- Home

- »

- Next Generation Technologies

- »

-

Indonesia Contact Center Software Market Size Report, 2033GVR Report cover

![Indonesia Contact Center Software Market Size, Share & Trends Report]()

Indonesia Contact Center Software Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Solution (ACD, CTI), By Deployment (Hosted, On-premise), By Services, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-754-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

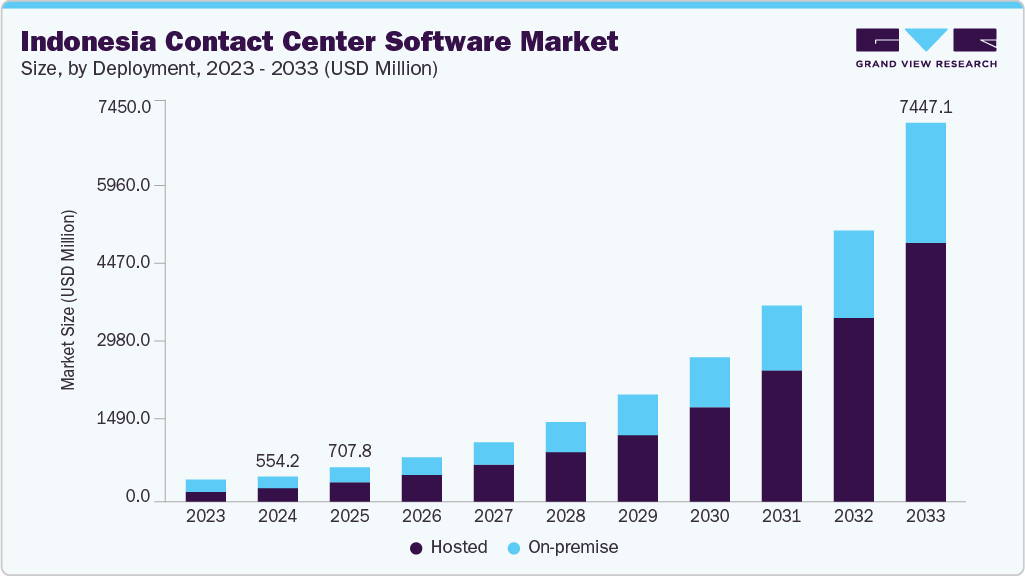

The Indonesia contact center software market size was estimated at USD 554.2 million in 2024 and is expected to reach USD 7,447.1 million by 2033, registering a CAGR of 34.2% from 2025 to 2033. The increasing internet penetration in Indonesia is fueling market growth. Widespread and growing internet access has transformed how consumers engage with businesses, shifting expectations toward faster, more convenient, and digitally enabled customer service experiences. As more Indonesians rely on smartphones and internet-connected devices to shop online, access financial services, book travel, and engage with public services, businesses across industries are pressured to deliver responsive, omnichannel support. This shift prompts greater investment in contact center software to meet evolving customer demands and gain a competitive edge.

The increasing internet penetration in Indonesia is fueling market growth. The widespread internet access has transformed how consumers interact with businesses, shifting expectations toward faster, more convenient, and digitally enabled customer service experiences. As more Indonesians use smartphones and internet-connected devices to shop online, access banking services, book travel, and interact with government platforms, businesses across sectors are pressured to deliver responsive and seamless support across digital channels.

In addition, the surge in internet connectivity supports integrating advanced technologies such as AI, chatbots, and real-time analytics into contact center systems. These innovations rely heavily on high-speed internet to function effectively and are increasingly being adopted by Indonesian businesses looking to differentiate their services and stay competitive. As digital connectivity expands, driven by 4G and 5G network investments, the infrastructure to support modern, intelligent contact centers becomes more robust, paving the way for even broader adoption across industries such as e-commerce, BFSI, telecom, healthcare, and public services.

Indonesia’s cloud ecosystem has rapidly evolved in recent years, supported by substantial investments from global technology providers such as Google Cloud, Microsoft Azure, Amazon Web Services (AWS), and major local players. These investments have expanded cloud infrastructure and data center availability nationwide, enhancing accessibility, reliability, and speed for cloud-hosted services. This development is particularly important for contact center operations, which require uninterrupted access, real-time data processing, and high uptime to maintain quality customer engagement. As the cloud infrastructure matures, more businesses are migrating their contact center operations to the cloud to benefit from these capabilities.

Factors such as technology, regulations, suppliers, and buyers’ trends shape market growth dynamics. Technology trends have emerged as a key force behind market growth. Integrating artificial intelligence (AI) and automation into contact center operations is transforming the industry. AI-powered chatbots, voicebots, and virtual assistants are being widely used to manage routine inquiries, allowing human agents to focus on more complex issues. In addition, AI is used for predictive call routing, sentiment analysis, and real-time agent assistance, improving efficiency and customer satisfaction.

Despite strong growth prospects, the uneven digital infrastructure across Indonesia’s archipelago is restraining market growth. While major urban centers such as Jakarta, Surabaya, and Bandung have benefited from robust internet connectivity and expanding data center networks, many rural and remote regions still suffer from limited broadband access, slow internet speeds, and frequent service interruptions. These challenges directly affect the performance and reliability of cloud-based contact center platforms, which rely heavily on stable, high-speed internet to manage real-time communications and data processing. As a result, businesses operating outside of Java or major metropolitan areas often face operational inefficiencies or are unable to adopt modern software at all.

Solution Insights

The interactive voice response segment dominated the market in 2024 with a share of 20.14%. The growth of interactive voice response (IVR) solutions in Indonesia’s market is driven by the rise of AI-powered, conversational IVR systems. These modern IVR platforms leverage natural language processing (NLP) and speech recognition technologies to enable more natural and intuitive interactions between callers and automated systems.

The customer collaboration segment is expected to witness the highest growth rate of 39.4% over the forecast period, driven by the increasing demand for personalized and real-time customer engagement across multiple communication channels. Organizations increasingly leverage collaboration tools such as co-browsing, video chat, and interactive voice response (IVR) to enhance customer support and deliver seamless service experiences. The growing emphasis on customer satisfaction, retention, and loyalty, especially in competitive sectors like retail, BFSI, and telecommunications, further fuels the adoption of customer collaboration features within contact center platforms.

Service Insights

The integration & deployment segment dominated the market in 2024 with a share of 41.86%. The rapid adoption of cloud-based technologies and digital transformation initiatives in Indonesia drives the integration and deployment of services in the country's market. As more contact centers migrate to cloud or hybrid environments, businesses increasingly require expert services to ensure smooth deployment and seamless integration of new tools with their existing infrastructure.

The managed services segment is expected to grow fastest over the forecast period. The growth of managed services in Indonesia’s market is driven by increasing emphasis on cybersecurity and regulatory compliance, particularly following the enactment of the 2022 Personal Data Protection (PDP) law. This regulation mandates stricter controls over customer data collection, storage, and processing, especially in highly regulated sectors such as banking, financial services, and healthcare.

Deployment Insights

Based on deployment, the hosted segment dominated the market in 2024 with a share of 60.27% in 2024. The ease of scalability and rapid deployment drive market growth. Unlike traditional on-premises systems, hosted solutions can be implemented quickly, often within days, without the need for extensive hardware installations or IT infrastructure. This allows businesses to respond swiftly to changing market conditions or customer service demands.

The on-premise segment is expected to grow significantly over the forecast period, primarily due to rising concerns over data privacy, security, and compliance with industry-specific regulations. Many large enterprises prefer on-premise solutions, offering greater control over infrastructure, customizable features, and seamless integration with legacy systems. In addition, industries handling sensitive customer data, such as banking, healthcare, and government, are likely to drive demand for on-premise contact center software to ensure data sovereignty and minimize external risk exposure.

Enterprise Size Insights

The large enterprise segment dominated the market in 2024 with a share of 56.53%. The need to efficiently manage high volumes of customer interactions across various communication channels fuels the adoption of contact center software among large enterprises. Large organizations typically engage with thousands of customers daily through calls, emails, live chat, social media, and messaging apps.

The small & medium enterprise (SME) segment is expected to witness the fastest growth of 36.0% over the forecast period, driven by increasing digital transformation initiatives and the growing adoption of cloud-based contact center solutions. SMEs increasingly recognize the importance of delivering enhanced customer experiences to remain competitive, leading to greater investments in affordable, scalable, and flexible software solutions. Moreover, AI, automation, and analytics advancements have made it easier for smaller businesses to implement sophisticated contact center functionalities without significant infrastructure investments.

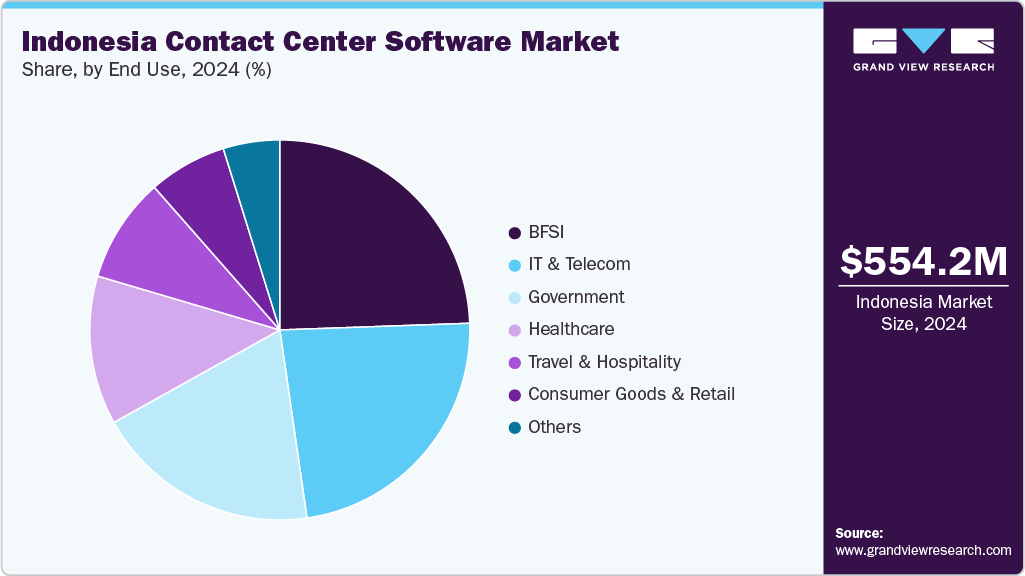

End Use Insights

The BFSI segment led the Indonesia market, accounting for more than 24% of the revenue in 2024. This dominance can be attributed to the rising demand for secure, efficient, and omnichannel customer engagement solutions across banking, insurance, and financial institutions. As digital banking expands and customer expectations for real-time assistance grow, BFSI organizations increasingly invest in advanced contact center platforms with features such as AI-driven chatbots, voice analytics, and CRM integration. These tools enable financial institutions to streamline operations, improve customer satisfaction, and ensure regulatory compliance in a highly competitive environment.

The consumer goods & retail segment is expected to witness the fastest growth over the market forecast period. This growth is primarily driven by the rapid expansion of e-commerce, shifting consumer behavior, and the increasing need for personalized and responsive customer service. Retailers are adopting contact center solutions to manage high volumes of customer interactions across multiple channels, including voice, email, chat, and social media.

Key Indonesia Contact Center Software Company Insights

Some key players operating in the market include Genesys, Avaya LLC, and Cisco Systems, Inc.. These companies actively focus on research and development (R&D) to enhance platform capabilities, improve scalability, and optimize omnichannel communication. Innovation efforts are centered around integrating AI-driven analytics, natural language processing (NLP), and automation tools to streamline customer interactions and boost agent productivity. Furthermore, these players are expanding their local presence and forming strategic partnerships with regional service providers to meet the growing demand for advanced customer engagement solutions across Indonesia’s rapidly evolving digital economy.

-

Genesys delivers cloud and hybrid contact center solutions to organizations worldwide. It supports enterprises in financial services, telecommunications, and insurance in Indonesia. The company partners with local system integrators to deploy platforms that unify customer engagement across voice, email, and messaging channels. Indonesian businesses use Genesys technology to manage service operations at scale and comply with evolving data residency laws. The company’s expansion of cloud availability in Southeast Asia supports performance and regulatory needs for clients in the region.

-

Avaya provides enterprise communications and customer experience technologies to clients worldwide. Indonesia's systems are used by utility firms, public institutions, and private businesses to manage customer interaction across various formats. Many organizations implement Avaya technology when upgrading traditional phone systems and adding digital capabilities. Hybrid architecture options allow for flexibility in deployment while maintaining operational continuity. Support and integration are delivered through local technology partners familiar with Avaya’s legacy and cloud-based environments.

Key Indonesia Contact Center Software Companies:

- Genesys

- Avaya LLC

- Cisco Systems, Inc.

- Five9, Inc.

- NiCE

- Talkdesk

- 8x8, Inc.

- Freshworks

- Zendesk

- Qiscus

Recent Developments

-

In December 2024, Cisco Systems, Inc. extended its Webex Contact Center support to Indonesia through the Singapore-based APAC cloud region. With this setup, Indonesian contact centers can benefit from regional cloud hosting that meets data-localization requirements and ensures low-latency communication. This helps Indonesian enterprises comply with industry regulations while leveraging Cisco’s scalable global cloud infrastructure.

-

In March 2023, Genesys launched a Genesys Cloud satellite region in Jakarta. This local AWS deployment ensures voice media stays in-country, reduces latency, and complies with Indonesian data-residency laws, benefiting sectors like banking and insurance. Includes regional call-recording storage capability.

Indonesia Contact Center Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 707.8 million

Revenue forecast in 2033

USD 7,447.1 million

Growth rate

CAGR of 34.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise size, end use

Key companies profiled

Genesys; Avaya LLC; Cisco Systems, Inc.; Five9, Inc.; NiCE; Talkdesk; 8x8, Inc.; Freshworks; Zendesk; Qiscus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Indonesia Contact Center Software Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Indonesia contact center software market report based on solution, service, deployment, enterprise size, and end use:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic Call Distribution (ACD)

-

Call Recording

-

Computer Telephony Integration (CTI)

-

Customer Collaboration

-

Dialer

-

Interactive Voice Responses (IVR)

-

Reporting & Analytics

-

Workforce Optimization

-

Others

-

-

Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Consumer Goods & Retail

-

Government

-

Healthcare

-

IT & Telecom

-

Travelling & Hospitality

-

Others

-

Frequently Asked Questions About This Report

b. The Indonesia contact center as a service market size was estimated at USD 554.2 billion in 2024 and is expected to reach USD 707.8 billion in 2025.

b. The Indonesia contact center as a service market is expected to grow at a compound annual growth rate of 34.2% from 2025 to 2033 to reach USD 7,447.1 million by 2033.

b. The interactive voice response segment accounted for the highest revenue share of more than 20.14% in 2024 in the Indonesia CCaaS market.

b. Some key players operating in the Indonesia CCaaS market include Genesys; Avaya LLC; Cisco Systems, Inc.; Five9, Inc.; NiCE; Talkdesk; 8x8, Inc.; Freshworks; Zendesk; Qiscus.

b. The Indonesia CCaaS market is growing rapidly, driven by increasing cloud adoption supported by local data centers, stricter data protection laws, and the rising need for omnichannel engagement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.