- Home

- »

- Homecare & Decor

- »

-

Modular Kitchen Market Size, Share & Growth Report, 2030GVR Report cover

![Modular Kitchen Market Size, Share & Trends Report]()

Modular Kitchen Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Floor Cabinet, Wall Cabinet), By Layout (L-Shape, U-Shape, Parallel, Straight, Island), By Application, By Distribution, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-177-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Modular Kitchen Market Summary

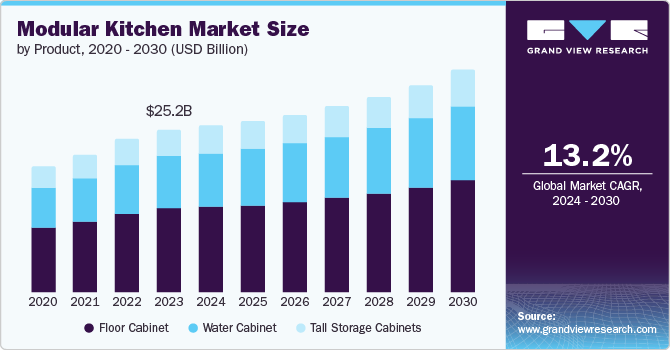

The global modular kitchen market size was valued at USD 25.21 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. A modular kitchen setup helps upgrade the kitchen's aesthetics, improves functionality, and enhances the kitchen's appearance.

Key Market Trends & Insights

- Europe modular kitchen market accounted for a 33.33% market share in 2023.

- By product, floor cabinets accounted for the leading share of 51.6% in 2023.

- By end use, L-shape accounted for the market share of 33.4% in 2023.

- By application, residential accounted for the largest market share of 80.1% in 2023.

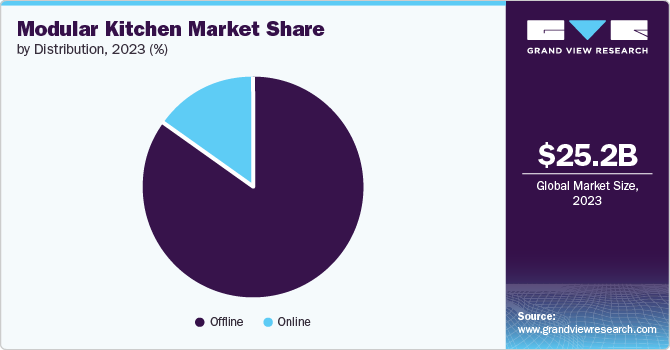

- By distribution, offline segment accounted for the largest market share of 84.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 25.2 Billion

- 2030 Projected Market Size: USD 34.39 Billion

- CAGR (2024-2030): 4.9%

The prefabricated cabinets and modules use wood, laminates, and metals. The modular kitchens are customized to fit any space and cater to the user's requirements. With a broad range of accessories and customization, cooking and cleaning tasks become easy for homemakers.

Modular kitchen designs have technically evolved. These include automation, smart appliances, IIoT (Integrated Internet of Things). The demand for automation is increasing in luxury households as the kitchen setups have become Furthermore, the increasing trend of open-plan living areas drives the need for visually alluring and well-structured kitchens. Moreover, eco-friendly materials and energy-efficient appliances in modular kitchens present profitable prospects for market growth.

Modular kitchen is gaining popularity worldwide, propelled by the rising need for modern and efficient kitchen solutions. Factors such as the increasing number of housing projects and higher incomes have shaped the market developments. In addition, the market is positively impacted by the growing benefits of modular kitchens, such as easy installation, flexibility, and customization options.

Furthermore, the modular kitchen industry has been experiencing remarkable value addition. It adds luxury, refined choices, convenience, and architectural excellence. While a traditional kitchen offers limited design options, ordinary finish, and minimum convenience, modular kitchens offer trending, space-optimized, and stylish kitchens for customers. Overall, the change in lifestyle and consumer interests have led to the rising demand for organized space and convenient amenities.

Product Insights

The floor cabinets accounted for the leading share of 51.6% in 2023. These products form crucial components due to their durable countertops. In addition, the various forms of floor products provide storage and organization for everyday needs. The increasing need for storage solutions capable of accommodating large quantities of food products is expected to drive the demand for these cabinets. Moreover, these cabinets, also referred to as utility cabinets, offer the versatility to store a wide range of items such as electronics and crockeries.

Moreover, wall cabinet is expected to grow in the forthcoming years with a CAGR of 5.5%. Wall cabinets are mounted on the wall, above countertops and appliances. They are best for storing lighter items like glasses, dishes, and spices. They come with features like adjustable shelves and glass doors for better visibility and easy access. They help in freeing up floor space and making kitchen more organized & well-managed. Space optimization is increasingly important in the realm of kitchen design. The modular kitchens are equipped with cabinets having pull-out drawers and adjustable shelves, allowing for maximum utilization of space. These kitchens offer ample room for individuals to work in an organized manner. This particular attribute appeals to customers seeking both functionality and aesthetic appeal.

Layout Insights

The L-shape accounted for the market share of 33.4% in 2023. The L-shape layout features a corner created by two neighboring walls. Its adaptable design is suitable for both spacious and compact rooms. With ample workspace and extra room for a dining table or more storage units, this layout is ideal for seamlessly connecting different areas within a home. Therefore, these products have gained significant popularity among nuclear families with limited space due to their efficient utilization of floor and flexible work zones. Usually, these products have distinct parts for cooking and clean-up areas. They easily fit into open-living floor plans as they optimize storage space. The globally increasing middle-class population has been rapidly adopting this cost-effective design.

Moreover, the parallel type of layout is expected to grow in the forthcoming years with a CAGR of 6.0%. The surface is positioned as two parallel walls or countertops in a parallel configuration. This layout is also known as the corridor or galley kitchen. The double run-through is efficient and well-organized, although it can feel cramped if not thoughtfully designed. It is ideal for compact spaces and is frequently found in townhouses, apartments, and smaller homes. By incorporating these appliances into a modular kitchen, the overall efficiency of the setup significantly improves, resulting in a highly functional space.

Application Insights

The residential accounted for the largest market share of 80.1% in 2023. The increasing popularity of modular kitchen construction in the residential sector has led to a rise in demand for modular kitchens. These kitchens are known for their space-saving design and efficient functionality. Several companies are now providing aesthetically pleasing and well-designed modular kitchens to meet the needs of consumers. Furthermore, individuals who move to new homes or renovate existing ones are opting for modular kitchen solutions, which is expected to drive the growth of the modular kitchen market.

Moreover, commercial use is expected to grow in the forecast years with a CAGR of 5.6%. Modular kitchens have gained importance in the commercial sector, particularly in hotels, restaurants, and cafes, because of their excellent durability, effortless maintenance, and improved functionality. These kitchens are engineered to withstand rough usage and can be effortlessly cleaned, making them an ideal selection for commercial kitchens that prioritize hygiene and cleanliness. In addition, modular kitchens provide design flexibility, allowing them to be tailored to meet the precise demands and specifications of commercial kitchens. Prominent global hoteliers are expanding their enterprises to achieve further advancement. The market experiences a rise in demand for food services, including restaurants, cafes, and food joints.

Distribution Insights

In terms of distribution, offline accounted for the largest market share of 84.8% in 2023. A broad variety of products offered in these stores continues to be an important aspect in portraying a larger consumer base to make purchases from brick-and-mortar retailers. In recent years, manufacturers have adopted a hybrid business method that combines traditional storefronts with online sales.

Moreover, online distribution is expected to grow in projected years with a CAGR of 5.9%. Online platforms let customers design their kitchens according to their needs, choices, and budget. The rise in the availability of modular kitchen types, including L-shaped, and U-shaped, Simple kitchen designs is prominent among homemakers. In addition, the share of kitchen furniture is gaining traction led by an increasing share of sales through online channels.

Regional Insights

The North America modular kitchen market is anticipated to experience growth, primarily attributed to the rise in consumer inclination towards contemporary and customizable kitchens. The increasing popularity of open-plan kitchens in residential properties, coupled with the surging demand for luxurious homes equipped with high-quality kitchen solutions propel the market expansion in this region. Furthermore, the affluent disposable income levels of consumers in North America empower them to invest in top-tier modular kitchen solutions that offer enhanced functionality and convenience. In addition, the implementation of energy-efficient policies and regulations by regional governments is expected to positively influence the market growth of modular kitchens.

U.S. Modular Kitchen Market Trends

The U.S. modular kitchen market is driven by the increasing desire for personalized and customized kitchens, influencing consumer purchase decisions. Consequently, vendors offer personalized kitchens with creative designs. Technology use is heavy in the U.S., especially with the proliferation of IoT devices with a DIY approach. Connectivity is expanding rapidly from the living room to the kitchen and beyond. Advanced technology integrated into modular kitchens acts as a personal nutritionist, aiding in achieving specific health goals more effectively. In addition, the growing number of residential homes and collaborations between modular kitchen manufacturers and real estate developers will further boost the modular kitchen market in the U.S.

Europe Modular Kitchen Market Trends

Europe modular kitchen market accounted for a 33.33% market share in the global industry and grew exponentially in several years. The strong focus of the players is on aesthetics and design which has helped players maintain their hold in the region. The rising popularity of modular kitchens in hotels, restaurants, and cafes is fueling market expansion in the area.

The modular kitchen market in the UK is witnessing a rise in the popularity of modern and minimalist styles in terms of design. These styles are known for their simplicity, clean aesthetics, and high functionality. Key features of this design include straight lines, neutral colors, smooth surfaces, and the absence of unnecessary ornaments in modern and minimalist-style modular kitchens. This design approach offers a sense of spaciousness and organization, allowing the creation of elegant and sophisticated spaces that can be tailored to the personal preferences and lifestyles of users.

The Germany modular kitchen market has experienced significant growth in recent years, mainly due to the increasing demand for efficient and sustainable housing solutions. This market is characterized by quality and well-executed manufacturing processes, which are crucial to excel in this sector. In addition, the surge in home renovation and remodeling trends in Germany, and France is expected to boost the demand for modular kitchens even further. The increasing inclination towards environment-friendly and sustainable kitchen solutions is also anticipated to open up opportunities for market growth in this region. The steep price of modular kitchens and the presence of more affordable alternatives impede market growth in this region.

Asia Pacific Modular Kitchen Market Trends

The modular kitchen market in Asia Pacific is anticipated to grow at a CAGR of 5.7% in projected years. The expansion of the middle class is propelling the modular kitchen industry, fueled by increasing income levels and enhanced living standards. With the increasing number of fast-food chains and food outlets, the participants in the food service industry are exploring different ways to optimize their accommodations in terms of space, ambiance, and efficiency while maintaining proper management & hygiene, which directly affects the demand for modular kitchens.

The India modular kitchen market is projected to attain a rapid CAGR. In addition, the revenue share of kitchen furniture in India witnessed continuous growth with an increasing share of sales through online channels, providing buyers with discounts. The metropolitan cities of Mumbai, Delhi, Bangalore, Ahmedabad, and others in India are experiencing a stable increase in annual household consumption expenditure. These cities are known for their high expenditure levels and widespread usage of modular kitchens. The growing need for space-saving solutions and efficient storage options that maximize the utilization of limited spaces among consumers is projected to boost the demand for modular kitchens.

The modular kitchen market in China can be attributed to the rising number of households and increasing disposable income levels in the nation, which have resulted in a surge in demand for contemporary and convenient kitchen solutions. In addition, the growing popularity of apartment living in urban areas has led to an increased demand for modular kitchens, as they offer efficient space utilization and customization options. Furthermore, the region's market growth is expected to be fueled by the availability of affordable modular kitchen solutions and the expansion of e-commerce platforms.

Key Modular Kitchen Company Insights

Some of the key companies in the global modular kitchen market include IKEA; nobilia.; Hettich Holding GmbH & Co. Ohg; Boston Cabinets, Inc; SieMatic Möbelwerke GmbH & Co. KG; LINEADECOR; Pedini USA; Poggenpohl; Red Bull Inc.; Häcker Küchen; Snaidero Rino s.p.a.

-

IKEA designs and sells ready-to-assemble furniture, kitchen appliances, home accessories, and more. With 482 stores in 63 countries, a well-established brand in furniture retail. IKEA has modernist furniture designs, cost control, and immersive shopping concepts. The company operates under a complex corporate structure, with franchise stores managed by Inter IKEA Systems B.V. and Ingka Group.

-

Häcker Küchen manufactures modern kitchens, that set good quality, functionality, durability and design. The family-owned business is widely known in the industry for setting new standards in reliability, commitment, and sustainability.

Key Modular Kitchen Companies:

The following are the leading companies in the modular kitchen market. These companies collectively hold the largest market share and dictate industry trends.

- IKEA

- nobilia.

- Hettich Holding GmbH & Co. Ohg

- Boston Cabinets, Inc

- SieMatic Möbelwerke GmbH & Co. KG

- LINEADECOR

- Pedini USA

- Poggenpohl.

- Häcker Küchen

- Snaidero Rino Spa Bulthaup GmbH & Co KG

Recent Developments

-

In April 2022, Snaidero Rino Spa Bulthaup GmbH & Co KG launched the new brand MandiCasa, which includes kitchen cabinets, bath vanities, bathrooms, closets, and other offerings from a range of premium Italian suppliers.

-

In April 2022, Hettich Canada partnered with Upper Canada Forest Products. The long-term deal would enable the companies to grow in Western Canada based on extended product portfolio.

Modular Kitchen Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.84 billion

Revenue forecast in 2030

USD 34.39 billion

Growth Rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, layout, application, distribution, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Australia, Brazil, South Africa, Saudi Arabia

Key companies profiled

IKEA; nobilia.; Hettich Holding GmbH & Co. Ohg; Boston Cabinets, Inc; SieMatic Möbelwerke GmbH & Co. KG; LINEADECOR; Pedini USA; Poggenpohl; Red Bull Inc.; Häcker Küchen; Snaidero Rino Spa Bulthaup GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Modular Kitchen Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global modular kitchen market report based on product, layout, application, distribution, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Floor Cabinet

-

Water Cabinet

-

Tall Storage Cabinets

-

-

Layout Outlook (Revenue, USD Million, 2018 - 2030)

-

L-Shape

-

U-Shape

-

Parallel

-

Straight

-

Island

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.