- Home

- »

- Pharmaceuticals

- »

-

Infant Nutrition Market Size & Share, Industry Report, 2030GVR Report cover

![Infant Nutrition Market Size, Share, & Trends Report]()

Infant Nutrition Market (2025 - 2030) Size, Share, & Trends Analysis Report By Product Type (Infant Milk Formula, Baby Food), By Form (Solid, Liquid), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-163-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Infant Nutrition Market Summary

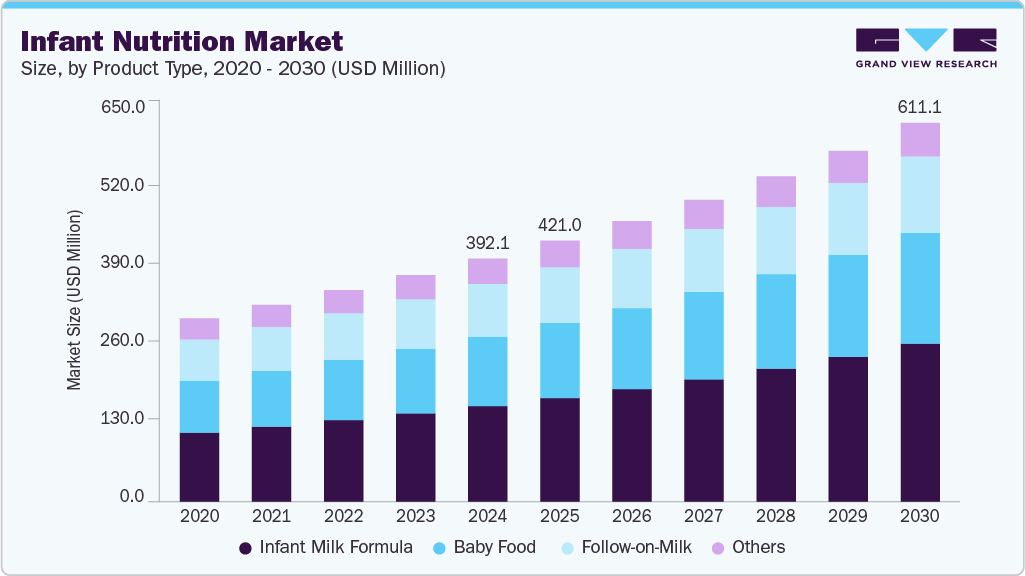

The global infant nutrition market size was valued at USD 392.1 million in 2024 and is projected to reach USD 611.1 million by 2030, growing at a CAGR of 7.7% from 2025 to 2030. The market growth is driven by factors such as increasing awareness and acceptance of infant nutrition products, urbanization, and changing lifestyles.

Key Market Trends & Insights

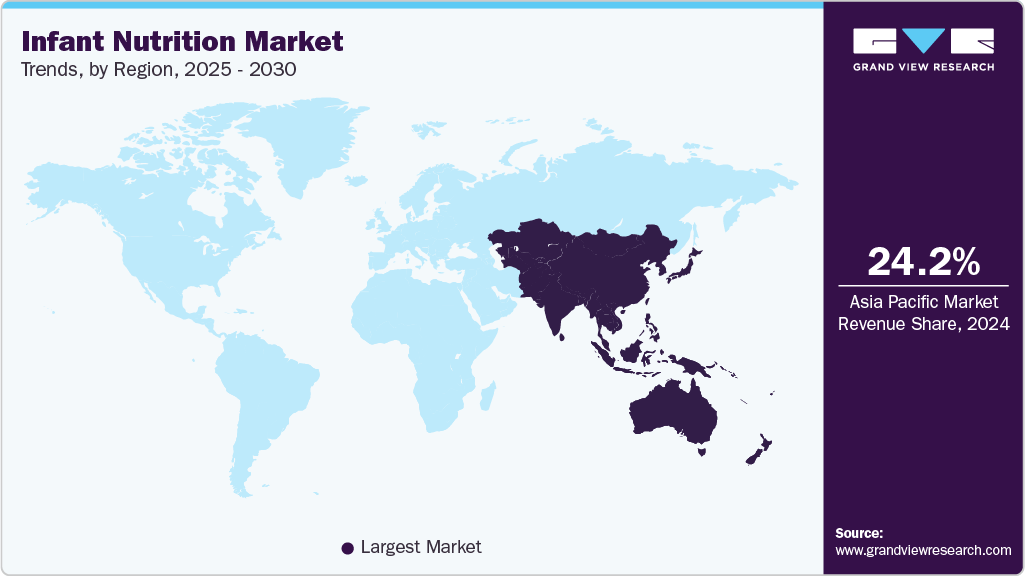

- Asia Pacific infant nutrition industry accounted for the largest global revenue share of over 24.2% in 2024.

- The India infant nutrition market is anticipated to grow at the fastest CAGR of 12.1% during the forecast period.

- By product type, the infant milk formula segment held the largest revenue share of 39.3% in 2024.

- By form, the solid form segment dominated the global infant nutrition market in 2024, accounting for 62.9% of the revenue share.

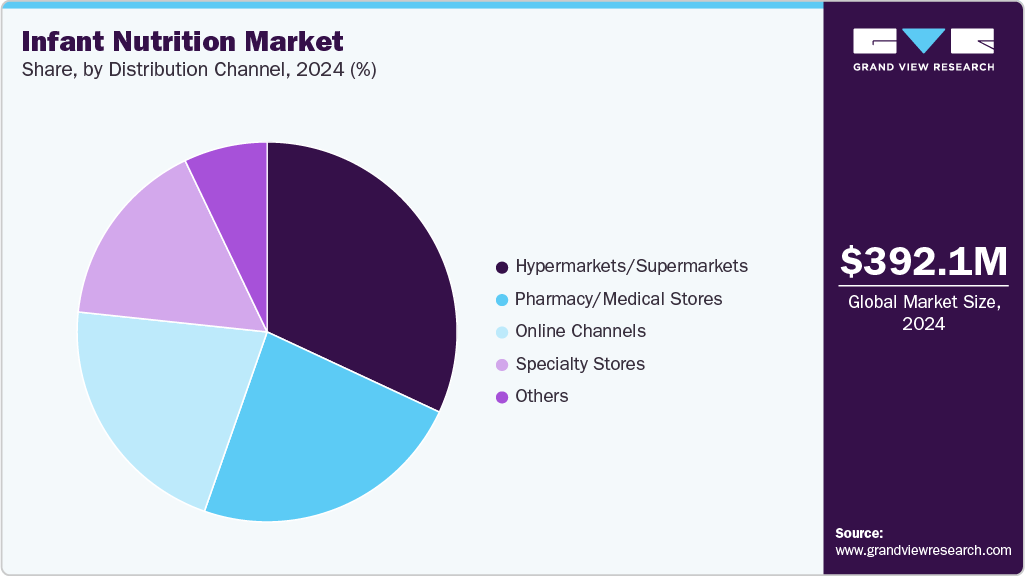

- By distribution channel, In 2024, hypermarkets and supermarkets held the largest share of the distribution channels, accounting for a 31.9% share of total revenue.

Market Size & Forecast

- 2024 Market Size: USD 392.1 Million

- 2030 Projected Market Size: USD 611.1 Million

- CAGR (2025-2030): 7.7%

- Asia Pacific: Largest market in 2024

The demand for specialized infant nutrition products is growing as parents prioritize their children's health and seek products tailored to specific nutritional needs during crucial infancy. In May 2023, Arla Foods Ingredients introduced a new alpha-lactalbumin-rich infant formula ingredient to address the increasing demand for low-protein formulations.The increasing investments to raise birth rates in several countries contribute to the growing demand for infant nutrition throughout the forecast period. In June 2023, Japan announced it would invest around USD 24 million (3.5 trillion yen) to raise its fertility rate. The growing number of working mothers, increased spending on infant health, and growing demand for organic baby food are some factors driving the market's expansion. The number of young working mothers has significantly increased in the last several years.

Due to the heavy reliance on processed infant nutrition products, working women have played a significant role in driving the expansion of the infant nutrition industry. In June 2023, according to a survey published by THE JAPAN TIMES LTD. in 2022, there were a record 30.35 million working women in Japan, an increase of 1.22 million from the previous five years. Similarly, as per AXIOS' September 2023 update, women with children under five comprised 70.4% of the working population in June 2023, down from 68.9% at the pandemic's peak.

As more women join the workforce and pursue professional careers, the need for convenient and time-saving solutions for infant feeding has risen substantially. Working mothers often face challenges in managing the demands of their jobs along with the responsibilities of caring for their infants. This has increased reliance on infant nutrition products that offer convenience, ease of preparation, and nutritional assurance.

Moreover, the originating trend of dual-income households and busy lifestyles has also fueled the demand for convenient and ready-to-feed infant nutrition solutions, contributing to market expansion. In addition, the influence of social media has facilitated the dissemination of information about the latest and most effective infant nutrition products, driving consumer choices. A combination of health consciousness, technological advancements, and changing lifestyles propels the market's growth.

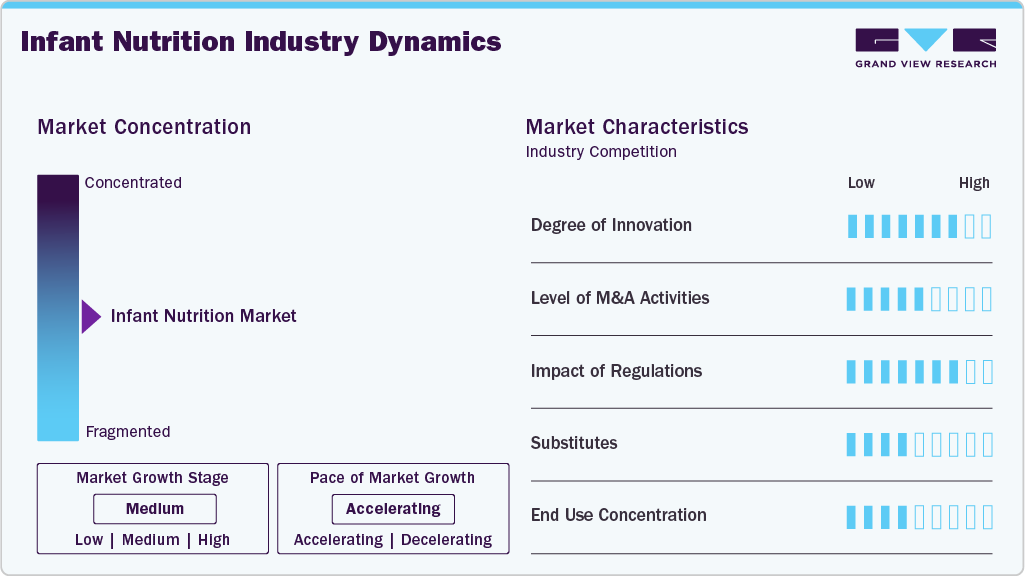

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The global infant nutrition industry is characterized by a moderate to high degree of innovation. With continuous advancements and improvements in product formulations, manufacturing processes, and packaging. The launch of allergen-free and hypoallergenic products and the trend for organic and natural ingredients allow manufacturers to offer new and effective products. Neocate announced the launch of Neocate Syneo Infant, the first hypoallergenic formula with prebiotics and probiotics designed for food-allergic infants.

Market players are engaged in merger and acquisition activities to broaden their product portfolio and geographical reach. For instance, in July 2023, Bobbie, a provider of clean-label infant formula, acquired an Ohio-based pediatric nutrition company, Nature’s One. In November 2022, Perrigo Company announced it acquired Nestlé’s Gateway infant formula plant in Wisconsin and the U.S. and Canadian rights to the Good Start brand for USD 170 million.

Regulatory bodies such as the FDA and European Commission set standards for infant nutrition products' nutritional and composition content. These standards are designed to ensure that products meet the specific dietary needs of infants and are safe for consumption. Formulas must follow regulations governing the levels of vital nutrients such as vitamins, minerals, proteins, and lipids. Compliance with these standards is required for market access and customer confidence.

There is no direct substitute for infant nutrition products. Plant-based newborn formulae and baby meals are becoming popular. These substitutes are frequently produced with soy, almond, or rice milk.

Product Type Insights

The infant milk formula segment held the largest revenue share of 39.3% in 2024. This market dominance was fueled by heightened parental awareness of optimal infant nutrition and the convenience of formula feeding. Continuous innovation in baby formula with formulations closely resembling breast milk nutrition appeals to consumers seeking specialized and high-quality options. Shifting lifestyles, including more working mothers and the prevalence of nuclear families, drive the adoption of infant milk formula as a convenient feeding choice. Manufacturers respond by offering diverse newborn formula products to meet varying dietary needs. For instance, in September 2022, Nestlé launched Nutrilearn Connect, featuring myelin, a unique ingredient, in Hong Kong.

The baby food segment is anticipated to witness significant market growth over the forecast period. Companies are strategically offering a diverse range of convenient and nutritious options for parents, capitalizing on the rising popularity of ready-to-eat and easy-to-prepare baby food to meet the demand for time-saving solutions.

Form Insights

The solid form segment dominated the global infant nutrition market in 2024, accounting for 62.9% of the revenue share. Powdered infant formulas offer greater convenience and portability than liquid alternatives, making them a preferred choice for on-the-go parents or those who prefer flexibility in preparation. In addition, powdered formulas are generally more cost-effective than ready-to-feed or liquid concentrates, attracting price-sensitive consumers. The rising number of working women globally significantly boosts demand for convenient baby food options. For Instance, the rise in female labor force participation from 23.3% in 2017-18 to 37.0% in 2022-23 has increased the number of working mothers who seek convenient, ready-to-eat baby food options to balance work and childcare. This shift, combined with urbanization and changing lifestyles, drives demand for nutritious and easy-to-prepare baby food products in India.

The liquid form segment is expected to grow over the forecast period, driven by pre-packaged and sealed options, addressing contamination concerns, and appealing to parents prioritizing hygiene and safety. Ready-to-feed liquid formulas require no mixing or measuring, reducing contamination risk and making them especially popular among parents and healthcare professionals. This ease of use is a key factor driving demand, particularly for newborns, low-birth-weight, or sick babies. In August 2024, Abbott announced the expansion of its Pure Bliss by Similac line to include organic and European-made infant formulas.

Distribution Channel Insights

In 2024, hypermarkets and supermarkets held the largest share of the distribution channels, accounting for a 31.9% share of total revenue. Hypermarkets and supermarkets, such as SM Market, Walmart, Amazon, Morrisons, and others, provide a convenient one-stop shopping experience for parents seeking infant nutrition products alongside groceries and household items. The appeal of this convenience factor drives consumer preference for these retail channels. Companies are increasingly launching their products in hypermarkets/supermarkets to enhance sales. For instance, in July 2023, Else Nutrition expanded its distribution in the Midwest market through a partnership with Schnucks, a major regional supermarket chain. The Else Toddler Organic 22oz product is now available at approximately 110 Schnucks locations across Missouri, Wisconsin, Illinois, and Indiana. In May 2023, Else Nutrition announced that Walmart added its Toddler Organic and Toddler Omega products to store shelves.

The online channels segment is anticipated to grow at the fastest CAGR of 9.6% in 2024. Online platforms offer a broad range of infant nutrition products, including various formulas, baby food, and supplements. This extensive product selection allows consumers to explore different options and choose products that meet their preferences and requirements. The increasing internet penetration and global shift towards online shopping would likely drive the segment growth over the forecast period.

Regional Insights

North America is experiencing strong growth in the infant nutrition market, driven by factors such as the increasing number of working women, government support for quality healthcare, high purchasing power parity, and the presence of key market players. In the North America, the proportion of working women is increasing. According to The World Bank Group, North America's female labor force participation rate was approximately 45.8% in 2024. This relatively high participation rate increases demand for convenient infant nutrition products, as working mothers seek easy-to-prepare and reliable baby food options

U.S. Infant Nutrition Market Trends

The U.S. held the largest North American infant nutrition market share of 56.5% in 2024. High parental awareness about infant health and nutrition fuels demand for premium, organic, and fortified baby food products. The U.S. market benefits from strong innovation in product formulations, including clean-label and plant-based options, meeting consumer preferences for safety and quality. Rising urbanization and a large working mother population increase demand for convenient, ready-to-use infant nutrition products.

Europe Infant Nutrition Market Trends

The Europe infant nutrition market is expected to experience growth in the coming years. The increasing demand for premium and organic products drives sales, as health-conscious parents prefer formulas with clean labels and high-quality ingredients. Strict EU regulations ensure product safety and nutritional standards, enhancing consumer trust and export potential.

The U.K. dominated the European infant nutrition market with a 17.7% revenue share in 2024, driven by high consumer spending on premium and organic baby food products. The market benefits from strong parental awareness about infant health and nutrition, supported by well-established distribution channels, including supermarkets and e-commerce.

Asia Pacific Infant Nutrition Market Trends

The Asia Pacific infant nutrition market is growing fastest at a CAGR of 10.5% over the forecast period. The region has a growing infant population driven by high birth rates, especially in countries such as China and India. Rising disposable incomes and expanding middle-class populations enable more families to afford premium and organic baby food products.

The India infant nutrition market is anticipated to grow at the fastest CAGR of 12.1% during the forecast period. This growth is driven by a rising birth rate, increasing parents' awareness of the importance of early childhood nutrition, and a growing preference for branded and fortified baby food products.

Key Companies & Market Share Insights

Some of the key companies in the Infant Nutrition market include Nestlé, Nutricia, Abbott, Perrigo Company plc, and China Mengniu Dairy Company Limited.

-

Nestlé is a Swiss multinational food and beverage company. Nestlé's nutrition brand portfolio includes NANGROW, CEREGROW, LACTOGROW, and GERBER, catering to early childhood stages. These products offer essential nutrients like DHA, probiotics, iron, and vitamins to support growth and development.

-

Nutricia is a global healthcare company specializing in advanced medical nutrition. It also produces infant milk formula and specialized nutritional products.

Key Infant Nutrition Companies:

The following are the leading companies in the infant nutrition market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- Arla Foods amba

- Nutricia

- Abbott

- The Hain Celestial Group, Inc, Inc.

- Holle baby food AG

- China Mengniu Dairy Company Limited

- Perrigo Company plc,

- The Kraft Heinz Company

- DANA DAIRY GROUP

Recent Developments

-

In May 2025, ByHeart launched the Anywhere Pack, the first whole milk single-serve infant formula in the U.S., offering parents a convenient, travel-ready feeding option with high nutritional quality.

-

In March 2025, Nestlé India launched CEREGROW, a multigrain cereal with no refined sugar for toddlers aged 2 to 6 years. The cereal contains 19 essential nutrients, including protein, calcium, vitamin D, and Omega-3, to support healthy bone, muscle, and brain development.

-

In September 2024, Perrigo Company plc announced a partnership between Good Start and Dr. Brown's. The collaboration will offer Soothe Pro and Gentle Pro in new packaging to celebrate new partnership.

-

In September 2023, Danone announced the launch of a novel infant formula in China containing milk droplets that closely mimic the structure found in mothers’ milk

-

In August 2023, ByHeart announced its first retail launch: its clinically proven, easily digestible, and certified-clean ingredients newborn formula that will be available at Target stores across the U.S. In addition, the company declared that later this year, it will reintroduce its product directly to consumers at ByHeart.com

-

In July 2023, Bobbie Baby acquired Nature’s One, an Ohio-based pediatric nutrition company. The aim behind the acquisition is to oversee the whole production process of Nature's One, from procuring raw materials to canning

-

In April 2023, Danone announced the expansion of its nutrition portfolio in Poland by acquiring ProMedica

Infant Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 421.0 million

Revenue forecast in 2030

USD 611.1 million

Growth rate

CAGR of 7.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product Type, Form, Distribution Channel, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Spain, Italy, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

Nestlé; Arla Foods amba.; Nutricia; Abbott; The Hain Celestial Group, Inc; Holle baby food AG; China Mengniu Dairy Company Limited; Perrigo Company plc; The Kraft Heinz Company; DANA DAIRY GROUP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Infant Nutrition Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global infant nutrition market report based on product type, form, distribution channel, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Infant Milk Formula

-

Baby food

-

Follow-on-Milk

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid

-

Liquid

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Pharmacy/Medical Stores

-

Online Channels

-

Specialty Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

France

-

Germany

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.