- Home

- »

- Advanced Interior Materials

- »

-

Positive Displacement Pumps Market, Industry Report, 2033GVR Report cover

![Positive Displacement Pumps Market Size, Share & Trends Report]()

Positive Displacement Pumps Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Rotary, Reciprocating), By End Use (Agriculture, Construction & Building Services, Water & Wastewater, Power Generation), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-678-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2026

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Positive Displacement Pumps Market Summary

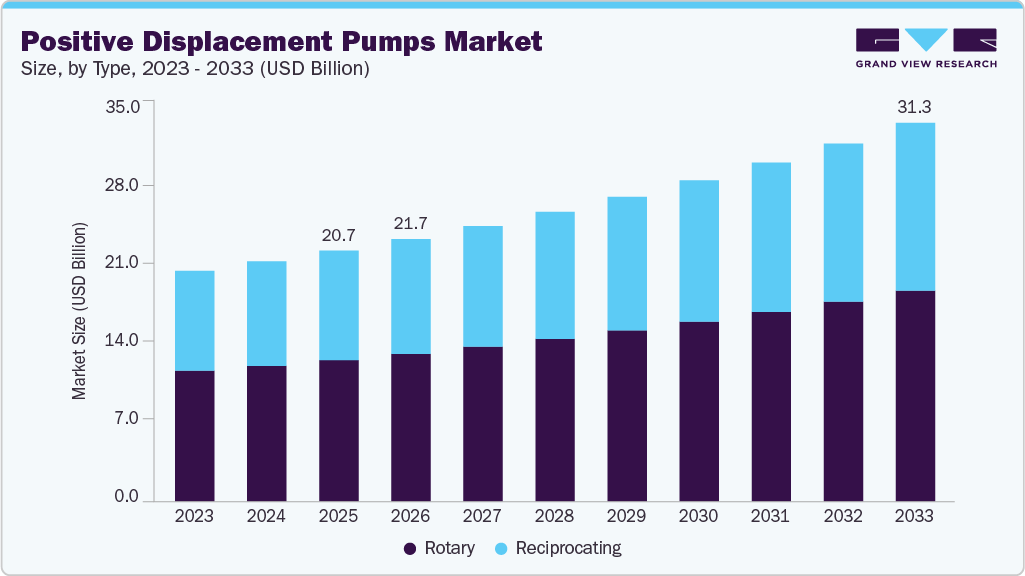

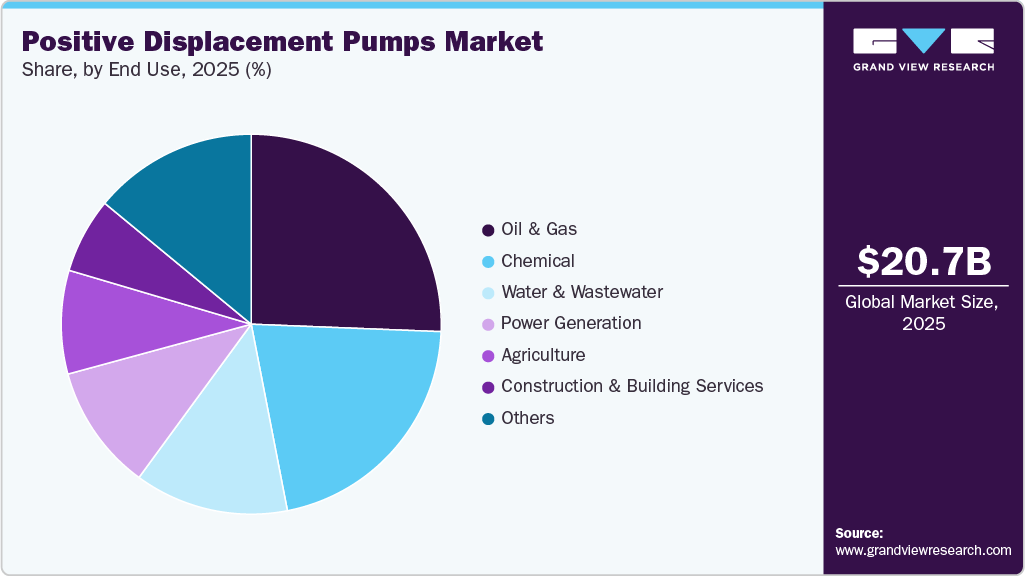

The global positive displacement pumps market size was estimated at USD 20,721.9 million in 2025 and is projected to reach USD 31,304.3 million by 2033, growing at a CAGR of 5.4% from 2026 to 2033. Market growth is primarily driven by rising investments in chemical processing, wastewater treatment, and industrial fluid handling infrastructure, particularly in emerging economies.

Key Market Trends & Insights

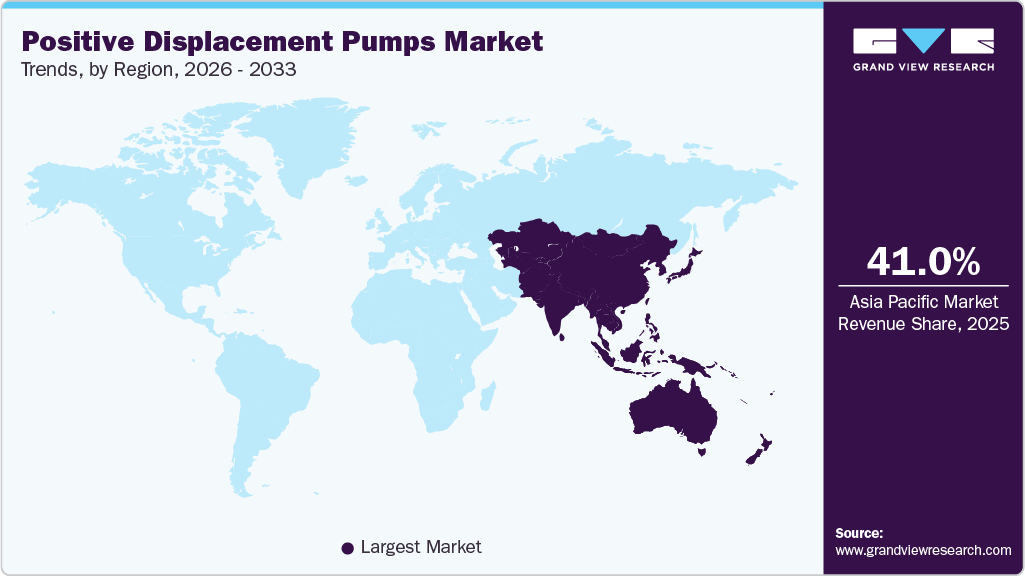

- Asia Pacific dominated the positive displacement pumps industry with the largest revenue share of 41.0% in 2025.

- The positive displacement pumps market in India is expected to grow at a substantial CAGR of 7.1% from 2026 to 2033.

- By type, the reciprocating segment is expected to grow at a considerable CAGR of 5.6% from 2026 to 2033 in terms of revenue.

- By end use, the chemical segment is expected to grow at a considerable CAGR of 6.5% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 20,721.9 Million

- 2033 Projected Market Size: USD 31,304.3 Million

- CAGR (2025-2033): 5.4%

- Asia Pacific: Largest market in 2024

Positive displacement pumps provide precise and consistent flow rates, independent of pressure variations, making them well-suited for applications involving viscous, abrasive, and shear-sensitive fluids across various industries, including chemicals, oil & gas, food & beverages, and pharmaceuticals.

Positive displacement pumps are capable of generating high pressures. This makes them suitable for applications where a high-pressure output is required, such as in hydraulic systems or processes that involve pumping fluids over long distances or through pipelines. Moreover, positive displacement pumps find widespread usage across diverse applications due to their versatility and precision. In industries such as oil & gas, these pumps play a vital role in the transfer of viscous crude oil, while in chemical processing, they are employed for accurate dosing and metering of various chemicals.

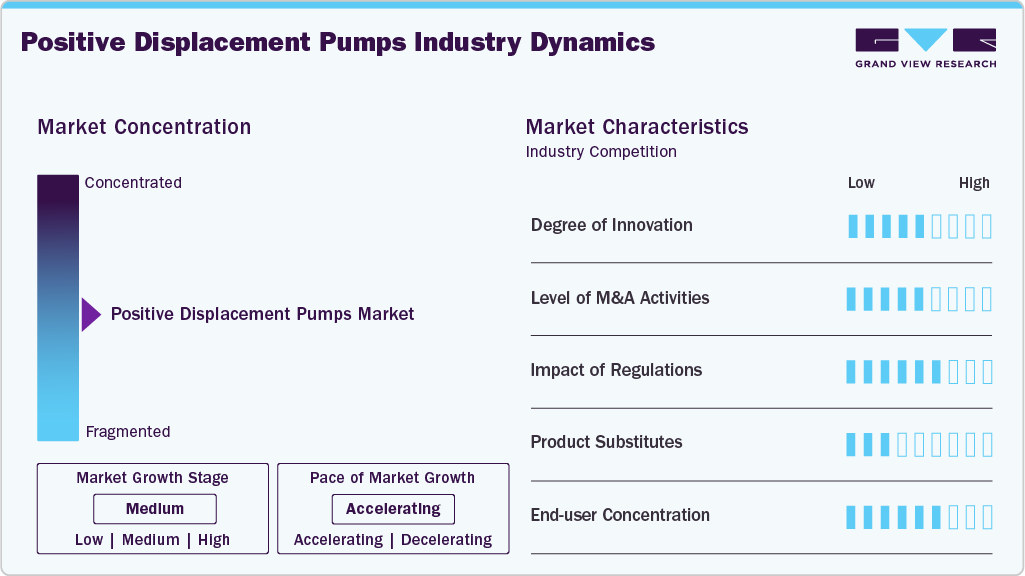

Market Concentration & Characteristics

The positive displacement pumps industry is moderately fragmented, as no single company dominates globally. Multiple regional and specialized manufacturers share market presence, driven by varied industrial needs. Barriers such as technology, customization, and service support favor smaller players. While major firms hold significant shares, numerous mid-sized and local companies keep competition balanced, preventing high concentration and ensuring diverse offerings and pricing.

The positive displacement pumps industry shows significant innovation focused on efficiency, reliability, and digital integration. Manufacturers invest in advanced materials, energy-saving designs, and IoT-enabled monitoring systems to reduce downtime and lifecycle costs. Customization for specific fluids and harsh environments drives R&D. While innovation varies by segment, incremental improvements in automation, smart diagnostics, and additive manufacturing enhance performance, sustainability, and operational insight across industries using these pumps.

Mergers and acquisitions in the market aim to expand product portfolios, geographic reach, and technological capabilities. Leading firms often acquire niche manufacturers to gain specialized expertise, address industry demands, and strengthen service networks. Consolidation helps achieve cost efficiencies and scale in competitive segments. Strategic deals also integrate advanced digital and energy-efficient solutions. These activities shape competitive dynamics by combining resources, broadening offerings, and enhancing customer access worldwide.

Regulations influence the market by enforcing energy efficiency, safety, and environmental standards. Policies promoting reduced emissions and lower energy consumption push manufacturers to develop compliant, high-efficiency models. Industry-specific rules (e.g., chemical handling, wastewater management) require robust designs and materials. Compliance drives innovation and can increase production costs. Global and regional standards harmonization affects exportability and competitiveness, while regulatory oversight ensures performance reliability, worker safety, and minimal environmental impact across applications.

Drivers, Opportunities & Restraints

Increasing need for precise and reliable fluid handling across industries such as oil & gas, chemicals, pharmaceuticals, and food & beverages is significantly driving the market growth. These pumps provide constant flow rates regardless of pressure variations, making them ideal for metering, dosing, and handling high-viscosity fluids. Rising industrial automation, process efficiency requirements, and demand for accurate control in critical operations are further accelerating market growth globally.

Growing investment in water and wastewater treatment projects worldwide is creating significant opportunity in the market. Rapid urbanization, population growth, and stricter environmental regulations are increasing demand for efficient sludge handling and chemical dosing systems. Positive displacement pumps are highly effective in these applications due to their accuracy and ability to handle thick fluids. Expansion of infrastructure in emerging economies offers significant untapped growth potential.

One key challenge facing the positive displacement pumps industry is its relatively high capital and maintenance costs compared to that of centrifugal pumps. These pumps require precise design, skilled installation, and regular maintenance to ensure optimal performance. In addition, components can experience faster wear when handling abrasive or corrosive fluids, leading to downtime and higher operating expenses. Cost sensitivity among small and medium-scale industries can limit adoption despite technical advantages.

Type Insights

The rotary segment held the dominant share in the market of 56.4% in 2025, driven by its suitability for handling viscous fluids and continuous flow applications. Food & beverage, pharmaceuticals, wastewater treatment, and polymer industries increasingly use rotary pumps for gentle, pulsation-free fluid transfer. Compact design, low shear characteristics, and improved efficiency make rotary pumps attractive for modern processing lines, supporting their expanding role in industrial and hygienic applications.

Reciprocating segment is expected to grow at a considerable CAGR of 5.6% from 2026 to 2033 in terms of revenue. The reciprocating segment is expected to grow significantly due to rising demand for high-pressure and precise flow applications. Industries such as oil & gas, power generation, and chemicals rely on reciprocating pumps for metering, injection, and hydraulic services. Their ability to handle extreme pressures with high efficiency and accuracy supports increased adoption in critical and demanding industrial operations.

End Use Insights

The oil & gas segment dominated the market and accounted for a share of 25.6% in 2025, due to increasing exploration, production, and refining activities. These pumps are widely used for high-pressure injection, crude oil transfer, and handling viscous fluids. Their ability to deliver accurate flow under extreme conditions supports demand in upstream, midstream, and downstream operations, especially as energy infrastructure expands globally.

The chemical segment is expected to grow at a significant CAGR of 6.5% from 2026 to 2033 in terms of automotive revenue. The chemical segment is projected to experience significant growth as manufacturers require precise, safe, and reliable fluid handling solutions. Positive displacement pumps are ideal for metering, dosing, and transferring corrosive or hazardous chemicals with high accuracy. Growing specialty chemical production, stricter safety regulations, and increased automation in chemical processing plants are key factors driving adoption across global chemical industries.

Regional Insights

North America Positive Displacement Pumps Market Trends

North America positive displacement pumps industry is expected to grow at a CAGR of 4.2% over the forecast period, due to strong demand from oil & gas, chemicals, food processing, and water treatment industries. Aging infrastructure upgrades, rising shale gas activities, and increasing automation in industrial processes are supporting pump adoption. Stringent regulatory standards related to process efficiency, safety, and environmental compliance are further encouraging the deployment of advanced pump technologies.

U.S. Positive Displacement Pumps Market Trends

The U.S. positive displacement pumps industry is experiencing steady growth, supported by expanding shale oil and gas production, continued investments in chemical manufacturing, and rising expenditure on wastewater and water treatment infrastructure. End use industries increasingly require high-pressure, precise, and reliable fluid-handling solutions, which is driving strong demand for both reciprocating and rotary positive displacement pumps

Mexico’s positive displacement pumps industry is witnessing steady expansion, driven by rising oil & gas exploration and refining activities, along with increased investments in water and wastewater infrastructure. Government initiatives aimed at strengthening energy security and industrial development are supporting demand for reliable and high-performance fluid-handling equipment across upstream, midstream, and processing applications.

Europe Positive Displacement Pumps Market Trends

Europe positive displacement pumps industry is witnessing moderate growth, primarily driven by stringent environmental regulations and increasing demand for energy-efficient and low-emission fluid-handling solutions. The water and wastewater treatment, chemical processing, and pharmaceutical sectors remain key end-use industries supporting market demand. In addition, rising levels of industrial automation and the ongoing replacement of aging pumping infrastructure across manufacturing facilities are contributing to steady adoption.

Germany’s positive displacement pumps industry is growing significantly due to its strong industrial base and leadership in chemical, pharmaceutical, and manufacturing sectors. High emphasis on precision, efficiency, and compliance with environmental standards drives demand for advanced pumping solutions. Investments in Industry 4.0, automation, and wastewater management further support growth, while Germany’s engineering expertise promotes innovation in high-performance reciprocating and rotary pumps.

The UK positive displacement pumps industry is expanding due to increasing investments in water and wastewater treatment, pharmaceuticals, and food processing industries. Aging infrastructure replacement and strict regulatory compliance for fluid control systems drive pump demand. In addition, growth in specialty chemicals and renewable energy projects supports adoption. Focus on efficient, low-maintenance pumping solutions and modernization of industrial facilities contributes to steady market growth.

Asia Pacific Positive Displacement Pumps Market Trends

Asia Pacific positive displacement pumps industry is a dominant market and accounted for the 41.0% share in 2025, driven by rapid industrialization, urbanization, and infrastructure development. Rising demand from water treatment, chemicals, oil & gas, and food processing industries supports market expansion. Increasing investments in manufacturing and energy projects, along with population growth and stricter environmental regulations, are boosting adoption of efficient and reliable pumping solutions across emerging economies.

China’s positive displacement pumps industry is growing rapidly due to large-scale industrial expansion and infrastructure development. Strong demand from chemical processing, water treatment, power generation, and oil & gas sectors drives adoption. Government focus on environmental protection and wastewater management further supports market growth. In addition, rising domestic manufacturing capabilities and technological advancements in pump design are strengthening China’s position as a major market and producer.

The positive displacement pumps market in India is expected to grow at a substantial CAGR of 7.1% from 2026 to 2033. India positive displacement pumps industry is witnessing strong growth, driven by expanding industrial activity and rising infrastructure investments across both public and private sectors. Large-scale water and wastewater treatment projects, along with growing demand from chemical manufacturing, oil & gas, and food processing industries, are key contributors to market expansion. Government initiatives focused on clean water access, urban infrastructure development, and industrial modernization are further accelerating the adoption of positive displacement pumping solutions.

Middle East & Africa Positive Displacement Pumps Market Trends

Middle East and Africa positive displacement pumps industry is witnessing moderate growth, driven primarily by oil & gas exploration, refining, and water desalination projects. Harsh operating conditions increase demand for durable and high-pressure pumping solutions. Rising investments in infrastructure, wastewater treatment, and industrial development across emerging African economies also contribute to regional market expansion.

Saudi Arabia’s positive displacement pumps industry is experiencing steady expansion, driven by large-scale oil & gas operations and sustained capital investments aligned with Vision 2030 initiatives. Increasing activity in petrochemicals, refining, and water desalination projects is generating strong demand for high-capacity, durable, and reliable pumping solutions capable of operating under high-pressure and corrosive conditions. In parallel, ongoing infrastructure modernization and broader industrial diversification efforts are accelerating the adoption of advanced and energy-efficient positive displacement pumps across the energy, water, and manufacturing sectors.

Latin America Positive Displacement Pumps Market Trends

Latin America positive displacement pumps industry is experiencing moderate growth due to rising investments in oil & gas, mining, and water infrastructure. Industrial development in countries such as Brazil and Argentina supports demand for accurate fluid handling equipment. Increasing focus on wastewater treatment, food processing, and chemical industries also contributes to steady adoption across the region.

Brazil’s positive displacement pumps industry is growing due to expanding oil & gas production, particularly offshore, and rising investments in water and wastewater treatment. Growth in chemical, food & beverage, and biofuel industries further supports demand. Infrastructure development and industrial modernization initiatives encourage adoption of efficient pumping solutions, while Brazil’s strong industrial base sustains long-term market expansion.

Key Positive Displacement Pumps Company Insights

Some of the key players operating in the market include Ingersoll Rand, SPX Flow, Alfa Laval

-

Ingersoll Rand is a global industrial company specializing in compressed air systems, fluid handling, and pumping solutions. Its portfolio includes positive displacement pumps, centrifugal pumps, and related equipment for industries such as oil & gas, chemicals, water treatment, and manufacturing. The company focuses on energy-efficient, reliable, and technologically advanced solutions, leveraging innovation and global service networks to improve operational efficiency and meet demanding industrial and municipal fluid handling requirements worldwide.

-

SPX Flow is an international provider of engineered flow components, including positive displacement pumps, valves, mixers, and filtration systems. Serving food & beverage, chemical, pharmaceutical, and industrial markets, the company emphasizes precision, hygiene, and process efficiency. Its positive displacement pumps ensure accurate dosing, metering, and fluid transfer for complex processes. SPX Flow combines innovative designs, global manufacturing, and strong service capabilities to support sustainable and high-performance fluid handling solutions.

Key Positive Displacement Pumps Companies:

The following are the leading companies in the positive displacement pumps market. These companies collectively hold the largest Market share and dictate industry trends.

- Ingersoll Rand

- SPX Flow

- Alfa Laval

- Viking Pump, Inc.

- Grundfos

- IDEX Corporation

- Schlumberger Limited

- Weir Group PLC

- KSB Group

- Sulzer Ltd.

- HERMETIC-Pumpen GmbH

- Flowserve Corporation

- Dover Corporation

- Moyno

- Netzsch Pumps

Recent Developments

-

In July 2025, Sulzer opened its third facility in Argentina, expanding its presence in Latin America. This move supports the company’s growth strategy, enhances regional manufacturing and service capabilities, and strengthens its ability to serve pumps markets.

-

In May 2025, Grundfos announced an expansion of its production facilities in Brookshire, Texas, to strengthen its manufacturing presence in the U.S. The expansion aims to meet rising regional demand, improve supply chain resilience, and support growth in water, wastewater, and industrial pumping solutions.

Global Positive Displacement Pumps Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 21,684.0 million

Revenue forecast in 2033

USD 31,304.3 million

Growth rate

CAGR of 5.4% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Ingersoll Rand; SPX Flow; Alfa Laval; Viking Pump, Inc.; Grundfos; IDEX Corporation; Schlumberger Limited; Weir Group PLC; KSB Group; Sulzer Ltd.; HERMETIC-Pumpen GmbH; Flowserve Corporation; Dover Corporation; Moyno; Netzsch Pumps

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Positive Displacement Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global positive displacement pumps market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Rotary

-

Gear Pump

-

Screw Pump

-

Vane Pump

-

Lobe Pump

-

Others

-

-

Reciprocating

-

Diaphragm

-

Piston

-

Plunger

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Agriculture

-

Water & Wastewater

-

Power Generation

-

Construction & Building Services

-

Oil & Gas

-

Chemical

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the global positive displacement pumps market include Ingersoll Rand, SPX Flow, Alfa Laval, Viking Pump, Inc., Grundfos, IDEX Corporation, Schlumberger Limited, Weir Group PLC, KSB Group, Sulzer Ltd., HERMETIC-Pumpen GmbH, Flowserve Corporation, Dover Corporation, Moyno, and Netzsch Pumps.

b. The global positive displacement pumps market size was estimated at USD 20,721.9 million in 2025 and is expected to be USD 21,684.0 million in 2026.

b. The global positive displacement pumps market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2026 to 2033 to reach USD 31,304.3 million by 2033.

b. The rotary segment holds the dominant share in the market, accounting for 56.4% in 2025, driven by its suitability for handling viscous fluids and continuous flow applications. The food and beverage, pharmaceutical, wastewater treatment, and polymer industries are increasingly using rotary pumps for gentle, pulsation-free fluid transfer.

b. The global positive displacement pumps market is driven by growing demand from oil & gas, chemicals, and water treatment industries, increasing need for precise and reliable fluid handling, rising industrial automation, and effective management of high-viscosity and complex fluids.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.