- Home

- »

- Drilling & Extraction Equipments

- »

-

Industrial Pumps Market Size, Share & Trends Report, 2030GVR Report cover

![Industrial Pumps Market Size, Share & Trends Report]()

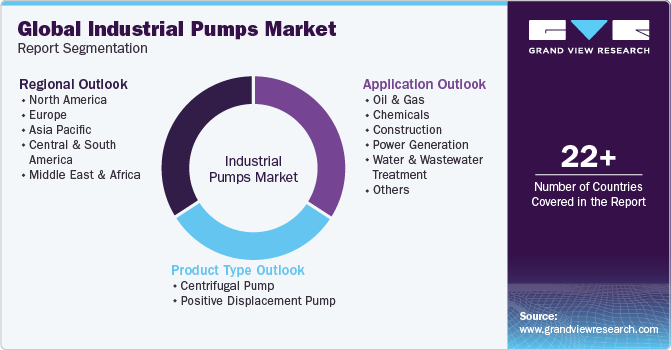

Industrial Pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Centrifugal Pump, Positive Displacement Pump), By Application (Oil & Gas, Chemicals, Construction), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-325-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Pumps Market Summary

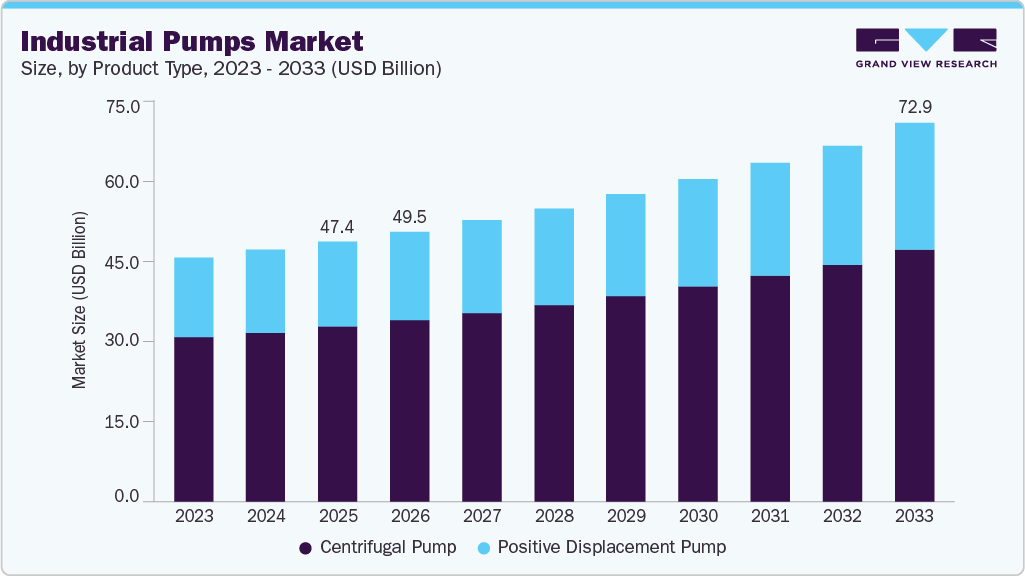

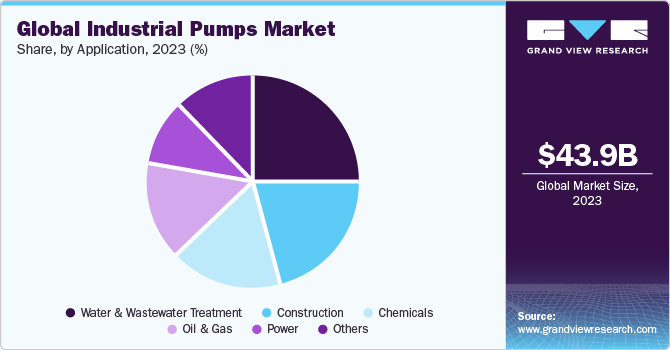

The global industrial pumps market size was estimated at USD 43.90 billion in 2023 and is projected to reach USD 59.95 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. Rising adoption of industrial pumps in various industries, including water & wastewater, chemicals, oil & gas, and power generation, is expected to drive the market growth.

Key Market Trends & Insights

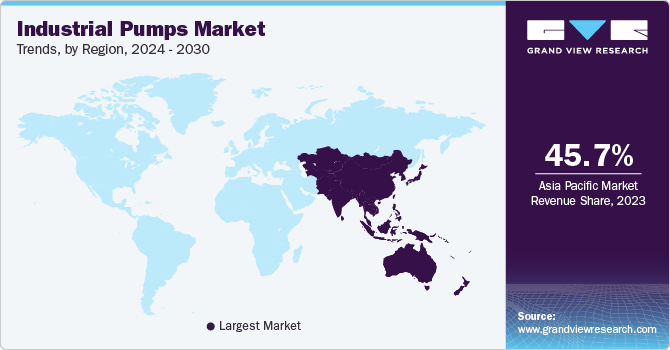

- The industrial pumps market in Asia Pacific led the market share in 2023.

- China industrial pumps market held a revenue share of over 43.2% in Asia Pacific.

- By product type, the centrifugal pump segment dominated the market by holding 67.4% market share in 2023.

- By application, the water & wastewater treatment segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 43.90 Billion

- 2030 Projected Market Size: USD 59.95 Billion

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2023

Growth in population, urbanization, and manufacturing activities are leading to increasing wastewater generation. In water & wastewater treatment facilities, the pumps are used to move the wastewater from lower to higher elevations to allow continuous and cost-effective water treatment. Industrial pumps are ideal for handling highly viscous fluids with constant flow rate in wastewater treatment facilities. Hence, the growth of wastewater treatment facilities is expected to lead to the adoption of industrial pumps over the foreseeable period. Moreover, increasing investments in exploration & production activities by oil & gas companies across the globe are anticipated to boost the demand for industrial pumps in the oil & gas industry. Industrial pumps are used to move oil through a pipeline or pump oil from the ground. Rising infrastructural upgrades, in terms of changing or installation of new pipelines, are expected to have a positive impact on the market growth.

Growing investments by the federal government and adoption of stringent regulations to strengthen the supply of clean water are driving the industrial pumps market in the U.S. In February 2024, the U.S. government announced its plan to invest USD 6.0 billion in clean drinking water & wastewater infrastructure. Additionally, environmental acts established by the U.S. government, such as the Clean Water Act (CWA) and Safe Drinking Water Act (SDWA), have been implemented to govern water regulations in the country. Such regulations are expected to increase the commencement of new water treatment plants, thereby driving the adoption of industrial pumps in the country.

Moreover, ongoing technological innovations in industrial pumps are propelling market expansion. Technologically advanced industrial pumps improve the productivity and capability of various end-use industries, such as chemical, oil & gas, and pharmaceutical. For instance, artificial intelligence-based pump monitoring technology is driving the market. This new intelligent pump monitoring technology continuously collects data from pump operations, as well as evaluates and analyses the data, which acts as a barrier against sudden pump failure.

At the global level, growing construction and power generation industries are driving the demand for industrial pumps. Industrial pumps are used for transferring cement slurry, sludge handling, and treatment for concrete washout in the construction industry. Industrial pumps are used to pump water in the boilers and maintain thermal control in power plants. Increasing demand for power generation in emerging economies is expected to boost the demand for industrial pumps over the forecast period.

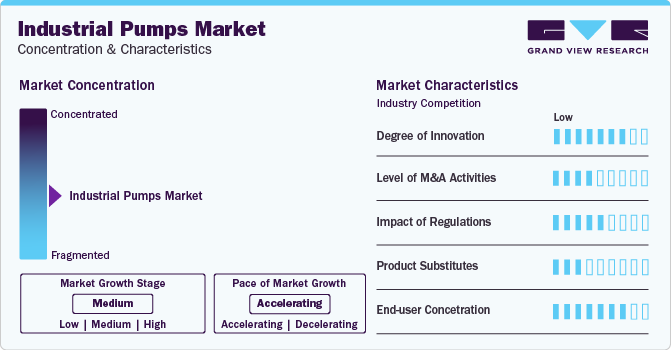

Market Concentration Characteristics

The industrial pump industry is at a medium growth stage with an accelerating pace of growth, characterized by high degree of competition, owing to various cost-efficient technologies adopted by industry players for manufacturing industrial pumps. Furthermore, emerging economies witnessed rapid growth in end-use industries, such as oil processing and water & wastewater treatment, thereby driving the competition between industry players to design and manufacture technologically advanced & cost-effective pumps. The industrial pump industry is fragmented and characterized by a high degree of product innovation, which results in the development of high-quality industrial pumps.

Key industry players, such as KSB SE & Co. KGaA and Xylem, are dominating the industry by launching new products and entering into new segments. In November 2023, Xylem launched an e-80SCXL vertical in-line centrifugal pump, which is equipped with a modular pump condition monitoring system. This system analyses the pump temperature & vibrations and recommends predictive maintenance before the pump fails. Key industry players adopted strategies like acquisitions and regional expansion. Strategic acquisitions can assist players to increase their industry penetration by entering new segments and expanding their customer base.

Product Type Insights

The centrifugal pump segment dominated the market by holding 67.4% market share in 2023. These pumps are used to control and regulate the direction of gases, vapors, liquids, and other fluids. Due to the low maintenance requirement and ability to achieve higher fluid flow rates, these products are widely utilized in several applications, including water supply, food & beverage, pharmaceutical, and chemical industries. Furthermore, these pumps are used in power generation facilities to transfer the coolant. Hence, with rising demand for electricity and power, the demand for industrial pumps is also likely to grow over the forecast period.

The positive displacement pump segment is anticipated to witness the highest growth over the forecast period, as reciprocating pumps are used in precision dosing and high-pressure output applications. The investment in specialized reciprocating pumps is increasing, due to their requirement in the complex refining process, which involves high temperatures and high-pressure operations. Moreover, these pumps can handle viscous and abrasive fluids more effectively as compared to centrifugal pumps.

Application Insights

The water & wastewater treatment segment dominated the market in 2023, owing to increasing demand for water treatment facilities to manage the wastewater being generated and overcome the growing water scarcity in municipalities across the globe. Centrifugal pumps are used to transfer water over longer distances. Additionally, positive displacement pumps can handle a variety of sludges found in wastewater. With the growing urbanization, the demand for wastewater treatment is growing, which is likely to drive the demand for industrial pumps.

The chemicals segment is likely to witness the highest growth over the forecast period. Industrial pumps are extensively utilized in the chemicals industry, due to their ability to handle a wide range of chemical fluids with different pH levels, maintain precise control over fluid discharge rates, and operate reliably under various pressure conditions. Positive displacement pumps are used to inject the catalyst with accurate quantity and synthesize quality compounds in the chemical processing industry. Centrifugal pumps are used to transfer different acidic, corrosive, highly viscous, volatile, and hazardous chemicals from one point to another.

Regional Insights

North America industrial pumps market is characterized by growth in the oil & gas and chemicals industries. Industrial pumps are used to accurately dose catalysts in chemical manufacturing plants. They are also used in oil production and refining facilities to pump crude as well as processed oil from one point to another.

U.S. Industrial Pumps Market Trends

The industrial pumps market in the U.S. accounted for more than 65.4% of the regional revenue share in 2023. Demand for industrial pumps is driven by the growing oil & gas, construction, and chemical industries. In November 2023, the American Chemistry Council (ACC) reported that the U.S. Chemical Production Regional Index (U.S. CPRI) registered 8% growth in August 2023 compared with that of July 2023. The rise in chemical production is driving the demand for industrial pumps in the U.S.

Europe Industrial Pumps Market Trends

Europe industrial pumps market is expected to grow in the coming years due to its developed industrial sector. These pumps are used in various industries, such as chemical, power generation, and construction. Furthermore, there is an increase in demand for efficient rotary pumps to reduce the carbon footprint in industrial processes and improve carbon credit, which has been driving the market in the region.

The industrial pumps market in Germany accounted for a significant market share in 2023, due to the growing demand for wastewater recycling and the established chemical industry. With the growing urbanization and industrial expansion, the need for high-quality water is rising, which has been percolated into the growing need for wastewater recycling facilities.

France industrial pumps market is expected to grow at the second highest CAGR, due to the growing construction and power generation industries. The government's sectoral policies targeted at the manufacturing and energy sectors are likely to drive the demand for industrial pumps in power generation, chemical, pharmaceutical, and automotive industries.

Asia Pacific Industrial Pumps Market Trends

The industrial pumps market in Asia Pacific led the market share in 2023. Rapid industrialization, coupled with the growing demand for fluid handling in several countries, including China and India, is expected to boost the market potential. Construction, chemical, and water & wastewater treatment industries in Asia Pacific have been witnessing significant growth on account of the rising urbanization. Additionally, the rising investments in power generation and construction sectors by the governments of China, India, and Japan are likely to drive the demand for industrial pumps.

China industrial pumps market held a revenue share of over 43.2% in Asia Pacific. Demand for industrial pumps is rising, due to the growth in construction, chemical, and power generation sectors. According to China’s 14th Five-year plan, the country has been investing in new infrastructure projects, green building development, and new urbanization measures with an investment of USD 4.2 trillion. Such growing investment in the construction sector is likely to drive the demand for industrial pumps in China.

The pumps market in India is anticipated to grow at a significant CAGR over the forecast period, due to the growing demand for water & wastewater treatment facilities, rising need for potable water supply, population growth, increasing investment by the government in wastewater treatment facilities, and the growing manufacturing sector.

Central & South America Industrial Pumps Market Trends

Central & South America industrial pumps market is expected to witness significant growth, owing to the growth in urbanization. Growing urbanization has contributed to wastewater generation. Additionally, the need for a potable water supply is growing. Furthermore, the growing manufacturing sector in Central & South America is driving the demand for industrial pumps in the region.

The industrial pumps market in Brazil is projected to grow over the forecast period. A rise in chemical manufacturing activities, along with ongoing oil & gas activities in the country, is expected to drive the demand for industrial pumps. Furthermore, rising concerns about water pollution are further expected to drive the demand for water & wastewater treatment systems, thereby benefiting the market for industrial pumps.

Middle East & Africa Industrial Pumps Market Trends

The Middle East & Africa industrial pumps market is driven by the well-developed oil & gas and power generation industries. The Middle East is a major hub to produce oil & gas. Industrial pumps are used during the crude oil transfer and refining process.

The industrial pumps market in Saudi Arabia is projected to grow at a significant CAGR over the forecast period. Moreover, Saudi Arabia has been investing heavily in constructing facilities. Additionally, rising investment to set up a petrochemical complex is driving the demand for industrial pumps. For instance, in December 2022, Aramco and TotalEnergies invested USD 11 billion to build a petrochemical complex in Saudi Arabia.

Key Industrial Pumps Company Insights

Some of the key players operating in the market include Grundfos Holding A/S, Xylem, Ingersoll-Rand, Flowserve Corporation, Sulzer Ltd., and EBARA International Corporation.

-

Grundfos Holding A/S offers a wide range of products through various categories, namely, pumps, services, mixing loops, agitators, disinfection systems, water dispenser systems, digital dosing pumps, fire systems, pump controllers, dosing systems, pump systems, lift stations, pressure managers, water treatment systems, measurement & control, mechanical dosing pumps, pump motors, solutions, sensors, and accessories.

-

Ingersoll-Rand offers its products to various industries, including aerospace, chemicals, plastics & rubbers, consumer, electronics & semiconductors, environmental, food & beverage, general manufacturing, government & military, industrial gases, marine, oil & gas, power generation, PET bottle blowing, and water & wastewater treatment.

SPX Flow, Iwaki Co. Ltd., Vaughan Company, and HERMETIC-Pumpen GmbH are some of the emerging participants in the industrial pumps market.

-

SPX Flow’s product portfolio supports global industries, such as food & beverage, chemical processing, compressed air, and mining, by offering a wide range of pumps, filters, mixers, valves, air dryers, separators, hydraulic tools, homogenizers, and heat exchangers, along with the aftermarket materials and services.

-

HERMETIC-Pumpen GmbH designs and produces hermetically sealed centrifugal pumps and supplies them globally. The company’s pump range includes magnetic drive pumps, canned motor pumps, and vacuum pumps.

-

The industrial pumps market consists mainly of global players, of which a few operate regionally. New product launches, mergers & acquisitions, partnerships, and collaborations are vital strategies adopted by companies for sustained growth. Furthermore, key raw material suppliers and equipment manufacturers have integrated their operations to provide raw materials and manufacture the final product to cut down on raw materials procurement and operation costs.

-

Market players have been investing in research & development activities to improve their product customization abilities. Additionally, the market players are striving to improve their market offerings to accommodate varying product compositions, packaging formats, and sizes, thereby enhancing their market penetration and customer satisfaction. New product developments and approvals are also a part of initiatives undertaken by key companies to gain substantial market penetration. Moreover, the market players have undertaken marketing strategies to improve their brand recall in the market.

-

Major market players frequently undertake geographical expansion strategies to enter established and newer markets. For instance, in July 2023, Xylem, along with its regional partner, the Tiba Manzalawi Group, announced the opening of a new pump manufacturing site in Egypt. This new pump production facility is likely to provide innovative water solutions to customers across North America and other regions.

Key Industrial Pumps Companies:

The following are the leading companies in the industrial pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Grundfos Holding A/S

- Ingersoll-Rand

- Flowserve Corporation

- Sulzer Ltd.

- Pentair

- ITT, INC.

- Schlumberger Limited

- EBARA International Corporation

- The Weir Group PLC

Recent Developments

-

In January 2024, SPX FLOW's Waukesha Cherry-Burrell brand launched the Universal 2 ND Positive Displacement Pump (U2 ND) Series for industrial users. This new series is designed to improve reliability and performance across industrial applications, surpassing the capabilities of other pump styles like industrial gear, lobe, or progressive cavity pumps. The U2 ND series is expected to significantly expand the WCB pump range and provide better solutions for industrial pump requirements. This new product launch is anticipated to help the company increase its market share.

-

In March 2023, KSB SE & Co. KGaA announced the acquisition of technology from Bharat Pumps and Compressors (BP&CL). BP&CL is an important manufacturer of centrifugal pumps and reciprocating pumps. With this new technology acquisition, KSB SE &Co. KGaA is likely to expand its product line in both the new pump and aftermarket markets.

Industrial Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 45.56 billion

Revenue forecast in 2030

USD 59.95 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; China; Japan; India; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Grundfos Holding A/S, Xylem; Ingersoll-Rand; Flowserve Corporation; SPX Flow; KSB SE &Co. KGaA; Sulzer Ltd.; Pentair; Iwaki Co. Ltd.; ITT, INC.; Schlumberger Limited; EBARA International Corporation; The Weir Group PLC; Vaughan Company; HERMETIC-Pumpen GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the industrial pumps market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Centrifugal Pump

-

Axial Flow Pump

-

Radial Flow Pump

-

Mixed Flow Pump

-

-

Positive Displacement Pump

-

Reciprocating

-

Rotary

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals

-

Construction

-

Power Generation

-

Water & Wastewater Treatment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial pumps market size was estimated at USD 43.90 billion in 2023 and is expected to be USD 45.56 billion in 2024.

b. The global industrial pumps market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 59.95 billion by 2030.

b. Asia Pacific region dominated the market and accounted for a 45.7% share in 2023, owing to the growth in the construction and manufacturing sector. Further, the higher population level attracts investment in water and wastewater infrastructure. This growing investment in water and wastewater infrastructure is driving the industrial pump market demand.

b. Some of the key players operating in the industrial pumps market include Grundfos Holding A/S, Xylem, Ingersoll-Rand, Flowserve Corporation, SPZ Flow, KSB SE &Co. KGaA, Sulzer Ltd., Pentair, Iwaki Co. Ltd., ITT, INC., Schlumberger Limited, EBARA International Corporation, The Weir Group PLC, Vaughan Company, HERMETIC-Pumpen GmbH.

b. The key factors that are driving the industrial pump market include growing investment in water and wastewater treatment, rising demand for energy fuel, and technological advancement in industrial pumps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.