- Home

- »

- Homecare & Decor

- »

-

Induction Cooktops Market Size, Share, Industry Report, 2030GVR Report cover

![Induction Cooktops Market Size, Share & Trends Report]()

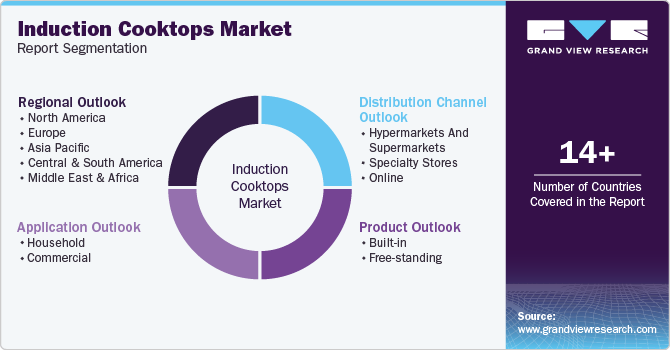

Induction Cooktops Market (2025 - 2030) Size, Share & Trends Analysis Report by Product (Built-in, Free-standing), By Application, By Distribution Channel (Hypermarket & Supermarket, Online, Specialty Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-253-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Induction Cooktops Market Summary

The global induction cooktops market size was valued at USD 27.67 billion in 2024 and is projected to reach USD 38.02 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The growth is driven by an increase in the number of residential and non-residential development projects, as well as a rise in the number of restaurants and eateries.

Key Market Trends & Insights

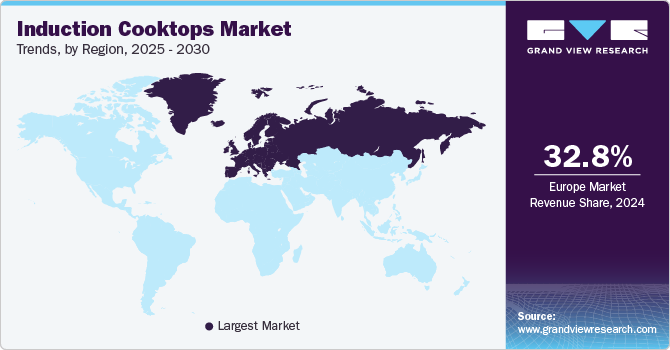

- Europe dominated the induction cooktops market with a revenue share of 32.8% in 2024.

- The Asia Pacific induction cooktops market is expected to grow at the fastest CAGR from 2025 to 2030.

- By product, the built-in product segment led the market, with a revenue share of 64.1% in 2024.

- By application, The household segment led the market, with a significant revenue share in 2024.

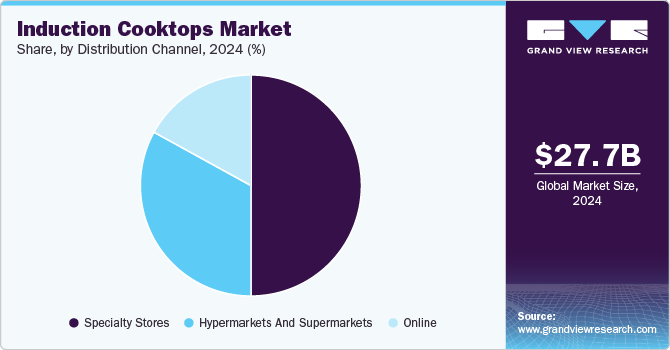

- By distribution channel, the specialty stores segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.67 Billion

- 2030 Projected Market Size: USD 38.02 Billion

- CAGR (2025-2030): 6.2%

- Europe: Largest market in 2024

The improved profitability and performance of the restaurant business are generating sufficient prospects for the market as people continue to patronize fast-food restaurants. The rise in fuel expenses for conventional gas cooktops and the growing trend of modular kitchens due to the comfort and safety benefits are driving the household induction cooktops market.

With various new residential construction projects in place, the demand for induction cooktops is expected to rise. The gradual shift from gas cooktops has benefitted the market in the past, and an increasing number of consumers are inclined toward installing induction cooktops in their houses or large-scale residential projects. This is due to an increase in awareness regarding its benefits over gas cooktops. Induction cooktops are also widely used in non-residential projects, such as restaurants or hotels. The shift is gradual for commercial applications; however, it is expected to increase over the forecast period.

Furthermore, increasing demand for energy efficiency and cost-saving factors at home is raising the growth of the induction cooktop market. Induction cooktops are among the most energy-efficient appliances, with up to 90% of the energy consumed has been transferred to food, compared with 74% for electric cooktops and 40% for gas cooktops. Induction cooktops use less energy, which means it's better for the climate and also cost saving as it reduces electric bill.

Several advancements, such as cooking appliance manufacturers replacing old mechanical controls and displays with touch technology to reduce dependability and after-sale expenses, and smart features such as programmable timers, smartphone control, and diagnostic systems, are expected to boost the market growth. Touch screens with large graphics and increased functionality, like multi-zone heating capabilities, are also becoming increasingly popular. Constantly changing business & family routines, increased demand for eco-friendly appliances, and improving affordable electricity accessibility are expected to push consumers to purchase technology-driven kitchen gadgets.

The rapid growth of online marketing across the globe is contributing significantly to the industry's growth. The growing adoption of high-tech products is anticipated to support the growth of kitchen appliances, including cooking hobs. However, the initial investment required in specialized cookware may hamper the growth of the industry in the near future. In addition, these products are considered to be more expensive as compared to conventional gas cooktops.

Product Insights

The market has been segmented into built-in and free-standing. In terms of value, the built-in product segment dominated the market with a share of 64.1% in 2024. An increasing number of residential as well as commercial construction projects is driving the segment. The inherent benefits of the technology, more chefs and manufacturers are increasingly promoting induction to construction professionals and consumers. Induction is more efficient than typical electric and gas-based technology. The contents inside the heated pots and pans are heated using conduction and convection, with very little inefficiency.

The demand for the free-standing segment is expected to grow gradually over the forecast period. Free-standing induction cooktops are gaining popularity as they are efficient, flexible, safe, and convenient due to their ease of installation and adaptability to various kitchen layouts. The growing demand from renters and homeowners who are seeking versatile cooking solutions is further driving the segment's growth. For instance, companies like Wonderchef Home Appliances Pvt. Ltd offers free-standing induction cooktops with built-in ovens, advanced kitchen convenience, multiple heating zones, and modes with various sizes and designs.

Application Insights

The household segment led the global market with a significant revenue share in 2024 and will expand further at the fastest CAGR over the forecast period. In residential settings, induction cooktops are favored because they deliver better cooking results. Induction ranges from low power, moderate enough for bakers to melt chocolate without a double boiler, to high power, capable of boiling water significantly faster than a comparable gas burner.

Unlike standard electric cooktops, which are slower to respond to temperature changes, induction cooktops provide precise and near-instantaneous temperature control. Furthermore, a worldwide increase in disposable income has led to people buying several

homes or having multiple kitchens in larger homes. This will contribute to market growth. In countries like India, LPG rates have been steadily rising, affected by international prices and the value of the rupee against the dollar.

The commercial segment is expected to grow at a significant CAGR over the forecast period. Despite its higher cost than traditional stoves, an induction cooktop's unique advantages make it an ideal choice for various commercial settings. The increasing number of restaurants, catering businesses, and food joints has driven the demand for the induction cooktop industry. According to the Fast Food Statistics published by The Barbecue Lab in April 2025, there were 826,000 fast food restaurants worldwide.

Distribution Channel Insights

The specialty stores segment accounted for the largest revenue share in 2024. Specialty stores have more demand for buying induction cooktops because they offer more personalized advice, a wide range of selection of brands, sizes, models, and a more knowledgeable staff compared to general retailers. These stores may also provide demo units for a hands-on experience before making a purchase. Additionally, they also provide post purchase support such as installation assistance.

The online segment is expected to record the fastest CAGR from 2025 to 2030. The growing acceptance of technologically advanced and high-tech products is expected to drive the growth of e-commerce websites for kitchen appliances. Additionally, attractive offers and discounts provided by online retailers, especially during festivals, are boosting the market for induction cooktops. For instance, in November 2023, Flipkart offered a 50% discount on induction cooktops during the Diwali sale. Additionally, online platforms make it easier for customers to compare prices and products from various brands and retailers; online retailers such as Boss Appliances offer a wide range of induction cooktops and often provide affordable prices and convenient shopping experiences.

Regional Insights

The North America induction cooktops market is expected to grow at a significant CAGR during the forecast period due to increasing consumer preference for sustainable, energy-efficient, safe, quick, and technologically advanced cooking appliances in the region. Additionally, the growing number of uniting & acquisitions, product launches, collaboration, and other strategic development activities by the regional players is further fueling the regional market growth. For instance, in February 2024, Whirlpool Corporation collaborated with Austria-based kitchen products and services provider BORA to bring numerous design opportunities to induction cooktops. Both companies collaborated to bring the best induction downdraft technology exclusively to KitchenAid and JennAir brand induction downdraft cooktops in the region.

U.S. Induction Cooktops Market Trends

The U.S. induction cooktops market is expected to rise gradually during the forecast period. Several factors are driving the growth of induction cooking appliances in the U.S., such as government incentives and regulations, sustainability objectives, and concerns about indoor air quality linked to gas burners. Customers are also discovering numerous performance advantages, including faster cooking, precision, simpler cleanup, and increased safety.

The market is experiencing the launch of more sophisticated, high-quality induction models that offer advanced features such as precise temperature control, built-in smart technology, and visually appealing designs. These premium products attract consumers interested in luxury kitchen appliances, further enhancing sales trends.

Europe Induction Cooktops Market Trends

Europe was the largest regional market in 2024 and accounted for 32.8% revenue share. An increasing number of government initiatives and supporting regulatory policies promoting energy-efficient appliances are driving the growth of the induction cooktops industry in Europe. For instance, according to a report published by a nonprofit organization, Collaborative Labeling and Appliance Standards Program (CLASP), in Jan 2023, over 54% of European households use gas cooking, which has exceeded WHO’s indoor air quality limits for NO2, which is a harmful pollutant. However, using electric appliances is the quickest way to eliminate this harmful source.

Germany dominated the regional cooktops industry in 2024 and is expected to maintain its dominance throughout the forecast period. German Households focus on energy saving and affordable Induction cooktops which has increased the demand of the induction cooktops in the country. According to a report published by Infineon Technologies AG, about 17 percent of a total of more than 40 million households in Germany are equipped with induction cooktops.

Asia Pacific Induction Cooktops Market Trends

The Asia Pacific Induction cooktops industry is anticipated to grow at the fastest CAGR during the forecast period of 2025 to 2030. The growing urbanization and increased spending power of consumers in the Asia Pacific are likely to propel market growth. The presence of worldwide consumer induction cooktop providers in the region also contributes to the market growth. Moreover, changing lifestyles and growing preferences for contemporary appliances contribute to market development.

The China induction cooktops industry held a substantial market share in 2024. China is significantly advertising the electrification of households to achieve its carbon neutrality goals. China’s electrification rate stood at 52.6% in 2024, significantly moving closer to its 2050 goal of reaching 60% carbon neutrality. This is expected to result in a huge increase in the demand for electric appliances. Eventually, it is expected to drive the demand for induction cooktops as they are safe, easier, and sustainable.

Key Induction Cooktops Insights

Some of the key companies in the pore strips industry include Midea, Robert Bosch GmbH, and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Midea induction cooktops offer quick and consistent heating at the highest efficiency. It comes with multiple power settings to let you cook anything you want anytime while saving power.

-

Robert Bosch GmbH offers induction hobs with a wide range of modern features, which makes cooking advanced and easy. The company provides swift, safe, clean, and flexible induction cooktops.

Key Induction Cooktops Companies:

The following are the leading companies in the induction cooktops market. These companies collectively hold the largest market share and dictate industry trends.

- Haier Inc.

- Midea

- Panasonic Malaysia Sdn Bhd.

- SAMSUNG

- Philips Electronics

- LG Electronics

- Robert Bosch GmbH

- Miele & Cie. KG

- Whirlpool Corporation

- Electrolux AB

- Fisher & Paykel Appliances Holdings Ltd.

- Daewoo Electronics Corporation

Recent Developments

-

In January 2023, Midea introduced its Celestial Flex Series, the first kitchen appliances to use the newly finalized Ki wireless power standard, allowing devices like a blender, steamer, and kettle to operate cordlessly by drawing power wirelessly from an induction cooktop. This innovation leverages electromagnetic induction technology to eliminate power cords, enhance kitchen convenience, and reduce clutter.

-

In April 2024, Electrolux Professional Group acquired Adventys, a French manufacturer specializing in induction cooking solutions, for approximately USD 23.9 million. This acquisition is expected to enable Electrolux Professional to advance its own induction technology development and strengthen its leadership in sustainable horizontal cooking, as induction cooking reduces CO2 emissions by using energy only when the surface is active.

-

In May 2024, Samsung showcased its latest AI induction cooktop at Eurocucina in Milan. The cooktop consists of a new coil system and an enhanced non-scratch surface. The new coil system provides 50% more space for cooking than a traditional induction cooktop of this size. The enhanced non-scratch surface can handle 1.5 times more pressure than Samsung’s previous induction cooktops.

Induction Cooktops Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.74 billion

Revenue forecast in 2030

USD 38.02 billion

Growth Rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa.

Country scope

U.S., Canada, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, UAE, and South Africa

Key companies profiled

Haier Inc.; Midea; Panasonic Malaysia Sdn Bhd.; SAMSUNG; Philips Electronics; LG Electronics; Robert Bosch GmbH; Miele & Cie. KG; Whirlpool Corporation; Electrolux AB; Fisher & Paykel Appliances Holdings Ltd.; Daewoo Electronics Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Induction Cooktops Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global induction cooktops industry report based on product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Built-in

-

Free-standing

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets and supermarkets

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.