- Home

- »

- Automotive & Transportation

- »

-

Industrial Tugger Market Size & Share, Industry Report, 2033GVR Report cover

![Industrial Tugger Market Size, Share & Trends Report]()

Industrial Tugger Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Electronic, Gasoline), By Load Capacity, By Application (Warehouse, Manufacturing Plants), By End Use (Automotive, E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-765-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Tugger Market Summary

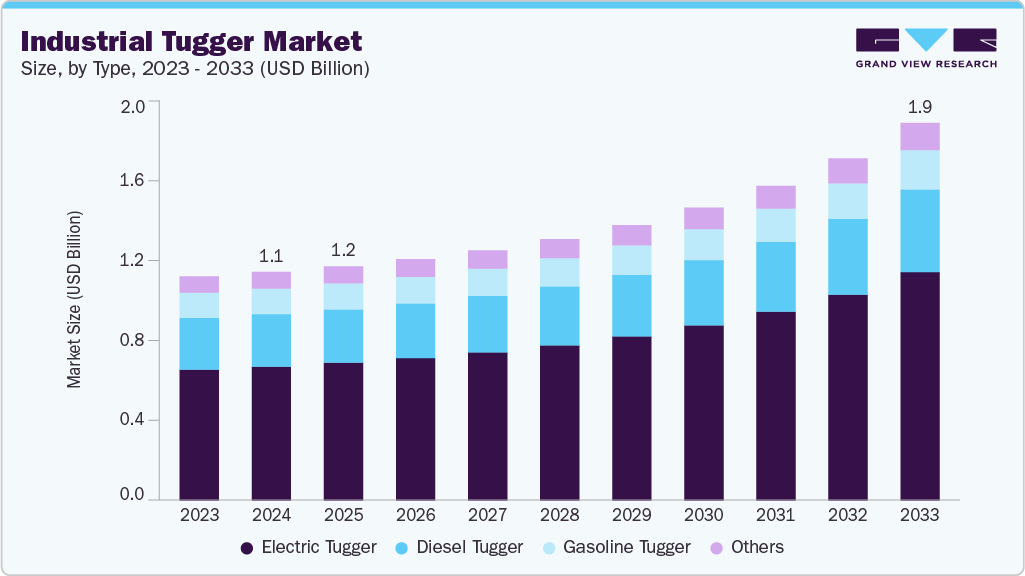

The global industrial tugger market size was estimated at USD 1.13 billion in 2024, and is projected to reach USD 1.87 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The market is primarily driven by the growing demand for efficient and safe material handling solutions across industries such as automotive, e-commerce, aerospace, and manufacturing.

Key Market Trends & Insights

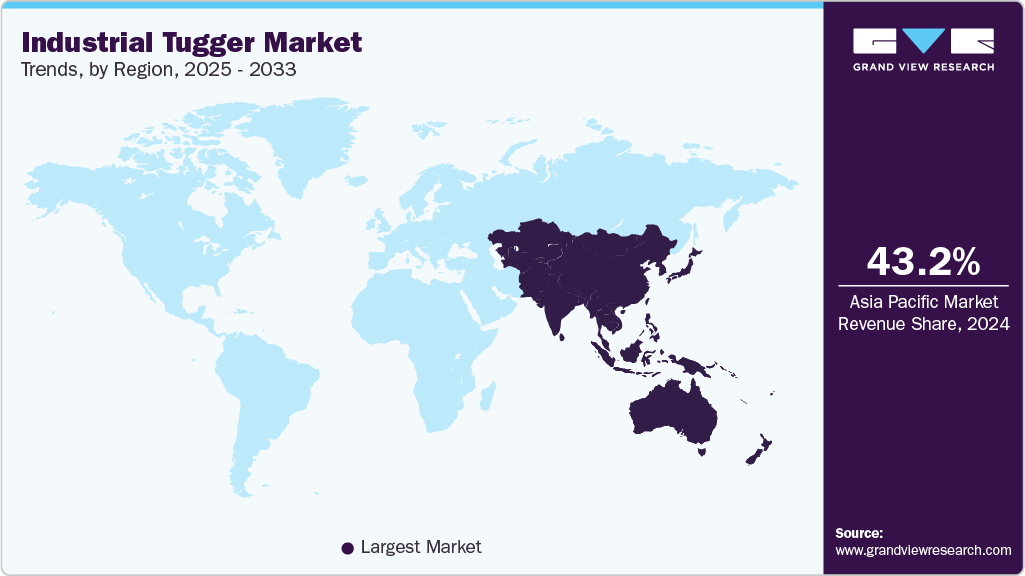

- Asia Pacific industrial tugger market accounted for a 43.2% share of the overall market in 2024.

- The industrial tugger industry in the China held a dominant position in the Asia Pacific region in 2024.

- By type, the electric tugger segment accounted for the largest share of 58.6% in 2024.

- By load capacity, the upto 5000 lbs segment held the largest market share in 2024.

- By application, the warehouse segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.13 Billion

- 2033 Projected Market Size: USD 1.87 Billion

- CAGR (2025-2033): 6.2%

- Asia Pacific: Largest market in 2024

The rise of lean manufacturing, just-in-time logistics, and high-volume order fulfillment has made tuggers an essential alternative to forklifts, as they allow for safer, more streamlined movement of goods. Technological innovation is reshaping the market, with the emergence of electric, lithium-ion battery-powered, and autonomous tugger solutions. Automation and integration with Industry 4.0 technologies are enabling tuggers to operate within smart factories and logistics hubs, reducing labor dependency and improving efficiency. Advancements in autonomous mobile robots (AMRs) and vision-guided navigation systems are transforming conventional tuggers into intelligent machines that can adapt to dynamic environments.

Regulatory policies play a significant role in shaping the market for industrial tugger. Emission control standards in Europe and North America are driving the transition from diesel-powered tuggers to electric and hybrid models. Safety regulations in workplaces are also encouraging companies to replace traditional forklifts with tuggers, as they reduce traffic congestion and accident risks on shop floors. Moreover, government incentives for the adoption of green and sustainable material handling equipment are accelerating the deployment of electric and autonomous tuggers in developed and emerging economies alike.

Despite strong growth prospects, the market faces restraints such as high initial investment costs for advanced electric and autonomous tugger systems, which can be a barrier for small and medium-sized enterprises (SMEs). The lack of charging infrastructure and power limitations in certain regions continue to hinder the adoption of electric tuggers, especially in heavy-duty operations. Diesel tuggers, while powerful, face challenges from stringent environmental regulations and rising fuel costs, which may reduce their long-term viability.

Type Insights

The electric tugger segment accounted for the largest share of 58.6% in 2024. The rising adoption of sustainable and energy-efficient material handling equipment is driving the demand for electric tuggers. With stricter environmental regulations and corporate ESG commitments, industries are actively seeking alternatives to reduce emissions and noise pollution inside warehouses and factories. Electric tuggers offer benefits such as lower operating costs, reduced maintenance needs compared to internal combustion engines, and improved energy efficiency, especially when paired with advanced lithium-ion battery technologies that allow for faster charging and longer run times.

The diesel tugger segment is expected to grow at a significant CAGR, during the forecast period. Diesel tuggers continue to see growth in applications where heavy-duty load handling, high endurance, and outdoor operations are critical. Many industries, such as construction, mining, ports, airports, and large-scale industrial sites, require tuggers with higher towing capacities and the ability to perform in rugged, long-hour operations where electric charging infrastructure may not be practical. Diesel tuggers are valued for their high torque output, long operational cycles, and refueling convenience, which ensures minimal downtime compared to battery recharging. Emerging markets with limited access to charging infrastructure are also contributing to sustained demand.

Load Capacity Insights

The upto 5000 lbs segment held the dominating revenue share in the market in 2024. Tuggers with capacities of up to 5,000 lbs are gaining traction because of their widespread use in light- to medium-duty material handling applications. Industries such as e-commerce, retail, electronics, and food & beverage rely heavily on these models for moving smaller loads across warehouses and production floors. The push toward lean manufacturing and just-in-time (JIT) logistics is boosting adoption, as these lighter-capacity tuggers are more maneuverable in confined spaces and better suited for frequent, short-distance transport tasks.

The above 10,000 lbs segment is expected to grow at a significant CAGR during the forecast period. The segment is expanding due to increasing demand in heavy-duty industries such as automotive, aerospace, mining, steel, shipbuilding, and large-scale manufacturing. These sectors require equipment capable of towing exceptionally heavy loads safely and efficiently, often over long shifts. Growth is further supported by infrastructure development projects and the expansion of global supply chains, where high-capacity tuggers are needed to move bulky raw materials and finished goods.

Application Insights

The warehouse segment dominated the market in 2024. In warehouses, the adoption of industrial tuggers is driven by the need for efficient material movement within confined indoor spaces. Warehouses are increasingly adopting lean inventory management and high-frequency replenishment strategies, which require quick and safe transportation of goods between storage areas and assembly or packing stations.

The distribution centers segment is projected to grow at a significant CAGR over the forecast period. In distribution centers, industrial tuggers are being adopted to handle large-scale, high-throughput operations that involve moving goods across long distances and in bulk quantities. The rise of global supply chains and just-in-time distribution models requires equipment that can transport palletized goods, heavy loads, and multiple trailers efficiently. Industrial tuggers, especially those with capacities above 10,000 lbs, help reduce turnaround times and improve flow between receiving, sorting, and outbound areas.

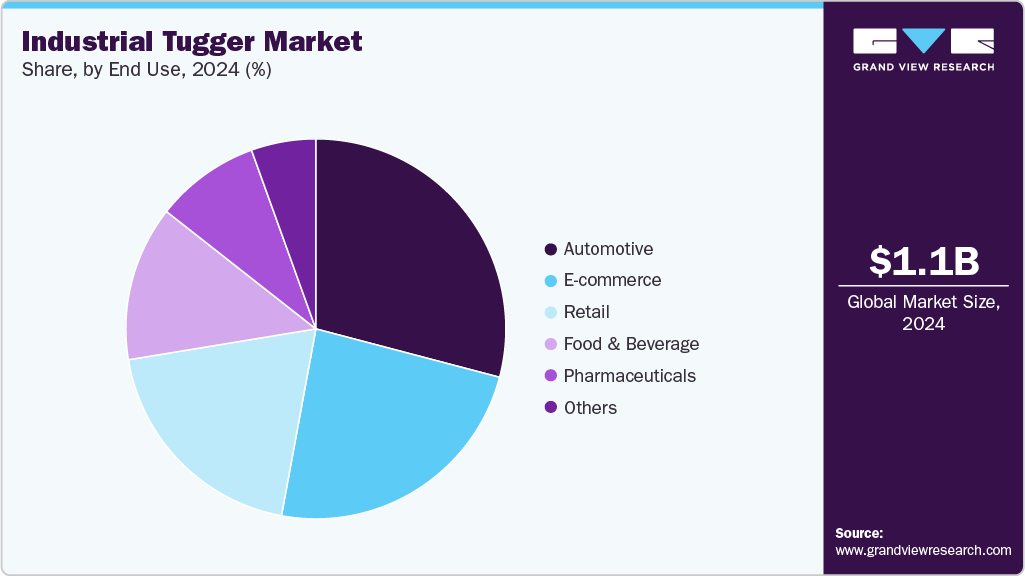

End Use Insights

The automotive segment dominated the market in 2024 in terms of revenue. In the automotive sector, industrial tuggers are increasingly adopted due to the industry’s reliance on lean manufacturing and just-in-time (JIT) production processes. Automakers and component suppliers need efficient ways to transport parts, sub-assemblies, and raw materials across large manufacturing facilities with precision and timeliness. Industrial tuggers support tugger train systems, which allow multiple loads to be moved in a single trip, reducing labor costs and improving production flow.

The e-commerce segment is expected to register the fastest CAGR over the forecast period, In the e-commerce industry, the adoption of industrial tuggers is primarily driven by the need to handle high-frequency, small-batch, and time-sensitive order fulfillment. E-commerce warehouses and fulfillment centers face constant pressure to improve speed and accuracy in moving goods from storage to sorting and packing areas. Industrial tuggers, especially in the up to 5,000 lbs capacity range, are well-suited for these operations because of their agility, energy efficiency, and compatibility with automation technologies.

Regional Insights

The North America industrial tugger industry held a significant share in 2024. Growth in North America is fueled by the rapid adoption of automation and Industry 4.0 practices across the manufacturing and logistics sectors. The rise of e-commerce, automotive production, and large-scale warehousing is pushing demand for both electric and autonomous tuggers. Increasing focus on workplace safety and labor efficiency also supports adoption.

U.S. Industrial Tugger Market Trends

The U.S. industrial tugger industry held a dominant position in 2024, driven by the strong presence of e-commerce fulfillment centers, automotive manufacturing plants, and advanced logistics hubs. Investments in automation technologies and government incentives for sustainable material handling equipment are further boosting the shift toward electric and autonomous tugger solutions.

Europe Industrial Tugger Market Trends

The Europe industrial tugger industry was identified as a lucrative region in 2024. Europe is experiencing growth due to stringent environmental regulations that encourage the adoption of low-emission electric tuggers. Expansion of automated intralogistics solutions in industries like automotive, aerospace, and food processing is also driving adoption.

The UK industrial tugger industry is expected to grow rapidly in the coming years. In the UK, the surge in e-commerce activity, retail distribution, and post-Brexit logistics restructuring is increasing demand for flexible and efficient tugger solutions. Adoption of automation in warehouses and fulfillment centers is particularly strong, with a focus on electric tuggers to meet sustainability goals.

Asia Pacific Industrial Tugger Market Trends

The Asia Pacific industrial tugger industry is expected to grow at the fastest CAGR of 7.1% over the forecast period. The region is seeing rapid growth due to industrial expansion, rising e-commerce penetration, and large-scale manufacturing activities. Countries such as China, Japan, and India are investing heavily in warehouse automation and electric equipment to improve efficiency and sustainability.

The Japan industrial tugger industry is expected to grow rapidly in the coming years. In Japan, adoption is driven by the country’s automotive and electronics manufacturing strength, coupled with its early adoption of automation and robotics. Space-efficient, electric, and autonomous tuggers are gaining traction in smart factory environments.

The China industrial tugger industry held a substantial market share in 2024 due to its massive e-commerce sector, large-scale manufacturing base, and rapid industrial automation investments. Government policies promoting green and electric equipment are further pushing adoption, making electric and high-capacity tuggers popular in both warehouses and production facilities.

Key Industrial Tugger Company Insights

Some of the key companies in the market include Toyota Material Handling, Crown Equipment Corporation, Hyster-Yale Materials Handling, Inc., and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Toyota Material Handling is a provider of material handling equipment, including forklifts, warehouse trucks, and industrial vehicles such as tow tractors and tuggers. Toyota Material Handling offers a comprehensive product line with Toyota, BT, and Raymond brands, catering to various market needs with electric and internal combustion forklifts, automated guided vehicles, and tow tractors designed for heavy-duty industrial use. Their industrial tuggers, also called tow tractors, are robust and designed for efficient movement of heavy loads in warehouses and manufacturing plants, featuring ergonomic controls and advanced electric systems for performance and reliability.

-

Mitsubishi Logisnext Co., Ltd. is an integrated logistics equipment manufacturer, delivering comprehensive solutions for material handling and logistics operations worldwide. The company develops, designs, manufactures, and sells a wide range of equipment, including electric and engine-powered forklifts, automated guided vehicles (AGVs), and industrial vehicles such as tuggers and tow tractors. The company offers robust and technologically advanced electric tow tractors designed to improve efficiency and safety in warehouse and industrial environments. These vehicles are engineered to handle heavy loads and operate smoothly alongside human workers, contributing to optimized transport and logistics processes.

Key Industrial Tugger Companies:

The following are the leading companies in the industrial tugger market. These companies collectively hold the largest market share and dictate industry trends.

- Toyota Material Handling

- Crown Equipment Corporation

- Hyster-Yale Materials Handling, Inc.

- MITSUBISHI LOGISNEXT CO.,LTD.

- Lift Truck Center, Inc.

- CLARK

- The Raymond Corporation

- Global Equipment Company Inc.

- MasterMover, Inc.

- Cyngn Inc.

Recent Developments

-

In April 2024, Motrec introduced an innovative, fully autonomous electric tugger developed in partnership with Cyngn, a company specializing in AI-driven autonomous software for industrial applications. This hybrid tow tractor, based on the Motrec MT-160 model, can operate in both manual and autonomous modes. It features notable industrial capabilities, including a towing capacity of up to 6,000 lbs and a tight turning radius of 54 inches. It is ideal for maneuvering in confined spaces typical of warehouses and industrial yards.

Industrial Tugger Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.16 billion

Revenue forecast in 2033

USD 1.87 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, load capacity, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Toyota Material Handling; Crown Equipment Corporation; Hyster-Yale Materials Handling, Inc.; MITSUBISHI LOGISNEXT CO.,LTD.; Lift Truck Center, Inc.; CLARK; The Raymond Corporation; Global Equipment Company Inc.; MasterMover, Inc.; Cyngn Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Tugger Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial tugger market report based on type, load capacity, application, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Electric Tugger

-

Gasoline Tugger

-

Diesel Tugger

-

Others

-

-

Load Capacity Outlook (Revenue, USD Billion, 2021 - 2033)

-

Upto 5000 lbs

-

5,001-10,000 lbs

-

Above 10,000 lbs

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Warehouse

-

Manufacturing Plants

-

Distribution Centers

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

E-commerce

-

Retail

-

Food & Beverage

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial tugger market size was estimated at USD 1.13 billion in 2024 and is expected to reach USD 1.16 billion in 2025.

b. The global industrial tugger market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 1.87 billion by 2033.

b. Asia Pacific dominated the industrial tugger market with a share of 43.2% in 2024. The region is seeing rapid growth due to industrial expansion, rising e-commerce penetration, and large-scale manufacturing activities. Countries such as China, Japan, and India are investing heavily in warehouse automation and electric equipment to improve efficiency and sustainability.

b. Some key players operating in the industrial tugger market include Toyota Material Handling; Crown Equipment Corporation; Hyster-Yale Materials Handling, Inc.; MITSUBISHI LOGISNEXT CO.,LTD.; Lift Truck Center, Inc.; CLARK; The Raymond Corporation; Global Equipment Company Inc.;MasterMover, Inc.; Cyngn Inc.

b. The industrial tugger market is primarily driven by the growing demand for efficient and safe material handling solutions across industries such as automotive, e-commerce, aerospace, and manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.