- Home

- »

- Advanced Interior Materials

- »

-

Inorganic Insulation Market Size, Share, Industry Report 2030GVR Report cover

![Inorganic Insulation Market Size, Share & Trends Report]()

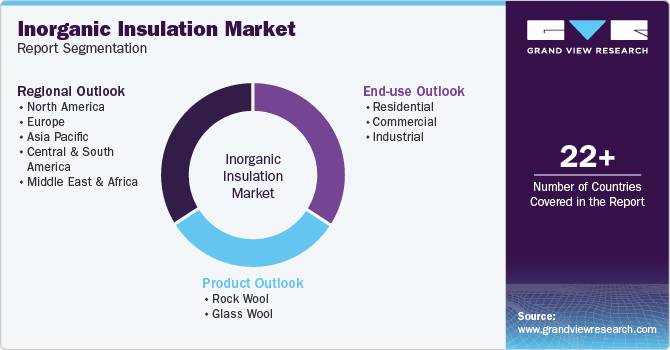

Inorganic Insulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Glass Wool, Rock Wool), By End Use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-495-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Inorganic Insulation Market Size & Trends

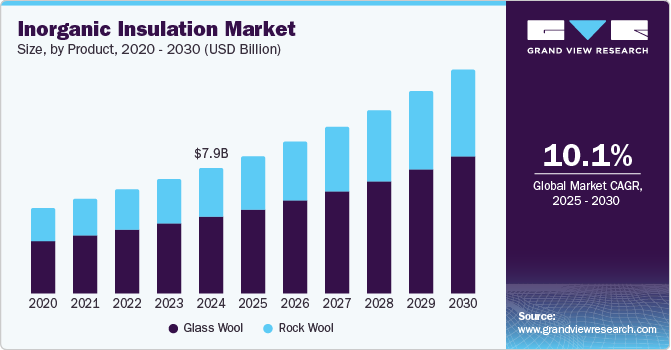

The global inorganic insulation market size was estimated at USD 7.87 billion in 2024 and is projected to grow at a CAGR of 10.1% from 2025 to 2030. The market growth can be attributed to the rising need for energy-efficient and environmentally sustainable solutions. Materials such as glass wool and rock wool are widely adopted across residential, commercial, and industrial sectors due to their superior thermal and acoustic properties.

In addition, governments worldwide are implementing stricter regulations to reduce energy consumption, promoting the adoption of inorganic insulation materials. These materials improve thermal efficiency and contribute to environmental conservation, aligning with global green initiatives. This push for sustainability, combined with increasing urbanization and industrialization, makes inorganic insulation a key product in construction and industrial applications.

However, the high cost of certain materials and the expertise required for installation are significant restraints to market growth. Many potential users hesitate to invest in inorganic insulation due to its initial expense despite the long-term energy savings it offers. Moreover, concerns about the health risks of handling fibrous materials such as glass wool pose challenges to broader adoption. This has created a need for manufacturers to develop safer, more cost-effective alternatives to overcome these barriers.

Moreover, the market faces challenges such as fluctuating raw material prices and supply chain disruptions. These issues can increase production costs and create uncertainties for manufacturers and consumers. Furthermore, the growing popularity of organic insulation alternatives, often perceived as more environmentally friendly, intensifies competition in the industry.

Furthermore, technological advancements and innovations in insulation materials present lucrative opportunities for the market. A rising focus on renewable energy projects, such as wind turbines and solar power plants, has further expanded the scope of inorganic insulation. Emerging economies such as Asia Pacific and the Middle East & Africa are experiencing rapid urbanization and infrastructure development, which in turn offers untapped potential for market players.

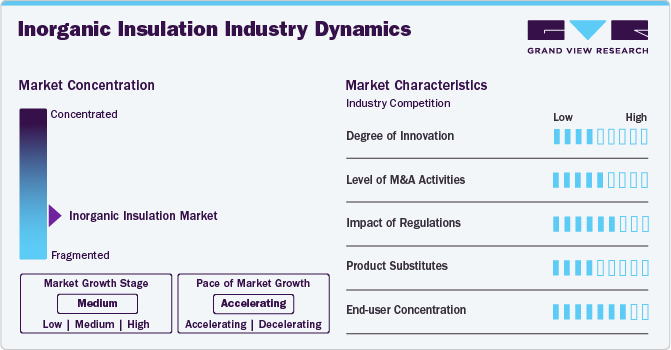

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market is fragmented as various companies have evolved as major players in the production and supply of insulation products. Furthermore, with an aim to serve a large industry base, they are also trying to expand their product portfolio by focusing on developing cost-effective materials with enhanced properties. This is further expected to increase the competition in the market.

The market is governed by various regulations, including Construction Products Regulation (CPR), ETAG 004, European Standards, and the American Society for Testing and Materials. Several entities have levied regulations on materials used in the manufacturing process. The regulations have also been implemented on the requirements and test methods for inorganic insulation production.

The market witnesses a wide range of substitutes for inorganic insulation, such as polyurethane foam, polystyrene, and cellulose. These lightweight and cost-effective solutions for specific applications offer the same fire resistance, durability, and thermal performance as inorganic options like rock wool and glass wool, limiting their suitability for high-temperature industrial and fire-critical applications.

Product Insights

Glass wool dominated the market with a revenue share of 62.3% in 2024. Glass wool is one of the most widely used materials in the inorganic insulation market, valued for its excellent thermal and acoustic insulation properties. It is made from recycled glass and sand and is lightweight, non-combustible, and environmentally friendly, making it a popular choice in residential, commercial, and industrial construction.

Furthermore, it offers a cost-effective solution for reducing energy consumption in heating and cooling systems while also providing effective soundproofing. The material’s versatility allows it to be used in various forms, including rolls, panels, and loose-fill insulation, catering to a wide range of applications. Furthermore, advancements in manufacturing technology have improved the safety and efficiency of glass wool insulation.

Rock wool is another prominent product segment in the inorganic insulation market and is expected to grow fastest over the forecast period. This product has exceptional fire resistance and thermal efficiency. Produced from volcanic rock, basalt, and slag, rock wool is inherently non-combustible and can withstand extremely high temperatures, making it ideal for fire safety applications in buildings and industrial facilities.

Furthermore, its superior sound absorption capabilities make it a preferred choice for noise control in urban construction projects. The material is also highly durable and resistant to moisture, mold, and pests, ensuring long-term performance in harsh environments. Furthermore, growing emphasis on fire safety standards and energy conservation in developed and emerging markets drives the demand for rock wool insulation.

End Use Insights

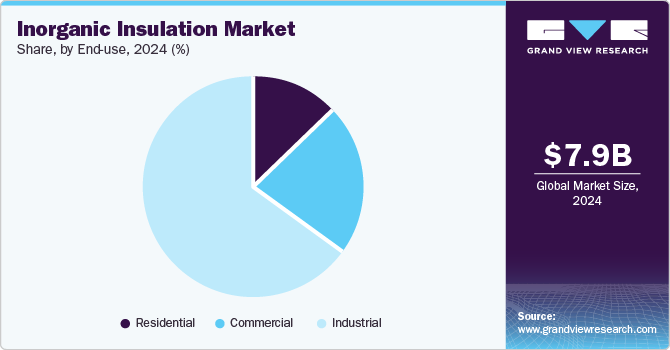

This market is segmented into residential, commercial, and industrial based on end use. Industrial accounted for the largest revenue share of 65.3% in 2023, driven by the need to maintain energy efficiency, ensure fire safety, and withstand extreme temperatures in factories, power plants, and oil refineries. Materials like rock wool and ceramic fibers are commonly used in industrial settings due to their high thermal resistance and ability to reduce energy losses in equipment such as boilers, furnaces, and pipelines. These properties also make them essential for complying with safety and environmental regulations in industries that operate in high-temperature environments.

Demand for inorganic insulation is expected to grow fastest in the commercial sector, driven by the need for energy efficiency and fire safety in large-scale structures such as office buildings, malls, hotels, and hospitals. Inorganic insulation materials like rock wool are particularly valued in commercial projects for their superior fire resistance and durability, ensuring compliance with stringent safety standards.

Moreover, these materials provide effective acoustic insulation, creating quieter and more comfortable environments in spaces like meeting rooms, theaters, and hospitality venues. Furthermore, the rising adoption of green building certifications, such as LEED (Leadership in Energy and Environmental Design), is further propelling the use of inorganic insulation in the commercial sector.

Regional Insights

In 2024, the Asia Pacific inorganic insulation market was the largest segment, valued at USD 2.60 billion globally. This growth is attributed to rapid urbanization, infrastructure development, and the rise in industrial activities. Countries like India, Japan, and South Korea drive demand as governments push for energy-efficient buildings and industrial facilities to reduce carbon emissions.

China Inorganic Insulation Market Trends

The inorganic insulation market in China is experiencing strong demand due to its massive construction sector and growing industrial base. The government’s focus on energy efficiency, green building standards, and industrial modernization has amplified the adoption of glass wool, rock wool, and other insulation materials over the years.

North America Inorganic Insulation Market Trends

The inorganic insulation market in North America is propelled by stringent building codes and energy efficiency standards across residential, commercial, and industrial sectors. The rising trend of retrofitting older structures and the adoption of green building certifications further boost demand. Technological advancements and strong industrial growth in the U.S. and Canada make this region a key market for premium insulation materials.

The U.S. demand for inorganic insulation market is driven by initiatives to reduce energy consumption in commercial and residential buildings. Federal incentives for sustainable construction and strict fire safety regulations have increased the adoption of inorganic insulation materials. Furthermore, the country’s strong industrial sector also contributes to the growing demand for high-performance insulation solutions.

Europe Inorganic Insulation Market Trends

The inorganic insulation market in Europe is growing significantly, supported by strict energy efficiency and environmental regulations. The European Union’s focus on achieving carbon neutrality by 2050 has led to increased retrofitting activities and the construction of green buildings. Demand is particularly high in countries like Germany and France, where sustainability and energy conservation are prioritized.

The UK inorganic insulation market is witnessing steady growth due to government policies promoting energy efficiency and fire safety in residential and commercial buildings. The increasing adoption of retrofitting solutions to meet green building standards and reduce energy costs is a key driver in this market.

Central & South America Inorganic Insulation Market Trends

The inorganic insulation market in Central & South America is growing due to expanding industrial activities and infrastructure development in countries like Brazil and Argentina. Rising energy costs and need to improve thermal efficiency in buildings are driving adoption of glass wool and rock wool in this region.

Middle East & Africa Inorganic Insulation Market Trends

The inorganic insulation market Middle East & Africa region is seeing increased demand due to large-scale construction projects and industrial expansions. Countries like Saudi Arabia and UAE are driving this growth as they invest in energy-efficient infrastructure and comply with global environmental standards. Furthermore, harsh climatic conditions in region also make insulation essential for maintaining energy efficiency in buildings.

Key Inorganic Insulation Company Insights

Some of the key players operating in the market include Owens Corning and Saint-Gobain.:

-

Owens Corning is a global player in building materials and composites, with a strong presence in the India inorganic insulation market. The company specializes in producing high-performance insulation materials that cater to the construction, industrial, and infrastructure sectors. Owens Corning's product portfolio includes fiberglass insulation, which offers excellent thermal and acoustic properties, making it ideal for energy-efficient buildings. In addition, the company provides mineral wool and foam-based insulation solutions tailored to industrial applications requiring high-temperature resistance.

-

Saint-Gobain is a prominent player in the inorganic insulation market, specializing in advanced solutions for diverse industrial and construction needs. The company offers a wide range of products, including mineral wool insulation, glass wool, and stone wool. These products are designed for thermal, acoustic, and fire-resistant applications, catering to sectors such as building construction, industrial facilities, and energy efficiency projects.

Wedge India and Paramount Insulation are emerging market participants in the inorganic insulation market.

-

Paramount Insulation is a prominent Indian company that provides advanced insulation solutions for various industrial and commercial applications. The company is known for its high-quality products, including Acco Isolate Insulation and Thermo Isolate Insulation, designed to deliver excellent thermal efficiency and energy conservation. These insulation materials are widely used in construction, HVAC, and manufacturing industries to minimize energy loss and ensure operational efficiency.

-

Wedge India is a rapidly expanding multinational company specializing in manufacturing and supplying high-efficiency insulation systems for industrial applications, building constructions, and cold chain logistics. With strong manufacturing support bases in India, the UK, Spain, and China, Wedge India offers a diverse range of insulation materials, including nonporous, mesoporous, microporous, and macroporous types. Their product portfolio encompasses thermal and acoustic solutions such as foam glass insulation, mineral wool, ceramic fiber products, and high-temperature adhesives.

Key Inorganic Insulation Companies:

The following are the leading companies in the inorganic insulation market. These companies collectively hold the largest market share and dictate industry trends.

- Rockwool

- Owens Corning

- Wedge India

- Paramount Insulation

- Saint-Gobain

- Etex Group

- BASF SE

- Johns Manville Corporation

- Knauf Insulation

- Morgan Advanced Materials plc

Recent Developments

-

In September 2024, Armacell, a global provider of advanced insulation materials, announced plans to open a new aerogel insulation plant in India, marking a significant investment in the country's growing construction and industrial sectors. The new facility will produce ArmaGel XG, a next-generation aerogel insulation product designed to offer superior thermal performance, lightweight properties, and enhanced fire resistance. This strategic move underscores Armacell's commitment to expanding its presence in the Indian market and addressing the increasing demand for high-performance, energy-efficient insulation solutions.

-

In June 2024, Saint-Gobain India announced its plans to double its insulation production capacity as part of a strategic move to meet the increasing demand for energy-efficient building materials in India. This expansion aims to strengthen its position in the Indian inorganic insulation market, which is witnessing rapid growth due to the country’s focus on sustainability, energy efficiency, and green building practices. By increasing its production capacity, Saint-Gobain aims to provide a broader range of high-performance insulation products that address thermal, acoustic, and fire safety needs across various sectors, including residential, commercial, and industrial construction.

Inorganic Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.65 billion

Revenue forecast in 2030

USD 14.04 billion

Growth rate

CAGR of 10.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons and, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Rockwool; Owens Corning; Wedge India; Paramount Insulation; Saint-Gobain; Etex Group; BASF SE; Johns Manville Corporation; Knauf Insulation; Morgan Advanced Materials plc

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inorganic Insulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inorganic insulation market report based on product, end use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rock Wool

-

Glass Wool

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global inorganic insulation market size was estimated at USD 7.87 billion in 2024 and is expected to reach USD 8.65 billion in 2025.

b. The inorganic insulation market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2030 to reach USD 14.04 billion by 2030.

b. Based on end use, the industrial sector accounted for the largest revenue share of 65.3% in 2024 driven by the need to maintain energy efficiency, ensure fire safety, and withstand extreme temperatures in facilities like factories, power plants, and oil refineries.

b. Key players operating in the market are Rockwool, Owens Corning, Wedge India, Paramount Insulation, Saint-Gobain, Etex Group, BASF SE, Johns Manville Corporation, Knauf Insulation, and Morgan Advanced Materials plc.

b. The key factors that are driving inorganic insulation include rising need for energy-efficient and environmentally sustainable solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.