- Home

- »

- Medical Devices

- »

-

India Senior Housing Market Size, Industry Report, 2030GVR Report cover

![India Senior Housing Market Size, Share & Trends Report]()

India Senior Housing Market Size, Share & Trends Analysis Report By Housing Units (1Bhk, 2Bhk, 3Bhk, Independent Villas), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-264-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

India Senior Housing Market Size & Trends

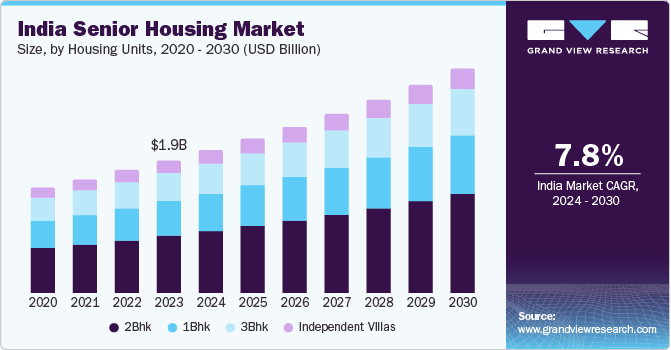

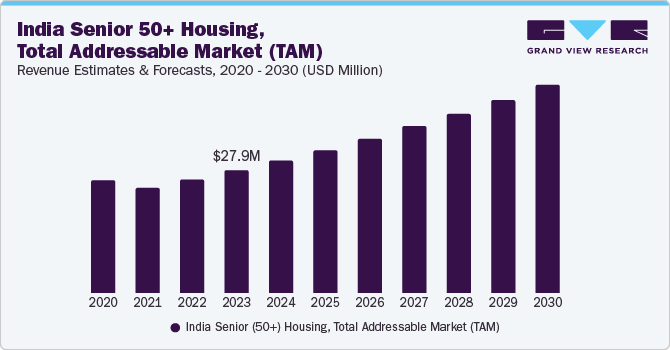

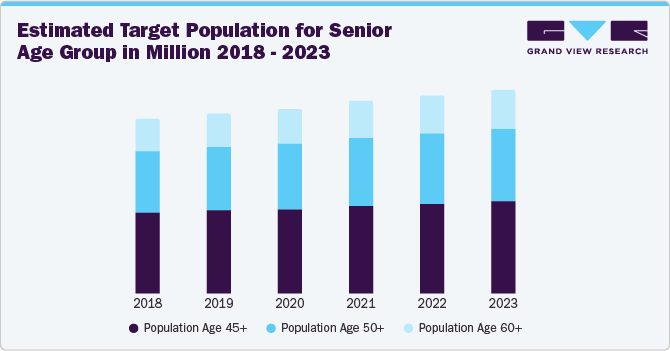

The India senior housing market size was estimated at USD 1.91 billion in 2023 and is expected to grow at a CAGR of 7.78% from 2024 to 2030. India is witnessing a notable demographic shift, with a rising number of seniors seeking specialized care and accommodation options, presenting a lucrative opportunity for senior housing. This trend is not only driven by seniors but also by changing lifestyle preferences of upper-middle-class Indians in their 60s and even those in their late 40s planning for retirement. Factors fueling this shift are increasing nuclear families, greater mobility due to career opportunities, the growing need for senior care services, and the reducing social stigma associated with senior living.

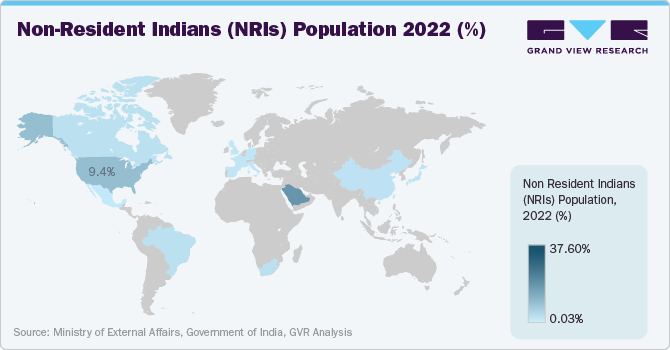

Changing societal attitudes toward aging and retirement have contributed to the rising demand for senior living options. Many seniors seek vibrant & active lifestyles with access to amenities, recreational activities, and social opportunities. As a result, investors are keen to capitalize on this demand by developing senior living communities offering various services and facilities designed to enhance residents' overall quality of life. Moreover, the return of Non-Resident Indians (NRIs) to India after retirement is also contributing to the growth of the senior housing market. These individuals seek high-quality care and lifestyle options in their postretirement years, driving the demand for senior living communities.

According to a report published by the Confederation of Indian Industry in 2018, a majority of developers, accounting for 68%, prefer to develop senior living projects on land sizes less than 5 acres. Around 22% of developers prefer land sizes ranging from 5 to 20 acres, while only 10% opt for land sizes exceeding 20 acres. These preferences indicate that most developers are testing the market and focusing on smaller-scale projects, potentially expanding to larger-scale ventures in the future.

Some Statistics Related To India Senior Housing

According to a report published by Ministry of Health and Family Welfare on Technical Group of Population Projections, the proportion of elderly population is anticipated to rise from 10.1% in 2021 to 15% in 2036. Moreover, the report shows that the southern region and a few northern states, such as Punjab and Himachal Pradesh, had a higher share of the elderly population than the national average in 2021. The state of Kerala is expected to show a rise in the elderly population from 16.5% in 2021 to 22.8% in 2036. This rise in the elderly population leads to the increased demand for senior housing and care services across the states to cater to seniors.

Region Wise Key Cities Preferred As A Retirement Destination

Region

Key Cities Preferred as a Retirement Destination

Northern Region

NCR, Chandigarh, Dehradun, Lucknow, Jaipur, and Amritsar

North-Eastern Region

Guwahati and Shillong

Eastern Region

Ranchi, Jamshedpur, Kolkata, and Patna

Western Region

Mumbai, Pune, Nasik, Ahmedabad, Vadodara, Panaji, and Surat

Southern Region

Bengaluru, Chennai, Hyderabad, Coimbatore, Mysore, and Puducherry

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of M&A activities, impact of regulations, and geographic expansion. The degree of innovation is high, the impact of regulations on the market is medium, and the geographic expansion of the market is high.

The increasing adoption of technology contributes to the growth of India’s senior housing market. Digital healthcare technologies are helping reduce costs, improve care quality, and create a more sustainable business model for senior care. Remote healthcare and telemedicine services enable seniors to receive medical consultations & treatments from the comfort of their homes. Technology solutions such as smart home technologies, healthcare monitoring systems, and wearable devices are improving safety & security for seniors.

Favorable and stable government policies are expected to impact market accessibility, growth, and compliance positively. For instance, in September 2023, the Ministry of Social Justice and Empowerment released a list of organizations from various states, including Jharkhand, Bihar, and Kerala. Madhya Pradesh, Manipur, West Bengal, Maharashtra, Uttar Pradesh, Rajasthan, and Nagaland, which are eligible to run projects in gap districts under the Integrated Programme for Senior Citizens (IPSrC). This scheme aims to aid the maintenance and smooth running of senior citizens’ homes/care homes.

The growth in emerging markets is being driven by established industry leaders who are expanding their reach. These companies are investing in new facilities and locations to expand their operations. For instance, in May 2023, Columbia Pacific Communities (CPC) announced its plan to invest approximately USD 24.12 million (INR 200 Cr) in India to develop a senior living project spanning 2 million square feet (msf) over the next 2 years. By the end of the fiscal year 2024 to 2025, the company aims to have eight communities with approximately 2,000 homes under construction and available for sale in nine cities nationwide.

Housing Units Insights

The 2Bhk segment accounted for the largest revenue share of over 43% in 2023. The increasing popularity of 2BHK apartments among senior citizens in India's housing market is expected to have a substantial impact on the growth of the senior housing sector. A survey by PHD Research Bureau indicated that approximately 65% of residents have chosen to purchase apartments, flats, or independent houses in senior housing projects. Furthermore, the survey revealed that a highest percentage than other housing units, specifically opted for 2BHK apartments. This preference for 2BHK units is anticipated to drive the growth of this segment during the forecast period.

The 1Bhk segment is expected to witness a significant growth over the forecast period from 2024 to 2030. According to the PHD Research Bureau's survey on the senior housing sector in India, a significant 25% of residents are living alone. The 1BHK segment, with its compact and manageable size, perfectly aligns with living alone seniors. Furthermore, 1BHK apartments are affordable compared to larger units such as 2BHK or higher. The cost of living is an important factor for many seniors, especially those on fixed incomes or retirement funds. 1BHK apartments offer a more affordable option, allowing seniors to maintain their financial independence while enjoying a comfortable living space.

Country Insights

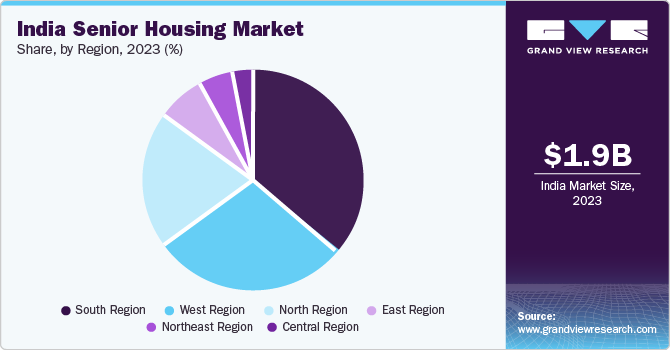

The South regionaccounted for the largest revenue share of over 35% in 2023, According to the PHD Research Bureau, Survey of senior housing sector in India survey findings, around 78% of senior housing projects in India are concentrated in the Western and Southern cities of Chennai, Bengaluru, Puducherry, Coimbatore, Hyderabad, and Mysore. These cities have emerged as preferred post-retirement destinations due to factors such as better connectivity, familiarity with the area, favorable climate, and improved employment opportunities for retirees' children. The Southern Region's dominance is expected to continue driving the expansion of the senior housing market in India.

The North regionis expected to witness a fastest growth over the forecast period from 2024 to 2030. The north region offers lower square feet rates compared to other regions, making it an attractive prospect for both developers and seniors. As a result, the north region is expected to play an important role in driving the growth of India's senior housing market.

In the Northeast region, the senior housing market is still untapped and the developers are coming up with more and more projects in these regions with lower square feet rates as compared to other regions to tap the market.

Key India Senior Housing Company Insights

Increasing industry consolidation activities such as expansion, acquisitions and mergers, and partnership by the major market players as well as growing investment in a different location by key players are also anticipated to increase their share in the market.

Key India Senior Housing Companies:

- Columbia Pacific Communities

- Vedaanta

- Ashiana Housing Ltd.

- Paranjape Schemes (Construction) Ltd.

- PRIMUS

- AntaraSeniorCare

- Advait Homes LLP

- Saket Group

- Prarambh Life

- Brigade Enterprises Ltd

Recent Developments

-

In February 2024, Asset Homes and Columbia Pacific Communities partnered to launch four senior living projects in Kochi, Kottayam, Thiruvananthapuram, and Kozhikode. These luxury projects, named Asset Young Heart by Columbia Pacific, are aimed at serving Kerala's growing senior citizen population. The initial phase will include around 1,000 units, with plans for a Q1 launch in the 2024-25 fiscal year.

-

In May 2023, Columbia Pacific Communities partnered with Embassy Group to launch Serene Amara at Embassy Springs. This joint development project will be managed by Columbia Pacific Communities and built by Embassy Group.

-

In January 2023, Atulya Senior Living raised USD 9.3 million from North Haven India Infrastructure Partners with the aim of expanding its services. It operates in Chennai & Bengaluru and has provided care to over 20,000 senior citizens. The company plans to utilize the funding to expand its services across South India.

India Senior Housing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.06 billion

Revenue forecast in 2030

USD 3.23 billion

Growth rate

CAGR of 7.78% from 2024 to 2030

Historical data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Housing units, country

Country scope

India

Regional scope

South Region; West Region; North Region; East Region; Northeast Region; Central Region

Key companies profiled

Columbia Pacific Communities; Vedaanta; Ashiana Housing Ltd.; Paranjape Schemes (Construction) Ltd.; PRIMUS; Antara Senior Care; Advait Homes LLP; Saket Group; Prarambh Life; Brigade Enterprises Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Senior Housing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the India senior housing market report based on of housing units, and country.

-

Housing Units Outlook (Revenue, USD Million, 2018 - 2030)

-

1Bhk

-

2Bhk

-

3Bhk

-

Independent Villas

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

South Region

-

West Region

-

North Region

-

East Region

-

Northeast Region

-

Central Region

-

Frequently Asked Questions About This Report

b. The India senior housing market size was estimated at USD 1.91 billion in 2023 and is expected to reach USD 2.06 billion in 2024.

b. The India senior housing market is expected to grow at a compound annual growth rate of 7.78% from 2024 to 2030 to reach USD 3.23 billion by 2030.

b. 2Bhk dominated the market with a share of over 43% in 2023. The increasing popularity of 2BHK apartments among senior citizens in India's housing market is expected to have a substantial impact on the growth of the senior housing sector

b. Some key players operating in the India senior housing market include Columbia Pacific Communities, Vedaanta, Ashiana Housing Ltd., Paranjape Schemes (Construction) Ltd., PRIMUS, AntaraSeniorCare, Advait Homes LLP, Saket Group, Prarambh Life, and Brigade Enterprises Ltd

b. Key factors that are driving the India senior housing market growth include increasing investments in the senior housing sector, shift from communicable to lifestyle diseases, increasing disposable income.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."