- Home

- »

- Display Technologies

- »

-

Smart TV Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Smart TV Market Size, Share & Trends Report]()

Smart TV Market (2025 - 2030) Size, Share & Trends Analysis Report By Resolution, By Screen Size, By Operating System, By Distribution Channel, By Technology, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-209-9

- Number of Report Pages: 132

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart TV Market Summary

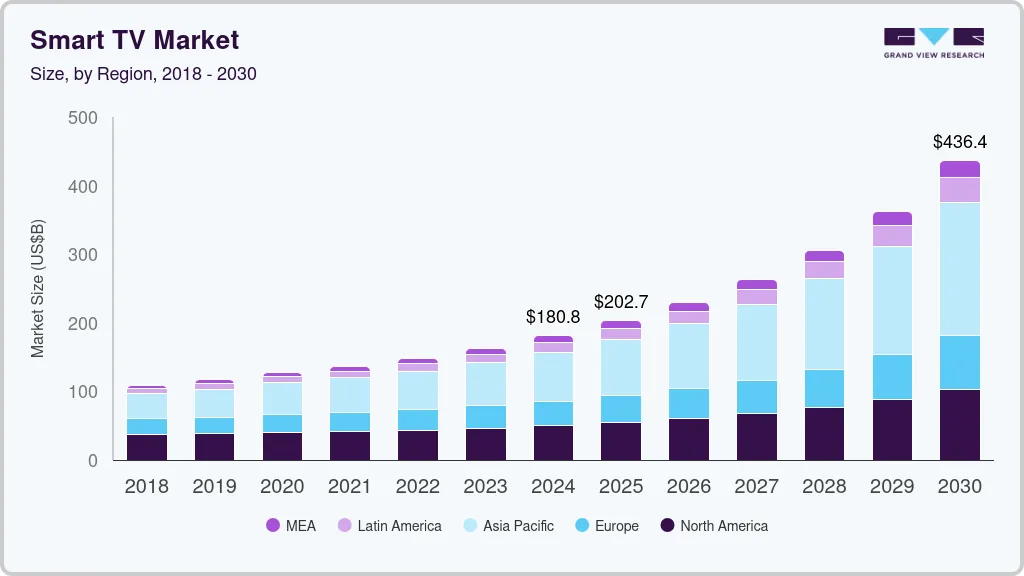

The global smart TV market size was estimated at USD 227.52 billion in 2024 and is projected to reach USD 451.26 billion by 2030, growing at a CAGR of 12.8% from 2025 to 2030. The market is witnessing growth due to integrated streaming services and internet connectivity. As consumers shift away from traditional cable and satellite services, Smart TVs allow easy access to on-demand streaming platforms, gaming, and social media, all within a single device.

Key Market Trends & Insights

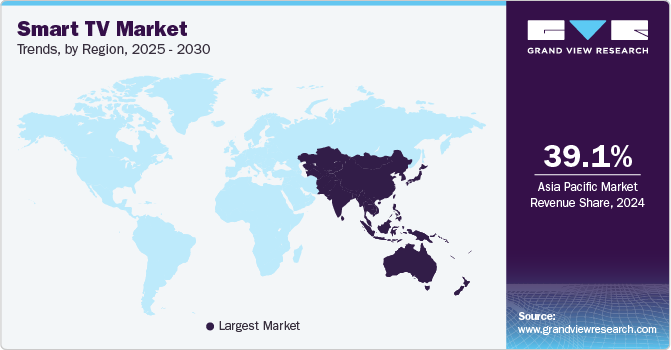

- The smart TV market in Asia Pacific region accounted for a significant market share of approximately 39.1% in 2024.

- The smart TV market in U.S. is witnessing significant growth.

- Based on screen size, the 46 to 55-inch smart TV segment commands a high market share due to the versatility and suitability of this screen size for a wide range of living spaces.

- In terms of distribution channel, online segment captured a significant revenue share in 2024 due to the convenience and variety available through e-commerce platforms.

Market Size & Forecast

- 2024 Market Size: USD 227.52 billion

- 2030 Projected Market Size: USD 451.26 billion

- CAGR (2025-2030): 12.8%

- Asia Pacific: Largest market in 2024

Besides is the advancement in high-definition display technology, like 4K and 8K resolutions, which enhances the viewing experience and fuels consumer interest. Growing internet penetration, especially in developing regions, further supports this demand, as it enables access to online content and connectivity. Additionally, the decreasing cost of manufacturing Smart TVs has made them more affordable, boosting their adoption globally. Governments worldwide are implementing various initiatives to stimulate the growth of the Smart TV industry as part of broader digital transformation strategies. Many countries are incentivizing the production and adoption of electronic goods, including Smart TVs, through subsidies, tax incentives, and reduced import duties to attract foreign investment and encourage domestic manufacturing.

In some regions, governments are enhancing internet infrastructure, which indirectly benefits Smart TV sales by providing a stable and fast connection necessary for streaming. For instance, initiatives to increase digital literacy and subsidize internet access help more people explore Smart TVs’ benefits, contributing to the overall market expansion.

The smart TV industry holds significant growth opportunities, particularly in emerging markets where internet access and technology adoption rates are rapidly increasing. As the demand for content streaming continues to rise, there’s an opportunity for brands to offer affordable, feature-rich Smart TVs tailored to the needs of price-sensitive customers. Furthermore, advancements in artificial intelligence (AI) and voice recognition create potential for Smart TVs to act as central hubs in connected homes, thus opening avenues for cross-industry partnerships with smart home device manufacturers. Gaming is also a notable growth area, as smart TVs evolve to support cloud gaming services, appealing to a broad, global audience of gamers.

Manufacturers are actively investing in research and development to expand their presence in the Smart TV industry, driven by the high demand for interactive home entertainment solutions. Many leading brands are collaborating with streaming platforms, providing consumers with exclusive access to popular streaming services directly through their TV interface. By offering models across various price points and emphasizing innovation in screen technology, manufacturers aim to appeal to both high-end and budget-conscious customers. Additionally, they are focusing on expanding their distribution networks and exploring new sales channels, such as e-commerce platforms, to increase product accessibility and reach wider audiences.

Technological innovation continues to propel the market forward, as new features improve user experience and integrate seamlessly with other devices in the digital ecosystem. High Dynamic Range (HDR), Quantum Dot, and OLED technologies have significantly improved display quality, providing sharper images and vivid colors that enhance viewing satisfaction. In addition, integration with AI has enabled voice-activated controls, content recommendations, and even personalized viewing experiences. Furthermore, advancements in Internet of Things (IoT) connectivity allow Smart TVs to function as smart home hubs, enabling users to control lighting, thermostats, and security systems directly through their TV. These innovations position smart TVs as versatile, essential devices in the modern connected home.

Resolution Insights

The 4K Ultra High Definition (UHD) segment holds a substantial share in the smart TV market, largely due to the increasing demand for high-resolution displays that deliver clearer and more immersive viewing experiences. The 4K resolution, which offers four pixels of Full HD, has gained popularity as more content becomes available in this format. Streaming platforms, gaming, and even social media videos are now frequently offered in 4K, making it an attractive choice for consumers looking for high-quality visuals. The price of 4K UHD TVs has also decreased over time, which has helped make them more accessible to a broader market segment.

Full HD TVs continue to experience steady growth in the smart TV industry as they offer a high-quality viewing experience at a more affordable price than 4K models. Full HD remains a popular choice for consumers in regions with limited internet bandwidth where 4K streaming may not be feasible. As a result, Full HD Smart TVs provide an optimal balance of quality and price, especially for budget-conscious consumers who want smart features without necessarily needing ultra-high resolutions. This segment appeals to a diverse range of customers and remains particularly strong in emerging markets.

Screen Size Insights

The 46 to 55-inch smart TV segment commands a high market share due to the versatility and suitability of this screen size for a wide range of living spaces. This size range is popular among consumers looking for a large screen that fits comfortably in both small and medium-sized rooms, making it ideal for households that want an immersive viewing experience without requiring extra space. Manufacturers have responded by offering an array of options within this segment, including various resolutions and features, which has further solidified their popularity in the market.

Smart TVs above 65 inches in size are experiencing significant growth as more consumers seek larger screens for enhanced viewing experiences like theaters. These TVs are particularly popular among high-end consumers and home entertainment enthusiasts who prioritize immersive experiences. With improvements in picture quality and the increasing affordability of larger screen sizes, this segment is rapidly expanding. Demand for these TVs is also growing due to the rising popularity of in-home streaming, gaming, and the integration of smart home features, making the above 65-inch segment an area of considerable growth potential.

Operating System Insights

Android TVs hold a large share of the smart TV market due to the platform's open ecosystem, compatibility with various applications, and user-friendly interface. Android TV’s access to the Google Play Store enables users to download a wide range of apps, games, and streaming services, adding to its appeal. The interface’s familiarity also makes it an attractive choice for users already accustomed to Android devices. Android TVs have gained traction across multiple price points, providing consumers with flexibility and convenience, contributing to their high market share.

The Roku segment is experiencing substantial growth as it offers a simplified, easy-to-navigate interface that appeals to a broad range of users. Roku's success stems from its compatibility with most major streaming services and its straightforward remote and platform design, which make it particularly attractive to non-tech-savvy consumers. As streaming becomes more popular, the Roku platform’s affordability and accessibility position it well within the Smart TV industry. Additionally, partnerships with various manufacturers have helped Roku expand its presence, further boosting its growth.

Distribution Channel Insights

Online segment captured a significant revenue share in 2024 due to the convenience and variety available through e-commerce platforms. Consumers are increasingly turning to online channels to compare brands, models, and prices before purchasing, which allows them to find the best deals. Online platforms also frequently offer discounts, customer reviews, and quick delivery options, enhancing the appeal of online shopping for Smart TVs. This trend has been further accelerated by the rise of online-exclusive brands and models, making online platforms a major sales channel in the Smart TV industry.

Offline channels for Smart TV sales, particularly those for high-end smart glass models, are seeing significant growth. Many consumers still prefer the tactile experience of visiting a physical store, where they can see the display quality firsthand and receive guidance from sales staff. Smart glass TVs, which use advanced display technology for enhanced clarity and sleek design, appeal to consumers seeking premium experiences and are often showcased in-store. As a result, offline channels remain relevant, especially for high-end purchases that benefit from in-person consultation and demonstration.

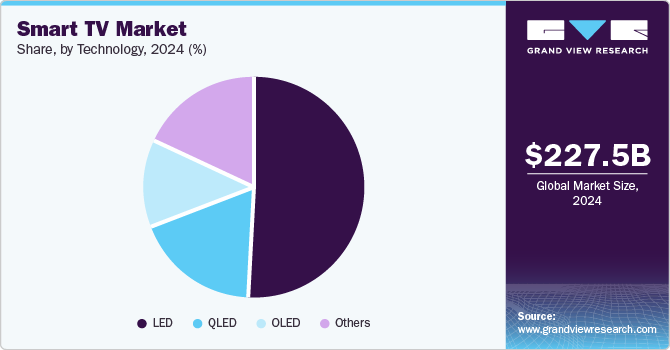

Technology Insights

LED technology dominates the Smart TV market due to its energy efficiency, brightness, and affordability. LED Smart TVs offer sharp picture quality and vibrant colors, making them suitable for most viewing environments. Their long lifespan and relatively lower production costs make LED TVs accessible to a wide range of consumers. The versatility of LED technology allows for various screen sizes, which has enabled manufacturers to cater to different consumer needs, contributing to its strong market presence.

OLED Smart TVs are experiencing considerable growth as consumers seek superior picture quality and contrast ratios. OLED technology, which offers deeper blacks and a wider color range than LED, is highly appealing for users prioritizing visual quality. Though more expensive than LED TVs, OLED’s popularity is rising as prices decrease and more content becomes available in high-definition formats. This segment is particularly favored among high-end consumers, as OLED TVs deliver a cinematic experience that enhances home entertainment. As OLED technology continues to improve, its market share is likely to expand further.

Regional Insights

North America smart TV market is driven by the increasing demand for advanced features and connectivity options in smart TVs, such as voice control, streaming services, and AI-based content recommendations. Consumers are increasingly opting for smart TVs with larger screen sizes and 4K/8K resolution.

U.S. Smart TV Market Trends

The smart TV market in U.S. is witnessing significant growth, driven by the growing consumer preference for on-demand content and streaming services over traditional cable. This has led to a surge in demand for smart and conventional TVs with integrated streaming platforms

Asia Pacific Smart TV Market Trends

The smart TV market in Asia Pacific region accounted for a significant market share in 2024. The promising growth prospects of the market can be attributed to the rapid economic development observed across countries such as China, India, and Southeast Asian nations. The growing disposable incomes in these countries are enabling more consumers to invest in home entertainment products. Urbanization and the expansion of middle-class populations are also contributing to this trend, as more households seek modern, connected devices for their homes.

The strong growth of the China Smart TV market can be attributed to a well-established and thriving electronics manufacturing industry featuring some of the world’s leading TV manufacturers, including Hisense International Co., Ltd., TCL, and Xiaomi. These companies offer innovative offerings at competitive pricing, making advanced TV technologies accessible to a broader audience.

India smart TV market experiences significant economic growth and rising disposable incomes, more households are investing in televisions. The proliferation of affordable smart TV options and the increasing availability of high-speed internet are driving product adoption, as consumers seek to access a wide range of digital content and streaming services.

Europe Smart TV Market Trends

Europe is expected to witness significant growth in the Smart TV industry. Europe's smart and conventional TV market is driven by the widespread availability of high-speed internet, which facilitates seamless streaming and smart home integration across the region. Increasing consumer shift toward on-demand content and digital platforms is boosting the demand for connected TVs.

Key Smart TV Company Insights

The key players use strategies such as partnerships, ventures, innovation, research and development, and geographical expansion to solidify their market position. The key players focus on improving their product offerings to better suit to the changing needs of users and stay competitive. Streaming platforms are collaborating with manufacturers to preinstall their application in smart TVs, so customers have quick access. Netflix and Amazon Prime, two leading streaming platforms, have preinstalled on Samsung and LG smart TVs.

Key players operating in the Smart TV Market and their company profiles are:

-

Haier Group Corporation is a multinational home appliances and consumer electronics company. It has grown into one of the largest white goods manufacturers worldwide, with a comprehensive portfolio that includes refrigerators, air conditioners, washing machines, and televisions. Haier Group Corporation has established manufacturing plants, design centers, and marketing networks across the world.

-

Hisense International Co., Ltd. is a multinational manufacturer of electronics and appliances. The company has grown to become one of the leading producers of consumer electronics, including televisions, refrigerators, air conditioners, and mobile phones. The company operates globally, with its products and services available in over 130 countries.

Key Smart TV Companies:

The following are the leading companies in the smart TV market. These companies collectively hold the largest market share and dictate industry trends.

- Haier Inc.

- Hisense International

- Intex Technologies

- Koninklijke Philips N.V

- LG Electronics Inc

- Panasonic Corporation

- Samsung Electronics Co. Ltd

- Sansui Electric Co. Ltd

- Sony Corporation

- TCL Electronics Holdings Limited

- Toshiba Visual Solutions (TVS Regza Corporation)

Recent Development

-

In August 2024, Haier Group Corporation announced the launch of its premium M95E series of QD-Mini LED 4K televisions in India. These latest models are equipped with advanced technology to provide exceptional experience in viewing, sound, and gaming.

-

In July 2024, Sony Group Corporation announced the launch of the new BRAVIA 7 series, bringing an enhanced visual and auditory experience through its innovative features and state-of-the-art technology. This new lineup integrates the innovative Mini LED, Cognitive Processor XR, and XR Triluminos Pro technology, presenting vivid imagery and captivating sound that mimics real-life experiences.

-

In July 2024, Koninklijke Philips N.V. launched its 2024 OLED models, including OLED809 and OLED909, which are available in Europe. OLED809 has a 144Hz screen and an enhanced video processing unit and supports Apple AirPlay 2 and HomeKit. OLED909 is equipped with a 4-sided Ambilight and has replaced the OLED908

Smart TV Market Report Scope

Report Attribute

Details

Market size in 2025

USD 246.96 billion

Revenue forecast in 2030

USD 451.26 billion

Growth rate

CAGR of 12.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in million units, revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue and demand forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resolution, screen size, operating system, distribution channel, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Austria; Belgium; Czech Republic; Denmark; Finland; France; Germany; Iceland; Ireland; Italy; Netherlands; Norway; Poland; Spain; Sweden; Switzerland; United Kingdom; Australia; China; Hong Kong; India; Indonesia; Japan; Malaysia; New Zealand; Philippines; Singapore; South Korea; Taiwan; Thailand; Mexico; Brazil; Argentina; Chile; Saudi Arabia; UAE; South Africa; Israel; Turkey; Nigeria

Key companies profiled

Haier Inc; Intex Technologies; Koninklijke Philips N.V.; LG Electronics; Panasonic Corporation; Samsung Electronics Co. Ltd; Sansui Electric Co. Ltd; Sony Corporation; TCL Electronics Holdings Limited; Toshiba Visual Solutions; Hisense International

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart TV Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and analyzes the latest market trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart TV market report based on resolution, screen size, operating system, distribution channel, technology, and region:

-

Operating System Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Android TV

-

Tizen

-

WebOS

-

Roku

-

Other

-

-

Resolution Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

4K UHD TV

-

HDTV

-

Full HD TV

-

8K TV

-

-

Screen Size Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Below 32 inches

-

32 to 45 inches

-

46 to 55 inches

-

56 to 65 inches

-

Above 65 inches

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Technology Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

OLED

-

QLED

-

LED

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Austria

-

Belgium

-

Czech Republic

-

Denmark

-

Finland

-

France

-

Germany

-

Iceland

-

Ireland

-

Italy

-

Netherlands

-

Norway

-

Poland

-

Spain

-

Sweden

-

Switzerland

-

United Kingdom

-

-

Asia Pacific

-

Australia

-

China

-

Hong Kong

-

India

-

Indonesia

-

Japan

-

Malaysia

-

New Zealand

-

Philippines

-

Singapore

-

South Korea

-

Taiwan

-

Thailand

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

South Africa

-

Israel

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global smart TV Market size was estimated at USD 227.52 billion in 2024 and is expected to reach USD 246.96 billion in 2025.

b. The global smart TV Market is expected to grow at a compound annual growth rate of 12.8% from 2025 to 2030 to reach USD 451.26 billion by 2030.

b. The 4K Ultra High Definition (UHD) segment holds a substantial share of the Smart TV market, largely due to the increasing demand for high-resolution displays that deliver clearer and more immersive viewing experiences. The 4K resolution, which offers four pixels of Full HD, has gained popularity as more content becomes available in this format. Streaming platforms, gaming, and even social media videos are now frequently offered in 4K, making it an attractive choice for consumers looking for high-quality visuals. The price of 4K UHD TVs has also decreased over time, which has helped make them more accessible to a broader market segment.

b. Some of the key players operating in the smart TV Market include Haier Inc; Intex Technologies; Koninklijke Philips N.V.; LG Electronics; Panasonic Corporation; Samsung Electronics Co. Ltd; Sansui Electric Co. Ltd; Sony Corporation; TCL Electronics Holdings Limited; Toshiba Visual Solutions; Hisense International

b. The Smart TV market is witnessing growth due to integrated streaming services and internet connectivity. As consumers shift away from traditional cable and satellite services, Smart TVs allow easy access to on-demand streaming platforms, gaming, and social media, all within a single device. Besides is the advancement in high-definition display technology, like 4K and 8K resolutions, which enhances the viewing experience and fuels consumer interest. Growing internet penetration, especially in developing regions, further supports this demand, as it enables access to online content and connectivity.

b. The flat segment accounted for the largest market share due to their versatile, sleek, and easier to mount or integrate with different room layouts features. Flat screens are often more cost-effective to produce and purchase than curved alternatives, making them appeal to a broad audience. The demand for flat models is also driven by the wide range of sizes and resolutions available, allowing consumers to find a flat-screen TV that matches their preferences and budget. The practical design of flat screens remains highly popular in both residential and commercial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.