Mobile-based Surveillance Quest using IT (MoSQuIT) to automate surveillance, the National Malaria Case-Based Reporting App (MCBR), enhanced Rapid Diagnostic Tests (RDTs) that provide precise results, nanotechnology-based devices such as the Nanomal DNA analyzer, and the integration of AI and geospatial technology have significantly improved the overall surveillance and diagnosis procedures for malaria in India.

Technology Insights

The rapid diagnostic test (RDT) technology segment accounted for a revenue share of 53.8% in 2023. RDTs are highly valued for their ability to provide quick and accurate results, which is crucial in the timely diagnosis and treatment of malaria. These tests are particularly beneficial in remote and resource-limited settings with limited access to laboratory facilities. The ease of use and minimal training required for RDTs make them an ideal choice for widespread deployment in malaria-endemic regions. In addition, the Indian government’s initiatives to enhance malaria diagnosis and treatment, including the distribution of RDT kits in high-risk areas, have further boosted the adoption of this technology.

The molecular diagnostics tests technology segment is anticipated to grow at a CAGR of 6.9% from 2024 to 2030. Molecular diagnostics, including Polymerase Chain Reaction (PCR) and other nucleic acid-based tests, play a critical role in the early detection and management of malaria. Advances in molecular diagnostics and integration with emerging technologies such as AI and machine learning are expected to enhance the accuracy and efficiency of malaria diagnosis, driving market growth.

Molecular Diagnostic Tests Insights

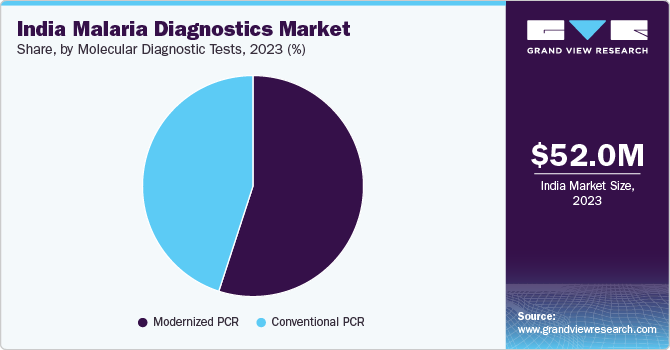

The modernized PCR molecular diagnostic tests segment dominated the market in 2023 due to the advanced capabilities of techniques such as real-time PCR (qPCR), offering high sensitivity and specificity in detecting malaria parasites. These tests can identify low levels of parasitemia missed by traditional methods, aiding in early detection and disease management. Integration of automated systems and high-throughput technologies has enhanced efficiency and accuracy, supporting widespread adoption.

The conventional PCR molecular diagnostic tests segment is expected to grow significantly from 2024 to 2030. The growing need for reliable and affordable diagnostic solutions in both urban and rural healthcare settings is driving the demand for conventional PCR tests. These tests remain valuable in resource-limited settings and are supported by initiatives such as the National Vector Borne Disease Control Program in India. Ongoing research aims to enhance the accuracy and accessibility of traditional PCR methods.

Key India Malaria Diagnostics Company Insights

Some of the key companies in the India malaria diagnostics market include Abbott., Bio-Rad Laboratories, Inc., Nikon India Pvt Ltd., and many other companies. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Abbott Laboratories is a healthcare company, with a prominent presence in India, especially in the area of diagnostics. Abbott provides various advanced products such as rapid diagnostic tests (RDTs) and molecular diagnostic solutions in the Indian market for malaria diagnostics, improving disease management and patient outcomes by enabling quick and precise detection of malaria.

-

BIOMÉRIEUX offers in vitro diagnostics solutions, focusing on infectious diseases, such as malaria. The company in India provides various diagnostic products using advanced technologies like molecular biology and immunoassays to improve the precision and speed of detecting malaria.

Key India Malaria Diagnostics Companies:

- Abbott.

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Beckman Coulter, Inc.

- Olympus Corporation

- ACCESS BIO.

- Premier Medical.

- MicroGene Diagnostic Systems (P) Ltd

- Nikon India Pvt Ltd

- BIOMÉRIEUX

Recent Developments

-

In May 2024, the Serum Institute of India (SII) initiated the distribution of its R21/Matrix-M malaria vaccine to Africa, starting with the Central African Republic (CAR) in May 2024. Developed in collaboration with Novavax and the University of Oxford, this vaccine is the second to be approved for use in children residing in malaria-endemic regions. The initial shipment comprises 43,200 doses, representing a portion of the 163,800 doses allocated to the CAR region. To date, the SII has manufactured a total of 25 million vaccine doses, with the capacity to expand production to 100 million doses annually.

-

In October 2023, St. John's Research Institute (SJRI) in Bengaluru was selected as one of four international collaborators for the Point of Care Technology Research Network (POCTRN), a joint initiative between Cornell University and the National Institutes of Health (NIH). The POCTRN aims to accelerate the development, deployment, and commercialization of innovative point-of-care (POC) diagnostic devices.

India Malaria Diagnostics Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 55.7 million

|

|

Revenue forecast in 2030

|

USD 73.5 million

|

|

Growth rate

|

CAGR of 4.73% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Technology, molecular diagnostic tests

|

|

Key companies profiled

|

Abbott.; Siemens Healthineers AG; Bio-Rad Laboratories, Inc.; Beckman Coulter, Inc.; Olympus Corporation; ACCESS BIO.; Premier Medical.; MicroGene Diagnostic Systems (P) Ltd; Nikon India Pvt Ltd; BIOMÉRIEUX

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

India Malaria Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India malaria diagnostics market report based on technology, and molecular diagnostics tests:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Diagnostic Tests Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional PCR

-

Modernized PCR