- Home

- »

- Smart Textiles

- »

-

Industrial Protective Clothing Market Size Report, 2030GVR Report cover

![Industrial Protective Clothing Market Size, Share & Trends Report]()

Industrial Protective Clothing Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Heat & Flame Protection, Chemical Defending, Clean Room Clothing, Mechanical Protective Clothing), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-206-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Protective Clothing Market Summary

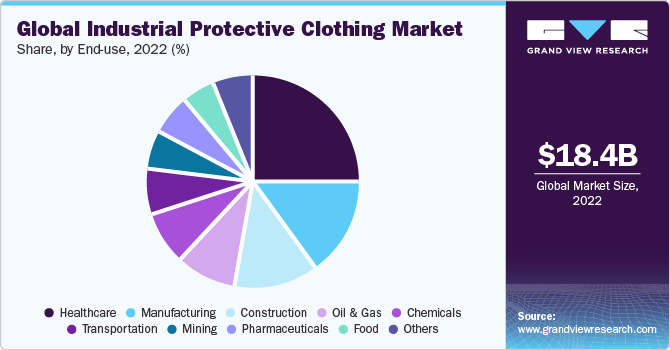

The global industrial protective clothing market size was estimated at USD 18.35 billion in 2022 and is projected to reach USD 31.18 billion by 2030, growing at a CAGR of 6.9% from 2023 to 2030. Rising awareness regarding the importance of preventing work-related fatal accidents is likely to propel market growth.

Key Market Trends & Insights

- Europe dominated the market and accounted for the largest revenue share of 33.5% in 2022.

- Asia Pacific is expected to expand at the fastest CAGR of 8.1% during the forecast period.

- Based on product, the chemical defending segment accounted for the largest revenue share of 31.7% in 2022.

- Based on end-use, the healthcare segment accounted for the largest revenue share of 24.3% in the industrial protective clothing market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 18.35 Billion

- 2030 Projected Market Size: USD 31.18 Billion

- CAGR (2023-2030): 6.9%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

Governments globally have made the wearing of industrial protective clothing essential in order to limit infection risks. Owing to the COVID-19 pandemic, healthcare professionals prefer industrial protective clothing to safeguard their health, thus driving their demand. Increased onshore and offshore drilling operations, as well as increased shale gas production in the U.S., are factors expected to boost industrial protective clothing demand to protect personnel from workplace hazards.

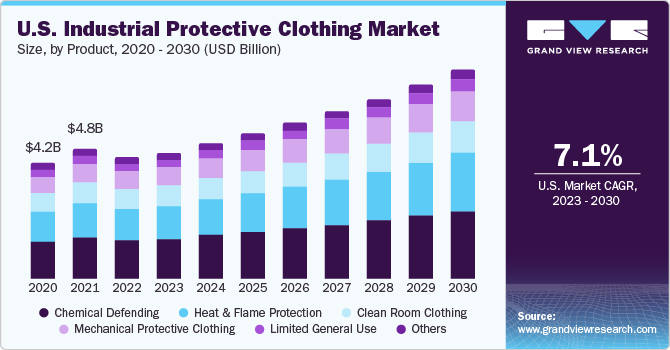

Improvements in government initiatives to make the U.S. more energy-independent are expected to increase local shale output even further. The U.S. is one of the world’s largest producers of chemicals and pharmaceuticals. Furthermore, the country has a large workforce involved in oil and gas activities, which necessitates the use of high-quality protective apparel. The existence of regulating organizations such as the Occupational Safety and Health Administration (OSHA) along with severe labor rules is expected to boost market expansion in the country.

In 2020, during the COVID-19 pandemic, the most affected countries, including the U.S., implemented specific legislations, such as the Defense Production Act (DPA), entrusting local manufacturers with the production of PPE, including industrial protective clothing and ventilators for healthcare workers. Such factors have propelled product demand. Various fashion conglomerates, premium brands, and designers produced masks, face shields, and protective clothing to safeguard employees from the COVID-19 virus. For example, in April 2020, Adidas partnered with Carbon, a 3D printing business located in the U.S., to develop face shields during the pandemic crisis.

Product Insights

The chemical defending segment accounted for the largest revenue share of 31.7% in 2022. Chemical defending garments protect employees against exposure or contact with chemicals. Most of these products are employed in the oil & gas, chemical, and healthcare industries. In sectors where workers are exposed to harsh conditions such as radiation, pressure, and high temperatures, durable industrial protective clothing is utilized. Increased demand for long-lasting protective clothing to allow uninterrupted work is expected to drive the demand for industrial protective clothing during the forecast period.

On the other hand, the heat & flame protection segment is expected to advance at the fastest CAGR of 7.3% during the forecast period. This is owing to the steady growth of the construction, oil & gas, chemical, and firefighting industries globally, particularly in emerging economies of Asia Pacific including China, India, and Vietnam, coupled with the penetration of the product in these industries.

Mechanical industrial protective clothing accounted for a notable share of the global industrial protective clothing revenue in 2022. Mechanical protective clothing safeguards employees against various hazards, including injuries due to sharp objects such as cuts, slash hazards including chain saws, sheet metal, glass, knives or sharp edges, and stab- & puncture-related injuries.

End-use Insights

The healthcare segment accounted for the largest revenue share of 24.3% in the industrial protective clothing market in 2022. The adoption of new practices and the development of advanced products are expected to have a positive impact on the use of medical services across the globe in the coming years. In addition, increasing disposable income is expected to aid developing economies in availing advanced healthcare services, thereby driving the expenditure of the healthcare industry.

The construction segment is expected to expand at the fastest CAGR of 8.3% during the forecast period. The overhead costs associated with workshop mortalities and injuries are anticipated to augment the demand for protective clothing in the construction sector during the forecast period. The rapidly-growing construction industry, particularly in economies such as Germany and the UK, is expected to boost the demand for the product throughout the forecast period.

The manufacturing end-use segment is likely to expand at a lucrative rate during the forecast period. With the rising workforce in this sector, new factories and plants have been set up across economies, which is expected to drive the market for industrial protective clothing in this space through the forecast period. In addition, the growing workforce in the industry is likely to trigger product demand to safeguard employees and avoid overhead costs such as compensations.

The pharmaceutical segment accounted for a significant revenue share in 2022. Employees working in this industry face various on-the-job hazards as they come in contact with biological agents, chemical substances, and drugs. Different types of protective clothing are required by workers that include protection against liquid pressurized chemicals, hazardous and non-hazardous particles, and liquid aerosol.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 33.5% in 2022. The increased construction activity in Europe due to low mortgage rates is expected to propel the use of protective clothing in new construction as well as renovation tasks. Additionally, demographic factors such as differences in economic activity and income distribution are expected to drive the market in the region.

The North American market for industrial protective clothing is oversaturated. However, categories such as heat and fire-retardant protective garments are experiencing tremendous expansion. The increased use of flame-retardant clothing in the chemicals, oil & gas, metals, and pulp & paper sectors has contributed to the region’s industrial protective clothing penetration in recent years.

Asia Pacific is expected to expand at the fastest CAGR of 8.1% during the forecast period. The rising number of occupational fatalities, coupled with the growing importance of industrial protective clothing requirements, the need for durable mechanical wear resistance, and use of high-utility industrial protective clothing in a majority of the core industries such as refining, oil & gas, metal manufacturing, and automotive, is expected to drive market growth in the Asia Pacific region during the forecast period.

The Central & South America region is expected to advance at the second-fastest CAGR during the forecast period. Demand for protective clothing products is likely to be driven by factors such as the rising construction industry, which includes the development of ports, apartments, buildings, and hotels. Furthermore, the rising spending in Argentina’s healthcare and pharmaceutical industries is expected to boost regional market growth.

Key Companies & Market Share Insights

Manufacturers use a variety of strategies, such as acquisitions, mergers, joint ventures, new product developments, and geographic expansions, to increase market penetration and meet the shifting technological demands from numerous end-use areas, including manufacturing, construction, mining, chemical, oil & gas, healthcare, pharmaceuticals, and others. Some of the prominent players in the global industrial protective clothing market include:

-

W. L. Gore & Associates, Inc.

-

Honeywell International Inc.

-

Lakeland Industries, Inc.

-

PBI Performance Products, Inc.

-

Kimberly-Clark

-

Bennett Safetywear

-

Ansell Ltd.

-

TEIJIN LIMITED

-

ADA (Australian Defence Apparel)

-

Workwear Outfitters, LLC

-

DuPont

-

TenCate Protective

Recent Developments

-

In April 2023, TenCate Protective Fabrics introduced Tecasafe360+, an inherent FR fabric integrated with the XLANCE stretch technology, offering stretch with remarkable recovery. It can endure several washings and uses while maintaining its shape without drooping or bagging. By providing a perfect fit that doesn't sag, Tecasafe360+'s superior shape recovery aims to keep workers safe

-

In May 2023, DuPont released a statement announcing that it has entered into an agreement for the acquisition of Spectrum Plastics Group from AEA Investors, which was completed in August.The partnership is in an ideal position to continue providing cutting-edge solutions for critical healthcare applications and strong customer service

-

In April 2023, DuPont revealed the Kevlar EXO aramid fiber, one of the most crucial breakthroughs in aramid fiber, and an altogether novel technology platform intended to serve a limitless number of diverse applications where protection and performance are required in the midst of extreme and demanding conditions. A combination of flexibility, lightness, and protection from aramid fiber will be possible through Kevlar EXO, with life protection being one of its many uses

-

In April 2023, Australian Defence Apparel (ADA), the largest apparel manufacturer in Australia, formally opened its new Canberra warehouse hub in order to better handle garment supply contracts from the Australian Federal Police (AFP) and the Australian Border Force (ABF), among other clients

-

In March 2023, Ansell Ltd. announced the first phase of the opening of its brand-new Kovai manufacturing facility in India for packing and irradiation operations. Even though the production mainly focuses on surgical and life science products, the facility is built with substantial future expansion capacity that can accommodate a broad spectrum of their products, such as their examination glove line, and support their future growth strategies

Industrial Protective Clothing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.97 billion

Revenue forecast in 2030

USD 31.18 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; Spain; Russia; UK; China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia; Argentina; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

W. L. Gore & Associates, Inc.; Honeywell International Inc.; Lakeland Industries, Inc.; PBI Performance Products, Inc.; Kimberly-Clark; Bennett Safetywear; Ansell Ltd.; TEIJIN LIMITED; ADA; Workwear Outfitters, LLC; DuPont; TenCate Protective

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Protective Clothing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global industrial protective clothing market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat & flame protection

-

Chemical defending

-

Clean room clothing

-

Mechanical protective clothing

-

Limited general use

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

Russia

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Thailand

-

Malaysia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial protective clothing market size was estimated at USD 18.35 billion in 2022 and is expected to reach USD 18.97 billion in 2023.

b. The global industrial protective clothing market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 31.18 billion by 2030.

b. Europe dominated the industrial protective clothing market with a revenue share of 33.4% in 2022. The market is growing due to stringent government laws governing employee safety compelling employers to conform with industry standards, creating demand for industrial protective clothing.

b. Some of the key players operating in the industrial protective clothing W. L. Gore & Associates, Inc., Honeywell International Inc, Lakeland Industries, Inc., PBI Performance Products, Inc., Kimberly-Clark, Benette Safetywear, Ansell Ltd, TEIJIN LIMITED, Australian Defense Apparel, Workwear Outfitters, LLC, DuPont, and TenCate Protective

b. The key factors that are driving the industrial protective clothing market include rapid infrastructural development, rising construction, oil & gas, mining, pharmaceuticals, medical & health care industries, manufacturing, chemical, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.