- Home

- »

- Biotechnology

- »

-

Industrial Microbiology Market Size & Share Report, 2030GVR Report cover

![Industrial Microbiology Market Size, Share & Trends Report]()

Industrial Microbiology Market Size, Share & Trends Analysis Report By Product (Equipment And Systems, Reaction Consumables), By Test Type (Sterility Testing), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-013-8

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

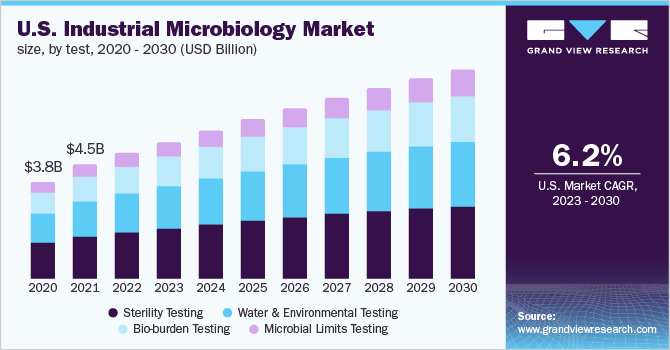

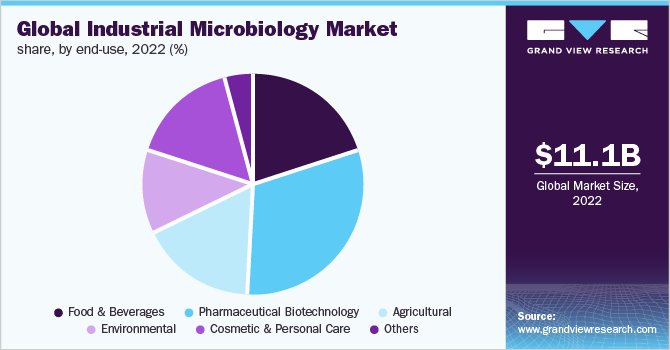

The global industrial microbiology market size was valued at USD 11.12 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. The growing requirement for microbial testing and quality assurance in multiple industries are expected to be the key growth determinants of the market. The advancements in the field of industrial microbiology have been led by the growth of applied microbiology. Wherein the knowledge of microorganisms is used to create industrial products with high yields.

With increasing attention to quality standards for products, numerous industries have initiated the use of microbiological testing techniques. The stringent testing requirements by regulatory bodies to ensure the integrity and quality control of the product are anticipated to surge the industrial microbiology market size in the ensuing years. For instance, in August 2020, U.S-FDA issued a manual for pharmaceutical microbiology. The document serves as a technical guideline for performing microbiological inspections of biotechnology, medical devices, and drug manufacturers. The purpose of the manual is to offer a standardized framework for techniques, knowledge, tools, and quality standards to assess the efficacy and safety of medical products in testing labs.

Moreover, the understanding of molecular biology along with genetic technologies has posed a positive impact on microbiological applications for the development of novel diagnostics methods. The COVID-19 pandemic has also strengthened industry growth. For instance, in April 2021, published research by professionals from Universitat Pompeu Fabra, Universitat de Barcelona, and Hospital Clínic reviewed the microbiological diagnostic technique for COVID-19. Similarly, the American Society for Microbiology established a verification process to assist labs in effective and efficient verification for commercial COVID-19 molecular tests.

Additionally, increasing drug exports and imports has compelled manufacturers to follow pharmacopeia that is accepted by regions. Considering that sterility testing is a significant part of pharmacopeia, increasing exports and imports is likely to impact the demand for sterility testing. Other than Japanese Pharmacopeia, European Pharmacopeia, and the United States Pharmacopeia, British Pharmacopeia is highly accepted by 54 commonwealth countries. While India and China have different Pharmacopeia.

Similarly, increasing strategic initiatives by companies in the market are anticipated to accelerate innovation in product offering thus increasing the regional footprint. For instance, in November 2022, ADM announced its expansion in North America by opening a microbiology lab at the manufacturing site in Decatur, IL. The expansion doubles the company’s microbiology lab footprint and significantly increases the testing capabilities for industrial food processing. Furthermore, the facility is expected to offer testing services to 26 manufacturing sites of the company.

Product Insights

The reaction consumables in industrial microbiology are revenue-generating segments with the largest market share of 54.2% in 2022. The industrial microbiology testing consumables are not applicable for substitution and require regular operations. During COVID-19, the segment witnessed unprecedented demand, further disrupting the supply chain. Hence, various regions encouraged the players to increase the domestic production of consumables to reduce the reliance on imports. Increasing production of consumables in the emerging market is anticipated to accelerate the competitiveness of the segment in industrial microbiology testing.

The exponential growth of the equipment and system segment is likely to attract players from similar or related markets, this will enable them to maintain synergy amongst the resources and maximize profits. For instance, in November 2022, IDEXX announced the acquisition of Tecta-PDS, Canada based company that integrated automation and water microbiology testing. The acquisition is expected to give IDEXX access to automated instruments. Hence, increasing adoption of industrial microbiology testing in multiple applications is expected to result in a rise in demand for equipment and instruments.

Test Insights

The increasing importance of sterility testing in biopharmaceutical manufacturing is anticipated to support the growth of industrial microbiology. According to India Pharmacopeia, British Pharmacopeia, and United States Pharmacopeia, the sterility test is employed on medical products, drugs, and preparations to be sterile and ensure compel with the regulations. Along with that, each component and raw material employed for manufacturing a drug is required to pass the sterility test. Hence, the volume of drug manufacturing is directly proportional to the use of sterility testing in pharma and biopharma applications.

Microbial limit testing is witnessing increasing adoption in industrial microbiology for raw materials testing. International Organization for Standardization (ISO) has also issued guidelines for the use of microbiological limits testing in nutraceutical and cosmetic industries. Hence, increasing scrutiny of quality and efficacy within the cosmetics industry, along with rising monitoring by regulatory bodies is expected to support the growth of the market.

End-use Insights

The pharmaceutical biotechnology segment is one of the major key revenue generators of the industrial microbiology market, accounting for USD 3,485.9 million in 2022. In the pharmaceutical & biotechnology industries, quality is to be maintained throughout the manufacturing process. These standards are maintained via different methods, one such method is the environmental monitoring process which determines the quality and sterility of the controlled production environment. For instance, in November 2022, SAE announced that the 11th Annual Conference on Pharmaceutical Microbiology is to be held in January 2023 to explore the automated process, regulations, and technologies in microbiology. The conference also highlights the integration of sequencing technology with microbiology. Hence, innovation by the players is anticipated to boost the market.

Furthermore, the food & beverage industry is estimated to have significant growth during the forecasted period. Since the end-users heavily rely on industrial microbiology testing techniques to eliminate any possible pathogens and toxins in the products and protect the customer from ingestion of microbes. For instance, in the U.S., 20 states prohibit the direct sales of raw milk to consumers. Hence, it is mandatory for the players in the food and beverage field to underpass the products for safety tests.

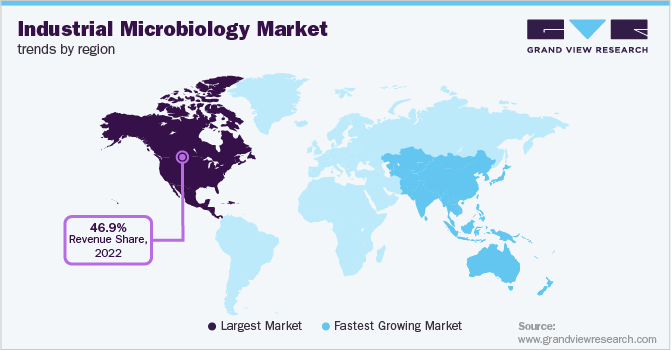

Regional Insights

North America is observed to dominate the industrial microbiology market with a share of 46.94% in 2022. The foremost determinant of the largest market share is the existence of well-established companies from industries such as pharmaceutical and biotechnology, and food and beverages. Similarly, existing players are indulging strategic initiatives to expand the industrial testing capabilities in multiple applications. For instance, a U.S. and UK-based CRO, Perfectus Biomed Group was acquired by NAMSA in October 2022. This acquisition aims at improving the personalized services of microbiology and developing a global presence through 20 locations offering lab services across the U.S., Europe, and Asia.

Asia Pacific is estimated to witness the fastest growth in the market owing to the enhanced infrastructure of the healthcare facilities, and improving growth of economic factors, resulting in a positive impact on the market. For instance, in June 2022, Merck India announced the establishment of a Microbiology Application Training Lab (MAT Lab) in Bangalore, for academic and industrial purposes. The Lab encourages biopharma and pharma players to collaborate with Merck to develop capabilities in the analysis of microbial.

Key Companies & Market Share Insights

The continuous demand for industrial microbiology testing solutions by multiple end-users has created numerous market opportunities for major players to capitalize on. Launch of new systems, reagents & products, partnerships, expansion, or opening of new facilities are some of the business expansion and profit maximization steps undertaken by key players. For example, Charles River Laboratories International, Inc. announced in May 2022 the opening of a new facility in Germany. This facility is a center for the microbial solution business of the company in eastern and central Europe. Some of the key players in the global industrial microbiology market include:

-

bioMerieux SA

-

Thermo Fisher Scientific Inc.

-

Bio-Rad Laboratories Inc.

-

Becton Dickinson and Company

-

3M Company

-

Danaher Corporation

-

Eppendorf AG

-

Merck KGaA

-

Sartorius AG

-

Asiagel Corporation

Industrial Microbiology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.15 billion

Revenue forecast in 2030

USD 19.36 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

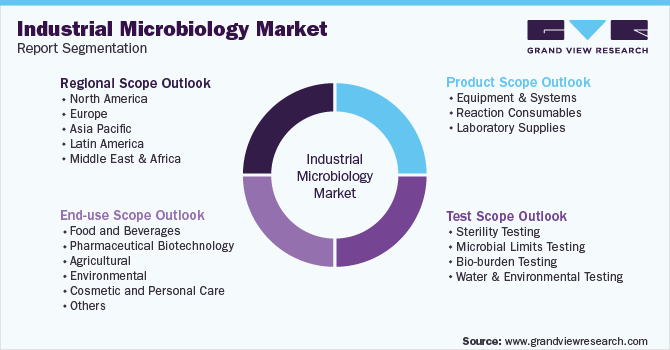

Global Industrial Microbiology Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the industrial microbiology market based on product, test, end use, and region.

-

Product Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment and Systems

-

Filtration Pumps and Systems

-

Microbial Detection Systems

-

Air Monitoring Systems

-

Automated Equipment

-

Incubators and Culture Apparatus

-

Others

-

-

Reaction Consumables

-

Media

-

Reagents and Strains

-

-

Laboratory Supplies

-

Bags and Bottles

-

Loop and Needles

-

Petri Dishes, Racks, Seals, Plates and Holders

-

Filtration Disc and Membranes

-

Others

-

-

-

Test Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterility Testing

-

Microbial Limits Testing

-

Bio-burden Testing

-

Water and Environmental Testing

-

-

End-use Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Food and Beverages

-

Pharmaceutical Biotechnology

-

Agricultural

-

Environmental

-

Cosmetic and Personal Care

-

Others

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global industrial microbiology market size was estimated at USD 11.12 billion in 2022 and is expected to reach USD 12.15 billion in 2023.

b. The global industrial microbiology market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 19.36 billion by 2030.

b. North America dominated the industrial microbiology market with a share of 46.94% in 2022. This is attributable to well-established pharmaceutical and biopharma companies within the region

b. Some key players operating in the industrial microbiology market include bioMerieux SA; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories Inc.; Becton Dickinson and Company; 3M Company; Danaher Corporation; Eppendorf AG; Merck KGaA; and Sartorius AG

b. Key factors that are driving the market growth include increasing production of pharmaceutical products, vaccines, and increasing production capacities of end users such as pharma companies and food & beverage manufacturers

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."