- Home

- »

- Next Generation Technologies

- »

-

Influencer Marketing Platform Market Size Report, 2030GVR Report cover

![Influencer Marketing Platform Market Size, Share & Trends Report]()

Influencer Marketing Platform Market (2025 - 2030) Size, Share & Trends Analysis Report By Application, By Organization Size (Large Enterprises, SME’s), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-159-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Influencer Marketing Platform Market Summary

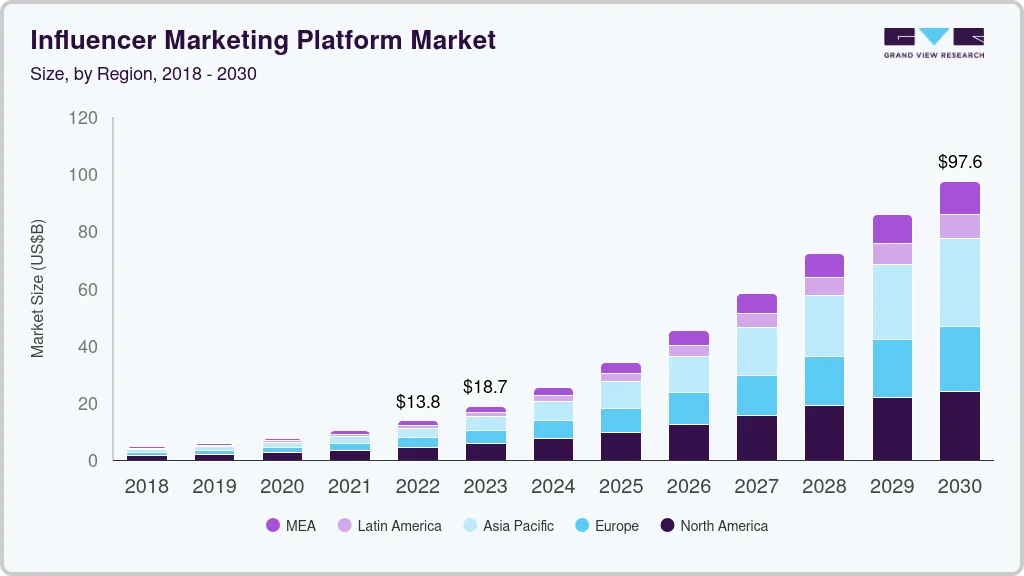

The global influencer marketing platform market size was estimated at USD 25.44 billion in 2024 and is projected to reach USD 97.55 billion by 2030, growing at a CAGR of 23.3% from 2025 to 2030. The market is primarily driven by the growing integration of influencer marketing platforms with AI and Machine Learning (ML) to enhance influencer discovery and campaign optimization.

Key Market Trends & Insights

- The North America influencer marketing platform market dominated the industry with a revenue share of over 29% in 2024.

- The U.S. influencer marketing platform market held a dominant position in 2024.

- By application, the search & discovery segment accounted for the largest market share of over 32% in 2024.

- By end-use, the fashion & lifestyle segment dominated the market in 2024.

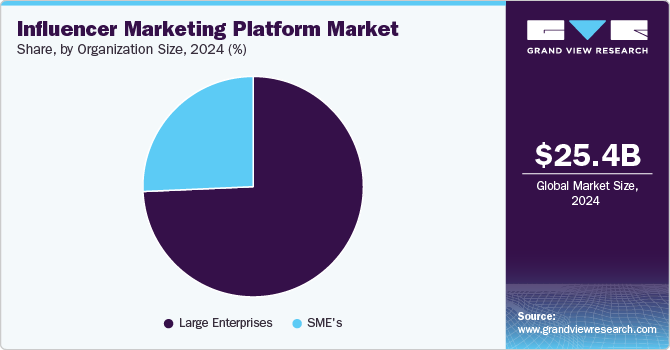

- By organization size, the large enterprises segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.44 Billion

- 2030 Projected Market Size: USD 97.55 Billion

- CAGR (2025-2030): 23.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These technologies analyze vast datasets to recommend the most suitable influencers and predict campaign performance, leading to more precise targeting and improved return on investment (ROI) for brands, which is expected to further fuel the market growth in the coming years.

The growth of the influencer marketing platform market is linked to the rise of social media platforms. Social media's rapid expansion has led to an explosion in user engagement across various social media platforms. With billions of active users spending significant time on these platforms, they have become fertile ground for marketers aiming to reach a broad and engaged audience. Each platform attracts different demographics and interests, enabling brands to precisely target specific groups.

In addition, augmented reality and virtual reality technologies are opening new avenues for influencer marketing by creating immersive and interactive experiences. Influencers can use AR filters or VR environments to engage their audience in unique ways, making content more memorable and engaging. Brands are increasingly exploring these technologies to create innovative campaigns that stand out in a crowded digital space. This trend particularly appeals to tech-savvy and younger audiences seeking novel digital experiences, thereby boosting market expansion.

Furthermore, the ability to measure and analyze campaign performance is critical in influencer marketing. Platforms leverage advanced analytics to provide brands with detailed insights into campaign effectiveness, ROI, audience demographics, and engagement metrics. These data-driven insights enable brands to make informed decisions, adjust strategies on the fly, and justify their marketing spend. This trend is expected to further boost the market growth in the coming years.

Moreover, with the rise of social commerce, influencer marketing platforms are increasingly integrating with e-commerce platforms to facilitate seamless shopping experiences. This trend allows consumers to purchase products directly through social media posts, influencer content, or embedded links. These integrations enable brands to track conversions and sales directly from influencer campaigns, bridging the gap between social engagement and revenue generation.

Application Insights

The search & discovery segment accounted for the largest market share of over 32% in 2024. The growth is attributable to the increasing need among brands to identify the most relevant influencers for their target audiences. As influencer marketing becomes more sophisticated, companies seek influencers that align with their brand values, target demographic, and niche markets, and have a proven track record of engaging with their audiences. This has led to increased demand for platforms offering effective search and discovery tools equipped with advanced filtering options, AI-powered recommendations, and data-driven insights.

The influencer management segment is expected to witness the fastest CAGR from 2025 to 2030. The growing prominence of influencer marketing across industries has highlighted the need for efficient management of influencer relationships, campaigns, and performance tracking. Moreover, the growing demand for sophisticated management systems that can track influencer performance in real-time and offer data-driven insights to identify the most effective collaborations for personalized marketing strategies is further contributing to segment growth.

End-use Insights

The fashion & lifestyle segment dominated the market in 2024. The growth of the fashion and lifestyle sector relies heavily on the latest trends, personal expression, and aesthetics, which presents the need for new-age marketing mediums, such as social media influencers, for brands to connect with their target audience. Influencers, especially those in the fashion and lifestyle niches, have strengthened their relationships with their followers by providing content that is more authentic and personalized. The growth of the segment is further driven by the advent of analytics and AI-driven influencer marketing platforms that help enhance the efficiency of campaigns, enabling brands to track engagement, conversion rates, and demographic data to optimize their strategies.

The sports & fitness segment is expected to register the fastest CAGR from 2025 to 2030. The increasing awareness of the global population about health and fitness has led to a surge in demand for sports-related products, services, and digital content. As more people adopt active lifestyles, brands in the fitness industry have recognized the potential of influencer marketing to effectively reach their target audience. Fitness influencers, ranging from professional athletes to everyday fitness enthusiasts, have built substantial followings on social media platforms. Moreover, influencer-driven marketing offers a more relatable and customized approach to the growing consumer demand for personalized fitness solutions. These factors are favoring the demand for influencer marketing platforms in the sports & fitness sector.

Organization Size Insights

The large enterprises segment accounted for the largest market share in 2024. The segment growth can be attributed to the higher demand for influencer marketing solutions among large enterprises. With the rise of social media and digital content consumption, influencer marketing has become an effective tool for large-scale organizations to reach targeted audiences effectively. Moreover, large enterprises have the resources and scale to invest significantly in marketing strategies that can drive brand awareness and customer engagement, which is opening lucrative growth opportunities for the segment.

The SME’s segment is expected to register the fastest CAGR from 2025 to 2030. SMEs are increasingly recognizing the cost-effectiveness and high return on investment offered by influencer marketing over conventional advertising methods. With limited budgets, SMEs find influencer marketing a more accessible way to reach targeted audiences, especially on social media platforms where niche influencers operate. Moreover, these businesses are increasingly leveraging micro and nano influencers, who often have more engaged followings in specific interest areas.

Regional Insights

The North America influencer marketing platform market dominated the industry with a revenue share of over 29% in 2024. Brands in the region are heavily investing in collaborations with content creators and influencers, ranging from mega-influencers with billions of followers to micro-influencers who target niche markets, which is driving the regional market growth. In addition, the availability of advanced influencer marketing platforms equipped with AI, analytics, and automation tools is propelling the market expansion. These platforms allow brands to identify the right influencers, measure the impact of their marketing efforts in real time, and manage campaigns efficiently, thereby boosting the traction of influencer marketing platforms in the region.

U.S. Influencer Marketing Platform Market Trends

The U.S. influencer marketing platform market held a dominant position in 2024. Social media platforms are becoming increasingly popular in the U.S., and influencers are considered trusted sources of information. This has made influencer marketing an effective tool for brands to reach their target audience. Furthermore, the shift toward digital marketing and the growing importance of content marketing has contributed to the growth of influencer marketing platforms in the U.S.

Europe Influencer Marketing Platform Market Trends

The European influencer marketing platform is expected to grow at a considerable CAGR of over 22% from 2025 to 2030, driven by increased social media engagement in the region. Government initiatives focused on digital transformation, especially in sectors including tourism, healthcare, and education, have instigated the adoption of influencer marketing to reach target consumers, which is expected to further stimulate market growth.

The U.K. influencer marketing platform market is expected to grow rapidly in the coming years. The U.K. has a large and engaged online population with a high penetration rate of social media platforms. Moreover, the strong presence of the influencer marketing industry, with a variety of platforms and agencies offering influencer services, has contributed to the market's growth.

Influencer marketing platform market in Germany held a substantial market share in 2024. A wide range of industries in Germany, from fashion and beauty to automotive, technology, and food & beverage, are leveraging influencer marketing to boost brand awareness and drive sales. The increasing digitalization of the country, coupled with the rising popularity of social media platforms, is driving the market growth.

Asia-Pacific Influencer Marketing Platform Market Trends

The influencer marketing platform market in Asia Pacific region is expected to grow at the highest CAGR of 27% from 2025 to 2030. The Asia Pacific region has seen an explosive rise in social media users, driven by affordable smartphones and improved internet access, especially in countries such as India, China, Indonesia, and the Philippines. Platforms such as Instagram, TikTok, and WeChat are particularly popular, creating promising growth opportunities for influencer marketing.

The Japan influencer marketing platform market is expected to grow rapidly in the coming years, owing to the country’s growing digital landscape, changing consumer behavior, and economic trends. Moreover, the presence of a tech-savvy population with higher online engagement is creating considerable demand for influencer marketing platforms.

The Influencer Marketing Platform market in China held a substantial market share in 2024. The growth is attributed to an increasing demand for influencer marketing solutions driven by heightened social media engagement across platforms such as WeChat, Weibo, Douyin, and Xiaohongshu, as they allow for seamless integration of content, commerce, and community building. China’s growing middle-class population, with rising disposable incomes, has fueled the demand for a wide range of consumer products, from fashion and beauty to electronics and luxury goods. Influencers have become essential partners for brands to attract new consumers and tap the market.

Key Influencer Marketing Platform Company Insights

Some of the key players operating in the market include Upfluence, and AspireIQ, Inc., among others.

-

Upfluence specializes in influencer marketing software tailored for e-commerce businesses. The company’s Software-as-a-Service (SaaS) platform offers a comprehensive solution that includes tools for influencer identification, recruitment, campaign management, reporting, and payment processing. The company also offers a Live Capture tool that enables brands to discover influencers visiting their e-commerce websites, enhancing their influencer marketing strategies. The company has offered services to more than 1,600 brands, including Amazon.com, Inc.; and ASICS Corporation; among others.

-

AspireIQ, Inc. offers the Aspire Platform and services, including Agency Services and Integrations & Partnerships, which help brands build communities of ambassadors, influencers, and affiliates and share their brand stories at a scale. The company has created a medium of "word-of-mouth marketing" to help businesses grow and empower creators. Operating from four offices, the company has served over 900 customers and paid out more than USD 150 billion to creators, maintaining an average 4.8 G2 rating. .

NeoReach and Webfluential are some of the emerging participants in the influencer marketing platform market.

-

NeoReach provides an influencer marketing software platform that helps brands run influencer marketing campaigns. Solutions offered by the company include software, managed services, API, and fraud detection. The company’s comprehensive influencer marketing software allows users to effortlessly search for influencers or analyze their own data using over 40 filters, including demographics and social platform performance. The platform also facilitates campaign planning, influencer relationship management, contract coordination, and tracking of payment history, all within a single, user-friendly interface shared across teams.

-

Webfluential provides an influencer marketing platform that allows influencers and marketers to connect and drive sales and awareness in e-commerce. Webfluential is a software platform designed to simplify the influencer marketing process for both influencers and brands. It enables influencers to manage their campaigns more efficiently, allowing them to focus on their creative work rather than administrative tasks. The platform provides tools to help influencers maintain a professional presence while streamlining communication and collaboration with brands.

Key Influencer Marketing Platform Companies:

The following are the leading companies in the influencer marketing platform market. These companies collectively hold the largest market share and dictate industry trends.

- Upfluence

- AspireIQ, Inc.

- Grapevine Marketing LLC.

- Later Influence

- Klear (Meltwater)

- NeoReach

- Traackr, Inc.

- Webfluential

- Hypetap

- CreatorIQ

Recent Developments

-

In August 2024, Sprout Social announced its acquisition of Tagger Media, Inc. expanding its capabilities in influencer marketing management. This acquisition enables Sprout Social users to access end-to-end influencer campaign management tools, enhancing their ability to find creators, manage campaigns, and analyze results.

-

In August 2024, Traackr introduced a new integration with Shopify aimed at simplifying influencer product seeding. This feature allows brands to manage product giveaways more efficiently while reducing waste associated with unused products. The integration streamlines the process of sending products to influencers, making it easier for brands to engage with creators and enhance their marketing efforts.

-

In July 2024, Upfluence announced the successful completion of its SOC 2 audit, reinforcing its commitment to data security and protection. This certification demonstrates that Upfluence meets rigorous standards for security, availability, processing integrity, confidentiality, and privacy.

Influencer Marketing Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.25 billion

Revenue forecast in 2030

USD 97.55 billion

Growth rate

CAGR of 23.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application; organization size; end-use; regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

Upfluence; AspireIQ, Inc.; Grapevine Marketing LLC; Later Influence; Klear (Meltwater); NeoReach; Traackr Inc.; Webfluential; Hypetap; CreatorIQ.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Influencer Marketing Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global influencer marketing platform market report based on application, organization size, end-use, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Campaign Management

-

Search & Discovery

-

Analytics & Reporting

-

Influencer Management

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Entertainment

-

Sports & Fitness

-

Travel & Holiday

-

Fashion & Lifestyle

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global influencer marketing platform market size was estimated at USD 25.44 billion in 2024 and is expected to reach USD 34.25 billion in 2025.

b. The global influencer marketing platform market is expected to grow at a compound annual growth rate of 23.3% from 2025 to 2030 to reach USD 97.55 billion by 2030.

b. The search and discovery application segment dominated the global influencer marketing platform market with a share of 32% in 2024. This is attributable to the rising demand from companies to collaborate with influencers to drive their digital advertising campaigns.

b. Some of the key players in the global influencer marketing platform market include Upfluence; Speakr Inc.; AspireIQ, Inc.; and Grapevine Logic Inc.

b. Key factors that are driving the influencer marketing platform market growth include technological disruptions in the influencer marketing industry and the advent of social media.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.