- Home

- »

- Next Generation Technologies

- »

-

India Smart TV Market Size, Share & Trends Report, 2030GVR Report cover

![India Smart TV Market Size, Share & Trends Report]()

India Smart TV Market (2023 - 2030) Size, Share & Trends Analysis Report By Operating System (Android TV, Tizen, WebOS, Roku), By Resolution, By Screen Size, By Screen Shape, And Segment Forecasts

- Report ID: GVR-4-68038-367-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

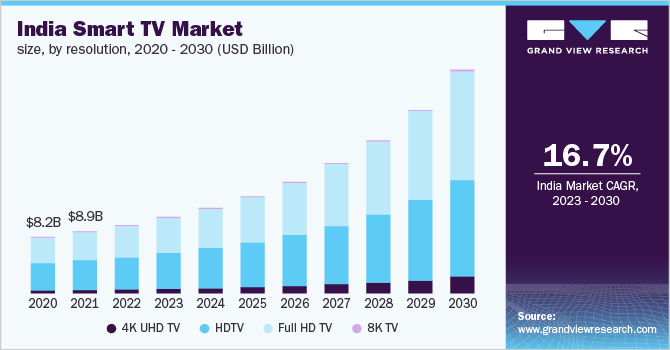

The India smart TV market size was valued at USD 9.88 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.7% from 2023 to 2030. This growth has primarily benefited from increasing disposable income and the rising move towards OTT services in the country. In addition, factors such as the proliferation of the internet, multiple new launches from TV brands with lucrative promotions & discounts, and online sales growth are projected to support the growth. Consumers across the country are actively looking for enhanced specifications in smart TVs to get enhanced viewing experiences, such as larger screen sizes and sound system improvements. This factor has encouraged smart TV manufacturers in the country to develop products with superior specifications.

Smart TVs are like smartphones as they have an operating system and offer streaming services via an internet connection. In addition, these TVs enable users to engage with services such as downloading apps, playing video games, and accessing social media sites, among other things. The Indian consumer is actively moving toward such products owing to increased admiration for OTT streaming services and the affordability of high-speed internet access across the country. Furthermore, the government's emphasis on Digital India and the ongoing Make in India initiative has become important growth driver.

On the other hand, telecom operators such as Airtel and Reliance Jio launched 5G services in 50 Indian cities as of December 2022. The introduction of 5G services has created greater opportunities for both the Smart TVs and OTT services industries in India. For instance, according to the FICCI-EY Report 2022, the number of smart TVs is anticipated to exceed 40 million by 2025.

Manufacturers are working towards the development of advanced smart TVs at competitive prices. For instance, in January 2023, OnePlus, one of India's leading smart TV brands, launched the OnePlus Q2 Pro, the new smart TV in the Indian market. This TV features a 65-inch QLED panel for a 4K resolution and a high refresh rate for enhanced animations. Based on features and quality, leading manufacturers make smart TVs ranging from entry-level to high-end. High-end smart TVs are manufactured using high-quality display panels and equipment, which raises the product price dramatically. Affordable smart TVs, on the other hand, stimulate market growth by making the product more accessible to a larger market.

The COVID-19 pandemic significantly influenced the India smart TV market due to delayed production, supply chain disruptions, and shutdown of manufacturing sites. However, people turned to indoor entertainment because of the lockdown and travel restrictions. For instance, there was a rapid growth in the popularity of OTT content consumption in India during the pandemic. This has contributed to the rising shift from small-screen entertainment options such as smartphones and tablets to large-screen smart TVs.

Operating System Insights

Android TV operating system (OS) accounted for a higher market revenue share of around 34.0% in 2022 while having a steady growth rate during the forecast period. The Android OS in TVs enables users to view popular streaming apps such as Netflix, Amazon Prime, and more. In addition, by utilizing Google Assistant, this operating system offers various types of voice input for instructions and universal searches across numerous service providers.

Such features of Android TV OS are contributing to the growth of this segment. Moreover, Google LLC, the developer of Android-supported OS, is constantly working towards enhancing the features and user experiences of smart TVs. For instance, in December 2022, the company launched Android 13 OS for Smart TVs to offer performance improvement and upgrades in the UI. The continuous updates from Google LLC are further contributing to the growth of the OS segment.

Roku is the fastest-growing operating system due to the rising popularity of Roku TVs in India and their easier interface, which enables access to a number of free and paid streaming channels. In addition, the Roku TV OS offers technologically advanced features, including fast search across top channels coupled with voice compatibility for Siri, Alexa, and Google Assistant.

Resolution Insights

The HDTV resolution segment accounted for the highest revenue share of around 53.0% in 2022 and is expected to witness significant growth during the forecast period. HDTV resolution enhances the customer's viewing experience compared with traditional TVs with standard resolution (SDTV) images.

In India, the companies operating in this segment are actively upgrading their HDTV products by adding Dolby Vision IQ, HDMI 2.1, and filmmaker mode. In addition, smart TVs with HDTV resolution are available at comparatively lower prices than higher resolutions such as 4K, 8K, and UHD. The cost-effectiveness of HDTV resolution-based TVs has further driven the growth of this segment.

The 8K segment is expected to witness a higher growth rate of more than 33.0% during the forecast period. This is the highest resolution of smart TVs available in India, which support more than 33 million pixels and offer ultra-high-definition picture quality. The continuous rise in demand for higher resolution drives the growth of this segment.

Screen Shape Insights

The flat screen shape dominated the market in 2022 and is projected to have a CAGR of around 17.0% during the forecast period. The growth is driven by consumers’ preferences for flat-screen TVs due to their lower costs compared with expensive substitutes. In addition, these TVs are easier to mount on walls. In addition, factors including low import duty on LCD panels and the introduction of small entry-size smart TV models with flat screens have further boosted the growth of this segment.

Curved TVs are seen as luxury and top-end models with big screen sizes, which offer an added depth experience to the viewer. Such TV screens also help to remove the deprivation of pictures that occur when watching the images or videos from the off-center axis. Thus, factors including demand for a more comfortable and immersive viewing experience have driven the growth of this segment.

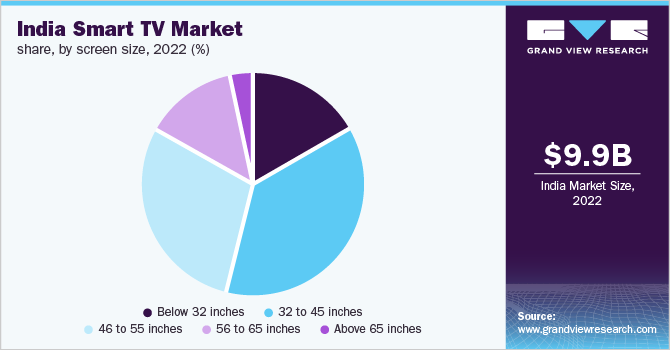

Screen Size Insights

The 32 to 45 inches segment dominated the market in 2022 with a revenue share of over 37.0%. The increased adoption of smart TVs drives the growth of this segment with medium screen sizes and the integration of 4K technology in such TVs. Moreover, the market players in India are introducing smart TVs with a screen size of 32 to 45 inches at competitive prices to attract the middle- and lower-income group population.

For instance, in March 2022, Blaupunkt, the German consumer electronic company, launched its 40-inch smart TV in the competitive price range compared to established brands, including Xiaomi, VU, and Compaq.

Moreover, the above 65 inches segment is anticipated to witness a significant CAGR of around 17.8% during the forecast period. The growth of this segment is credited to the increasing popularity of large-screen televisions coupled with the rising spending capacity and favorable financial payment methods such as EMIs. In addition, the lucrative offers from the banks, such as zero-cost payback options and discount options from the sellers on large-screen smart TVs, are projected to boost the market's growth.

Key Companies & Market Share Insights

Key players in the Indian smart TV market are focusing on introducing new technology along with bezel-less screens with competitive pricing and fully loaded features for consumers from different income groups.

-

In August 2022, Sony India introduced BRAVIA XR 86X95K 4K Mini LED TV, featuring innovative XR Backlight Master Drive technology. This smart TV can run videos in 4K 120fps with variable refresh rate, auto low latency mode, auto HDR tone, and auto game mode.

-

In September 2022, Samsung launched the Frame smart TVs in India. These TVs offer features including customizable bezels, art mode, and matte display to ensure immersive entertainment.

Some prominent players in the India smart TV market include:

-

Panasonic Corporation

-

Samsung India Electronics Pvt. Ltd.

-

L.G. Electronics India Pvt. Ltd.

-

Sony India Pvt. Ltd.

-

Xiaomi Inc.

-

Koninklijke Philips N.V

-

VU Technologies Pvt. Ltd.

-

Intex Technologies

-

Micromax Informatics Ltd.

-

TCL India

India Smart TV Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 11.7 billion

The revenue forecast in 2030

USD 32.57 billion

Growth rate

CAGR of 16.7% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion, Volume in Million Units, and CAGR from 2023 to 2030

Report Coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Operating system, resolution, screen size, screen shape

Country scope

India

Key companies profiled

Panasonic Corporation; Samsung India Electronics Pvt. Ltd.; LG Electronics India Pvt. Ltd.; Sony India Pvt. Ltd; Xiaomi Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Smart TV Market Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India smart TV market report based on operating system, resolution, screen size, and screen shape:

-

Operating System Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Android TV

-

Tizen

-

WebOS

-

Roku

-

Others

-

-

Resolution Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

4K UHD TV

-

HDTV

-

Full HD TV

-

8K TV

-

-

Screen Size Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Below 32 inches

-

32 to 45 inches

-

46 to 55 inches

-

56 to 65 inches

-

Above 65 inches

-

-

Screen Shape Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Flat

-

Curved

-

Frequently Asked Questions About This Report

b. The India smart TV market size was estimated at USD 9.88 billion in 2022 and is expected to reach USD 11.7 billion in 2023.

b. The India smart TV market is expected to grow at a compound annual growth rate of 16.7% from 2023 to 2030 to reach USD 32.57 billion by 2030.

b. The HDTV segment registered the highest volume share of over 53% in 2022 and is expected to retain its dominance over the forecast period in the Indian smart TV market.

b. Some of the key players operating in the Indian smart TV market include LG Electronics, Inc.; Panasonic Corporation; Samsung Electronics Co. Ltd.; Sony India Pvt. Ltd.; and Vu Technologies Pvt. Ltd..

b. Key factors that are driving the Indian smart TV market growth include an increase in the usage of streaming devices and the internet and the rising popularity of newer TV resolutions in 4K, UHD, and 8K across the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.