- Home

- »

- Advanced Interior Materials

- »

-

Industrial Couplings Market Size, Industry Report, 2033GVR Report cover

![Industrial Couplings Market Size, Share & Trends Report]()

Industrial Couplings Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Flexible Couplings, Rigid Couplings), By End Use (Manufacturing, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-789-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Couplings Market Summary

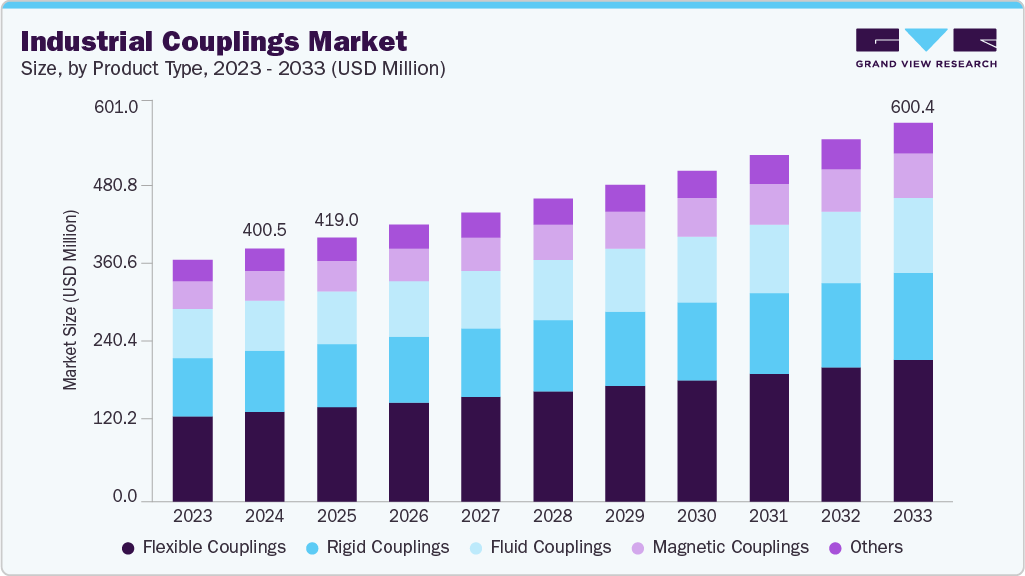

The global industrial couplings market size was estimated at USD 400.5 million in 2024 and is projected to reach USD 600.4 million by 2033, growing at a CAGR of 4.6% from 2025 to 2033. The growth is driven by the rapid expansion of industrial automation and the rising need for efficient power transmission systems across manufacturing facilities.

Key Market Trends & Insights

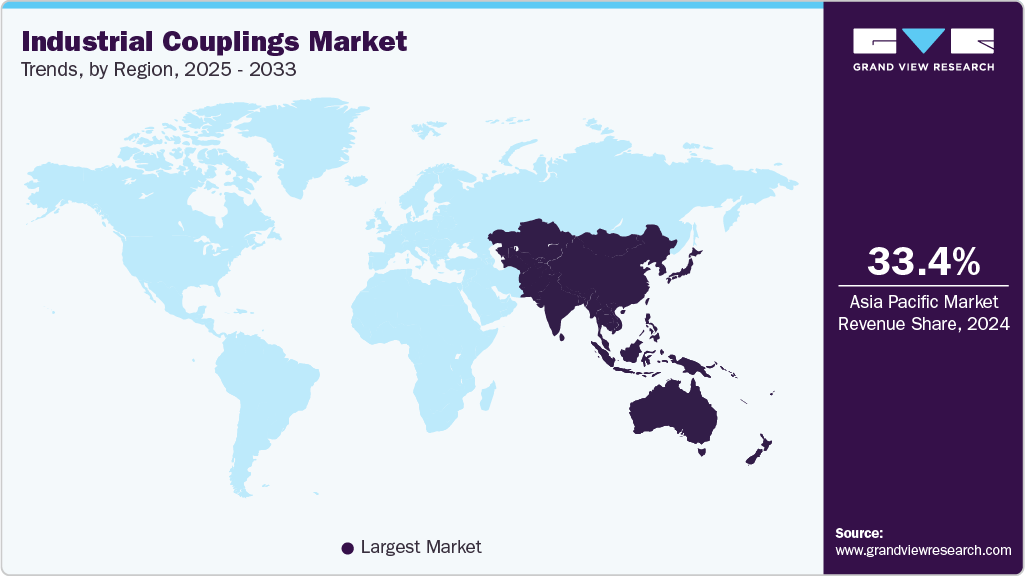

- Asia Pacific dominated the industrial couplings market with the largest revenue share of 33.4% in 2024.

- By product type, the flexible couplings segment is expected to grow at the fastest CAGR of 5.2% from 2025 to 2033.

- By end use, the oil & gas segment is expected to grow at the fastest CAGR of 5.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 400.5 Million

- 2033 Projected Market Size: USD 600.4 Million

- CAGR (2025-2033): 4.6%

- Asia Pacific: Largest Market in 2024

Couplings play a critical role in connecting rotating shafts, minimizing vibration, and enhancing equipment performance in automated systems. The growing adoption of smart factories and Industry 4.0 practices has increased demand for precision-engineered couplings capable of supporting high-speed and high-torque operations. Additionally, the integration of sensor-based monitoring in couplings to improve reliability and predictive maintenance is contributing to the market growth.The growth of the renewable energy and power generation sectors is another key factor propelling the industrial couplings market. Couplings are extensively used in wind turbines, hydroelectric systems, and power transmission networks to ensure efficient torque transfer and operational stability. The global shift toward clean energy generation has encouraged investment in advanced coupling solutions that withstand high mechanical stress and harsh environments. Moreover, ongoing upgrades to existing power infrastructure and the expansion of grid-connected renewable projects are boosting demand for durable and maintenance-free coupling systems.

Increasing infrastructure development and heavy industrial activity across emerging economies are significantly contributing to market expansion. The construction, mining, and oil & gas industries rely heavily on couplings for mechanical flexibility and torque control in pumps, compressors, and conveyors. The growing emphasis on industrial safety and operational efficiency has led to greater adoption of torsionally flexible and fail-safe coupling designs. Furthermore, the rising establishment of manufacturing plants in Asia and the Middle East is generating a consistent demand for customized, high-performance coupling systems tailored for diverse industrial applications.

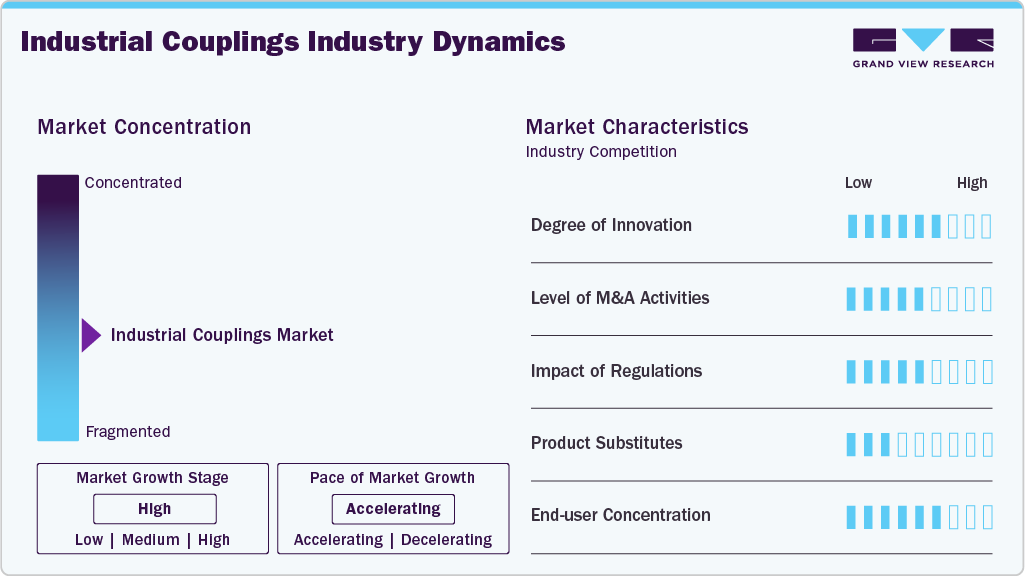

Market Concentration & Characteristics

The global industrial couplings market exhibits a moderate to high degree of innovation, driven by the increasing need for precision, energy efficiency, and reliability in industrial applications. Manufacturers are integrating advanced materials, such as high-strength composites and corrosion-resistant alloys, to improve performance and durability. Technological advancements, including smart monitoring systems and predictive maintenance capabilities, are also redefining product functionality. The market has experienced moderate levels of mergers and acquisitions as leading players aim to strengthen their global presence, diversify product portfolios, and access emerging markets. Strategic alliances between manufacturers and automation technology providers further enhance innovation and competitiveness.

Regulatory standards focusing on safety, environmental compliance, and energy efficiency significantly influence the industrial couplings market. Industry-specific regulations, such as ISO and ANSI certifications, mandate stringent testing and performance benchmarks, shaping design and production processes. The threat of service substitutes remains relatively low, as couplings serve a unique mechanical function that alternative components cannot easily replace. However, advances in direct-drive technologies and maintenance-free systems may pose minor substitution risks in specialized applications. End-user concentration is high in sectors such as manufacturing, oil & gas, power generation, and mining, where equipment reliability and operational continuity are critical. These industries’ demand for robust and adaptable couplings continues to define market dynamics and innovation trajectories.

Product Type Insights

The flexible couplings segment led the industrial couplings industry with the largest revenue share of 35.4% in 2024, driven by the growing demand for high-performance power transmission solutions that accommodate misalignment and reduce vibration in rotating machinery. These couplings are increasingly used in pumps, compressors, and conveyor systems to ensure smooth torque transfer and extended equipment lifespan. The rapid expansion of industrial automation and robotics further amplifies their need, as flexible couplings enhance operational precision and reliability. Manufacturers are focusing on advanced materials and designs to improve load capacity and thermal resistance.

The magnetic couplings segment is expected to grow significantly at a CAGR of 4.9% over the forecast period, driven by the increasing emphasis on contactless torque transmission and leakage-free performance in critical industrial processes. These couplings are gaining traction in the chemical, pharmaceutical, and food industries where contamination prevention and process integrity are crucial. The rising preference for non-mechanical power transfer solutions reduces wear and maintenance costs, enhancing system longevity. Continuous advancements in magnetic materials and permanent magnet technology have significantly improved torque density and efficiency.

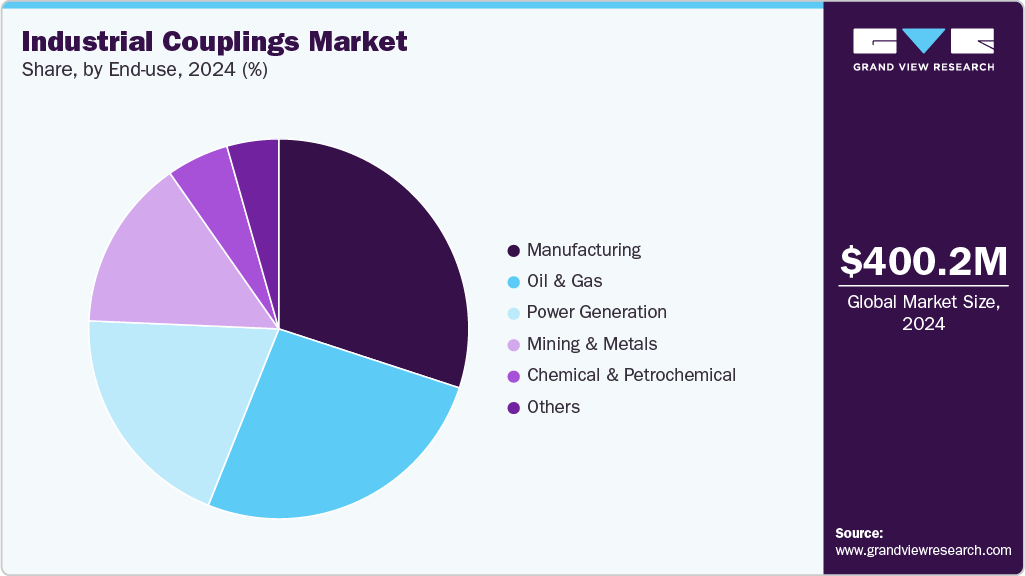

End Use Insights

The manufacturing segment dominated the industrial couplings market with the largest revenue share of 30.9% in 2024, driven by the global push toward higher productivity and energy efficiency across production facilities. Couplings play a crucial role in connecting motors, pumps, and conveyors, ensuring reliable power transmission and minimizing mechanical stress. As factories adopt automated and digitally controlled systems, the need for precision-engineered couplings that can handle dynamic loads and misalignments is increasing. The rise of smart manufacturing and Industry 4.0 initiatives has also spurred demand for couplings with advanced monitoring capabilities.

The oil & gas segment is expected to grow at the fastest CAGR of 5.2% over the forecast period, driven by the critical requirement for durable and corrosion-resistant couplings that can operate under extreme pressure and temperature conditions. Couplings are essential in drilling rigs, compressors, and pipeline systems, where operational safety and efficiency are paramount. The ongoing development of deepwater and unconventional energy projects has heightened demand for advanced coupling technologies capable of withstanding harsh environments. Manufacturers are increasingly investing in high-strength alloys and precision engineering to enhance performance and reduce downtime.

Regional Insights

The Asia Pacific industrial couplings market held the largest revenue share of 33.4% in 2024, experiencing robust growth due to rapid industrialization, urban development, and manufacturing expansion across emerging economies. Increasing investments in heavy industries, power generation, and transportation infrastructure are propelling demand for durable coupling systems. The region’s strong focus on automation and modernization of existing production facilities is also driving adoption. Moreover, government-led initiatives promoting industrial growth and foreign direct investments are strengthening regional production capacities. The availability of cost-effective labor and raw materials further supports the large-scale manufacturing of industrial couplings across countries like India, South Korea, and Japan.

China Industrial Couplings Market Trends

The China industrial couplings market is expected to grow over the forecast period. China remains a dominant force in Asia Pacific, driven by its large-scale industrial manufacturing and continuous infrastructure expansion. The country’s strong focus on upgrading its mechanical and energy sectors fuels demand for high-efficiency coupling systems. Increasing automation in production lines and the rise of electric vehicle manufacturing further stimulate market growth. Domestic manufacturers are investing heavily in precision engineering and adopting international standards to enhance global competitiveness. Additionally, government initiatives promoting smart manufacturing and sustainable industrial practices are fostering innovation and expansion in the coupling sector.

North America Industrial Couplings Market Trends

The North America industrial couplings industry is driven by the widespread adoption of advanced manufacturing technologies and a strong focus on industrial automation. The region’s well-established oil & gas, aerospace, and automotive sectors rely heavily on high-performance coupling systems for precision and reliability. Ongoing investments in smart factories and digitalization initiatives further enhance the demand for technologically advanced couplings. Additionally, increasing emphasis on predictive maintenance and energy-efficient machinery supports the adoption of intelligent coupling solutions. The presence of major global manufacturers and continuous R&D efforts contribute to steady market growth across the region.

In the United States, the industrial couplings industry benefits from a mature industrial base and significant advancements in automation and robotics. The growing need for efficient torque transmission systems across sectors such as manufacturing, energy, and construction is fueling demand. Rising adoption of renewable energy systems, including wind and solar, has also boosted the use of couplings in power generation. Furthermore, a strong government focus on upgrading infrastructure and enhancing industrial productivity is encouraging equipment modernization. U.S. manufacturers are increasingly investing in high-precision, lightweight, and maintenance-free coupling designs to meet diverse application requirements.

Europe Industrial Couplings Market Trends

The Europe industrial couplings industry is characterized by strong technological innovation and a commitment to sustainability and energy efficiency. The region’s mature industrial landscape, particularly in automotive, aerospace, and machinery manufacturing, drives consistent demand for high-quality couplings. Stringent EU regulations on machinery safety and emissions are encouraging the adoption of eco-friendly and efficient mechanical components. Furthermore, increasing integration of automation technologies and IoT-based maintenance systems is enhancing operational reliability. The region’s focus on high-precision engineering and advanced material technologies continues to strengthen its position in the global market.

The Germany industrial couplings market plays a pivotal role in Europe, due to its advanced engineering capabilities and strong industrial heritage. The nation’s thriving automotive, mechanical, and renewable energy sectors drive demand for high-performance coupling systems. Continuous innovation in design, material use, and digital integration enables German manufacturers to produce durable and energy-efficient solutions. Additionally, the country’s focus on Industry 4.0 and smart manufacturing practices supports the growth of intelligent coupling technologies. The strong presence of globally recognized engineering firms further consolidates Germany’s leadership in the European coupling industry.

Latin America Industrial Couplings Market Trends

The Latin America industrial couplings industry is gaining traction with the expansion of manufacturing, mining, and energy production sectors. Countries such as Brazil and Mexico are witnessing increased investment in industrial infrastructure, creating demand for robust and efficient coupling systems. The growing adoption of automation technologies and the development of renewable energy projects are additional growth drivers. Despite economic fluctuations, the rising focus on operational safety and maintenance efficiency is encouraging the use of modern coupling solutions. Furthermore, collaborations with global manufacturers are improving product availability and technology transfer in the region.

Middle East & Africa Industrial Couplings Market Trends

The Middle East & Africa industrial couplings industry is driven by rapid industrialization and the expansion of oil & gas, energy, and construction industries. Large-scale infrastructure projects and investments in petrochemical facilities continue to create strong demand for reliable power transmission components. The adoption of heavy-duty coupling systems in the mining and water treatment sectors is also increasing. Moreover, governments are promoting industrial diversification to reduce dependence on oil, encouraging manufacturing growth. The region’s focus on modernizing production facilities and implementing predictive maintenance solutions further supports steady market advancement.

Key Companies & Market Share Insights

Some of the key players operating in market include SKF Group and Siemens AG.

-

SKF Group, headquartered in Sweden, is a global leader in bearings, seals, and power transmission components, including industrial couplings. The company offers a comprehensive range of flexible, rigid, and fluid couplings designed for heavy-duty applications. SKF’s coupling solutions focus on improving torque transmission efficiency, reducing vibration, and enhancing machinery reliability across manufacturing and energy sectors.

-

Siemens AG, based in Germany, is a leading global technology and industrial automation company. Its industrial coupling products include elastic, gear, and fluid couplings used in various drive systems. Siemens emphasizes precision engineering and digital integration, ensuring optimal performance and reduced mechanical stress in industrial processes.

Rexnord Corporation and Altra Industrial Motion Corp. are some of the emerging participants in the industrial couplings market.

-

Rexnord Corporation, headquartered in the United States, is a prominent provider of power transmission and motion control products. The company’s coupling portfolio includes gear, disc, and elastomeric types designed for demanding applications in mining, manufacturing, and processing industries. Rexnord’s products are engineered for high reliability, minimal maintenance, and superior operational efficiency under challenging conditions.

-

Altra Industrial Motion Corp., based in the U.S., specializes in power transmission and motion control technologies. The company offers a wide variety of couplings, including flexible shaft, grid, and jaw couplings, under its well-known brands such as TB Wood’s and Ameridrives. Altra’s products are designed to deliver superior torque control, misalignment compensation, and mechanical safety in high-performance industrial applications.

Key Industrial Couplings Companies:

The following are the leading companies in the industrial couplings market. These companies collectively hold the largest market share and dictate industry trends.

- SKF Group

- Siemens AG

- Rexnord Corporation

- Altra Industrial Motion Corp.

- Voith GmbH & Co. KGaA

- Tsubakimoto Chain Co.

- John Crane (Smiths Group plc)

- ABB Ltd.

- KTR Systems GmbH

Recent Developments

- In October 2025, Dodge Industrial introduced its StratoLink Disc Couplings, marking a significant expansion of its advanced coupling portfolio. The new product line delivers next-generation performance, combining superior torque transmission with enhanced flexibility and durability. Designed for high-speed and high-torque industrial applications, StratoLink couplings ensure precise alignment and reduced maintenance requirements.

Industrial Couplings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 419.0 million

Revenue forecast in 2033

USD 600.4 million

Growth rate

CAGR of 4.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

SKF Group; Siemens AG; Rexnord Corporation; Altra Industrial Motion Corp.; Voith GmbH & Co. KGaA; Tsubakimoto Chain Co.; John Crane (Smiths Group plc); ABB Ltd.; KTR Systems GmbH

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Couplings Market Report Segmentation

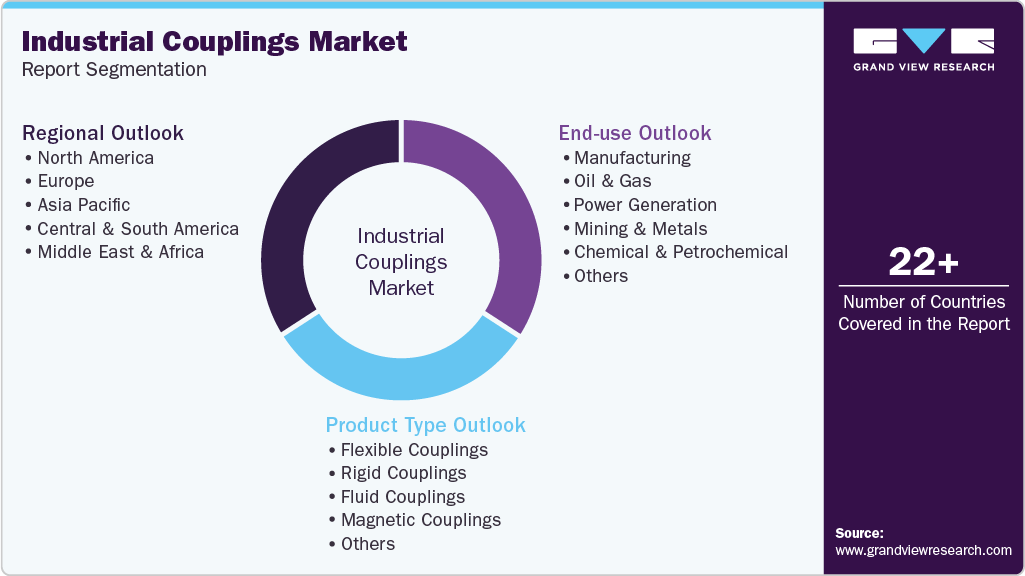

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial couplings market report based on product type, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flexible Couplings

-

Rigid Couplings

-

Fluid Couplings

-

Magnetic Couplings

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Oil & Gas

-

Power Generation

-

Mining & Metals

-

Chemical & Petrochemical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global industrial couplings market size was estimated at USD 400.5 million in 2024 and is expected to reach USD 419.0 million in 2025.

b. The global industrial couplings market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2033 to reach USD 600.4 million by 2033.

b. The manufacturing segment dominated the market and accounted for the largest revenue share of 30.9% in 2024, driven by the global push toward higher productivity and energy efficiency across production facilities.

b. Some of key players in the industrial couplings market include SKF Group, Siemens AG, Rexnord Corporation, Altra Industrial Motion Corp., Voith GmbH & Co. KGaA, Tsubakimoto Chain Co., John Crane (Smiths Group plc), ABB Ltd., and KTR Systems GmbH

b. The key factors driving the industrial couplings market include increasing demand for energy-efficient, low-maintenance tools, technological advancements in motor design, and the rising adoption of cordless solutions across industrial and residential applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.