- Home

- »

- Advanced Interior Materials

- »

-

Industrial Cranes Market Size & Share, Industry Report, 2033GVR Report cover

![Industrial Cranes Market Size, Share & Trends Report]()

Industrial Cranes Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Gantry Cranes, Jib Cranes), By Power Source (ICE, Electric, Hybrid, Pneumatic), By Capacity, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-826-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Cranes Market Summary

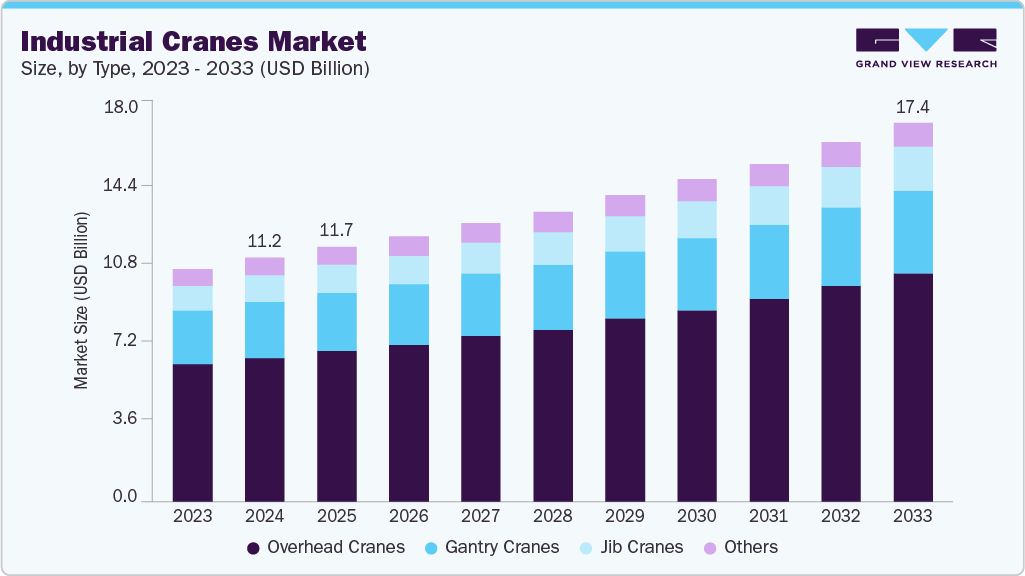

The global industrial cranes market size was estimated at USD 11.19 billion in 2024 and is projected to reach USD 17.38 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market is strongly driven by sustained capital expenditure across manufacturing, metals and mining, automotive, aerospace, power, and logistics sectors.

Key Market Trends & Insights

- Asia Pacific dominated the industrial cranes market, accounting for the largest revenue share of 42.3% in 2024.

- By type, the jib cranes segment is expected to record a CAGR of 5.9% from 2025 to 2033.

- By power source, the electric segment is projected to grow at a CAGR of 6.2% over the forecast period.

- By end use, the automotive & transportation segment is expected to expand at a CAGR of 6.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 11.19 Billion

- 2033 Projected Market Size: USD 17.38 Billion

- CAGR (2025-2033): 5.1%

- Asia Pacific: Largest market in 2024

Expansions in production facilities, modernization of industrial plants, and the rise of automated warehousing continue to generate strong demand for overhead, gantry, and electric cranes. Growing focus on efficiency, safety compliance, and higher material-handling throughput further accelerates crane adoption across these core industrial environments.

Emerging economies, including Southeast Asia, the Middle East, and Africa, offer significant greenfield potential due to expanding industrial parks, logistics hubs, and mega construction projects. The rise of hybrid cranes, autonomous lifting systems, and digital twin solutions also provides long-term revenue prospects for OEMs and service providers.

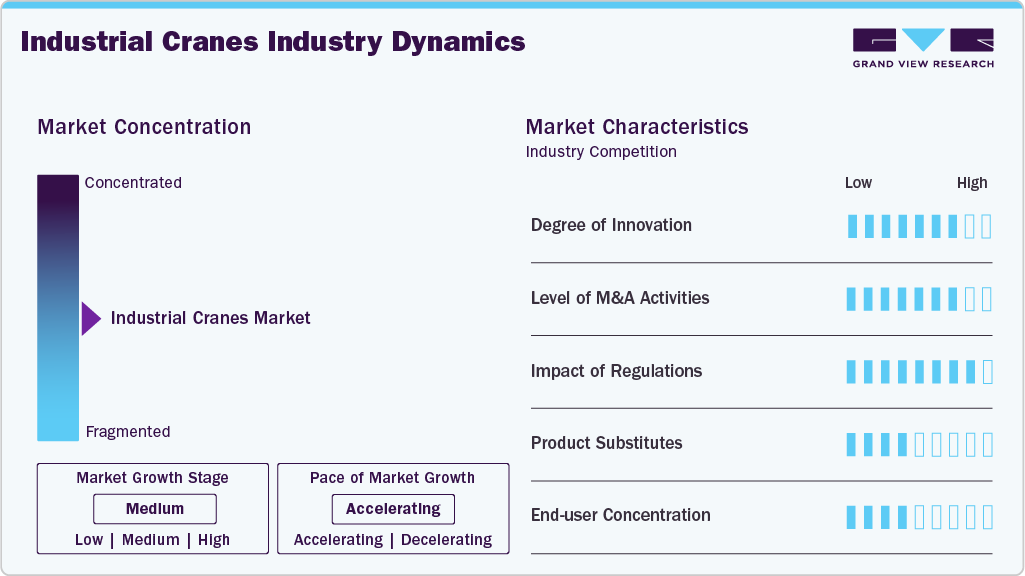

Market Concentration & Characteristics

The industrial cranes industry remains moderately consolidated, with global OEMs such as Konecranes, Liebherr Group, Cargotec, and Tadano holding a significant share of high-capacity and technologically advanced crane categories. These players benefit from deep engineering expertise, broad service networks, and strong portfolios in electrification, automation, and digital control systems. At the same time, the market includes a large base of regional manufacturers, particularly in China, India, and Europe, that maintain strong positions in overhead, gantry, and jib cranes through localized production, competitive pricing, and customization capabilities. This combination keeps competition active across segments, although major OEMs retain an edge in complex lifting systems, long-term service agreements, and integrated industrial material-handling solutions.

Regulations continue to shape crane adoption patterns, especially around emissions, workplace safety, lifting standards, and equipment inspection requirements. Regions with stricter decarbonization mandates are accelerating the shift from diesel-powered cranes to electric and hybrid models in manufacturing plants, logistics facilities, and heavy industrial sites. Occupational safety regulations, structural design codes, and operator certification requirements push demand for cranes equipped with overload protection, anti-sway systems, and enhanced monitoring. Environmental rules aimed at reducing noise, particulate emissions, and energy consumption further strengthen the case for electric and digitally controlled cranes, particularly in indoor or urban industrial environments.

Technology adoption is reshaping the industrial cranes industry as manufacturers integrate IoT connectivity, automation, and advanced diagnostics into lifting equipment. Modern overhead and gantry cranes now incorporate real-time load monitoring, predictive maintenance, anti-collision systems, and remote diagnostics to improve safety and operational continuity. In industrial facilities, smart cranes equipped with synchronized lifting, automated path optimization, and digital twin capabilities are enhancing workflow efficiency. Electrification, hybrid powertrains, improved hydraulics, and energy-recovery systems form another key technological frontier, enabling lower operating costs and supporting compliance with emerging sustainability requirements across industrial sectors.

Drivers, Opportunities & Restraints

The industrial cranes industry is primarily driven by expanding manufacturing output, rising automation in material-handling operations, and increasing investment in heavy industries such as metals, mining, automotive, and power generation. Continued growth in warehousing and logistics, fueled by e-commerce and supply-chain modernization, also boosts demand for efficient lifting solutions. Adoption of electric and hybrid cranes is increasing as industries pursue lower operating costs and stricter energy-efficiency goals. Infrastructure upgrades, safety regulations, and the need for higher load-handling precision further support crane replacement and modernization across key end-use sectors.

The industrial cranes industry is poised for strong growth opportunities driven by the shift toward electrification, automation, and modernization across manufacturing, automotive, mining, power, and logistics sectors. Rising adoption of Industry 4.0 practices is accelerating demand for smart overhead, gantry, and jib cranes equipped with IoT-enabled monitoring, load optimization, and predictive maintenance features. Warehousing and logistics facilities are expanding automation footprints to improve throughput and safety, creating opportunities for electrically powered and hybrid cranes. In addition, increasing investment in metals, mining, and power infrastructure is generating sustained demand for higher-capacity cranes and technologically advanced lifting solutions.

Despite strong structural demand, the market faces constraints related to high capital investment, slow replacement cycles, and operational complexities. Heavy-duty cranes represent substantial upfront costs, limiting adoption among small and mid-sized industrial facilities and creating longer decision cycles for end-users. Electrification of high-capacity cranes remains challenging due to high power requirements and limited battery technology maturity, slowing adoption in mobile and crawler categories. The market is also impacted by fluctuating commodity prices, which influence investment cycles in mining, steel, and oil & gas, which are key end users of industrial cranes.

Type Insights

The overhead cranes segment dominated the market, accounting for 58.9% of total revenue in 2024, driven by the expansion of manufacturing, metal processing, automotive production, and warehousing operations that require efficient indoor material handling. Their ability to move heavy loads safely within fixed facilities supports rising automation and throughput needs, especially as factories modernize and adopt Industry 4.0 systems.

The jib cranes segment is expected to grow at a significant CAGR of 5.9% from 2025 to 2033 in terms of revenue.The growth of the jib cranes segment is supported by their versatility in handling localized, repetitive lifting tasks within manufacturing, automotive, and maintenance environments. Their compact design and ease of installation make them ideal for workstation-level material handling where precision and speed are required. As factories expand automation and assembly-line efficiency, jib cranes are increasingly used to improve ergonomics and reduce manual handling. Growth in small and mid-sized industrial facilities also contributes to steady adoption.

Power Source Insights

The internal combustion engine (ICE) segment dominated the market in 2024, accounting for 43.1% of the total revenue due to its suitability for heavy-duty, high-capacity operations in metals, mining, power, and large manufacturing environments. Their ability to operate in remote or outdoor locations without reliance on external power infrastructure keeps them relevant for rugged industrial workflows. Despite rising interest in cleaner alternatives, ICE cranes continue to dominate applications that require long operating hours, high torque, and uninterrupted lifting performance. Their durability and established support ecosystem further sustain their adoption across traditional heavy industries.

The electric segment is expected to grow at a significant CAGR of 6.2% from 2025 to 2033 in terms of revenue. Electric cranes are gaining momentum as industries prioritize energy efficiency, lower operating costs, and compliance with stricter workplace and emissions regulations. Their quiet operation, reduced maintenance needs, and seamless integration with automated and digital monitoring systems make them increasingly attractive in manufacturing, warehousing, automotive, and logistics facilities. Growth in indoor lifting applications and modernization of factory floors is accelerating the shift toward electric overhead, gantry, and jib cranes. As Industry 4.0 adoption rises, electric cranes are becoming the preferred choice for precision-controlled, sustainable material handling.

Capacity Insights

The 10 to 50 Tons segment dominated the market in 2024, accounting for a 33.8% share of the total revenue due to its suitability for medium-duty lifting tasks across manufacturing, automotive, warehousing, and general industrial operations. This capacity segment offers the ideal balance between versatility and cost efficiency, making it widely adopted for routine material handling, equipment movement, and assembly workflows. As factories modernize and expand, these cranes are increasingly used for process optimization, maintenance activities, and semi-automated lifting applications. Their broad applicability across indoor facilities continues to keep this segment a core volume driver in the market.

The above 100 tons segment is expected to grow at a rapid CAGR of 8.9% from 2025 to 2033 in terms of revenue.Cranes above 100 tons cater to heavy-duty applications in metal production, mining operations, power plants, and large-scale industrial fabrication. Demand is driven by the need to lift oversized equipment, heavy castings, and large structural components that exceed the limits of standard industrial cranes. Although purchased in lower volumes, these cranes carry high strategic importance due to their role in mission-critical operations and major industrial upgrades. Their advanced engineering, enhanced durability, and high load-handling capability make them essential for facilities where extreme lifting requirements are routine.

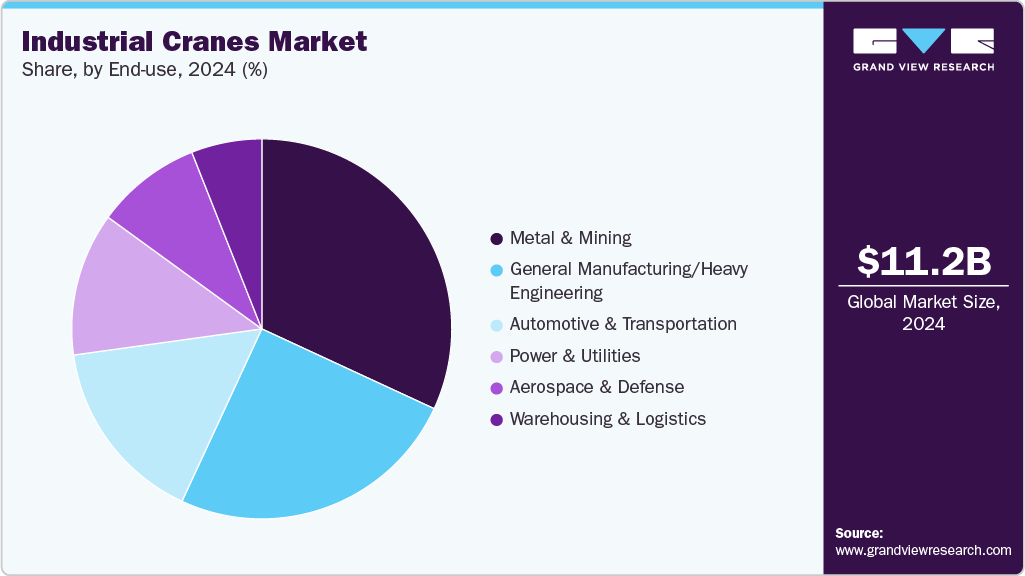

End Use Insights

The metals & mining segment dominated the market in 2024, accounting for 31.9% of the share, fueled by the need for heavy-duty lifting solutions capable of handling molten metal, raw ore, large castings, and maintenance of processing equipment. Overhead and gantry cranes are essential in steel mills, smelters, and mineral processing plants where durability, high load capacity, and heat resistance are critical. Ongoing modernization of metal manufacturing facilities and expansions in mining operations continue to drive crane upgrades and replacements. In addition, the emphasis on operational efficiency and worker safety strengthens the adoption of advanced lifting systems across this sector.

The automotive & transportation end use segment is expected to grow at a CAGR of 6.2% from 2025 to 2033 in terms of revenue.Demand for cranes in the automotive & transportation sector is driven by expanding vehicle production, rising automation on assembly lines, and the need for efficient handling of engines, chassis, and heavy tooling. Overhead and jib cranes play a central role in lifting components within manufacturing plants, while gantry systems support material flow in large fabrication and stamping facilities. Increasing investment in EV manufacturing and battery assembly plants is further boosting the requirement for precise, clean, and automated lifting solutions. Growing throughput expectations and safety standards continue to reinforce crane adoption across automotive production and logistics operations.

Regional Insights

The North America industrial cranes market is growing steadily, supported by federal infrastructure spending, industrial expansion, and strong reshoring activity across the U.S. and Mexico. Demand is driven by crane installations in manufacturing, automotive, metals, mining, and power sectors, particularly as factories modernize and new production facilities come online. Growth in renewable energy projects and grid upgrades also supports demand for higher-capacity cranes. While electrification adoption lags behind Europe, steady capital expenditure cycles ensure moderate, stable expansion through 2033.

U.S. Industrial Cranes Market Trends

The industrial cranes market in the U.S. expands steadily due to large-scale investment through the Infrastructure Investment and Jobs Act (IIJA) and significant upgrades across manufacturing, power, utilities, and transportation equipment industries. Reshoring manufacturing, particularly in semiconductors, EVs, batteries, and heavy equipment, drives the adoption of overhead and gantry cranes in new and expanded plants. Mining and metals processing facilities continue to modernize lifting systems, while renewable energy and grid-strengthening projects sustain demand for high-capacity cranes. Overall, growth is moderate but resilient, supported by long-term industrial investment cycles.

Europe Industrial Cranes Market Trends

The industrial cranes market in Europe is driven by aggressive decarbonization policies that are accelerating the transition from diesel-powered industrial equipment to electric and automated cranes across factories, logistics hubs, and industrial facilities. High infrastructure density and frequent modernization cycles support steady demand for overhead, gantry, and jib cranes in manufacturing, automotive, and metal-processing plants. Despite being a mature market, ongoing investments in advanced warehousing, EV production, and clean-energy projects provide incremental expansion. Stricter safety, emissions, and efficiency standards further drive replacement-led growth, keeping overall momentum stable and consistent.

Germany industrial cranes market maintains strong crane demand due to its advanced manufacturing base, extensive logistics infrastructure, and large automotive and machinery sectors. Industrial facilities continue to adopt electric and automated overhead and gantry cranes to comply with rigorous emissions and workplace safety regulations. Steel, metals, and engineered-products plants are upgrading to IoT-enabled lifting systems that enhance precision and productivity. Renewable energy and power grid modernization projects also support demand for higher-capacity industrial cranes. Growth remains moderate, driven primarily by modernization and digitalization of existing facilities.

The industrial cranes market in the UK grows at a modest pace, largely driven by replacement-led demand in manufacturing, logistics centers, and aerospace and defense facilities. Warehousing expansion, driven by e-commerce and supply-chain upgrades, continues to generate opportunities for overhead and electric gantry crane installations. Power and utility upgrades, along with selective industrial modernization projects, provide additional support for higher-capacity cranes. Industrial CAPEX remains steady but restrained by economic uncertainty, resulting in stable yet slower growth compared to continental Europe.

Asia Pacific Industrial Cranes Market Trends

The industrial cranes market in the Asia Pacific held the largest market share in 2024, accounting for 42.3% of the global revenue share, driven by rapid expansion in manufacturing, automotive production, electronics, metals, and large-scale logistics development. Rising industrial automation and strong investment in EV, battery, and semiconductor plants accelerate demand for overhead, gantry, and electric cranes. Mining activity in Australia and Southeast Asia also supports higher-capacity crane installations.

China industrial cranes market leads regional demand due to its large manufacturing base, extensive metals and mining sectors, and rapid scaling of EV and advanced electronics production. Strong government support for industrial automation is accelerating the adoption of electric and smart overhead cranes in factories and logistics hubs. Modernization of steel mills, heavy engineering plants, and defense-related manufacturing adds further momentum. Growth remains high, sustained by both new project development and steady replacement cycles.

The industrial cranes market in India is driven by expanding automotive production, increasing investments in steel and metal-processing facilities, and the rapid development of warehousing and logistics infrastructure. Adoption of overhead and gantry cranes is rising as factories upgrade material-handling systems to meet quality, safety, and throughput requirements. The government’s push for Make-in-India manufacturing, along with growth in the power and renewable energy sectors, supports continued crane demand. Growth is strong but varies by state-level industrial activity.

Middle East & Africa Industrial Cranes Market Trends

The industrial cranes market in the Middle East grows steadily, supported by investments in metals, mining, power generation, and industrial manufacturing clusters in the UAE and Saudi Arabia. Expanding logistics hubs and modernization of industrial zones drive demand for overhead and electric cranes, while large-scale fabrication and heavy engineering projects support higher-capacity systems. Adoption of automated and electrically powered cranes is increasing in new manufacturing facilities as part of regional industrial diversification strategies. Overall growth is moderate but supported by ongoing industrial expansion.

Saudi Arabia industrial cranes market posts among the fastest global growth rates, driven by massive industrial and construction programs under Vision 2030. Mega-projects such as NEOM, industrial cities, manufacturing zones, and large-scale commercial developments significantly boost demand for cranes across fabrication, logistics, automotive, and large infrastructure sites. Expanding metals and mining operations, along with major refinery and petrochemical upgrades, sustain the need for high-capacity lifting solutions. Growing investment in power, utilities, and industrial diversification keeps Saudi Arabia a key engine of crane demand in the region.

Latin America Industrial Cranes Market Trends

The industrial cranes market in Latin America experiences moderate growth supported by mining activity, metals processing, and selective manufacturing expansion in countries such as Brazil, Chile, and Mexico. Industrial development continues but is tempered by macroeconomic volatility, influencing long-term capital investments. Demand for medium- and high-capacity cranes increases with mining, energy, and heavy industrial projects, while overhead and gantry cranes maintain stable adoption in manufacturing clusters and logistics facilities. Electrification and automation adoption progress slowly, keeping growth steady but below global averages.

Brazil industrial cranes market grows moderately, driven by strong mining operations, steel and metal-processing expansions, and gradual upgrades in manufacturing and logistics infrastructure. Overhead and gantry cranes see consistent adoption in steel mills, automotive plants, pulp & paper, and general industrial facilities. While construction-related demand fluctuates with economic cycles, essential energy and industrial projects support continued crane procurement. Political and economic volatility introduces uncertainty, keeping long-term growth positive but modest.

Key Industrial Cranes Company Insights

Some of the key players operating in the market include Konecranes and SANY Group.

-

Konecranes is a global manufacturer of industrial lifting equipment with a strong presence in ports, manufacturing, logistics, and process industries. The company offers a wide range of overhead, gantry, and port cranes, along with advanced automation and electrification solutions. Konecranes has a strong service portfolio and digital technologies, including condition monitoring and remote diagnostics. Its focus on electric RTGs, automated RMGs, and smart factory cranes positions it as a key player in crane modernization. The firm maintains a high share in Europe and Asia through consistent innovation and lifecycle services.

-

SANY Group is one of the world’s largest construction machinery manufacturers and a dominant crane supplier in China, with a fast-growing international presence. Its crane portfolio spans mobile, crawler, tower, and truck-mounted cranes, widely used across construction, energy, and industrial projects. SANY benefits from large-scale domestic infrastructure spending and competitive pricing supported by high-volume manufacturing. The company continues to expand globally through localized production and distribution networks. Strong growth in APAC, the Middle East, and Africa is driven by SANY’s focus on heavy-lift cranes and rapid technology upgrades.

Key Industrial Cranes Companies:

The following are the leading companies in the industrial cranes market. These companies collectively hold the largest Market share and dictate industry trends.

- Konecranes

- Liebherr Group

- SANY Group

- XCMG Group

- Tadano Ltd

- The Manitowoc Company, Inc

- Zoomlion Heavy Industry Science & Technology Co. Ltd

- Hiab Corporation

- Palfinger

- ElectroMech

- Anupam Industries Limited

- Street Crane Company Limited

- GH Cranes & Components

- Action Construction Equipment Ltd

- Raimondi

Recent Developments

-

In January 2025, Tadano Ltd. completed the acquisition of IHI Transport Machinery’s transportation system business, which was transferred through the newly formed subsidiary IUK Crane Ltd., soon to be renamed Tadano Infrastructure Solutions Ltd. This move enhances Tadano’s capabilities as a full-range lifting solutions provider and supports its Mid-Term Management Plan. The acquired portfolio, backed by more than five decades of engineering experience in jib climbing, offshore, wind power, and bulk-handling cranes, broadens Tadano’s offerings and complements its established crawler crane range.

-

In August 2024, Konecranes unveiled its new X-series industrial crane, positioned as the successor to the long-running CXT line and designed to set a new benchmark in connected, upgradeable lifting solutions. The crane features a compact structure, a redesigned hoisting motor, improved components for higher efficiency, and a low-headroom S-series hoist using durable synthetic rope. A key feature is its wireless upgrade capability, allowing customers to add Smart Features and receive software updates remotely, reducing downtime and improving flexibility.

Industrial Cranes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.67 billion

Revenue forecast in 2033

USD 17.38 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, power source, capacity, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Konecranes; Liebherr Group; SANY Group; XCMG Group; Tadano Ltd; The Manitowoc Company Inc.; Zoomlion Heavy Industry Science & Technology Co. Ltd.; Hiab Corporation; Palfinger; ElectroMech; Anupam Industries Limited; Street Crane Company Limited; GH Cranes & Components; Action Construction Equipment Ltd.; Raimondi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Cranes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial cranes market report based on type, power source, capacity, end use, and region:

-

Type Outlook (Revenue; USD Billion, 2021 - 2033)

-

Overhead Cranes

-

Gantry Cranes

-

Jib Cranes

-

Others

-

-

Power Source Outlook (Revenue; USD Billion, 2021 - 2033)

-

Internal Combustion Engine (ICE)

-

Electric

-

Hybrid

-

Pneumatic

-

-

Capacity Outlook (Revenue; USD Billion, 2021 - 2033)

-

Below 10 Tons

-

10 to 50 Tons

-

51 to 100 Tons

-

Above 100 Tons

-

-

End Use Outlook (Revenue; USD Billion, 2021 - 2033)

-

Metal & Mining

-

General Manufacturing / Heavy Engineering

-

Automotive & Transportation

-

Power & Utilities

-

Aerospace & Defense

-

Warehousing & Logistics

-

-

Regional Outlook (Revenue; USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial crane market size was estimated at USD 11.19 billion in 2024 and is expected to reach USD 11.67 billion in 2025.

b. The global industrial crane market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 17.38 billion by 2033.

b. The market in Asia Pacific dominated the global revenue share accounting for 42.3% driven by large-scale infrastructure projects, and accelerating industrialization in China, India, and Southeast Asia. Strong manufacturing growth and major investments in logistics, renewable energy, and construction make it the fastest-growing regional market for industrial cranes.

b. Some of the key players operating in the additive manufacturing equipment market include Konecranes, Liebherr Group, SANY Group, XCMG Group, Tadano Ltd, The Manitowoc Company Inc, Zoomlion Heavy Industry Science & Technology Co. Ltd, Hiab Corporation, Palfinger, ElectroMech, Anupam Industries Limited, Street Crane Company Limited, GH Cranes & Components, Action Construction Equipment Ltd, Raimondi.

b. The industrial crane market is driven by rising automation and modernization across manufacturing, automotive, metals, mining, and logistics facilities, which require efficient and precise material-handling systems. Growing investments in industrial expansion, safety compliance, and the transition toward electric and digitally enabled cranes further boost demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.