India Precipitated Silica Market Size & Trends

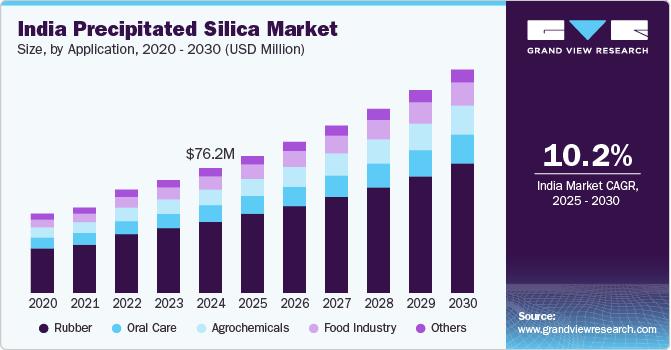

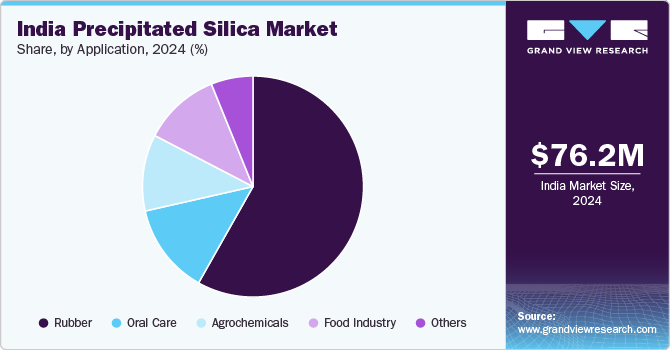

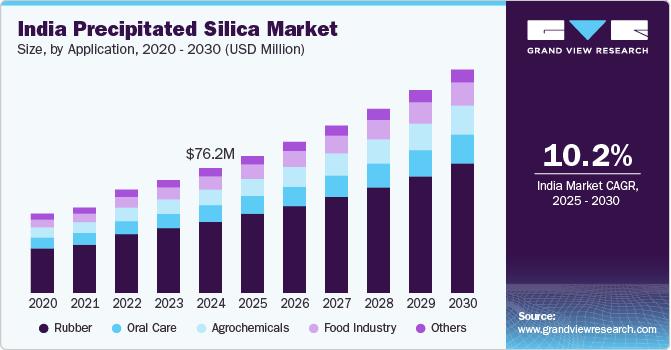

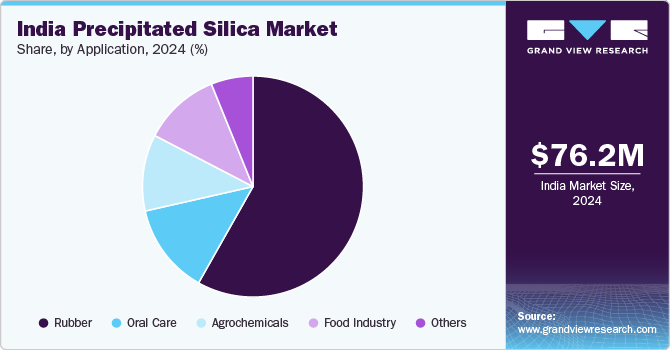

The India precipitated silica market size was valued at USD 76.2 million in 2024 and is expected to grow at a CAGR of 10.2% from 2025 to 2030. This growth can be attributed to the increasing demand from the automotive sector, where it is used as a strengthening filler in tires to improve performance. In addition, the rubber, agrochemicals, and oral care industries are also contributing to market expansion. Furthermore, government initiatives aimed at boosting domestic manufacturing and the growth of electric vehicles further support this growth.

Precipitated silica is an amorphous form of silicon dioxide (SiO2) that appears as a fine, white powder. It is produced through a chemical process known as precipitation, where a solution containing silicate salts is acidified to form silica particles. In India, the demand for precipitated silica is rising due to several factors. The ongoing industrialization and urbanization in India are significantly boosting the construction sector. As more people move to urban areas and disposable incomes increase, there is a greater need for housing and infrastructure development. This surge in construction activities enhances the demand for silica sand, essential in producing high-quality concrete and mortar.

In addition, the glass manufacturing industry also plays a crucial role in driving the demand for precipitated silica. Flat glass products, commonly used in buildings and automobiles, require high-purity silica to ensure clarity and strength. Furthermore, increasing specialty glass production, which necessitates specific silica characteristics, further contributes to this market. The automotive sector's shift towards more sustainable practices is expanding the use of precipitated silica in tire manufacturing. This trend aligns with growing consumer preferences for eco-friendly products. Moreover, the cosmetics and personal care industry also utilizes precipitated silica for its properties as an anti-caking agent and bulking agent in various formulations.

Application Insights

The rubber segment dominated the market and accounted for the largest revenue share of 57.3% in 2024. This growth can be attributed to the increasing demand for high-performance tires in the automotive industry. In addition, as vehicle ownership rises and consumers seek enhanced safety and efficiency, manufacturers turn to precipitated silica as a key reinforcing filler. Furthermore, this material improves tire durability, traction, and overall performance, making it essential for modern tire production. Moreover, the trend towards eco-friendly and sustainable products further drives the adoption of precipitated silica, contributing to the development of greener tire formulations.

The agrochemicals sector is expected to grow at a CAGR of 10.6% from 2025 to 2030, owing to an increased focus on sustainable agricultural practices. In addition, farmers and manufacturers seek effective solutions for pest management and soil enhancement, where silica-based products play a crucial role. Furthermore, precipitated silica is used in formulations for pesticides and fertilizers, improving their effectiveness and stability. Moreover, the shift towards eco-friendly agricultural inputs aligns with regulatory trends and consumer preferences, driving the adoption of silica in agrochemical applications.

Key India Precipitated Silica Company Insights

Key companies in the Indian precipitated silica industry include PQ Corporation, PPF Industries, Anten Chemical Co. Ltd, and others. These companies are adopting various strategies to enhance their competitive edge. Mergers and acquisitions are being pursued to expand market presence and access new technologies. In addition, companies are focusing on launching innovative products tailored to meet specific industry needs, thereby diversifying their offerings. Furthermore, strategic partnerships with other firms and research institutions are also being established to leverage shared expertise and resources, facilitating product development and market penetration advancements.

-

PQ Corporation operates within the specialty chemicals segment, providing high-quality silica products across various industries, including rubber, coatings, and personal care. The company’s precipitated silica serves multiple functions, such as reinforcing fillers, anti-caking agents, and moisture-absorbing materials.

-

PPF Industries operates in the specialty chemicals segment, offering various precipitated silica solutions for industries such as rubber, agriculture, and food processing. The company manufactures precipitated silica with tailored properties to enhance performance in various applications, including as a reinforcing agent in tires and an anti-caking agent in food products.

Key India Precipitated Silica Companies:

- Evonik Industries

- W. R. Grace & Co

- PQ Corporation

- PPF Industries

- Anten Chemical Co. Ltd

- Huber Engineered Materials

- PPG Industries, Inc.

- IQE Group

- Solvay S A.

- Oriental Silicas Corporation

- Tosoh Silica Corporation

- INEOS.

Recent Developments

-

In August 2024, PPG Industries announced an agreement to sell its silica products business, which includes precipitated silica, to QEMETICA. This strategic move enhances PPG's focus on its core operations while allowing QEMETICA to expand its portfolio in the silica market. The sale is expected to benefit both companies, as QEMETICA specializes in high-performance materials and will leverage the precipitated silica products for various applications.

India Precipitated Silica Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 83.9 million

|

|

Revenue forecast in 2030

|

USD 136.5 million

|

|

Growth rate

|

CAGR of 10.2% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in Kilotons; Revenue in USD Million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application

|

|

Country scope

|

India

|

|

Key companies profiled

|

Evonik Industries; W. R. Grace & Co; PQ Corporation; PPF Industries; Anten Chemical Co. Ltd; Huber Engineered Materials; PPG Industries, Inc.; IQE Group; Solvay S A.; Oriental Silicas Corporation; Tosoh Silica Corporation; INEOS.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

India Precipitated Silica Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the India precipitated silica market report based on application.