- Home

- »

- Plastics, Polymers & Resins

- »

-

Industrial Plastic Market Size & Share, Industry Report, 2030GVR Report cover

![Industrial Plastic Market Size, Share & Trends Report]()

Industrial Plastic Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PE, ABS, PBT, PSU, PPSU, PTFE), By Application (Building & Construction, Automotive, Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-189-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Plastic Market Summary

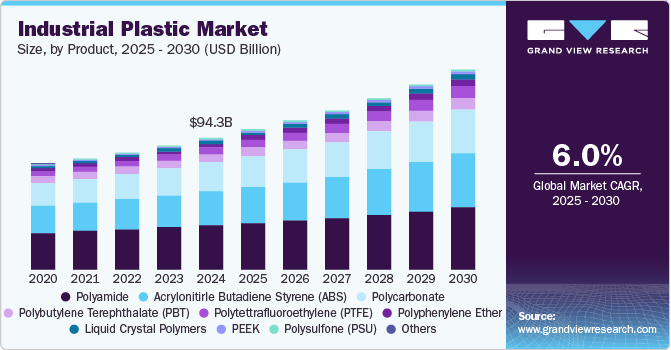

The global industrial plastic market size was valued at USD 94.26 billion in 2024 and is projected to reach USD 143.03 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. This anticipated growth is largely due to recent advancements in the electrical, electronics, and automotive sectors, which are generating the demand for lightweight industrial plastic components.

Key Market Trends & Insights

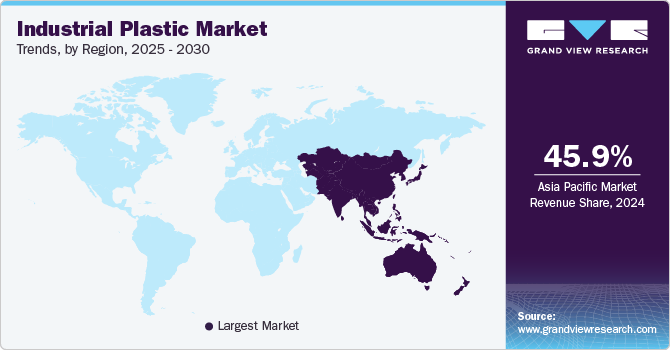

- Asia Pacific dominated the market in 2024, holding the largest revenue share at over 45.9%.

- China accounted for the largest share in the regional industrial plastic market in 2024.

- By product, polyamide emerged as the largest product segment and accounted for a 33.4% share in 2024.

- By application, the building and construction segment is experiencing substantial growth.

Market Size & Forecast

- 2024 Market Size: USD 94.26 Billion

- 2030 Projected Market Size: USD 143.03 Billion

- CAGR (2025-2030): 6.0%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The growing preference for environmentally friendly and energy-saving products is also expected to contribute to positive market expansion. Moreover, ongoing research and development in nanotechnology-based industrial plastics, with properties such as superior strength, thermal resistance, lighter weight, and enhanced efficiency, are expected to further stimulate the industrial plastic industry.

Ongoing technological advancements, innovations, and research efforts are broadening the potential applications of industrial plastics, which is expected to drive their demand in the coming years. Additionally, increasing investments from government and private entities in the aerospace and defense industries further boost the need for specialized plastics.

The growing use of industrial plastic components across various sectors, including packaging, building and construction, electrical and electronics, automotive and transportation, healthcare, and aerospace, is encouraging industrial manufacturers to pursue backward integration by incorporating raw material production into their operations. Greater involvement in the value chain could lead to faster turnaround times in converting raw materials into finished products and provide a cost advantage. Industrial plastic manufacturers are increasing their production capacity and infrastructure to meet the rising market demand. Furthermore, many companies in this sector are adopting strategies such as acquisitions and partnerships to secure their raw material supply. Mergers and joint ventures are also common in the industrial plastic industry, allowing companies to strengthen their market presence.

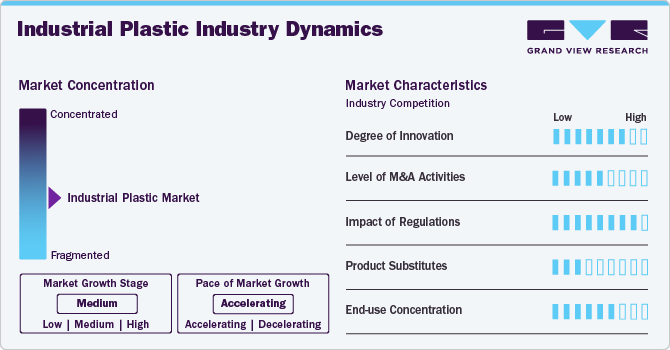

Market Concentration & Characteristics

The industrial plastics industry is fragmented, featuring a wide array of participants that include large multinational corporations and smaller, specialized manufacturers. The market is witnessing multiple innovations in new product development. Besides, advancements in processing techniques and the promotion of sustainable solutions, such as recycled and bio-based plastics, are driving innovation in industry. Additionally, nanotechnology is playing a growing role in enhancing material performance and functionality.

The impact of regulations on the market is high, as environmental policies emphasizing waste reduction, recyclability, and the elimination of hazardous substances are increasingly guiding product development and manufacturing practices. The threat of product substitutes is moderate. Although alternative materials such as metals, glass, and composites can be used in certain applications, plastics often provide a distinctive combination of advantages, such as lightweight, design flexibility, cost-effectiveness, and corrosion resistance, that makes them challenging to fully replace. End-user concentration in the market is moderate. Although the industrial plastics market caters to a wide array of industries, a substantial share of demand is driven by major sectors such as automotive, packaging, and building and construction.

Product Insights

In terms of revenue, polyamide emerged as the largest product segment and accounted for a 33.4% share in 2024. Polyamides offer excellent durability, elasticity, and moisture-wicking properties, making them ideal for sportswear, active wear, and high-performance clothing. Major brands, including Nike, Adidas, and Under Armour, regularly incorporate polyamide fibers into their premium product lines. The growing middle class in countries such as China and India have substantially boosted the demand for such performance textiles.

The developing automotive industry is expected to boost market growth over the forecast period. Moreover, ABS is used for pipes and fittings and vacuum construction owing to its properties such as excellent mechanical strength, resistance, and lightweight. ABS is widely used in the production of waste collector products owing to its superior corrosion resistance and long-lastingness. These factors are likely to boost global market growth in the forecast period.

Polycarbonate plastic has been witnessing increased demand from electrical and automotive applications over the recent past. The product is easily moldable and flexible, making it ideal for thermoforming applications. Some plastic compounds are resistant and durable, while others are optically transparent, making them easy to manufacture. Furthermore, rising expenditures on public infrastructure, particularly metro-rail and greenfield airports, will increase demand for PC resins in construction and mass transportation systems.

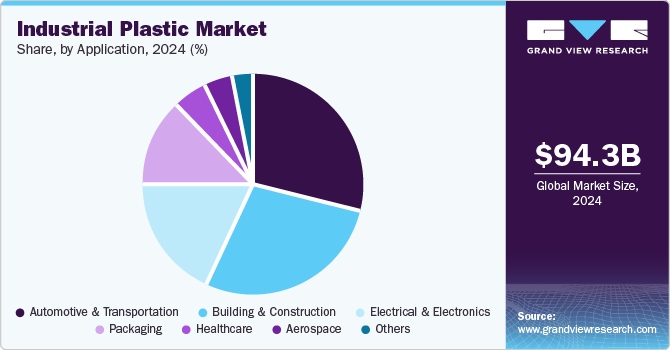

Application Insights

Increasing use of industrial plastics in automotive components, coupled with the growing production of electric passenger cars and heavy-duty vehicles, particularly in Central and South America and Asia Pacific, is expected to drive the automotive and transportation application segment during the forecast period. Vehicular weight regulations and standardization of emission norms are also contributing to the increasing demand for industrial plastics in automotive applications. ABS is one of the most widely used materials in automotive applications, about 12.5% of all automotive polymers used in the manufacturing of passenger automobiles are made of ABS. with its scope extending from engine parts to interior components. This plastic is used as a substitute for metals and other engineering plastics in the automotive industry due to its moldability and superior mechanical properties.

The building and construction market is experiencing substantial growth, fueled by a rising global population and significant advancements in technology. The increasing population directly drives the demand for more residential, commercial, and infrastructural developments, which proportionally encourages the growth in the industrial plastics used in infrastructure building. Polycarbonate is one of the most consumed building materials in various construction activities, including windows, skylights, wall panels, roof domes, exterior trims for LED lighting, and various others. It is modified as per specific requirements to meet structural designs and application.

Regional Insights

Asia Pacific dominated the market in 2024, holding the largest revenue share at over 45.9%. Asian countries are anticipated to be the primary growth markets for plastics in the Asia Pacific region throughout the forecast period. The expanding manufacturing sector is expected to significantly drive the demand for plastic compounds across key industries such as automotive, industrial machinery, construction, packaging, and electrical & electronics. Notably, both India and China have experienced a surge in automotive production recently, largely due to technology transfer from Western markets.

China Industrial Plastic Market Trends

China accounted for the largest share in the regional industrial plastic market in 2024. The country has a well-established industrial infrastructure across different sectors, including plastic, steel, and other industrial materials. China has considerable internal consumption of industrial plastic as well as export industrial plastics to multiple nations. According to an article published by SunSirs, China’s export value of plastic products in the year 2023 is USD 100.81 billion. The country achieved an export value of USD 78.02 billion in the first three quarters of 2024.

North America Industrial Plastic Market Trends

The overall North America industrial plastic market is projected to grow at the fastest CAGR from 2024 to 2030. The market is primarily driven by the rising demand for epoxy polymers in the medical devices segment for manufacturing disposables and devices such as catheters and surgical instruments. Furthermore, the demand for plastics across various application segments, including packaging, construction, electrical & electronics, automotive, agriculture, furniture & bedding, consumer goods, and utility, is expected to grow.

The U.S. industrial plastic industry dominated the regional market. Increasing demand for sustainable plastics, driven by environmental concerns and regulatory pressures, is a major driving factor promoting market growth. The burgeoning electric vehicle production is generating considerable demand for lightweight and durable plastic. Additionally, the strong building and construction sector utilizes industrial plastics for their cost-effectiveness and durability in various applications. Additionally, the presence of a large consumer goods industry that relies on plastics for packaging and product manufacturing contributes substantially to the market's growth.

Europe Industrial Plastic Market Trends

The Europe industrial plastic market accounted for a significant market share in the global market. The growth of the regional market is majorly driven by stringent environmental regulations and increasing awareness among consumers and organizations promoting sustainable plastics, including recycled and bioplastics. Consistently growing demand from the automotive sector and the building and construction industry for lightweight and durable plastic components is encouraging the industrial plastics market in the region. Besides, government initiatives and investments in research and development within the bioplastics and recycling sectors further bolster industrial plastic industry in Europe.

Germany dominated the industrial plastics market in terms of revenue in 2024. The automotive industry and other industrial manufacturing units in the country generate significant demand for industrial plastic. The country source its industrial plastics from China, the U.S., and Belgium. In 2024, Germany imported plastics and plastic products worth USD 60 billion. Besides automotive, other industries including electrical and electronics manufacturing, medical devices, and industrial machinery also contribute to the growing demand for

Key Industrial Plastic Company Insights

To ensure product quality and broaden their reach, many major players in the industrial plastics market have integrated their raw material production with their distribution networks. This strategic move offers them a competitive edge through cost advantages, ultimately boosting their profit margins. Furthermore, companies are actively investing in research and development to create innovative industrial plastics that meet evolving end-user needs and maintain their competitive standing. Research efforts centered on developing novel materials that offer a combination of desirable properties are expected to be widely adopted across the industry in the near future.

Key Industrial Plastic Companies:

The following are the leading companies in the industrial plastic market. These companies collectively hold the largest market share and dictate industry trends:

- BASF

- SABIC

- Victrex plc.

- Ensinger

- Evonik Industries AG

- LyondellBasell Industries Holdings B.V.

- Arkema Inc.

- Eastman Chemical Company.

- Solvay SA

- Formosa Plastics Corporation, U.S.A.

- Teijin Aramid

- Mitsubishi Engineering-Plastics Corporation

Recent Developments

-

In March 2025, BASF and Braven Environmental have agreed on a long-term supply of Braven PyChem, a certified advanced recycled feedstock from mixed plastic waste.

-

In July 2024, Neste and Mitsubishi entered into a partnership for renewable chemical and plastic supply chains. The partnership was made to focuse on developing value chains for renewable chemicals and plastics for and with Japanese brands

-

In November 2024, Berry Global agreed to merge with Amcor. This merger aims to create a global leader in plastic packaging, combining Berry's extensive manufacturing[ capabilities with Amcor's global reach.

-

In June 2023, Borealis announced it would acquire Rialti S.p, a leading manufacturer of recycled polypropylene compounds in Europe. The acquisition is expected to boost Borealis's circular portfolio.

Industrial Plastic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 100.41 billion

Revenue Forecast in 2030

USD 143.03 billion

Growth Rate

CAGR of 6.0% from 2025 to 2030

The base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Turkey, Spain, India, Japan, Southeast Asia, China, Brazil, Middle East, and Africa

Key companies profiled

BASF, SABIC, Victrex plc., Ensinger, Evonik Industries AG, LyondellBasell Industries Holdings B.V., Arkema Inc., Eastman Chemical Company., Solvay SA, Formosa Plastic Corporation, U.S.A., Teijin Aramid, Mitsubishi, Engineering-Plastics Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

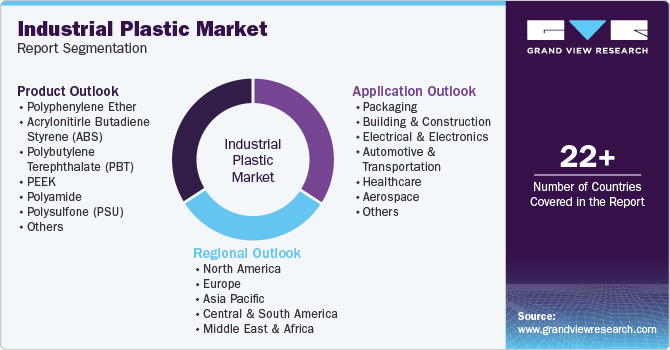

Global Industrial Plastic Market Report Segmentation

This report forecasts revenue growth at global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial plastic market report based on product, application and region.

-

Product Outlook (Revenue, USD Billion, Tons, 2018 - 2030)

-

Polyphenylene Ether

-

Acrylonitirle Butadiene Styrene (ABS)

-

Polybutylene Terephthalate (PBT)

-

PEEK

-

Polyamide

-

Polysulfone (PSU)

-

Polyphenylsulfone (PPSU)

-

Liquid Crystal Polymers

-

Polytettrafluoroethylene (PTFE)

-

Polyetherimide

-

PEKK

-

Polycarbonate

-

Others (PEK, etc.)

-

-

Application Outlook (Revenue, USD Billion, Tons, 2018 - 2030)

-

Packaging

-

Building & Construction

-

Electrical & Electronics

-

Automotive & Transportation

-

Healthcare

-

Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Billion, Tons, 2018 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Spain

-

Italy

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.