- Home

- »

- Disinfectants & Preservatives

- »

-

Industrial And Institutional Cleaning Chemicals Market Report, 2030GVR Report cover

![Industrial And Institutional Cleaning Chemicals Market Size, Share & Trends Report]()

Industrial And Institutional Cleaning Chemicals Market Size, Share & Trends Analysis Report By Raw Material (Chlor-alkali, Surfactants), By Product (General Purpose Cleaners, Disinfectants and Sanitizers), By End-Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-649-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

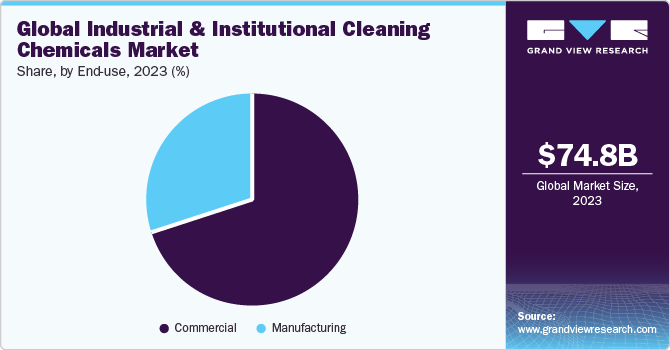

The global industrial and institutional cleaning chemicals market size was estimated at USD 74.81 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. Growing utilization of industrial & institutional cleaning chemicals in the healthcare and cleaning chemicals industries is driving market growth. The recent occurrence of the pandemic has raised safety and hygiene concerns, which have led to an increase in the consumption of cleaning chemicals globally and fueled the growth of the market. In addition, the manufacturers are venturing into the production of sustainable and environment-friendly cleaning solutions. This is a step toward sustainable development of the industry. This segment has a lot of untapped potential as people are choosing environment-friendly products to reduce their carbon footprint and coexist without the use of chemicals that cause damage to the environment.

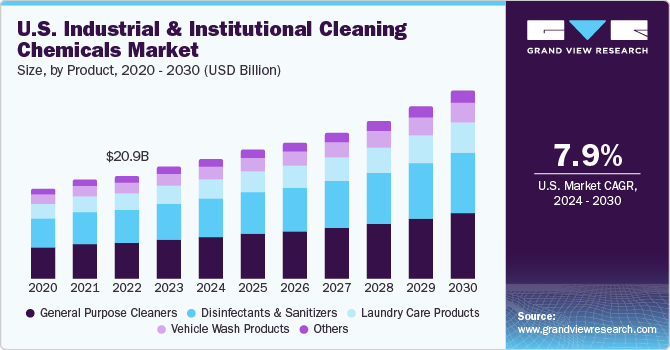

One of the largest markets for industrial and institutional cleaning chemicals is the U.S. The huge number of industries and manufacturing units and healthcare and maintenance of public spaces are accountable for the high demand for cleaners, disinfectants, and sanitizers across the country. The manufacturers in the country are involved in research and development for innovations and expanding their product portfolios.

The increasing awareness among the people and precautions taken to reduce the spread of the pandemic are major factors influencing the market. People are becoming more cautious in choosing the product and are inclined towards using environment-friendly products, which are accumulating high demand for organic and environment-friendly, and plant-based cleaning chemicals, especially in countries like the U.S.

The use of chemical cleaners is promoted by regulating authorities to maintain hygiene standards in the manufacturing units of different industries, especially in the food and healthcare sectors. In addition, the use of disinfectants and sanitizers is being promoted by the WHO amid the use of cleaners, which has also helped stop the spread of viruses.

Market Dynamics

Healthcare-associated infections in Canada are still a major problem, resulting in the need for development of various strategies to avoid related contaminations with medical devices. Consequently, the Canadian Nosocomial Infection Surveillance Program (CNISP) has surveyed to address the problems and collect hospital-wise data. There were 687,000 healthcare-associated infections in the U.S. acute care hospitals. Approximately, 72,000 hospital patients with healthcare-associated infections died during their hospitalizations. However, the national and state governments are trying their best to reduce the occurrence of HAIs by escalating the utilization of surface disinfectants and submitting different regulatory guidelines. The rising hygiene standards in the healthcare sector are positively impacting the demand for the industrial and institutional cleaning chemicals industry.

Moreover, according to the American Chemical Society, chemists working on bio-based chemicals are addressing global environmental issues and the socioeconomically unsustainable dependence of manufacturers on petroleum, which is a key feedstock for a wide array of products. The development of renewable feedstock derived from plant sources using catalytic chemistry is critical to achieving sustainability. Consumer consciousness toward the sustainability of the chemical ingredients used to manufacture consumer goods has increased. Thus, leading to a rise in the demand for bio-based cleaning products, positively impacting the market growth.

Raw Material Insights

Major raw materials used in the production of I&I cleaning chemicals include chlor-alkali, surfactants, solvents, and phosphates among others. Major feedstock used for the derivation of cleaning chemicals are petrochemicals; however, the emergence of bioethanol based on agricultural waste material, corn or sugarcane, lately has altered the market trend toward bio-based raw materials. The surfactants segment dominated the market with a revenue share of more than 29% in 2023. This high share is attributable to the extensive use of surfactants for the production of fabric softeners, herbicides, lubricants, anti-fogging liquids, inks, shaving creams, emulsifiers, and adhesives, among others.

The chemical properties of surfactants make them suitable for utilization in the manufacturing of many products. The antimicrobial properties of surfactants make them desirable to be used in cleaning products. The surfactant-based products have high efficiency, are highly demanded globally, and are likely to exhibit a high growth rate over the forecast period.

Another popular raw material segment that is among the top is the solvent segment. It is another widely utilized raw material for the production of chemical cleaners. Solvency for oils & greases, compatibility with water, and biodegradable properties make it an ideal raw material for the production of chemical cleaners, which can be utilized in diverse industries.

The biodegradable nature of solvent-based cleaning chemicals makes them more suitable as it minimizes the environmental damage and pollution caused by the cleaning chemicals. The high demand for the solvent segment from different industries has boosted the global industrial and institutional cleaning chemicals industry as it contributes significantly to the growth and revenue of the global market.

End-use Insights

The commercial segment dominated the market with a revenue share of more than 69% in 2023. Its high share is attributable to increasing commercial use of the product in various sectors, such as food service, healthcare, and others. The demand for various cleaning chemicals is obstinate across these businesses.

Retail stores, departmental stores, various public institutions such as colleges, recreational spaces, courts, and more demand all-purpose cleaners and a variety of disinfectants and sanitizing products. The rising demand for the commercial end-use segment significantly affects the market. This increase in demand, especially from the food service and healthcare segments, which have to follow stringent hygiene standards, requires considerate utilization of industry and institutional cleaning chemicals to maintain the required standards, boosting the overall market growth.

The other complementing segment is the manufacturing end-use segment, which does contribute significantly to the global revenue share. The manufacturing segment consists of the food & beverage processing sector, electronic component manufacturing sector, and metal fabrication industry, which serves the global construction, automotive, and packaging sectors, among others, and more.

The expanding demand from the diverse sector has reciprocated into the express expansion of the market on a global scale. The production standards defined by various regulatory institutions also promote the use of cleaning chemicals in the manufacturing industries, which contribute to the expansion of the market and better penetration.

Product Insights

General-purpose cleaner’s product segment dominated the market with a revenue share of over 34% in 2023. Its high share is attributable to its utilization in removing hard soil stains, greasy stains, hard-floor surfaces, and more, which makes them popular among the masses. The segment is expected to incur a moderate growth rate over the forecast period.

The general-purpose cleaners segment has a wide product portfolio customized for varied consumer demands. The products are utilized for cleaning in households, factories, public spaces, and institutions, among others. The extensive utilization of general-purpose cleaners is accountable for its high demand globally.

The integral product segment, disinfectants, and sanitizers, is utilized thoroughly in the cleaning industry solutions. The products can be utilized for cleaning surfaces and aid in making surfaces free of microbes, bacteria, and spores, among others, which can harm humans. Furthermore, since the onset of the pandemic, the demand for disinfectants and sanitizers has increased multiple folds. This is due to an increase in demand for sanitization, high hygiene standards, and prevention activities to prevent the spread of the virus. All these factors fuel the growth of the disinfectants and sanitizers product segment globally.

Regional Insights

North America dominated the market with a revenue share of over 33% in 2023. This is attributed to the growing consumption owing to the ongoing pandemic and increased demand from various industries for their manufacturing units. North America is a well-established market and is a manufacturing hub for many industries, propelling the high demand for industrial & institutional cleaning chemicals products.

The growing number of manufacturing facilities in the U.S. is anticipated to boost the demand for cleaning chemicals used in maintaining the workspace and warehouses. This will have a positive impact on the regional demand for industrial and institutional chemicals, boosting global market revenues.

Second in line in terms of market revenue share is the Asia Pacific region. The market in the Asia Pacific region is growing rapidly owing to the spread of pandemic and growing manufacturing industries in the region. Rapidly rising new business arrangements through the region are likely to reflect heavy growth opportunities for industrial and institutional cleaning chemicals manufacturers in the region to serve the regional market space.

The whole Asia Pacific region is undergoing prompt development. Macroeconomic factors such as a large population, growing healthcare facilities and industrial manufacturing output, and raw material availability at cost-effective rates are likely to drive the industrial and institutional cleaning chemicals industry in the region.

Key Companies & Market Share Insights

The competition in this market is high as the players involved in the market invest heavily in research and development to expand their product portfolios and gain an edge over the other players by patenting innovations in the market. The market is greatly concentrated with the presence of major multinational players, such as BASF SE, Procter & Gamble, Reckitt-Benckiser, Dow, 3M, and Henkel AG & Co. KGaA.

These players are involved in continuous innovation to increase the user base of the cleaning chemicals and target greater market growth in the future along with developing a cost-effective and efficient technological innovation for producing industrial & institutional cleaning chemicals. The companies are also continuously engaged in acquisitions and mergers to acquire new markets and enlarge their customer base globally. Innovation is the key factor for maintaining customers globally. For example, in February 2020, Procter & Gamble launched Microban-24, a disinfectant that could kill 99% of flu and cold viruses. This product alone has cashed in 200 million USD sales till mid-November that year.

Key Industrial And Institutional Cleaning Chemicals Companies:

- Procter & Gamble

- BASF SE

- Clariant

- The Clorox Company, Inc.

- Henkel AG & Co. KGaA

- 3M

- Kimberly-Clark Corporation

- Reckitt Benckiser Group plc

- Croda International PLC

- Albemarle Corporation

- Eastman Chemical Corporation

- Huntsman International LLC

- STEPAN Company

- Westlake Chemicals Corporation

- SOLVAY

- Dow

- Sasol

Industrial And Institutional Cleaning Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 80.05 billion

Revenue forecast in 2030

USD 128.0 billion

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw materials, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Procter & Gamble; BASF SE; Clariant; The Clorox Company, Inc.; Henkel AG & Co. KGaA; 3M; Kimberly-Clark Corporation; Reckitt Benckiser Group plc; Croda International PLC; Albemarle Corporation; Eastman Chemical Corporation; Huntsman International LLC; Stepan Company; Westlake Chemicals Corporation; SOLVAY; Dow; Sasol

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial And Institutional Cleaning Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial and institutional cleaning chemicals market report based on raw material, product, end-use, and region:

-

Raw Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Chlor-alkali

-

Caustic Soda

-

Soda Ash

-

Chlorine

-

-

Surfactant

-

Nonionic

-

Anionic

-

Cationic

-

Amphoteric

-

-

Solvents

-

Alcohols

-

Hydrocarbons

-

Chlorinated

-

Ethers

-

Others

-

-

Phosphates

-

Biocides

-

Others

-

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

General Purpose Cleaners

-

Disinfectants And Sanitizers

-

Laundry Care Products

-

Vehicle Wash Products

-

Others

-

-

End-Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Commercial

-

Food Service

-

Retail

-

Healthcare

-

Laundry Care

-

Institutional Buildings

-

Others

-

-

Manufacturing

-

Food & Beverage Processing

-

Metal Manufacturing & Fabrication

-

Electronic Components

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial and institutional cleaning chemicals market size was estimated at USD 74.81 billion in 2023 and is expected to reach USD 80.5 billion in 2024.

b. The global industrial and institutional cleaning chemicals market is expected to grow at a compound annual growth rate of 8.0% from 2024 to 2030 to reach USD 128.0 billion by 2030.

b. North America dominated the industrial and institutional cleaning chemicals market with a share of 33.6% in 2023. This is attributable to growing awareness pertaining to workplace hygiene along with increasing product demand from the food processing sector.

b. Some key players operating in the industrial and institutional cleaning chemicals market include Procter & Gamble, The Clorox Company, Henkel AG & Co. KGaA, BASF SE, Clariant, 3M, Kimberly-Clark Corporation, Reckitt Benckiser Group PLC.

b. Key factors that are driving the industrial and institutional cleaning chemicals market growth include growing public awareness in developing regions pertaining to hygiene, stringent environmental & safety regulations, and growing product consumption from the healthcare sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."