- Home

- »

- Next Generation Technologies

- »

-

Industrial Internet of Things Market Size & Share Report, 2030GVR Report cover

![Industrial Internet of Things Market Size, Share & Trends Report]()

Industrial Internet of Things Market Size, Share & Trends Analysis Report By Component, By End-use, By Software, By Connectivity Technology, By Device & Technology, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-803-9

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Industrial Internet of Things Market Trends

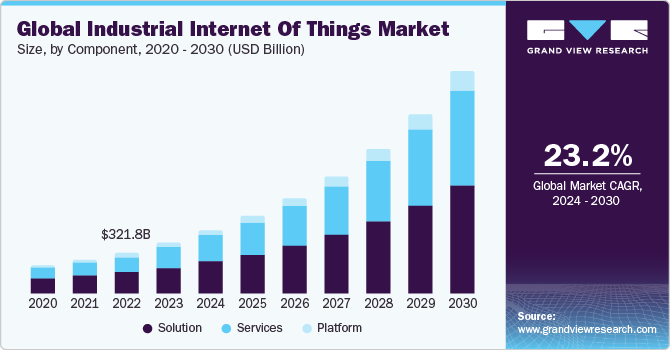

The global industrial internet of things market size was valued at USD 394.0 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 23.2% from 2024 to 2030. The increasing availability of affordable processors and sensors that can provide real-time access to information along with advancements in technology are expected to drive the growth. Moreover, the growing need to improve operational competence along with considerable collaboration between the key companies is further fueling the market’s growth. Several techniques are also being developed to create a united digital-human workforce, which is projected to provide significant growth opportunities.

Additionally, the significant advantages associated with the industrial internet of things such as automated quality assurance monitoring, large-scale profit margins through improvement in power efficiency, productivity improvement, and efficiency of the manufacturing industry, among others are anticipated to drive the market growth further.

Moreover, IIoT has the potential and capabilities to support industries in reducing operating costs, assuring worker safety, and increasing throughput. By offering measurable outcomes apart from selling solutions, companies are progressively building new product and service hybrids to strengthen their position and generate new revenue streams. This, in turn, is anticipated to boost market growth over the forecast period.

The IIoT market is witnessing a constant rise in the adoption of IoT, owing to the presence of numerous factors such as technological advancements in wireless network technologies, and strong penetration of Wi-Fi connectivity for machine sensors in factories. Furthermore, growth in the development of smart cities along with smart transportation leads to increased adoption of IoT, which is expected to propel the growth of the industrial internet of things industry in the coming years.

Moreover, the technology is aiding organizations to use sophisticated analytics and methodologies like Machine Learning (ML) and Artificial Intelligence (AI) to deliver prescriptive and predictive analytical solutions, paving the way for the sector to take advantage of new opportunities. The continuous learning process associated with ML and AI without any interruptions and downtime make it a more demanding tool in the IIoT market, which in turn is driving the market growth over the forecast period.

Industrial IoT is increasingly adopting edge computing due to its next-generation capabilities, such as its ability to offer IoT devices independence for analysis and data management. The architecture of edge computing enables instant response time as data processing occurs with reduced latency, which helps in noticing immediate and sudden changes in power flows that helps engineers engage in better decision-making. This architecture of edge computing is projected to create huge demand during the forecast period and is expected to drive the market growth further.

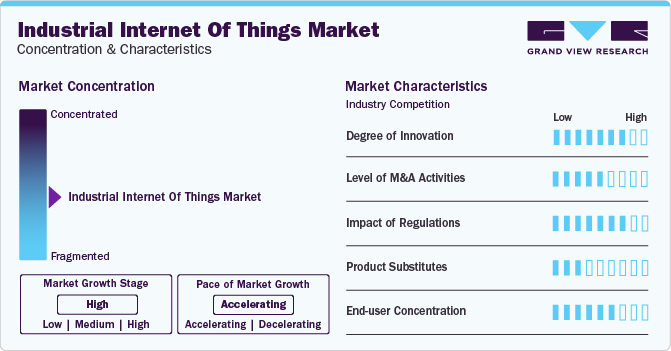

Industry Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The Industrial Internet of Things (IIoT) market is characterized by a high degree of innovation, owing to the increasing availability of affordable processors and sensors that can process real-time data and help companies make informed decisions.

The IIoT market is also characterized by a high level of merger and acquisition (M&A) activities by the leading market companies. The industry participants are expanding their portfolios by investing in product research & development and incorporating the latest technologies, which increases market growth.

The IIoT market is also subject to increasing regulatory scrutiny. This is due to concerns related to data protection, cybersecurity regulations, and environmental regulations, among others. Some regions have laws and regulations governing the localization and sovereignty of data. These regulations could have a significant impact on the IIoT market, affecting the development and adoption of the technology.

The IIoT is a distinctive and developing technology and there are a limited number of substitutes. However, other technologies such as Industry 4.0, SCADA (Supervisory Control and Data Acquisition), and edge computing serve similar purposes or address specific aspects of industrial IoT. These mediums can be used as an alternative to IIoT, but they typically address specific aspects of industrial connectivity, automation, and data analysis.

End-user concentration is a significant factor in the IIoT market, as a number of industry verticals are adopting various IIoT solutions. The rising demand for IIoT solutions, including remote monitoring, data management, and analytics, among others, creates opportunities for companies that focus on evolving IIoT solutions for these industries.

Component Insights

The solution segment accounted for the largest revenue share of over 50% in 2023 and is expected to dominate the market over the forecast period. Solution providers are putting a strong emphasis on the launch of innovative information systems for various sectors and industrial verticals as part of their efforts to grow their market share.

The service segment is projected to grow at the highest CAGR of over 24% from 2024 to 2030. The growth is attributed to a significant rise in the number of connected devices, which produce an enormous amount of data. In addition, IIoT applications rely on centralized cloud services to manage data flow and overall processes associated with the industry. Edge computing is also anticipated to change the industry by providing real-time analytical solutions and mechanisms for decentralizing storage and transactions across the network.

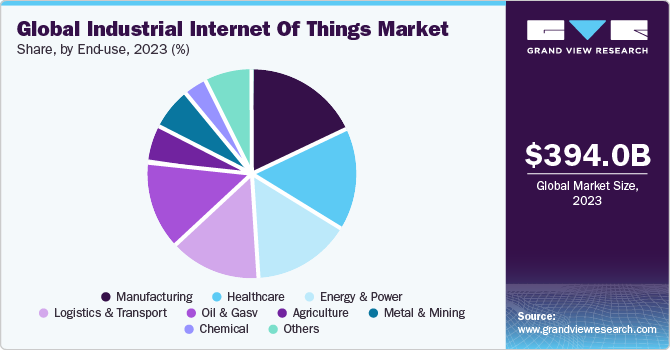

End-Use Insights

The manufacturing segment accounted for the largest market share in 2023 and is predicted to lead the market over the forecast period. With the introduction of Industry 4.0, IIoT is gaining popularity in discrete manufacturing as well as process manufacturing as it offers several possibilities to optimize operations, decrease downtime, increase efficiency, and aid in making data-driven decisions, which increases profit margins and lowers cost with fast returns on IoT adoption. Additionally, manufacturing industries are leveraging digital manufacturing technologies quickly and the implementation of IoT plays a significant role in these advanced technologies, which is expected to boost the market growth.

The logistics & transport segment is anticipated to grow at the highest CAGR from 2024 to 2030. This growth is attributed to the significant emphasis logistics placed by transportation companies on enhancing asset management. As a result, it leads to the implementation of smart transportation.

Modern alternatives like Bluetooth Low Energy (BLE) tags are also gaining popularity. These types of technologies possibly help in tracking data in more confined, smaller regions along with enhancing operational management, which is expected to fuel the market growth further.

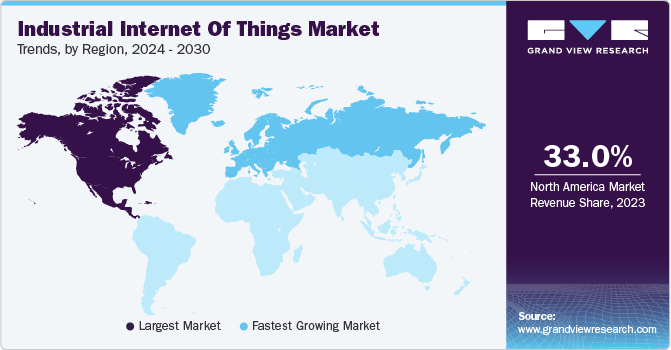

Regional Insights

North America accounted for the largest market share of over 33% in 2023 and is expected to retain its dominance during the forecast period. This is attributed to the early adoption and implementation of industrial IoT technology across the region. Moreover, strong government support for promoting digitalization across the industrial sector, an increase in the usage of industrial IoT devices, and increasing adoption of innovative technologies like cloud computing and AI is expected to drive the market growth during the forecast period.

U.S. Industrial Internet of Things Market Trends

The U.S. industrial internet of things market is expected to grow at a CAGR of over 18% from 2024 to 2030, driven by a strong technology infrastructure, widespread adoption of advanced manufacturing processes, and a focus on improving operational efficiency and competitiveness.

Europe Industrial Internet of Things Trends

Europe industrial internet of things market is expected to witness a CAGR of nearly 23% from 2024 to 2030. The growing need for virtualized environment along with AI, ML, cloud, analytics, security, digitization, connected device, and networking is expected to drive the adoption of IIoT in the European region. European countries witness a wide scale application of health-specific individual wellness, including wearable heart rate, blood pressure and glucose level monitors, and telehealth systems, which exchange medical data between medical professionals, sites, and patients. The surge in adoption of IIoT in other sectors such as retail and government are expected to contribute to regional growth.

U.K. industrial internet of things market accounted for nearly 22% revenue share of the European market in 2023. The UK's IIoT market is expanding due to a robust manufacturing sector, government initiatives supporting Industry 4.0, and a push towards digital transformation to enhance productivity and innovation.

Industrial internet of things market in Germany is expected to witness a CAGR of around 21% from 2024 to 2030. As a manufacturing powerhouse, Germany benefits from Industry 4.0 initiatives, a highly skilled workforce, and a tradition of engineering excellence. These factors contribute to the rapid growth of IIoT in the country.

France industrial internet of things market is expected to witness high growth from 2024 to 2030. France is witnessing growth in IIoT due to its emphasis on smart manufacturing, investments in research and development, and initiatives promoting the integration of digital technologies into industrial processes.

Asia Pacific Industrial Internet of Things Trends

The Asia Pacific region is expected to grow at a highest CAGR of over 26% from 2024 to 2030. The popularity of advanced factory automation systems is rising across the region, especially in China and Japan. The South Korea industrial internet of things (IIoT) market size is growing exponentially following the technological adoptions such as 5G and industry 4.0 along with smart factory trends in the country. Manufacturing industries in the region are starting to recognize the benefits of using robot arm technology. Prominent countries in the region are also investing heavily in industry 4.0 as they want to be independent in terms of production and manufacturing. This, in turn, is expected to fuel the industrial internet of things market growth across the region.

China industrial internet of things market is expected to witness a CAGR of over 24% from 2024 to 2030. China's IIoT market is booming due to its status as a global manufacturing hub, significant government support, and a drive towards technological advancement and automation to enhance competitiveness.

The Japan industrial internet of things market is expected to witness a significant CAGR of over 26% from 2024 to 2030. With a strong industrial base and a focus on innovation, Japan's IIoT growth is fueled by initiatives such as Society 5.0, which aims to integrate cutting-edge technologies into various industries for sustainable development.

Industrial internet of things market in India is expected to grow at an exponential growth rate from 2024 to 2030. India is experiencing IIoT growth owing to a burgeoning manufacturing sector, government initiatives like 'Make in India,' and an increasing focus on adopting digital technologies for operational efficiency and cost-effectiveness.

Middle East and Africa (MEA) Industrial Internet of Things Trends

Middle East and Africa (MEA) industrial internet of things market is expected to witness a considerable CAGR of over 25% from 2024 to 2030. Businesses across the Middle East & Africa are looking to expand their returns on huge asset investments with a precise analysis of their data and information. Several mining companies are optimizing their operations in real-time by connecting several plants to all others and their mine. The governments in these regions are also boosting the implementation of industrial IoT, which is expected to drive the regional markets in the coming years.

Saudi Arabia industrial internet of things market is expanding due to efforts to diversify the economy, investments in smart infrastructure, and a focus on digital transformation as part of the Vision 2030 initiative.

Key Industrial Internet of Things (IIoT) Companies:

The following are the leading companies in the industrial internet of things Market. These companies collectively hold the largest market share and dictate industry trends.- ABB Ltd.

- ARM Holding Plc

- Atmel Corporation

- Cisco Systems, Inc.

- General Electric Company (GE)

- Honeywell International Inc.

- Intel Corporation

- International Business Machines (IBM) Corporation

- Microsoft Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

Recent Developments

-

In July 2023, Honeywell acquired SCADAfence, a company that specializes in providing cybersecurity solutions for monitoring extensive operational technology (OT) Internet of Things (IoT) networks. This strategic move aligns with Honeywell’s emphasis on digitalization, sustainability, and OT cyber security SaaS solutions.

-

In February 2023, Cisco launched new cloud services within its IoT Operations Dashboard. This launch aims to enhance visibility into industrial assets, offering secure management capabilities from any location. The new cloud services also facilitate a seamless transition for Industrial Internet of Things (IoT) customers towards cloud automation, specifically catering to Operational Technology (OT) teams.

-

In March 2022, Intel Corporation launched the 12th generation Intel Core processors to get extreme business performance. The company has launched this in industrial IoT to increase the business class experience.

-

In February 2022, Ericsson AB launched IoT Accelerator Connect, to offer easier connectivity in IoT with plug-and-play access to cellular IoT connectivity. It helps in instant onboarding and connecting devices to simplify and increase the successful application of enterprise IoT projects. and connecting devices to simplify and increase the successful application of enterprise IoT projects.

Industrial Internet of Things (IIoT) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 394.0 billion

Revenue forecast in 2030

USD 1,693.30 billion

Growth rate

CAGR of 23.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component; end-use; software; connectivity technology; device & technology; region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; BENELUX; NORDICS; China; Japan; India; South Korea; Australia; Mexico; Brazil; Chile; Peru

Key companies profiled

ABB Ltd.; ARM Holding Plc; Atmel Corporation; Cisco Systems, Inc.; General Electric Company (GE); International Business Machines (IBM) Corporation; Intel Corporation; Rockwell Automation, Inc.; Siemens AG; Microsoft Corporation; Schneider Electric SE; Honeywell International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Internet of Things Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial internet of things (IIoT) market report based on component,software,connectivity technology, end-use, and region:

-

Component Outlook (Revenue, USD Million; 2018 - 2030)

-

Hardware

-

Solution

-

Remote Monitoring

-

Data Management

-

Analytics

-

Security Solutions

-

Others

-

-

Services

-

Professional

-

Managed

-

-

Platform

-

Connectivity Management

-

Application Management

-

Device Management

-

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aviation

-

Metal & Mining

-

Chemical

-

Manufacturing

-

Energy & Power

-

Smart Grids

-

Oil & Gas

-

Healthcare

-

Logistics & Transport

-

Intelligent Signaling System

-

Video Analytics

-

Incident Detection System

-

Route Scheduling Guidance System

-

-

Agriculture

-

Precision Farming

-

Livestock Monitoring

-

Smart Greenhouses

-

Fish Farming

-

-

Retail

-

Point of Sales

-

Interactive Kiosks

-

Self-Checkout Systems

-

-

Others

-

-

Software Outlook (Revenue, USD Million, 2018 - 2030)

-

Product Lifecycle Management

-

Manufacturing Execution Systems

-

SCADA

-

Outage Management Systems

-

Distribution Management Systems

-

Remote Patent Monitoring

-

Retail Management Software

-

Visualization Software

-

Transit Management Systems

-

Farm Management Systems

-

-

Connectivity Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired Technology

-

Ethernet

-

Modbus

-

Profinet

-

CC-Link

-

-

Foundation Fieldbus

-

-

Wireless Technology

-

Wi-Fi

-

Bluetooth

-

Cellular Technologies

-

4G/LTE

-

5G

-

-

Satellite Technologies

-

-

-

Device and Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sensors

-

Radio Frequency Identification (RFID)

-

Industrial Robotics

-

Distributed Control Systems

-

Condition Monitoring

-

Smart Meters

-

Electronic Shelf Labels

-

Cameras

-

Smart Beacons

-

Interface Boards

-

Yield Monitors

-

Guidance & Steering

-

GPS/GNSS

-

Flow & Application Control Devices

-

Networking Technology

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

BENELUX

-

NORDICS

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Chile

-

Peru

-

-

South Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial internet of things market size was estimated at USD 321.81 billion in 2022 and is expected to reach USD 394.00 billion in 2023.

b. The global industrial internet of things market is expected to grow at a compound annual growth rate of 23.2% from 2023 to 2030 to reach USD 1,693.30 billion by 2030.

b. North America dominated the industrial internet of things market with a share of around 32% in 2022. This is attributed to the early adoption and implementation of industrial IoT technology across the region. The region was also an early adopter of IIoT and has evolved into an innovation hotspot.

b. Some key players operating in the industrial internet of things market include ABB; ARM Holding Plc; Atmel Corporation; Cisco Systems, Inc.; General Electric Company (GE); International Business Machines Corporation (IBM); Intel Corporation; Rockwell Automation, Inc.; Siemens AG; Microsoft Corporation and many others.

b. Key factors that are driving the industrial internet of things market growth include rising demand for a connected supply chain, which enables operational efficacy, flexibility, and conformance to regulations, and increasing availability of affordable sensors and processors that can provide real-time access to information.

Table of Contents

Chapter 1. Industrial Internet of Things Market Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Information analysis

1.3.2. Market formulation & data visualization

1.3.3. Data validation & publishing

1.4. 1.4 Research Scope and Assumptions

1.4.1. List to Data Sources

Chapter 2. Industrial Internet of Things Market Executive Summary

2.1. Industrial Internet of Things (IIoT) Market Snapshot

2.2. Industrial Internet of Things (IIoT) Market - Segment Snapshot (1/2)

2.3. Industrial Internet of Things (IIoT) Market - Segment Snapshot (2/2)

2.4. Industrial Internet of Things (IIoT) Market - Competitive Landscape Snapshot

Chapter 3. Industrial Internet of Things Market Industrial Internet of Things (IIoT) Market - Industry Outlook

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.4. Industry Analysis Tools

3.4.1. Porter’s analysis

3.4.2. Macroeconomic analysis

3.5. Impact of COVID-19 on Industrial Internet of Things (IIoT) Industry

Chapter 4. Industrial Internet of Things (IIoT) Market: Component Estimates & Trend Analysis

4.1. Component Movement Analysis & Market Share, 2023 & 2030

4.2. Industrial Internet of Things (IIoT) Market Estimates & Forecast, By Component (USD Million)

4.2.1. Hardware

4.2.2. Solution

4.2.2.1. Remote Monitoring

4.2.2.2. Data Management

4.2.2.3. Analytics

4.2.2.4. Security Solutions

4.2.2.5. Others

4.2.3. Services

4.2.3.1. Professional

4.2.3.2. Managed

4.2.4. Platform

4.2.4.1. Connectivity Management

4.2.4.2. Application Management

4.2.4.3. Device Management

Chapter 5. Industrial Internet of Things (IIoT) Market: End-Use Estimates & Trend Analysis

5.1. End-Use Movement Analysis & Market Share, 2023 & 2030

5.1.1. Industrial Internet of Things (IIoT) Market Estimates & Forecast, By End-Use (USD Million)

5.1.2. Aviation

5.1.3. Metal & Mining

5.1.4. Chemical

5.1.5. Manufacturing

5.1.6. Energy & Power

5.1.7. Smart Grids

5.1.8. Oil & Gas

5.1.9. Healthcare

5.1.10. Logistics & Transport

5.1.10.1. Intelligent Signaling System

5.1.10.2. Video Analytics

5.1.10.3. Incident Detection System

5.1.10.4. Route Scheduling Guidance System

5.1.11. Agriculture

5.1.11.1. Precision Farming

5.1.11.2. Livestock Monitoring

5.1.11.3. Smart Greenhouses

5.1.11.4. Fish Farming

5.1.12. Retail

5.1.12.1. Point of Sales

5.1.12.2. Interactive Kiosks

5.1.12.3. Self-Checkout Systems

5.1.12.4. Others

Chapter 6. Industrial Internet of Things (IIoT) Market: Software Estimates & Trend Analysis

6.1. Software Movement Analysis & Market Share, 2023 & 2030

6.2. Industrial Internet of Things (IIoT) Market Estimates & Forecast, By Software (USD Million)

6.2.1. Product Lifecycle Management

6.2.2. Manufacturing Execution Systems

6.2.3. SCADA

6.2.4. Outage Management Systems

6.2.5. Distribution Management Systems

6.2.6. Remote Patent Monitoring

6.2.7. Retail Management Software

6.2.8. Visualization Software

6.2.9. Transit Management Systems

6.2.10. Farm Management Systems

Chapter 7. Industrial Internet of Things (IIoT) Market: Connectivity Technology Estimates & Trend Analysis

7.1. Connectivity Technology Movement Analysis & Market Share, 2023 & 2030

7.2. Industrial Internet of Things (IIoT) Market Estimates & Forecast, By Connectivity Technology (USD Million)

7.2.1. Wired Technology

7.2.1.1. Ethernet

7.2.1.1.1. Modbus

7.2.1.1.2. Profinet

7.2.1.1.3. CC-Link

7.2.1.2. Foundation Fieldbus

7.2.2. Wireless Technology

7.2.2.1. Wi-Fi

7.2.2.2. Bluetooth

7.2.2.3. Cellular Technologies

7.2.2.3.1. 4G/LTE

7.2.2.3.2. 5G

7.2.2.4. Satellite Technologies

Chapter 8. Industrial Internet of Things (IIoT) Market: Device and Technology Estimates & Trend Analysis

8.1. Device and Technology Movement Analysis & Market Share, 2023 & 2030

8.2. Industrial Internet of Things (IIoT) Market Estimates & Forecast, By Device and Technology (USD Million)

8.2.1. Sensors

8.2.2. Radio Frequency Identification (RFID)

8.2.3. Industrial Robotics

8.2.4. Distributed Control Systems

8.2.5. Condition Monitoring

8.2.6. Smart Meters

8.2.7. Electronic Shelf Labels

8.2.8. Cameras

8.2.9. Smart Beacons

8.2.10. Interface Boards

8.2.11. Yield Monitors

8.2.12. Guidance & Steering

8.2.13. GPS/GNSS

8.2.14. Flow & Application Control Devices

8.2.15. Networking Technology

Chapter 9. Regional Estimates & Trend Analysis

9.1. Industrial Internet of Things (IIoT) Market by Region, 2023 & 2030

9.2. North America

9.2.1. North America Industrial Internet of Things (IIoT) Market Estimates & Forecasts, 2018 - 2030 (USD Million)

9.2.2. U.S.

9.2.3. Canada

9.3. Europe

9.3.1. Europe Industrial Internet of Things (IIoT) Market Estimates & Forecasts, 2018 - 2030 (USD Million)

9.3.2. U.K.

9.3.3. Germany

9.3.4. France

9.3.5. Italy

9.3.6. Spain

9.3.7. BENELUX

9.3.8. NORDICS

9.4. Asia Pacific

9.4.1. Asia Pacific Industrial Internet of Things (IIoT) Market Estimates & Forecasts, 2018 - 2030 (USD Million)

9.4.2. China

9.4.3. Japan

9.4.4. India

9.4.5. South Korea

9.4.6. Australia

9.5. South America

9.5.1. South America Industrial Internet of Things (IIoT) Market Estimates & Forecasts, 2018 - 2030 (USD Million)

9.5.2. Brazil

9.5.3. Mexico

9.5.4. Chile

9.5.5. Peru

9.6. Middle East & Africa (MEA)

9.6.1. MEA Industrial Internet of Things (IIoT) Market Estimates & Forecasts, 2018 - 2030 (USD Million)

9.6.2. UAE

9.6.3. Saudi Arabia

9.6.4. South Africa

Chapter 10. Industrial Internet of Things (IIoT) Market - Competitive Landscape

10.1. Recent Developments & Impact Analysis, By Key Market Participants

10.2. Company Categorization

10.3. Participant’s Overview

10.4. Financial Performance

10.5. Product Benchmarking

10.6. Company Market Share Analysis, 2023

10.7. Company Heat Map Analysis

10.8. Strategy Mapping

10.8.1. Expansion/Divestiture

10.8.2. Collaborations/Partnerships

10.8.3. New Product Launches

10.8.4. Contract

10.9. Company Profiles

10.9.1. ABB Ltd.

10.9.1.1. Participant’s Overview

10.9.1.2. Financial Performance

10.9.1.3. Product Benchmarking

10.9.1.4. Recent Developments

10.9.2. ARM Holdings Plc

10.9.2.1. Participant’s Overview

10.9.2.2. Financial Performance

10.9.2.3. Product Benchmarking

10.9.2.4. Recent Developments

10.9.3. Atmel Corporation

10.9.3.1. Participant’s Overview

10.9.3.2. Financial Performance

10.9.3.3. Product Benchmarking

10.9.3.4. Recent Developments

10.9.4. Cisco Systems Inc.

10.9.4.1. Participant’s Overview

10.9.4.2. Financial Performance

10.9.4.3. Product Benchmarking

10.9.4.4. Recent Developments

10.9.5. General Electric Company (GE)

10.9.5.1. Participant’s Overview

10.9.5.2. Financial Performance

10.9.5.3. Product Benchmarking

10.9.5.4. Recent Developments

10.9.6. Honeywell International Inc.

10.9.6.1. Participant’s Overview

10.9.6.2. Financial Performance

10.9.6.3. Product Benchmarking

10.9.6.4. Recent Developments

10.9.7. International Business Machine (IBM) Corporation

10.9.7.1. Participant’s Overview

10.9.7.2. Financial Performance

10.9.7.3. Product Benchmarking

10.9.7.4. Recent Developments

10.9.8. Intel Corporation

10.9.8.1. Participant’s Overview

10.9.8.2. Financial Performance

10.9.8.3. Product Benchmarking

10.9.8.4. Recent Developments

10.9.9. Microsoft Corporation

10.9.9.1. Participant’s Overview

10.9.9.2. Financial Performance

10.9.9.3. Product Benchmarking

10.9.9.4. Recent Developments

10.9.10. Rockwell Automation Inc.

10.9.10.1. Participant’s Overview

10.9.10.2. Financial Performance

10.9.10.3. Product Benchmarking

10.9.10.4. Recent Developments

10.9.11. Schneider Electric SE

10.9.11.1. Participant’s Overview

10.9.11.2. Financial Performance

10.9.11.3. Product Benchmarking

10.9.11.4. Recent Developments

10.9.12. Siemens AG

10.9.12.1. Participant’s Overview

10.9.12.2. Financial Performance

10.9.12.3. Product Benchmarking

10.9.12.4. Recent Developments

List of Tables

Table 1 Industrial Internet of Things (IIoT) Market 2018 - 2030 (USD Million)

Table 2 Global Industrial Internet of Things (IIoT) Market Estimates and Forecasts by Region, 2018 - 2030 (USD Million)

Table 3 Global Industrial Internet of Things (IIoT) Market Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

Table 4 Global Industrial Internet of Things (IIoT) Market Estimates and Forecasts by End-Use, 2018 - 2030 (USD Million)

Table 5 Global Industrial Internet of Things (IIoT) Market Estimates and Forecasts by Software, 2018 - 2030 (USD Million)

Table 6 Global Industrial Internet of Things (IIoT) Market Estimates and Forecasts by Connectivity Technology, 2018 - 2030 (USD Million)

Table 7 Global Industrial Internet of Things (IIoT) Market Estimates and Forecasts by Device & Technology, 2018 - 2030 (USD Million)

Table 8 Company heat map analysis

Table 9 Key companies undergoing expansion

Table 10 Key companies involved in mergers & acquisitions

Table 11 Key companies involved in collaborations

Table 12 Key companies new product launches

Table 13 Key companies research & development

List of Figures

Fig. 1 Industrial Internet of Things (IIoT) Market Segmentation

Fig. 2 Industrial Internet of Things (IIoT) Landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/2)

Fig. 9 Segment Snapshot (2/2)

Fig. 10 Competitive Landscape Snapshot

Fig. 11 Industrial Internet of Things (IIoT) - Market Size and Growth Prospects (USD Million)

Fig. 12 Industrial Internet of Things (IIoT) Market: Industry Value Chain Analysis

Fig. 13 Industrial Internet of Things (IIoT) Market: Market Dynamics

Fig. 14 Industrial Internet of Things (IIoT) Mareket: PORTER's Analysis

Fig. 15 Industrial Internet of Things (IIoT) Marekt: PESTEL Analysis

Fig. 16 Industrial Internet of Things (IIoT) Market Share by Component: Key Takeaway

Fig. 17 Industrial Internet of Things (IIoT) Market, by Component: Market Share, 2023 & 2030

Fig. 18 Hardware Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 19 Solution Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 20 Services Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 21 Platform Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 22 Industrial Internet of Things (IIoT) Market Share by End-Use: Key Takeaway

Fig. 23 Industrial Internet of Things (IIoT) Market, by End-Use: Market Share, 2023 & 2030

Fig. 24 Aviation Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 25 Metal & Mining Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 26 Chemical Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 27 Manufacturing Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 28 Energy & Power Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 29 Smart Grids Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 30 Oil & Gas Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 31 Healthcare Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 32 Logistics & Transport Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 33 Agriculture Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 34 Retail Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 35 Industrial Internet of Things (IIoT) Market Share by Software: Key Takeaway

Fig. 36 Industrial Internet of Things (IIoT) Market, by Software: Market Share, 2023 & 2030

Fig. 37 Product Lifecycle Management Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 38 Manufacturing Execution Systems Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 39 SCADA Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 40 Outage Management Systems Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 41 Distribution Management System Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 42 Remote Patent Monitoring Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 43 Retail Management Software Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 44 Visualization Software Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 45 Transit Management Systems Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 46 Farm Management System Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 47 Industrial Internet of Things (IIoT) Market Share by Connectivity Technology: Key Takeaway

Fig. 48 Industrial Internet of Things (IIoT) Market, by Connectivity Technology: Market Share, 2023 & 2030

Fig. 49 Wired Technology Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 50 Wireless Technology Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 51 Industrial Internet of Things (IIoT) Market Share by Device & Technology: Key Takeaway

Fig. 52 Industrial Internet of Things (IIoT) Market, by Device & Technology: Market Share, 2023 & 2030

Fig. 53 Sensors Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 54 Radio Frequency Identification (RFID) Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 55 Industrial Robotics Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 56 Distributed Control Systems Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 57 Condition Monitoring Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 58 Smart Meters Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 59 Electronic Shelf Labels Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 60 Cameras Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 61 Smart Beacons Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 62 Interface Boards Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 63 Yield Monitors Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 64 Guidance & Steering Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 65 GPS/GNSS Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 66 Flow & Application Control Device Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 67 Network Technology Market Estimates & Forcasts, 2018 - 2030 (Revenue, USD Million)

Fig. 68 Industrial Internet of Things (IIoT) Market Revenue, by Region, 2023 & 2030 (USD Million)

Fig. 69 Regional Marketplace: Key Takeaways

Fig. 70 Regional Marketplace: Key Takeaways

Fig. 71 North America Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 72 U.S. Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 73 Canada Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 74 Europe Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 75 Germany Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 76 U.K. Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 77 France Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 78 Italy Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 79 Spain Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 80 BENELUX Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 81 NORDICS Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 82 Asia Pacific Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 83 China Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 84 Japan Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 85 India Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 86 South Korea Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 87 Australia Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 88 Latin America Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 89 Brazil Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 90 Mexico Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 91 Chile Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 92 Peru Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 93 Middle East and Africa Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 94 UAE Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 95 Saudi Arabia Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 96 South Africa Industrial Internet of Things (IIoT) Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Fig. 97 Key Company Categorization

Fig. 98 Company Market Positioning

Fig. 99 Key Company Market Share Analysis, 2023

Fig. 100 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Industrial Internet of Things (IIoT) Component Outlook (Revenue, USD Million; 2018 - 2030)

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- Industrial Internet of Things (IIoT) End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- Industrial Internet of Things (IIoT) Software Outlook (Revenue, USD Million; 2018 - 2030)

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- Industrial Internet of Things (IIoT) Connectivity Technology Outlook (Revenue, USD Million; 2018 - 2030)

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- Industrial Internet of Things (IIoT) Device & Technology Outlook (Revenue, USD Million; 2018 - 2030)

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- Industrial Internet of Things (IIoT) Regional Outlook (Revenue, USD Million; 2018 - 2030)

- North America

- North America Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- North America Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- North America Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- North America Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- North America Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- U.S.

- U.S. Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- U.S. Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- U.S. Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- U.S. Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- U.S. Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- U.S. Industrial Internet of Things (IIoT) Market, By Component

- Canada

- Canada Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- Canada Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- Canada Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- Canada Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- Canada Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- Canada Industrial Internet of Things (IIoT) Market, By Component

- North America Industrial Internet of Things (IIoT) Market, By Component

- Europe

- Europe Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- Europe Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- Europe Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- Europe Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- Europe Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- Germany

- Germany Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- Germany Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- Germany Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- Germany Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- Germany Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- Germany Industrial Internet of Things (IIoT) Market, By Component

- U.K.

- U.K. Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- U.K. Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- U.K. Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- U.K. Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- U.K. Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- U.K. Industrial Internet of Things (IIoT) Market, By Component

- France

- France Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- France Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- France Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- France Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- France Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- France Industrial Internet of Things (IIoT) Market, By Component

- Italy

- Italy Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- Italy Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- Italy Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- Italy Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- Italy Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- Italy Industrial Internet of Things (IIoT) Market, By Component

- Spain

- Spain Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- Spain Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- Spain Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- Spain Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- Spain Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- Spain Industrial Internet of Things (IIoT) Market, By Component

- BENELUX

- BENELUX Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- BENELUX Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- BENELUX Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- BENELUX Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- BENELUX Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- BENELUX Industrial Internet of Things (IIoT) Market, By Component

- NORDICS

- NORDICS Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- NORDICS Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- NORDICS Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- NORDICS Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- NORDICS Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- NORDICS Industrial Internet of Things (IIoT) Market, By Component

- Europe Industrial Internet of Things (IIoT) Market, By Component

- Asia Pacific

- Asia Pacific Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- Asia Pacific Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- Asia Pacific Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- Asia Pacific Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- Asia Pacific Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- China

- China Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- China Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- China Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- China Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- China Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- China Industrial Internet of Things (IIoT) Market, By Component

- Japan

- Japan Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- Japan Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- Japan Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software

- Visualization Software

- Transit Management Systems

- Farm Management Systems

- Japan Industrial Internet of Things (IIoT) Market, By Connectivity Technology

- Wired Technology

- Ethernet

- Modbus

- Profinet

- CC-Link

- Foundation Fieldbus

- Ethernet

- Wireless Technology

- Wi-Fi

- Bluetooth

- Cellular Technologies

- 4G/LTE

- 5G

- Satellite Technologies

- Wired Technology

- Japan Industrial Internet of Things (IIoT) Market, By Device & Technology

- Sensors

- Radio Frequency Identification (RFID)

- Industrial Robotics

- Distributed Control Systems

- Condition Monitoring

- Smart Meters

- Electronic Shelf Labels

- Cameras

- Smart Beacons

- Interface Boards

- Yield Monitors

- Guidance & Steering

- GPS/GNSS

- Flow & Application Control Devices

- Networking Technology

- Japan Industrial Internet of Things (IIoT) Market, By Component

- India

- India Industrial Internet of Things (IIoT) Market, By Component

- Hardware

- Solution

- Remote Monitoring

- Data Management

- Analytics

- Security Solutions

- Others

- Services

- Professional

- Managed

- Platform

- Connectivity Management

- Application Management

- Device Management

- India Industrial Internet of Things (IIoT) Market, By End-Use

- Aviation

- Metal & Mining

- Chemical

- Manufacturing

- Energy & Power

- Smart Grids

- Oil & Gas

- Healthcare

- Logistics & Transport

- Intelligent Signaling System

- Video Analytics

- Incident Detection System

- Route Scheduling Guidance System

- Agriculture

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Fish Farming

- Retail

- Point of Sales

- Interactive Kiosks

- Self-Checkout Systems

- Others

- India Industrial Internet of Things (IIoT) Market, By Software

- Product Lifecycle Management

- Manufacturing Execution Systems

- SCADA

- Outage Management Systems

- Distribution Management Systems

- Remote Patent Monitoring

- Retail Management Software