- Home

- »

- Pharmaceuticals

- »

-

India Nicotine Replacement Therapy Market Report, 2030GVR Report cover

![India Nicotine Replacement Therapy Market Size, Share & Trends Report]()

India Nicotine Replacement Therapy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Gums, Lozenges), By Strength (2 mg, 4 mg), By Distribution Channel (Online, Offline, Hospital Pharmacies, Retail Pharmacies), And Segment Forecasts

- Report ID: GVR-4-68040-163-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

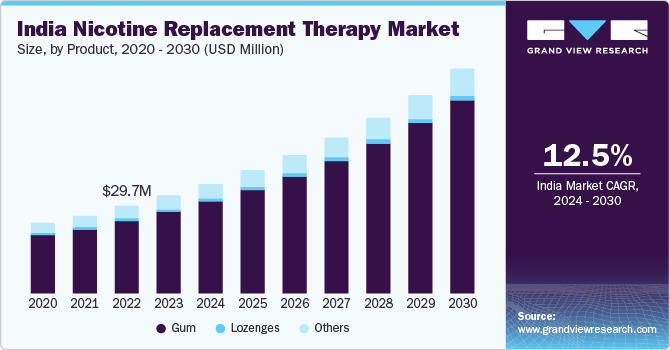

The India nicotine replacement therapy market size was valued at USD 33.09 million in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 12.56% from 2024 to 2030. Increasing emphasis on smoking cessation programs and awareness about the ill effects of tobacco consumption are expected to fuel the market during the forecast period. The substantial number of tobacco users in India approximately 267 million individuals-makes it the second-largest tobacco-consuming nation globally, following China. This large user base highlights the magnitude of the challenges posed by tobacco addiction and presents a significant growth opportunity for the country's Nicotine Replacement Therapy (NRT) market.

Gender disparity is also a crucial consideration, with tobacco use being significantly higher among men, constituting 42.4% of male tobacco users, compared to 14.2% among women. Addressing this gender gap through targeted marketing and educational initiatives can further expand the NRT market's reach. Prevalence of tobacco use varies significantly by state, ranging from as low as 9.7% in the southern state of Goa to as high as 64.5% in the northeastern state of Tripura. Understanding these regional variations and adapting NRT marketing and distribution strategies can help maximize market potential & impact.

In 2023, the Indian government considered making a prescription mandatory for buying all formulations containing 2 and 4 mg of nicotine, including nicotine gums, lozenges, and patches, to prevent their misuse. This issue was deliberated by the Drugs Technical Advisory Board (DTAB), which is India's primary technical advisory body for pharmaceuticals, during a meeting held in August 2023.

The rising health consciousness across India signifies a significant behavioral shift toward smoking that carries notable implications for the NRT market. This shift can be attributed to several interconnected factors that have reshaped individual attitudes toward smoking and using NRT products. Healthcare collaboration has become instrumental in guiding individuals toward NRT as a viable smoking cessation aid. Healthcare professionals, including pulmonologists, general practitioners, and smoking cessation specialists, are incorporating NRT into their treatment plans, leveraging its proven effectiveness to support individuals on their journey toward a healthy life.

Key technological trends and innovations include integrating technology through mobile apps and smart devices and the growth of online retail & e-commerce platforms. India is expected to leverage global Next Generation Product (NGP) innovations, including novel products containing nicotine salts and tobacco-free oral nicotine pouches, to provide effective & and appealing alternatives for adult smokers seeking to quit tobacco consumption.

The future of India's NRT market holds promising trends that revolve around accessibility, technology integration, and public health awareness. Integrating technologies through mobile apps and smart devices can personalize smoking cessation programs, aligning with India's smartphone-driven landscape. Public health campaigns can continue to educate and motivate individuals to opt for NRT as a safer alternative to quit smoking. These combined trends indicate a bright future for the NRT market in India, poised to contribute significantly to reducing tobacco-related harm. The inclusion of NRT in the National List of Essential Medicines (NLEM) in September 2022 marks a significant milestone. This move is poised to enhance accessibility and affordability.

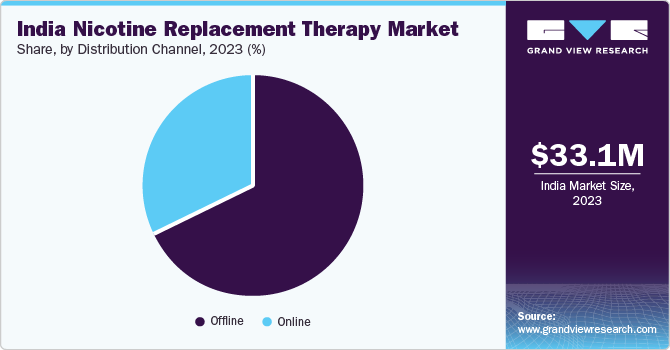

Distribution Channel Insights

The offline segment accounted for the largest revenue share of 68.28% in 2023. The offline distribution channel for NRT remains a critical avenue for reaching a diverse range of consumers seeking to quit smoking. Offline distribution channels allow an individual to interact directly with trained professionals. Retail pharmacies are the most preferred offline channel as these pharmacies provide a one-stop solution for smokers seeking effective cessation options. The comprehensive selection of a wide range of NRT products at retail pharmacies allows consumers to choose the most suitable NRT method.

The online distribution channel segment is expected to grow at a significant rate during the study period. The growth can be attributed to consumer preferences, user-friendly platforms, faster shipping, and optimum prices. The online NRT market has significantly improved accessibility for individuals seeking to quit smoking. Online platforms often offer comprehensive information about various NRT options, allowing consumers to make informed decisions based on their preferences and needs. This wealth of information empowers consumers to choose the most suitable NRT product for their quit-smoking journey. These capabilities are expected to drive the segment growth.

Product Insights

Based on product, nicotine gums accounted for the largest revenue share of 83.40% in 2023 and are expected to grow at the fastest CAGR over the forecast period. Increasing emphasis on NRTs, growing involvement of the government, and developments in the industry are key drivers of response for the dominance. Active involvement of the government in preventing the misuse of NRTs is also a major factor propelling the segment’s growth.

In 2023, to prevent the misuse of NRTs, such as nicotine gums, lozenges, and patches, the government is contemplating mandating the requirement of a prescription for the sale of all formulations containing 2 & 4 mg of nicotine. This issue was discussed by the Drugs Technical Advisory Board (DTAB), India's leading technical advisory body on pharmaceuticals, during a meeting conducted in August 2023.

Strategic activities by emerging players are expected to offer lucrative opportunities in the review period. For instance, in May 2020, Nicotex, a smoking cessation brand under Cipla Health, joined forces with the governments of Karnataka and Goa to offer NRT to frontline workers. Such partnerships with various state health ministries enable the company to conduct these initiatives on a much larger scale and extend the company's assistance to a broader population in their efforts to quit smoking.

Strength Insights

The 4 mg segment held the largest market share of over 62.0% in 2023. One of the primary drivers is the relatively higher price of 4 mg strength nicotine replacement products compared to their 2 mg counterparts. This higher pricing is often seen as indicative of increased potency for heavy smokers, which appeals to consumers seeking more robust solutions to address their nicotine cravings and addiction. Perceived effectiveness of higher nicotine concentrations and the willingness of certain consumers, such as heavy smokers, to navigate the prescription requirement in pursuit of more potent solutions to overcome nicotine addiction is another factor driving the segment growth.

2 mg nicotine replacement products are expected to witness the fastest growth over the forecast period, which can primarily be attributed to the fact that 2 mg strength products are easily available Over the Counter (OTC). Unlike the 4 mg strength nicotine replacement products, which require a prescription for purchase, the 2 mg variant can be obtained directly by consumers without doctor's prescription. This accessibility made it a preferred choice for individuals seeking nicotine replacement therapy, improving its market penetration.

State Insights

Maharashtra dominated the market in 2023 with a share of 7.68% and is estimated to grow at the fastest CAGR over the forecast period. Increasing awareness but low knowledge of quitline numbers, smokeless tobacco users expressing intent to quit, the need for state-specific cessation infrastructure, and increasing willingness to quit are factors responsible for the largest market share. According to the May 2022 Tobacco Control Programme (TCP) survey, awareness of cigarette health warnings has increased in Maharashtra over the last decade, but there is still low awareness of quitline numbers printed on cigarette packets. This represents an opportunity for government and health authorities to enhance their communication strategies and make quitline numbers more prominent, thereby aiding smokers in seeking assistance for cessation.

Karnataka is also expected to grow at a significant CAGR as the NRT market is undergoing substantial changes and facing considerable challenges, influenced by both government actions and global health considerations. One of the notable changes is the Karnataka government's decision to increase the minimum age for purchasing tobacco products to 21 years in September 2023. This move is in line with efforts to reduce tobacco consumption among the youth, aiming to create a healthier generation.

Key Companies And Market Share Insight

The key companies operating in India nicotine replacement therapy market are focusing on awareness campaigns, collaborations, campaigns as mentioned below,

-

In April 2023, Rusan Pharma Ltd. initiated a campaign to promote tobacco deaddiction under its brand 2baconil, India's first domestically developed, manufactured, and marketed 24-hour nicotine transdermal patch. The campaign runs across various social media platforms, including Instagram and YouTube.

-

Furthermore, Digital Video Campaigns (DVCs) were consistently shared. Prominent influencers from diverse backgrounds collaborated with this campaign, extending its message to a broader audience and encouraging them to quit smoking. The central theme highlights the advantages of the 2baconil nicotine patch as an effective therapy for reducing physical & psychological addiction to nicotine.

-

In October 2022, Piramal Pharma Ltd. acquired Nixit from Strides Pharma Science Ltd. Nixit, a smoking cessation brand, employs NRT to assist individuals in quitting smoking. Prior to the acquisition, Nixit was accessible for purchase through e-commerce platforms and local chemist stores across India. It was initially introduced in the market in FY 2018.

Key India Nicotine Replacement Therapy Companies:

- Glenmark Pharmaceuticals Ltd.

- Fertin Pharma

- Rubicon Consumer Healthcare Pvt. Ltd.

- Rusan Pharma Ltd.

- Cipla, Inc.

- Piramal Pharma Limited

- Johnson & Johnson Services, Inc.

- ITC Limited

- INVENTZ Lifesciences

- Sparsha Pharma International Pvt. Ltd.

India Nicotine Replacement Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.02 million

Revenue forecast in 2030

USD 75.74 million

Growth rate

CAGR of 12.56% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, strength, distribution channel

States covered

Andhra Pradesh, Bihar, Chhattisgarh, Goa, Gujarat, Haryana, Himachal Pradesh, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Rajasthan, Sikkim, Tamil Nadu, Telangana, Uttar Pradesh, Uttarakhand, West Bengal, Andaman and Nicobar Islands, Chandigarh, Dadra & Nagar Haveli and Daman & Diu, Delhi, Jammu and Kashmir, Lakshadweep, Puducherry, Ladakh, and North East India

Key companies profiled

Glenmark Pharmaceuticals Ltd.; Fertin Pharma; Rubicon Consumer Healthcare Pvt. Ltd.; Rusan Pharma Ltd.; Cipla; Inc.; Piramal Pharma Limited; Johnson & Johnson Services; Inc.; ITC Limited; INVENTZ Lifesciences; Sparsha Pharma International Pvt. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Nicotine Replacement Therapy Market Report Segmentation

This report forecasts revenue growth at country level, and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the India nicotine replacement therapy market report based on product, strength, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gum

-

Lozenges

-

Others

-

-

Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

2 mg

-

4 mg

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Frequently Asked Questions About This Report

b. The global India nicotine replacement therapy market size was estimated at USD 33.09 million in 2023 and is expected to reach USD 37.02 million in 2024.

b. The global India nicotine replacement therapy market is expected to grow at a compound annual growth rate of 12.56% from 2024 to 2030 to reach USD 75.74 million by 2030.

b. Nicotine gums accounted for the largest revenue share of 83.40% of India nicotine replacement therapy market in 2023 and is expected to grow at the fastest CAGR over the forecast period. Increasing emphasis on NRTs and, growing involvement of the government & developments in the industry are key drivers response for the dominance.

b. Some key players operating in the India nicotine replacement therapy market include Glenmark Pharmaceuticals Ltd., Fertin Pharma, Rubicon Consumer Healthcare Pvt. Ltd., Rusan Pharma Ltd., Cipla, Inc., Piramal Pharma Limited, Johnson & Johnson Services, Inc., ITC Limited, INVENTZ Lifesciences, Sparsha Pharma International Pvt. Ltd.

b. Key factors that are driving the market growth include increasing emphasis on smoking cessation programs, coupled with growing awareness about the ill effects of tobacco consumption

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.