- Home

- »

- Water & Sludge Treatment

- »

-

Industrial Waste Management Market, Industry Report, 2033GVR Report cover

![Industrial Waste Management Market Size, Share & Trends Report]()

Industrial Waste Management Market (2026 - 2033) Size, Share & Trends Analysis Report By Service Type (Collection, Transportation, Disposal), By End Use (Construction & Demolition, Manufacturing, Oil & Gas, Chemical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-835-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Waste Management Market Summary

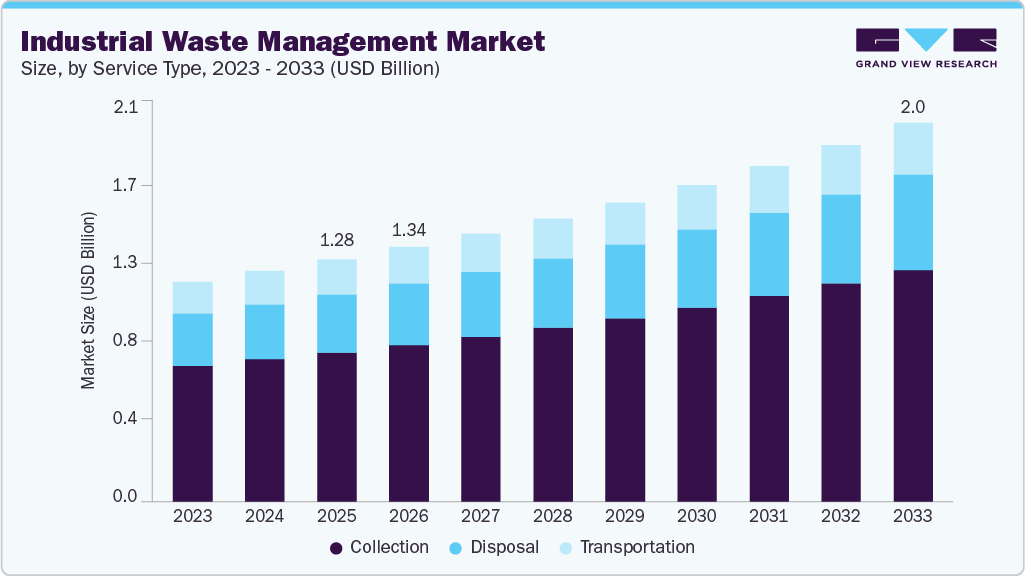

The global industrial waste management market size was estimated at USD 1,282.9 million in 2025 and is projected to reach USD 2010.8 million by 2033, growing at a CAGR of 5.9% from 2026 to 2033. The market is primarily driven by the tightening of environmental regulations and stricter government enforcement on industrial waste disposal.

Key Market Trends & Insights

- North America dominated the industrial waste management market with the largest revenue share of 33.4% in 2025.

- The industrial waste management market in the U.S. is expected to grow at a substantial CAGR of 5.3% from 2026 to 2033.

- By service type, disposal segment is expected to grow at the fastest CAGR of 6.4% from 2026 to 2033 in terms of revenue.

- By end use, manufacturing segment is expected to grow at a considerable CAGR of 6.2% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 1,282.9 Million

- 2033 Projected Market Size: USD 2,010.8 Million

- CAGR (2026-2033): 5.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Manufacturing plants, chemical industries, and energy producers are compelled to adopt structured waste handling systems to comply with emission norms and sustainability mandates. Another key driving factor is the growing emphasis on circular economy practices and resource recovery.

Industries are increasingly focusing on recycling industrial by-products to reduce raw material dependency and operational costs. Technological advancements in waste processing, including thermal treatment and waste-to-energy solutions, enhance efficiency and profitability. This shift toward sustainable production supports the steady expansion of the industrial waste management market.

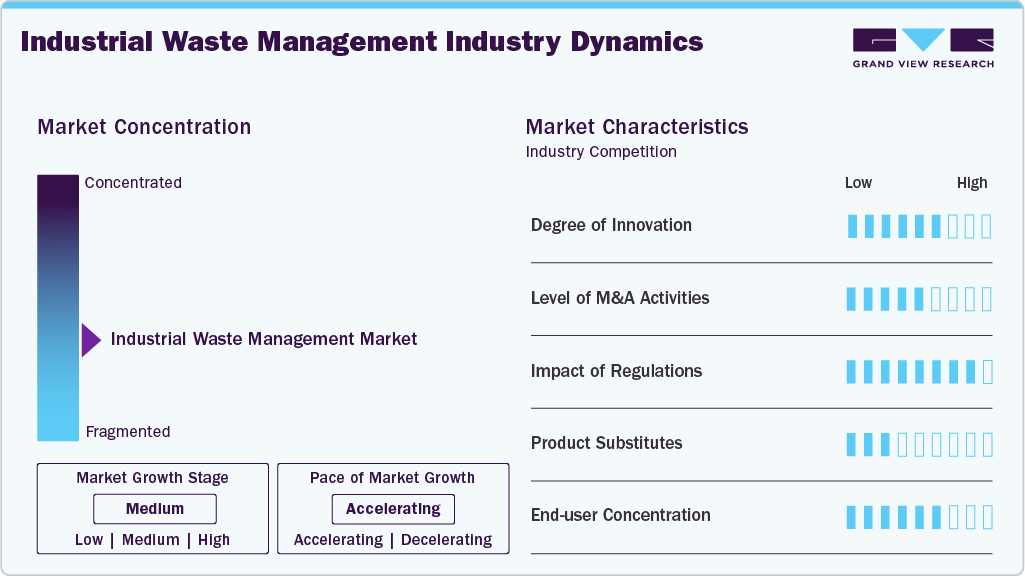

Market Concentration & Characteristics

The industrial waste management market is moderately fragmented, with a mix of large multinational players and numerous regional service providers operating across specialized waste streams. While global companies dominate large industrial contracts and integrated service offerings, local firms remain competitive due to proximity advantages and niche expertise. This structure encourages strong competition, driving service innovation and pricing flexibility.

The industrial waste management industry is witnessing a steady rise in innovation as companies integrate automation, IoT monitoring, and AI-based waste tracking systems into their operations. Smart segregation technologies and advanced treatment methods such as pyrolysis and plasma gasification are improving processing efficiency and recovery rates. Digital platforms for waste traceability are enhancing transparency and compliance reporting. These innovations help providers reduce operational costs while improving environmental performance.

Regulatory frameworks strongly shape industry operations, with stringent guidelines governing hazardous waste handling, emissions, and disposal standards. Compliance requirements drive continuous upgrades in treatment infrastructure and process optimization. Non-compliance risks, including heavy fines and legal consequences, push industries toward professional waste management services. As regulations evolve, service providers must adapt quickly to maintain operational and environmental alignment.

End user concentration is relatively diverse, with major demand coming from manufacturing, chemical, oil & gas, pharmaceuticals, and power generation sectors. Large industrial hubs generate high waste volumes, making them key clients for integrated service providers. However, small and mid-sized industries also contribute significantly through recurring service contracts. This broad user base stabilizes demand and reduces reliance on a single sector.

Drivers, Opportunities & Restraints

The Industrial Waste Management market is driven by stricter environmental policies and rising pressure on industries to minimize landfill disposal and carbon footprints. Rapid industrialization and expansion of manufacturing facilities increase the volume and complexity of waste streams. Growing awareness of sustainable practices encourages companies to adopt structured waste handling systems. Demand for safe treatment of hazardous and chemical waste further strengthens market growth.

Emerging opportunities lie in the adoption of waste-to-energy technologies and advanced recycling solutions that convert industrial by-products into reusable resources. The shift toward circular economy models allow service providers to offer value-added recovery services. Increasing investments in smart waste tracking and digital compliance systems open new revenue streams. Expansion of industrial zones in developing regions also creates potential for long-term contracts.

High capital expenditure associated with advanced treatment facilities and specialized equipment restrains market expansion. Complex regulatory compliance procedures increase operational costs for service providers and end users. Limited infrastructure in remote industrial areas restricts efficient waste collection and processing. Fluctuating costs of treatment technologies and skilled labor shortages also hinder consistent market development.

Service Type Insights

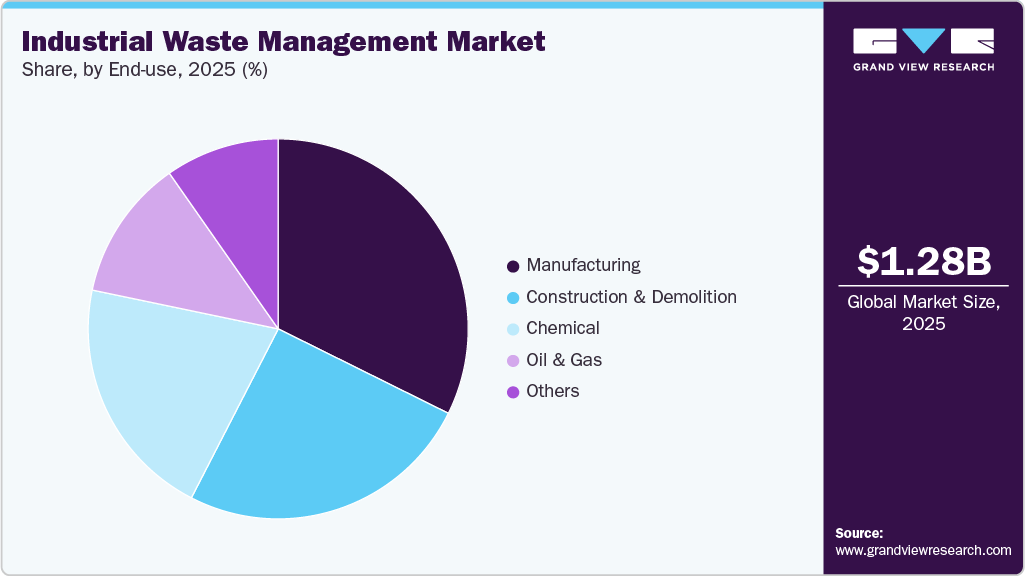

Disposal segment is expected to grow at the fastest CAGR of 6.4% from 2026 to 2033 in terms of revenue. The collection segment dominates the industrial waste management market and accounting for 61.6% share in 2025, due to the continuous generation of waste from manufacturing and processing facilities. Industries prioritize reliable and frequent waste pickup to maintain operational efficiency and compliance with environmental norms. The need for safe handling of hazardous and non-hazardous waste at the source further strengthens demand for professional collection services. Advanced logistics planning and scheduled pickup systems also enhance the dominance of this segment.

The disposal segment is the fastest growing as industries move away from uncontrolled dumping toward regulated and environmentally safe disposal methods. Increasing adoption of engineered landfills, secure hazardous waste containment, and advanced treatment sites supports this growth. Stricter regulations and higher penalties for improper disposal drive industries toward certified disposal solutions. Rising waste volumes from complex industrial processes continue to accelerate this segment’s expansion.

End Use Insights

The chemical segment is expected to grow at the fastest CAGR of 6.4% from 2026 to 2033 in terms of revenue. The manufacturing sector dominates the industrial waste management market and accounting for 32.3% share in 2025, due to its large-scale production processes and continuous generation of solid, liquid, and semi-hazardous waste. Industries such as automotive, metal fabrication, food processing, and electronics require consistent waste collection and treatment to maintain operational efficiency. High production volumes and strict compliance requirements increase reliance on professional waste management services. This sustained demand positions manufacturing as the primary contributor to market revenue.

The chemical segment is the fastest growing during the forecast period, as complex waste streams demand specialized handling and advanced treatment solutions. Rising production of specialty chemicals, agrochemicals, and petrochemicals increases the volume of hazardous waste requiring controlled disposal. Strict safety and environmental regulations compel chemical manufacturers to adopt structured waste management systems. Expanding chemical infrastructure in developing regions further accelerates growth in this segment.

Regional Insights

North America industrial waste management market dominates the respective global market and accounting for 33.4% share in 2025, due to its well-established industrial base and strict environmental compliance framework. High waste generation from manufacturing, energy, and chemical sectors drives continuous demand for professional services. Advanced treatment infrastructure and a strong presence of major service providers support market leadership. Consistent investments in sustainable waste technologies further reinforce regional dominance.

U.S. Industrial Waste Management Market Trends

The United States dominates the respective North American market due to its vast manufacturing base and high volume of industrial waste generation. Strong regulatory enforcement by environmental authorities drives continuous demand for compliant waste handling and treatment services. The presence of major waste management companies and advanced processing infrastructure strengthens market leadership. Increased focus on sustainability and waste-to-energy solutions further supports dominance.

Industrial waste management market in Canada is showing steady growth as industrial expansion increases waste output across mining, energy, and manufacturing sectors. Government initiatives promoting responsible waste disposal and recycling encourage the adoption of professional waste services. Rising investments in modern treatment facilities enhance operational efficiency. Growing awareness of environmental protection continues to support market expansion.

Europe Industrial Waste Management Market Trends

Europe continues to grow due to its strong focus on sustainability and circular economy initiatives. Strict waste disposal regulations and landfill reduction targets drive demand for advanced treatment services. Industries are increasingly adopting recycling and resource recovery practices to meet environmental goals. Technological innovation further strengthens steady market expansion across the region.

Industrial waste management market in Germany dominates the respective European market due to its strong manufacturing backbone and advanced environmental infrastructure. Strict regulatory compliance and well-defined waste segregation systems drive high adoption of professional waste services. The country’s focus on recycling, resource efficiency, and circular economy practices supports large-scale waste processing activities. Continuous investment in innovative treatment technologies reinforces its leading position.

The UK industrial waste management market is witnessing steady growth as industries increasingly prioritize sustainable waste handling and landfill reduction. Strengthening environmental policies and carbon reduction targets encourage the use of certified waste management services. Expansion of industrial and commercial sectors contributes to rising waste volumes. Growing investments in recycling and energy recovery facilities further fuel market development.

Asia Pacific Industrial Waste Management Market Trends

Asia Pacific is the fastest growing region at a CAGR of 6.5%, fueled by rapid industrialization and expansion of manufacturing hubs across emerging economies. Rising awareness of environmental impact and improving regulatory structures encourage structured waste handling practices. Increasing foreign investments and growth in chemical and automotive production boost waste volumes. Expanding urban-industrial clusters accelerate demand for modern waste management solutions.

Industrial waste management market in China dominates the respective Asia Pacific market due to its massive manufacturing sector and high industrial output. Large-scale production in chemicals, metals, and electronics generates significant waste volumes requiring structured treatment solutions. Strengthening government regulations and enforcement mechanisms drive widespread adoption of professional services. Continuous investment in waste treatment infrastructure supports its regional leadership.

India industrial waste management market is emerging as a rapidly growing market driven by industrial expansion and increasing waste generation across manufacturing hubs. Government initiatives promoting sustainable waste management and stricter compliance norms are encouraging organized service adoption. Rising awareness of environmental protection among industries supports market growth. Infrastructure development and private sector participation further accelerate expansion.

Latin America Industrial Waste Management Market Trends

Latin America shows growing momentum as industrial development and infrastructure investments increase waste generation. Governments are strengthening regulations to improve waste handling and environmental protection. Rising participation of private companies in waste management services supports market development. Expansion of industrial zones continues to create consistent service demand.

Industrial waste management market in Brazil is witnessing steady growth, due to expanding manufacturing, mining, and chemical industries generating higher waste volumes. Strengthening environmental regulations and increased enforcement are driving industries to adopt organized waste handling solutions. Government initiatives promoting sustainable disposal and recycling practices support market development. Rising investments in treatment infrastructure and private sector participation further enhance growth potential.

Middle East & Africa Industrial Waste Management Market Trends

The Middle East and Africa are experiencing growth due to expanding industrial activities and energy sector operations. Increased focus on environmental protection and sustainable waste disposal practices boosts service adoption. Infrastructure development and regulatory improvements support market progression. Growing awareness of safe waste handling is driving steady regional demand.

South Africa industrial waste management market is experiencing steady growth, due to expanding mining, manufacturing, and energy sectors generating higher waste volumes. Increasing government focus on environmental compliance and sustainable disposal practices is encouraging the shift toward organized waste services. Investments in modern treatment and recycling facilities are improving service efficiency and capacity. Rising awareness among industries about responsible waste handling continues to support market expansion.

Key Industrial Waste Management Market Company Insights

Some of the key players operating in the market include WM Intellectual Property Holdings, L.L.C., Suez, and Valicor.

-

WM operates as a specialized service provider focused on large-scale industrial and hazardous waste streams across complex operational environments. The company integrates advanced logistics, on-site waste segregation, and compliance-driven handling solutions for high-volume industrial clients. Its strength lies in managing regulated waste categories through controlled treatment and certified disposal networks. WM also emphasizes data-driven tracking systems to support regulatory reporting and operational transparency. This structured service model enhances efficiency for industries with stringent environmental requirements.

-

SUEZ delivers integrated industrial waste management solutions with a strong focus on resource recovery and waste valorization for industrial facilities. The company supports complex waste treatment processes including sludge management, chemical waste processing, and recycling optimization. Its expertise extends to designing customized waste management frameworks for heavy industries and manufacturing plants. SUEZ prioritizes sustainable waste transformation to reduce landfill dependency and optimize material reuse. This approach positions it as a key player in industrial circular economy implementation.

Key Industrial Waste Management Companies:

The following are the leading companies in the industrial waste management market. These companies collectively hold the largest Market share and dictate industry trends.

- WM Intellectual Property Holdings, L.L.C.

- Suez

- Valicor

- Veolia

- Waste Connections.

- Republic Services

- Biffa

- CLEAN HARBORS, INC.

- Reworld.

- DAISEKI CO., Ltd.

- Stericycle, Inc.

- Casella Waste Systems, Inc.

- CECO ENVIRONMENTAL.

- Cleanaway

- GFL Environmental Inc.

Recent Developments

-

In January 2025, SUEZ expanded its industrial waste recovery presence in Italy by acquiring a majority stake in Gruppo Ecosistem, strengthening its position in the local waste sector. The acquisition enhances its capacity in hazardous and non-hazardous waste treatment, recycling, and energy recovery services. This move supports SUEZ’s strategy to scale high-value industrial waste solutions across Europe. It also ensures continuity through the involvement of Gruppo Ecosistem’s existing management.

-

In November 2024, Reconomy strengthened its presence in the U.S. industrial waste market by acquiring Integrated Waste Analysts through its subsidiary, supporting its ongoing expansion strategy. This move enhances its service capabilities in industrial waste processing, recycling, and resource management across a wider client base. The acquisition also improves operational scale and strengthens its competitive positioning in North America. Overall, it reflects Reconomy’s focus on expanding circular economy services within the industrial waste sector.

Industrial Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,349.3 million

Revenue forecast in 2033

USD 2,010.8 million

Growth rate

CAGR of 5.9% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; Japan; India; Australia; South Korea; Argentina; Brazil; South Africa; UAE

Key companies profiled

WM Intellectual Property Holdings, L.L.C.; Suez; Valicor; Veolia; Waste Connections; Republic Services; Biffa; CLEAN HARBORS, INC.; Reworld; DAISEKI CO., Ltd.; Stericycle, Inc.; Casella Waste Systems, Inc.; CECO ENVIRONMENTAL; Cleanaway; GFL Environmental Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Waste Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the industrial waste management market report based on service type, end use, and region.

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Collection

-

Transportation

-

Disposal

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction & Demolition

-

Manufacturing

-

Oil & Gas

-

Chemical

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial waste management size was estimated at USD 1,282.9 million in 2025 and is expected to be USD 1,349.3 million in 2026.

b. The global industrial waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.9% from 2026 to 2033 to reach USD 2,010.8 million by 2033

b. Some of the key players operating in the industrial waste management market include WM Intellectual Property Holdings, L.L.C.; Suez; Valicor; Veolia; Waste Connections; Republic Services; Biffa; CLEAN HARBORS, INC.; Reworld; DAISEKI CO., Ltd.; Stericycle, Inc.; Casella Waste Systems, Inc.; CECO ENVIRONMENTAL; Cleanaway; GFL Environmental Inc.

b. Some key players operating in the industrial waste management market include Veolia, SUEZ, Waste Management, Inc., Republic Services, Inc., and Clean Harbors, Inc. Other notable players operating in the market include Remondis SE & Co. Kg, Advanced Disposal Services, Inc., Daiseki Co. Ltd., Covanta Holding Corporation, EnviroServ Waste, and Biffa.

b. The industrial waste management market is driven by stringent environmental regulations, rising industrial waste generation, and increasing focus on sustainable disposal practices. Growing adoption of recycling and waste-to-energy solutions further supports market expansion. Technological advancements in waste treatment also enhance efficiency and compliance across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.