- Home

- »

- Clinical Diagnostics

- »

-

Influenza Diagnostics Market Size And Share Report, 2030GVR Report cover

![Influenza Diagnostics Market Size, Share & Trends Report]()

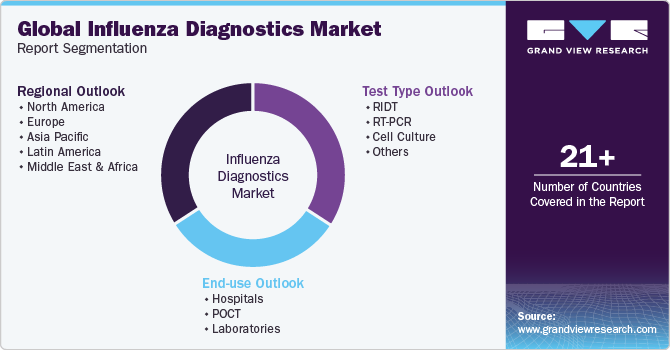

Influenza Diagnostics Market (2024 - 2030) Size, Share & Trends Analysis Report By Test Type (RIDT, RT-PCR, Cell Culture), By End-use (Hospitals, POCT, Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-259-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Influenza Diagnostics Market Summary

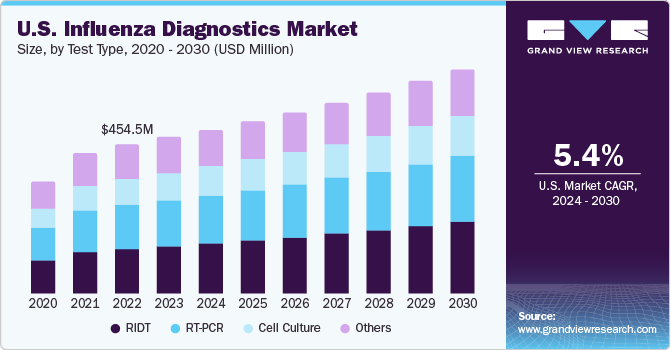

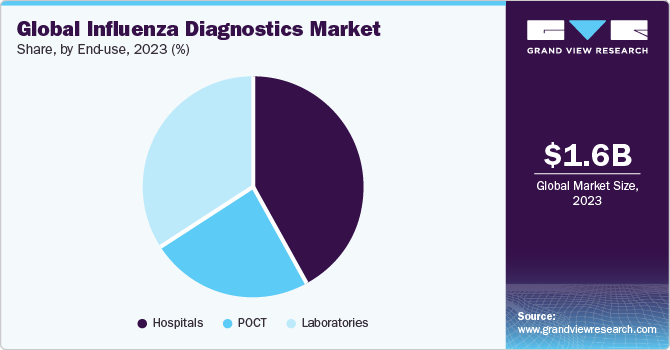

The global influenza diagnostics market size was estimated at USD 1,633.1 million in 2023 and is projected to reach USD 2,411.8 million by 2030, growing at a CAGR of 5.8% from 2024 to 2030. Influenza outbreak occurs yearly and has a significant socioeconomic impact on productivity, death rate, and medical costs.

Key Market Trends & Insights

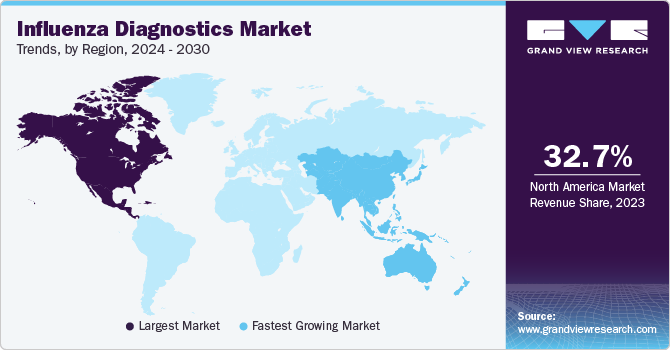

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Kuwait is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, ridt accounted for a revenue of USD 504.7 million in 2023.

- RIDT is the most lucrative test type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,633.1 Million

- 2030 Projected Market Size: USD 2,411.8 Million

- CAGR (2024-2030): 5.8%

- North America: Largest market in 2023

The elderly (65 years or older) people and children aged below 5 years are at elevated risk of influenza infection due to weak immune systems and high comorbid conditions. Hence, these are major factors that contribute to market growth.

The geriatric population faces an increased risk of flu related complications, such as pneumonia and other respiratory diseases. According to the National Foundation for Infectious Diseases data, pneumococcal hospitalizes over 150,000 individuals annually. Pneumococcal meningitis kills about 1 in 6 older infected patients and about 1 in 8 adults killed by bloodstream infection. Hence, the mortality rate is higher among older patients. These facts are indicative of the susceptibility the geriatric population faces due to flu infections. Hence, the abovementioned factors are expected to fuel demand for influenza tests for early disease diagnosis. The rising geriatric population is thus anticipated to drive market growth during the forecast period.

Furthermore, chronic conditions may increase the risk of influenza complications. Hence, increasing incidence of chronic diseases, such as cancer, diabetes, and other autoimmune diseases, is a major factor driving the growth of the market. According to National Health Council, around 133 million people in U.S., accounting for over 40% of the total population, are affected by chronic conditions. Factors such as antimicrobial resistance, unhealthy & sedentary lifestyles, alcohol abuse, and smoking are contributing to the rising prevalence of these chronic diseases.

Increasing healthcare expenditure and the availability of effective treatment options have led to an increase in the median age worldwide. The WHO, CDC, and European Centre for Disease Prevention and Control, among other regulatory bodies, are actively recording incidence & prevalence data to counter the disease systematically. These bodies work together with local governments to achieve overall control of the treatment and management of this disease. The Global Influenza Program (GIP) is one initiative the WHO undertook to provide technical support, strategic guidance, and coordination activities concerning zoonotic, pandemic, and seasonal flu cases. Such initiatives are expected to boost market growth during the forecast period.

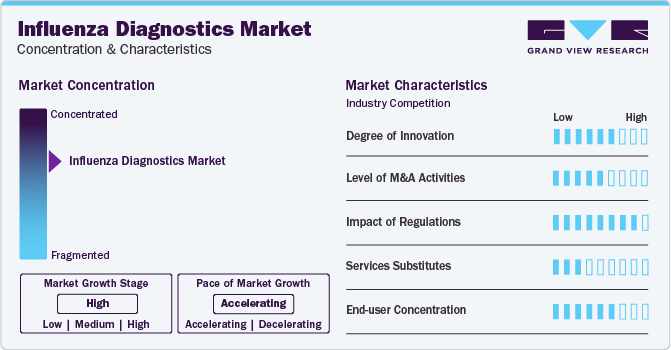

Market Concentration & Characteristics

The global influenza diagnostics market is characterized by high innovation, with new diagnostic technologies like RT-PCR and methods being developed and introduced regularly. It has become a popular option as a diagnostic method that provides safe and accurate results. As a result, market players are investing in innovative technologies and procedures to keep up with the demand.

The market is also characterized by the leading players' moderate level of merger and acquisition (M&A) activity. Market players like Abbott Laboratories, Becton, Dickinson and Company, and Quidel Corporation are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

The market is also subject to increasing regulatory scrutiny. Companies invest substantial resources in clinical trials and submissions to obtain regulatory approval for new diagnostic tests. This may result in increasing the cost of developing novel influenza diagnostics technologies. As a result, governments worldwide are developing regulations to govern the development and control cost of testing. These regulations could have a significant impact on the market, affecting the development and adoption of products.

The end-user concentration factor is crucial for any company in the influenza diagnostics space. By understanding the unique demands of each industry and tailoring their testing solutions accordingly, businesses can position themselves for success in this dynamic and ever-evolving market.

Test Type Insights

Rapid influenza diagnostics tests (RIDTs) segment led the market and accounted for 30.88% of the global revenue in 2023. The dominance can be attributed to the growing adoption of RIDT due to its high efficacy and accurate results. According to the Centers for Disease Control and Prevention Centers (CDC), FDA-cleared RIDT must achieve 80% sensitivity to detect influenza A and B viruses compared to the RT-PCR test type.

In addition, RIDT is also expected to register the fastest CAGR during the forecast period. This growth is attributed to improvements in testing, rising awareness of influenza among the general population, and a growing preference for physicians for RIDT over other test types. Rapid influenza diagnostic tests, more commonly known as dipsticks or Point-of-Care Tests (POCT), help detect particular viral influenza antigens in samples of patients with respiratory diseases. These are commercially available in cassettes, cards, and dipsticks. These tests' performance depends on the prevalence of influenza virus circulating in a particular population. For example, RIDTs are found to be less sensitive in the detection of avian influenza A. Thus, research and development of new RIDT with great accuracy is expected to boost segment growth during the forecast period.

End-use Insights

Hospitals accounted for largest market revenue share in 2023. This dominance is demonstrated by the rising hospitalization of influenza patients. Hospitals are primary care settings for diagnosis and treatment. Most of the population depends on these long-term facilities to diagnose, treat, and manage diseases. Constant changes in the healthcare industry have increased the need for hospitals with advanced facilities. Rise in healthcare expenditure globally has also contributed significantly toward the growth of market. As hospitals maintain and collect disease occurrence, regulatory bodies often collaborate to analyze disease surveillance.

Point of Care Testing (POCT) is expected to register the fastest CAGR during the forecast period. Most RIDTs that are CLIA (Clinical Laboratory Improvement Amendments) waived are typically used in POC settings. Easy handling, high specificity & sensitivity, rapid turnaround times, and effective results are some of the major factors propelling the segment growth. Technological advancements in POC test kits that provide error-free results in shorter turnaround times are expected to boost market growth in the near future. Thus, the rising incidence of this disease is expected to boost segment growth over the forecast period.

Regional Insights

North America dominated the market and accounted for a 32.69% share in 2023. Government support for high-quality healthcare, increased focus on influenza control, and high buying power are all crucial factors in this region's growth. The U.S. accounted for the largest share of the North American region in 2023. This can be attributed to the market being anticipated to grow due to well-established healthcare infrastructure and an increase in programs for influenza diagnostics.

Asia Pacific is anticipated to witness significant growth in the market. There are opportunities for growth due to rising awareness about disease and increasing prevalence of cancer & diabetes in countries like India and China. Influenza is a major concern for the Chinese populace and remains the most fatal disease type.Zhejiang, Jiangsu, Fujian, Guangdong, Shanghai, and Hunan are the most affected provinces in China. In order to reduce the spread of the disease, the government has initiated increased surveillance and has suspended live poultry markets in affected regions. Thus, a rise in the number of measures being taken is anticipated to drive the demand for diagnostic products in the nation.

Key Influenza Diagnostics Company Insights

Some of the key players operating in the market include Abbott Laboratories, Becton, Dickinson and Company, Thermo Fisher Scientific, Inc., and F. Hoffmann-La Roche Ltd. These players have a wide geographic presence and operate in multiple countries. These companies focus on various strategies to maintain their market dominance including focus on R&D, strategic acquisitions and partnerships, and product launches and approvals.

Some of the emerging players in this market include SQI Diagnostics Inc., DiaSorin, and Sekisui Diagnostics, LLC. These players adopt various strategies such as product differentiation,geographical expansion, collaborations, and partnerships andfocus on regulatory approvals to grow in the market.

Key Influenza Diagnostics Companies:

The following are the leading companies in the influenza diagnostics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these influenza diagnostics companies are analyzed to map the supply network.

- 3M Company

- AbbottLaboratories

- Becton, Dickinson and Company (BD)

- Meridian Bioscience, Inc.

- Quidel Corporation

- F. Hoffmann-La Roche Ltd

- SA Scientific Ltd

- SEKISUI Diagnostics

- Thermo Fisher Scientific, Inc.

- Hologic, Inc.

Recent Developments

-

In August 2023, the U.S. FDA granted 510(k) clearance to a respiratory viral panel (RVP) developed by BD for identification of patients with COVID-19, flue, and respiratory syncytial virus (RSV)

-

In February 2023, the U.S. FDA granted emergency use of authorization approval for Lucira COVID-19 & Flu Home Test developed by Pfizer Inc. to diagnose influenza viruses A and B. It is an over the counter (OTC) at-home diagnostic test.

-

In October 2022, Hologic Inc. launched its Aptima SARS-CoV-2/Flue test in Europe and North America. This approval is expected to drive market growth in both regions.

Influenza Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.72 billion

Revenue forecast in 2030

USD 2.41 billion

Growth rate

CAGR of 5.78% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M; Abbott; BD; Meridian Bioscience, Inc.; Quidel Corporation; F. Hoffmann-La Roche Ltd; SA Scientific Ltd; SEKISUI Diagnostics; Thermo Fisher Scientific, Inc.; Hologic, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Influenza Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global influenza diagnostics market report based on test type, end-use, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

RIDT

-

RT-PCR

-

Cell Culture

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

POCT

-

Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The RIDT segment is expected to dominate the influenza diagnostics market with a share of 30.88% in 2023 due to the growing adoption of RIDT due to its high efficacy and accurate results. According to the Centers for Disease Control and Prevention Centers (CDC), FDA-cleared RIDT must achieve 80% sensitivity to detect influenza A and B viruses compared to the RT-PCR test type.

b. Some key players operating in the influenza diagnostics market include 3M Company, Abbott Laboratories, Becton, Dickinson and Company (BD), Meridian Bioscience, Inc., Quidel Corporation, and F. Hoffmann-La Roche Ltd, among others.

b. Increased risk of flu among geriatric population, increasing healthcare expenditure, and the availability of effective treatment options are the major factors driving the influenza diagnostics market growth over the forecast period.

b. The global influenza diagnostics market size was estimated at USD 1.63 billion in 2023 and is expected to reach USD 1.72 billion in 2024.

b. The global influenza diagnostics market is expected to grow at a compound annual growth rate of 5.78% from 2024 to 2030 and is expected to reach USD 2.41 billion by 2030.

b. North America held the largest share of 32.69% in 2023 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the government support for high-quality healthcare, increased focus on influenza control, and high buying power in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.