- Home

- »

- Pharmaceuticals

- »

-

Influenza Medications Market Size And Share Report, 2030GVR Report cover

![Influenza Medications Market Size, Share & Trends Report]()

Influenza Medications Market Size, Share & Trends Analysis Report By Type (Antiviral Drugs, Antihistamines, Vaccines, Other), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-176-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Influenza Medications Market Size & Trends

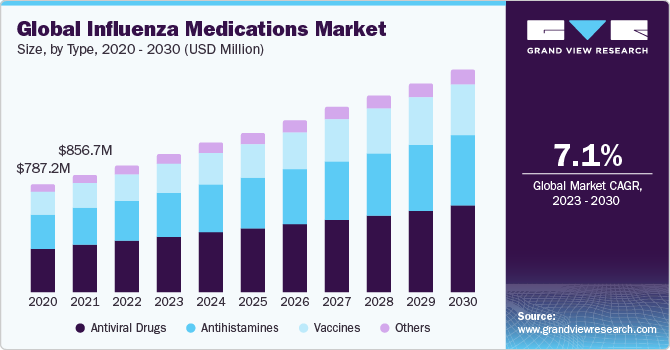

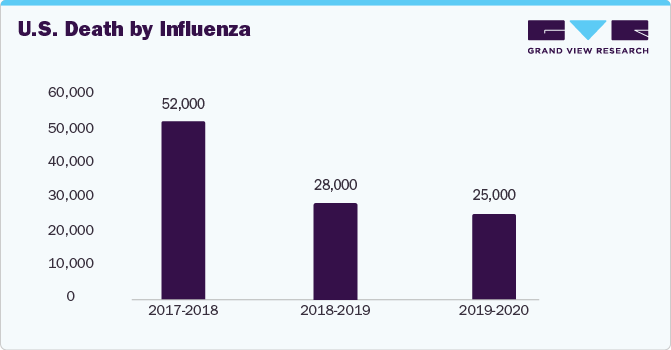

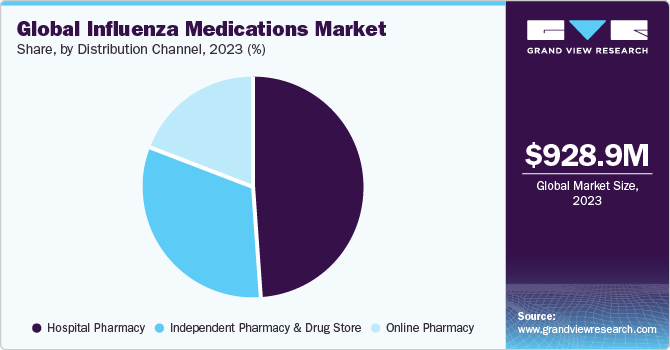

The global influenza medications market size was valued at USD 928.9 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.09% from 2024-2030. The increasing incidence of influenza is set to drive the global demand for influenza medications. The growing geriatric population, and heightened emphasis on research and development endeavors aimed at introducing innovative drugs and therapies are anticipated to generate lucrative prospects for the influenza medications market.

The influenza medications market experienced accelerated growth during the COVID-19 pandemic. The COVID-19 pandemic altered the global landscape of influenza-like symptoms. While COVID-19 and influenza share symptomatic similarities, they stem from different viruses—SARS-CoV-2 and influenza viruses, respectively. This distinction is pivotal due to varying complications and risks across demographic groups, necessitating specific testing, treatment, and preventive measures.

In March 2023, the FDA's Vaccines and Related Biological Products Advisory Committee (VRBPAC) convened to determine the vaccine’s composition for the influenza season of the U.S., 2023-2024. The committee thoroughly assessed surveillance data on the antigenic and epidemiology characteristics of the serological responses to 2022-2023 vaccines, the latest influenza isolates, and the availability of reagents and candidate strains.

Type Insights

The vaccine segment dominated the market in 2023. The growth is attributed to the continuous research and advancements in the influenza vaccines. The CDC annually conducts studies to assess the effectiveness of influenza (flu) vaccines in preventing flu. Recent findings indicate that flu vaccination reduces the risk of flu sickness by approximately 40% to 60% across the population during seasons when the circulating flu viruses closely match those used in vaccine production. Current flu vaccines demonstrate higher efficacy against influenza B and influenza A(H1N1) viruses. Furthermore, a 2021 study revealed that adults hospitalized with flu experienced a 26% reduced risk of intensive care unit (ICU) admission and a 31% lower risk of death from flu when they had been vaccinated, as opposed to their unvaccinated counterparts.

Distribution Channel Insights

The online pharmacy segment is expected to expand at the fastest CAGR for the forecast period. Online pharmacies drive growth in the influenza medications market by offering convenient and accessible channels for consumers to purchase healthcare products. For instance, in November 2020, Amazon.com, Inc. introduced two new pharmacy services to facilitate the convenient purchase of prescription medications for customers. The launch of Amazon Pharmacy, a new store on the Amazon platform, enables customers to seamlessly conduct pharmacy transactions using their desktop or mobile devices through the Amazon App.

Regional Insights

North America dominated the market in 2023. The growth is attributed to the advanced healthcare infrastructure in the U.S. and Canada. According to the Canadian government, in the 2022-2023 season, influenza vaccination coverage in all adults rose from 39% to 43%, returning to pre-pandemic levels. Canada aims to achieve an 80% vaccination rate among those at higher risk of flu complications, encompassing seniors (65 years and older) and adults aged 18-64 years with chronic medical conditions. Hence, these government initiatives, along with other factors, have boosted the influenza medications market in the North America region. On the other hand, Asia Pacific is projected to be the fastest-growing region during the forecast period.

Competitive Insights

Key players operating in the market are Biondvax, Daiichi Sankyo Company, Hoffmann-La Roche Ltd. (Genentech USA, Inc.), GlaxoSmithKline, Genentech USA, Inc., NATCO Pharma Limited, Novartis AG, Sanofi, Seqirus, and Shionogi & Co., Ltd. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In September 2022, Pfizer Inc. announced the commencement of dosing in a crucial Phase 3 clinical trial for its candidates of quadrivalent modified RNA (modRNA) influenza vaccine. The trial aimed to assess the vaccine's efficacy, safety, tolerability, and immunogenicity in around 25,000 healthy adults in the U.S.

-

In November 2020, Shionogi & Co., Ltd. announced that F. Hoffmann-La Roche Ltd., with global rights to Xofluza excluding Japan and Taiwan, successfully secured approval from the U.S. FDA for Xofluza (baloxavir marboxil). This approval extends the utilization of Xofluza as a preventive treatment for influenza in individuals aged 12 and older following exposure to a person with influenza, a practice known as post-exposure prophylaxis.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."