- Home

- »

- Electronic Security

- »

-

Industrial Barrier Systems Market Size & Share Report, 2030GVR Report cover

![Industrial Barrier Systems Market Size, Share & Trends Report]()

Industrial Barrier Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Guardrails, Bollards, Safety Fences), By Function, By Access Control Device, By Material (Metal, Non-metal), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-111-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Air Compressor Market Summary

The global industrial barrier systems market size was estimated at USD 2.16 billion in 2022 and is projected to reach USD 3.6 billion by 2030, growing at a CAGR of 6.8% from 2023 to 2030. The ongoing technological advancements and their integration into industrial barrier systems offer new possibilities, enhanced functionality, and increased efficiency in ensuring safety, security, and operational excellence.

Key Market Trends & Insights

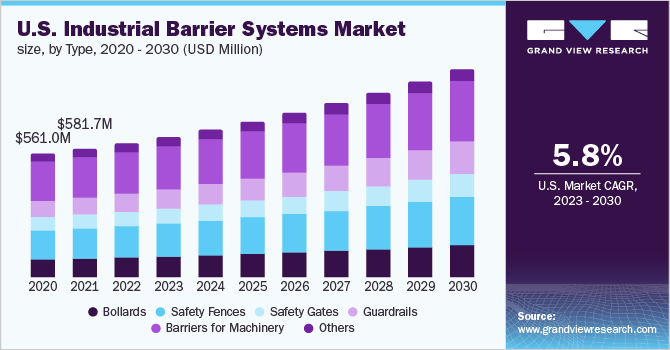

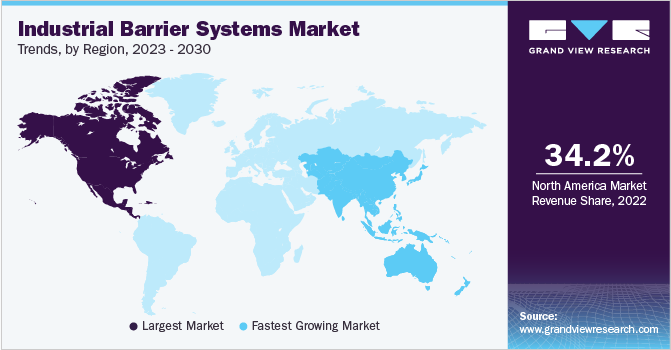

- North America held a major share of 34.2% of the industrial barrier systems market in 2022.

- By type, the barriers for the machinery segment accounted for the largest market share of 31.2% in 2022.

- By function, the passive barriers segment accounted for the largest market share of 70.6% in 2022.

- By material, the metal segment dominated the industrial barrier systems market with the largest revenue share of 53.7% in 2022.

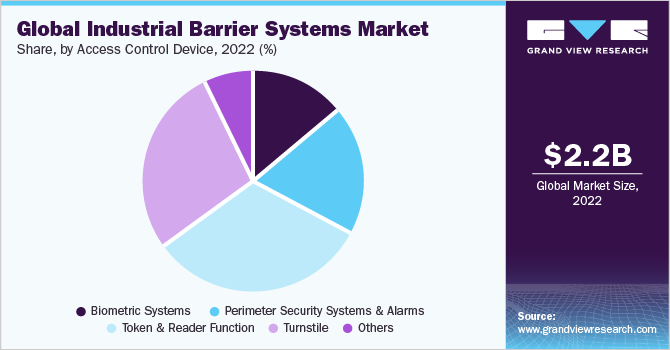

- By access control device, the token & reader function segment accounted for the largest market share of 31.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.16 Billion

- 2030 Projected Market Size: USD 3.6 Billion

- CAGR (2023-2030): 6.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The emergence of the Internet of Things (IoT) and sensor technologies allows for real-time monitoring, data collection, and automated responses within the industrial environment. Industrial barriers can be equipped with sensors, such as proximity sensors, motion detectors, or video analytics, to provide real-time information about potential threats, unauthorized access attempts, or anomalies in traffic patterns.

This enables immediate alerts, triggering appropriate responses and enhancing the overall effectiveness of barrier systems. Advancements in technologies such as Artificial Intelligence (AI) and machine learning offer exciting growth opportunities for industrial barrier systems. AI-powered systems can analyze vast amounts of data, identify patterns, and make intelligent real-time decisions. In the context of industrial barriers, AI algorithms can predict potential security breaches, optimize traffic flow, or dynamically adjust access control parameters based on evolving conditions.

Integration of automation in the industrial barrier systems market is allowing barriers and gateways to be operated and activated remotely using vehicle detection systems based on Machine Learning (ML), robotics, and artificial intelligence, thereby eliminating the need for any human intervention while improving productivity. These systems can detect movements and patterns, predict safety threats, and adjust barrier system responses accordingly. Several industrial barrier systems are also coupled with mobile applications to authorize individuals, monitor system status, obtain real-time alerts, and control the barriers remotely via tablets or smartphones.

Market players are making the market more adjustable and adaptable for different industrial situations. Such industrial barrier systems can be customized to suit specific requirements related to height, width, length, and varied combinations. Moreover, given that autonomous equipment is gradually proliferating the industrial environments, barrier systems are being designed to interact with autonomous equipment to ensure safe navigation and prevent collisions.

Moreover, sustainable industrial barrier systems are being utilized as part of green building techniques. In other words, apart from pursuing environmentally friendly construction activities, environmentally friendly and sustainable designs are also being considered for industrial barrier systems to reduce the carbon footprint of the overall construction projects. As green building techniques and environmentally friendly methods become more significant in infrastructure development projects, the demand for sustainable industrial barrier systems is also expected to grow, thereby encouraging innovation, progress, and overall growth industrial barrier systems market.

The implementation of industrial barrier systems may present logistical challenges, particularly in existing facilities or urban environments with limited space. Retrofitting barriers into an already operational facility can be complex and disruptive to ongoing operations. It may require modifications to existing infrastructure, such as installing foundation footings, reconfiguring traffic flow, or integrating barriers with existing security systems. These implementation challenges can result in additional costs, prolonged downtime, and logistical complexities that businesses must carefully consider before installing industrial barrier systems.

Type Insights

The barriers for the machinery segment accounted for the largest market share of 31.2% in 2022. The growth of this segment can be attributed to safeguarding employees from potential risks. Heavy equipment, moving parts, and hazardous procedures are prevalent in industrial settings. The risks of accidents and injuries are reduced by barriers, which serve as a physical barrier between workers and potentially hazardous locations. Companies can mitigate their legal responsibility in the event of accidents or injuries by putting in place adequate safety measures, such as industrial barriers.

The guardrails segment is anticipated to grow at a CAGR of 8.7% during the forecast period. The growth of the guardrails segment can be attributed to its simple installation in comparison to other safety devices. They can be put up rapidly and without causing major disturbance to ongoing activities. Guardrails are a low-cost method for minimizing falls and boosting safety in industrial settings. When compared to advanced safety technologies, their initial expenditure is comparatively low. Guardrails are usually constructed in a variety of settings and locations to meet the needs of varying industrial environments.

Function Insights

The passive barriers segment accounted for the largest market share of 70.6% in 2022. Safety equipment in heavy industrial environments is frequently subjected to adverse conditions such as excessive temperatures, high humidity, and exposure to chemicals. Passive barriers are often built to survive harsh environments, ensuring that they remain efficient over time. Passive barriers provide continuous protection without needing manual activation or monitoring. They create an ongoing physical barrier to limit access to hazardous places or dangerous equipment once installed.

The active barrier systems segment is anticipated to grow at a CAGR of 7.3% during the forecast period. Active barriers can be employed in response plans for emergencies. During an emergency, such as a chemical spill or equipment malfunction, they help in an instant block off certain sections to minimize additional harm or exposure to risks. Active barriers, such as automated gates, foldable barriers, hydraulic bollards, and automatic doors, offer various options to meet specific industrial needs. Moreover, active barriers provide more control over certain regions or equipment access. They can be controlled remotely or linked with access control systems to provide accurate control of entry and exit points.

Material Insights

The metal segment dominated the industrial barrier systems market with the largest revenue share of 53.7% in 2022. Metal barriers provide strong physical protection, making them ideal for use in environments where impact resistance is critical. They can endure unexpected collisions, and high loads while remaining intact and effective. Some essential industrial processes involve high temperatures or heat exposure. Metals are more resistant to high temperatures than other materials, making them ideal for barrier applications in such scenarios.

The non-metal segment is anticipated to grow at a CAGR of 7.2% during the forecast period. Electrical protection barriers are essential in some industrial environments. Non-metal barriers, particularly those composed of insulating materials such as specific plastics or fiberglass, can prevent electrical currents from flowing through, lowering the danger of electrical accidents. Non-metal barriers are preferable in industries where magnetic interference can cause problems, such as in sensitive electronic or medical devices because they avoid creating magnetic fields. Non-metal barrier components, such as high-strength composites, provide impact resistance capabilities, making them appropriate for applications involving collisions or impacts.

Access Control Device Insights

The token & reader function segment accounted for the largest market share of 31.8% in 2022. When compared to traditional locks and keys, the usage of tokens and readers adds an additional layer of security. Tokens can be encoded with encrypted information, making them difficult to replicate or counterfeit. Industrial machinery and equipment can integrate token and reader technology to regulate access depending on authorization levels or training demands. Multiple zones with varying levels of access are common in industrial operations. Detailed control can be obtained using token and reader systems, guaranteeing that only authorized personnel can access specified regions depending on their legal duties and permissions.

The biometric systems segment is anticipated to grow at a CAGR of 8.0% during the forecast period. Real-time authentication is accessible through biometric technologies, which allow for rapid verification of an individual's identification before authorizing access to restricted locations. Biometric technologies assist businesses in meeting severe security standards and demonstrating compliance with safety protocols in industries. Biometric systems provide a high level of security since they rely on unique physiological or behavioral traits of individuals, such as fingerprints or face features. It makes it highly difficult for unregistered workers to get access using counterfeited credentials.

Regional Insights

North America held a major share of 34.2% of the industrial barrier systems market in 2022. North American countries, such as the U.S. and Canada, have strict safety laws in place across a wide range of businesses. Industrial barrier systems are critical in meeting these safety criteria because they prevent accidents, protect workers, and separate hazardous and non-hazardous regions. With the increased automation of industrial processes, there is a greater requirement to maintain worker safety and prevent illegal access to automated machinery. Industrial barrier systems are an essential component of these safety precautions.

Asia Pacific is anticipated to emerge as the fastest-growing region over the forecast period with a CAGR of 8.7%. The Asia Pacific region has experienced fast industrialization and economic growth, resulting in a greater emphasis on worker safety. The necessity for industrial barrier systems to maintain employee safety and protect assets grows as companies expand. Manufacturing, building, oil and gas, mining, and logistics are among the businesses in the region that may include high-risk activities. Industrial barrier systems are critical in various industries for limiting risks and protecting workers. With rising urbanization and the development of infrastructure in many countries such as China, India, and Japan, there is a greater demand for safety measures on building sites and in public places, which is pushing the use of industrial barrier systems.

Key Companies & Market Share Insights

The key players include Betafence, A-Safe, BOPLAN, Ritehite, Fabenco by Tractel, and Lindsay Corporation. To broaden their product offering, companies utilize various inorganic growth strategies, such as regular mergers acquisitions, and partnerships. In June 2023, Ritehite launched RiteLoad, a new generation dock leveler that featured advanced controlling systems, reinforced construction, and improved design by focusing on enhanced safety measures. The stability and durability are achieved by optimized plateau construction and telescopic lip guidance, which facilitates a ten-year warranty on the construction and steelwork. Some prominent players in the global industrial barrier systems market include:

-

A-Safe

-

BOPLAN

-

Ritehite

-

Fabenco by Tractel

-

Lindsay Corporation

-

Valmont Industries Inc.

-

Barrier1

-

Betafence

-

Gramm Barriers

-

Hill & Smith PLC

-

CAI Safety Systems, Inc.

-

Kirchdorfer Industries

-

Tata Steel

-

Arbus

-

Avon Barrier Corporation Ltd.

Industrial Barrier Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.28 billion

Revenue forecast in 2030

USD 3.6 billion

Growth Rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, andtrends

Segments covered

Type, function, access control device, material, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; and Latin America

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; and South Africa

Key companies profiled

A-Safe; BOPLAN; Ritehite; Fabenco by Tractel; Lindsay Corporation; Valmont Industries Inc.; Barrier1; Betafence; Gramm Barriers; Hill & Smith PLC; CAI Safety Systems, Inc.; Kirchdorfer Industries; Tata Steel; Arbus; and Avon Barrier Corporation Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Barrier Systems Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the industrial barrier systems market report based on type, function, access control device, material, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bollards

-

Safety Fences

-

Safety Gates

-

Guardrails

-

Barriers for Machinery

-

Others

-

-

Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Active Barriers

-

Passive Barriers

-

-

Access Control Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biometric Systems

-

Perimeter Security Systems & Alarms

-

Token & Reader Function

-

Turnstile

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metal

-

Non-metal

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial barrier systems market size was estimated at USD 2.16 billion in 2022 and is expected to reach USD 2.28 billion in 2023.

b. The global industrial barrier systems market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 3.60 billion by 2030.

b. North America held the major share of 34.2% of the industrial barrier systems market in 2022. North American countries, such as the U.S. and Canada, have strict safety laws in place across a wide range of businesses.

b. The key players operating in the industrial barrier systems market include A-Safe, BOPLAN, Ritehite, Fabenco by Tractel, Lindsay Corporation, Valmont Industries Inc., Barrier1, Betafence, Gramm Barriers, Hill & Smith PLC, CAI Safety Systems, Inc., Kirchdorfer Industries, Tata Steel, Arbus, and Avon Barrier Corporation Ltd

b. The industrial barrier systems market growth can be attributed to the ongoing advancements in technologies and their integration into industrial barrier systems offer new possibilities, enhanced functionality, and increased efficiency in ensuring safety, security, and operational excellence.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.