- Home

- »

- Food Additives & Nutricosmetics

- »

-

India Spice Extract Market Size, Share, Industry Report 2033GVR Report cover

![India Spice Extract Market Size, Share & Trends Report]()

India Spice Extract Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Chilli, Black Pepper, Ginger, Turmeric, Nutmeg, Ajowan, Clove, Clove, Holy Basil, Nutmeg, Turmeric, Vetiver, Chilli, Clove, Coriander Seed), And Segment Forecasts

- Report ID: GVR-4-68040-846-8

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Spice Extract Market Summary

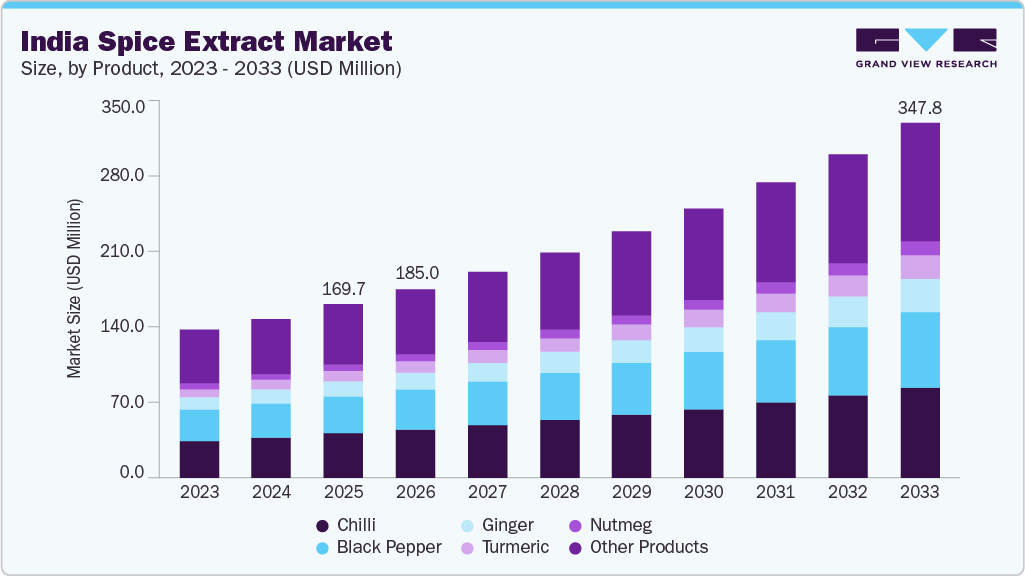

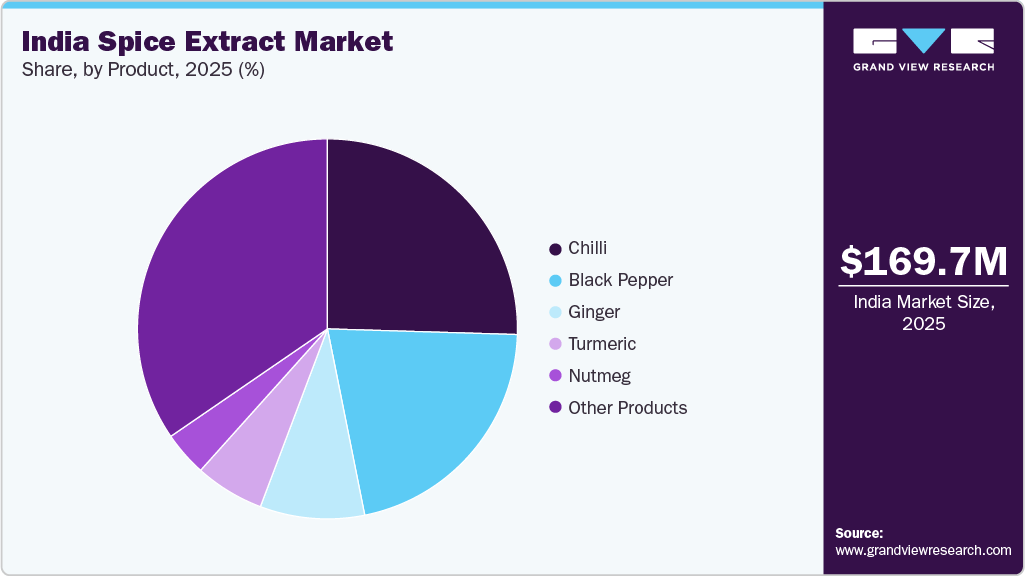

The India spice extract market size was estimated at USD 169.7 million in 2025 and is projected to reach USD 347.8 million by 2033, growing at a CAGR of 9.1% from 2026 to 2033. The increasing demand for natural, concentrated flavoring and coloring ingredients across food & beverages, nutraceuticals, pharmaceuticals, and personal care applications is driving market growth.

Key Market Trends & Insights

- By product, the davana segment is expected to grow at the fastest CAGR of 12.0% from 2026 to 2033.

- By product, the chilli segment led the market with the largest revenue share of 25.5% in 2025.

- By product, the curry leaf segment held the smallest revenue share of 0.02% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 169.7 Million

- 2033 Projected Market Size: USD 347.8 Million

- CAGR (2026-2033): 9.1%

The rising preference for clean-label formulations, the expanding use of spice oils and oleoresins in processed foods and beverages, the growing adoption of health-focused and traditional formulations, and continuous product innovation in standardized, export-quality extracts are contributing to the market’s steady expansion.Spice extracts are concentrated natural derivatives obtained from spices and are valued for their flavoring, coloring, aromatic, and functional properties. Spice extracts primarily comprising spice oils and oleoresins are produced through processes such as steam distillation and solvent extraction, and are widely used across food & beverages, nutraceuticals, pharmaceuticals, and personal care applications.

Rising demand for spice extracts is largely driven by growing preference for natural and clean-label ingredients, increasing use of standardized flavor and color solutions in processed foods, and expanding applications across health-focused and convenience-driven products, along with advancements in extraction technologies that enhance consistency, stability, and product performance.

According to industry and trade-oriented sources, the increasing adoption of natural, value-added spice derivatives across consumer-oriented industries in India is supporting demand for spice oils and oleoresins. Rising use of oleoresins as efficient alternatives to raw spices, coupled with growing emphasis on quality standardization, export compliance, and traceability, continues to encourage the adoption of high-purity spice extracts, further strengthening demand across the India spice extract industry.

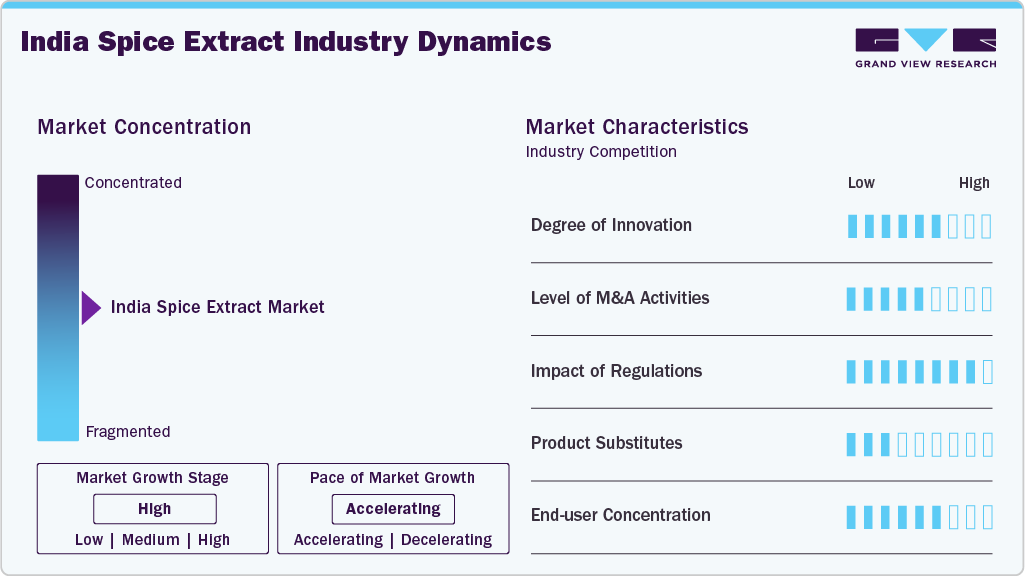

Market Concentration & Characteristics

The India spice extract industry is highly consolidated, with the presence of a mix of established spice extract manufacturers, flavor and ingredient companies, and export-oriented processors shaping the competitive landscape. These companies benefit from strong raw spice sourcing networks, long-standing relationships with food and nutraceutical manufacturers, and diversified portfolios of spice oils and oleoresins. Key participants are increasingly focusing on expanding extraction and processing capacities, investing in advanced and standardized extraction technologies, and developing traceable, quality-certified, and export-compliant spice oils and oleoresins to strengthen their competitive positioning in the India spice extract industry.

Leading players in the India spice extract industry are adopting a mix of capacity expansion, product innovation, strategic collaborations, and sustainability-focused initiatives to enhance their market presence. Companies operating across spice oil and oleoresin extraction, processing, and downstream formulation are investing in advanced extraction technologies, quality standardization, and product differentiation to improve flavor strength, color stability, and functional performance across end-use applications. To address rising domestic and export demand across food & beverages, nutraceuticals, pharmaceuticals, and personal care applications, several market participants are expanding their processing and sourcing capabilities, strengthening distribution and private-label partnerships, and collaborating with food processors and ingredient buyers to support application-specific and regulatory requirements.

Product Insights

The chili segment led the market with the largest revenue share of 25.5% in 2025. Demand for chili oils and oleoresins is driven by India’s strong raw material availability, cost competitiveness, and its intense flavor strength and color value across multiple end-use industries. Chili extracts are extensively used in processed foods, savory snacks, sauces, seasonings, and meat products, supporting strong adoption across both domestic consumption and export-oriented formulations. Other product types, including turmeric, pepper, ginger, cardamom, and cumin extracts, are also gaining traction due to their functional properties, health-associated benefits, and expanding application scope, and are analyzed in the report. Rising demand for natural flavoring and coloring ingredients, clean-label formulations, and standardized spice solutions is further boosting consumption of spice oils and oleoresins across the India market.

Chili extracts are valued for their high pungency, color consistency, and formulation efficiency, making them suitable for a wide range of food and industrial applications. Turmeric and ginger oleoresins are increasingly preferred for their coloring properties and functional benefits. At the same time, pepper and cardamom extracts find growing use in premium food formulations, nutraceuticals, and personal care products. Continued product innovation, increasing focus on quality standardization and traceability, expanding use of spice extracts in processed and convenience foods, and sustained demand from export-driven applications are expected to support the continued growth of spice extract product segments over the forecast period.

The davana segment is expected to grow at the fastest CAGR of 12.0% during the forecast period. Growth is driven by the rising demand for davana oil and oleoresins across fragrance, personal care, aromatherapy, and premium wellness applications, where these extracts are valued for their distinctive fruity-herbaceous aroma and blending characteristics. The increasing preference for natural and specialty botanical ingredients, along with the expanding use in high-value formulations and export-oriented products, is contributing to the higher adoption of davana extracts.

Rising focus on value-added and niche spice extracts, coupled with growing demand from fragrance houses, personal care manufacturers, and wellness brands, is further accelerating the growth of the davana segment in India. Ongoing product innovation, including the development of high-purity, traceable, and sustainably sourced davana extracts, along with increasing integration into custom fragrance blends and premium formulations, is expected to support the sustained growth of the segment over the forecast period.

Country Insight

The spice extract market in India represents a well-established and steadily evolving landscape, driven by the country’s strong spice production base, established extraction infrastructure, and rising domestic and export demand. The demand for spice oils and oleoresins across various applications, including food & beverages, nutraceuticals, pharmaceuticals, and personal care, is supporting sustained market activity. The increasing preference for natural flavoring and coloring solutions, clean-label ingredients, and functional food formulations, along with the growing adoption of these solutions in health-focused and convenience-oriented products, is shaping market dynamics across India.

The presence of leading domestic manufacturers, advanced extraction and processing technologies, and robust distribution networks further strengthens market development. Ongoing investments in quality standardization, traceable and sustainably sourced extracts, and product innovation, combined with rising consumer and industrial spending on natural, value-added ingredients, are expected to drive continued growth over the forecast period.

Key India Spice Extracts Company Insights

Key players, such as Synthite Group, Plant Lipids, and Mane Kancor (Kancor Ingredients), are dominating the market.

-

Synthite Group is a leading player in the India spice extract industry, specializing in the sourcing, extraction, and production of high-quality spice oils and oleoresins for food & beverages, nutraceuticals, pharmaceuticals, and personal care applications. The company leverages its integrated supply chain, advanced extraction technologies, and rigorous quality standards to deliver pure, standardized, and sustainably sourced spice extract solutions. Synthite Group’s focus on innovation, export-quality production, and value-added formulations strengthens its market presence. It reinforces its position as a key contributor to the growth of the India spice extract industry.

Key India Spice Extract Companies:

- Synthite Group

- Plant Lipids

- Mane Kancor (Kancor Ingredients)

- Akay Natural Ingredients

- AVT Naturals

- Universal Oleoresins

- Paprika Oleo’s India

- BOS Natural Flavors

- Ozone Naturals

- Ecospice Ingredients

- Natura Vitalis Industries (NVitalis)

- S.A. Herbal Bioactives LLP

- Kanta Enterprises

Recent Development

-

In March 2025, Gemini Edibles and Fats India, a Hyderabad-based sunflower oil producer, has formed a joint venture, GEF Foods India Pvt. Ltd., with Coimbatore-based Sree Annapoorna Foods, a spice processing company. This collaboration combines expertise in oil processing and spice extraction, enabling the production of high-quality spice oils and oleoresins for food and consumer applications. Such strategic partnerships enhance production capacities, improve supply chain integration, and support the development of value-added spice extract products, driving growth and competitiveness in the India spice extract industry.

India Spice Extract Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 185.0 million

Revenue forecast in 2033

USD 347.8 million

Growth rate

CAGR of 9.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

India

Key companies profiled

Synthite Group; Plant Lipids; Mane Kancor (Kancor Ingredients); Akay Natural Ingredients; AVT Naturals; Universal Oleoresins; Paprika Oleo’s India; BOS Natural Flavors; Ozone Naturals; Ecospice Ingredients; Natura Vitalis Industries (NVitalis); S.A. Herbal Bioactives LLP; Kanta Enterprises

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Spice Extract Market Report Segmentation

This report forecasts revenue growth at granular levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the India spice extract market report based on produc types.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Ajowan

-

Black pepper

-

Cardamom

-

Cumin Seed

-

Curry Leaf

-

Davana

-

Fennel

-

Ginger

-

Holy Basil

-

Nutmeg

-

Turmeric

-

Vetiver

-

Chilli

-

Clove

-

Coriander Seed

-

Other Products

-

Frequently Asked Questions About This Report

b. The India spice extract market size was estimated at USD 169.7 million in 2025 and is expected to reach USD 185.0 million in 2026.

b. The chili segment dominated the India spice extract market by product type in 2025, accounting for a significant share of 25.5% of overall consumption, driven by its high pungency, vibrant color, and wide applicability across food and processed products. Chili extracts, including chili oils and oleoresins, are extensively used in sauces, seasonings, savory snacks, meat products, and convenience foods due to their intense flavor, color consistency, and functional versatility.

b. The India spice extract market is primarily driven by rising demand from food & beverages, nutraceuticals, personal care, and wellness sectors, supported by increasing consumer preference for natural, plant-based, and clean-label ingredients. Growing adoption of standardized spice oils and oleoresins, continuous product innovation, and expanding use of sustainably sourced extracts are accelerating market growth. The deployment of spice extracts across processed foods, functional beverages, nutraceuticals, personal care, and specialty wellness applications, driven by the need for quality, flavor consistency, and regulatory compliance, continues to support steady expansion of the India Spice Extract market.

b. The India spice extract market is expected to grow at a compound annual growth rate of 9.1% from 2026 to 2033 to reach USD 347.8 million by 2033.

b. Some of the key players operating in the India spice extract market include Synthite Group, Plant Lipids, Mane Kancor (Kancor Ingredients), Akay Natural Ingredients, AVT Naturals, Universal Oleoresins, Paprika Oleo’s India, BOS Natural Flavors, Ozone Naturals, Ecospice Ingredients, Natura Vitalis Industries (NVitalis), S.A. Herbal Bioactives LLP, and Kanta Enterprises.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.