- Home

- »

- Next Generation Technologies

- »

-

Instant Grocery Market Size, Share & Growth Report, 2030GVR Report cover

![Instant Grocery Market Size, Share & Trends Report]()

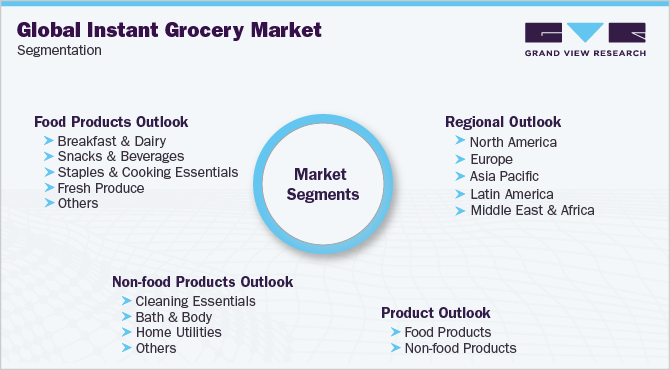

Instant Grocery Market (2022 - 2030) Size, Share & Trends Analysis Report By Product, By Food Products (Breakfast & Dairy, Snacks & Beverages), By Non-food Products (Cleaning Essentials, Bath & Body), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-965-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Instant Grocery Market Summary

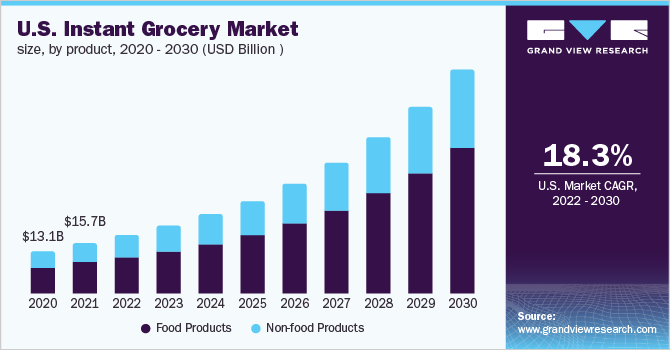

The global instant grocery market size was valued at USD 126.4 billion in 2021 and is expected to reach USD 588.2 billion by 2030, growing at a CAGR of 19.0% from 2022 to 2030. As e-commerce became more popular, the demand for rapid grocery delivery increased owing to the adoption of numerous hyperlocal strategies to provide customers with the newest products and the quickest delivery.

Key Market Trends & Insights

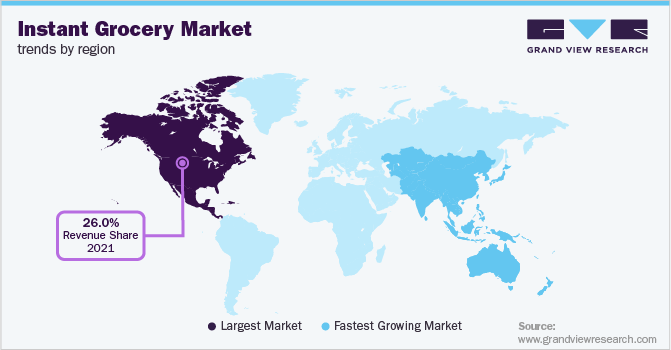

- North America held the largest revenue share of over 26.0% in 2021.

- By product, the food products segment dominated the market and accounted for a share of more than 62% in 2021.

- By food product, the staples & cooking essentials segment accounted for the largest revenue share of more than 25% in 2021.

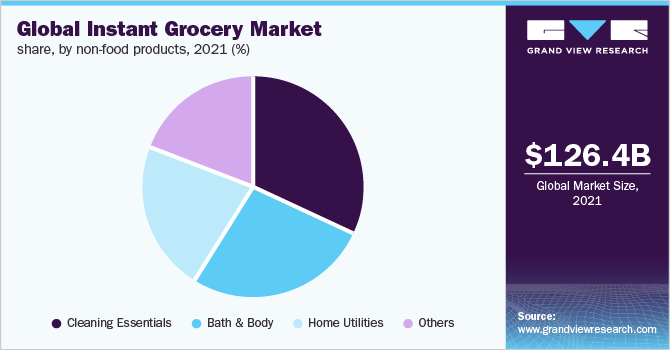

- By non-food products, the cleaning essentials segment dominated and accounted for a share of more than 32% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 126.4 Billion

- 2030 Projected Market Size: USD 588.2 Billion

- CAGR (2022-2030): 19.0%

- North America: Largest Market in 2021

- Asia Pacific: Fastest growing market

The industry is expanding due to the increased utilization of smartphones and the easy availability of the internet. Moreover, the growing demand for faster delivery options in line with the rising focus on digitalization and online payment methods are also expected to drive the industry’s growth.E-commerce companies are considering instant grocery delivery as a potential growth area and investing in developing grocery delivery platforms. Furthermore, the instant grocery channel for quick delivery is anticipated to grow as the transition from physical retail stores to online retail continues.

E-commerce companies are considering instant grocery delivery as a potential growth area and investing in developing grocery delivery platforms. Furthermore, the instant grocery channel for quick delivery is anticipated to grow as the transition from physical retail stores to online retail continues.

Key players are focused on customer satisfaction rather than just delivery of the goods. Thus, increasing investment by key players in building innovative platforms is projected to fuel the growth of the instant grocery market during the forecast period.

Over time, consumer expectations for delivery have changed, and today they include transparency as a feature of the overall buying experience. Real-time last-mile visibility has been one of the most in-demand features, from package fulfillment to delivery personnel’s location and estimated arrival time.

The grocery delivery market is undergoing a significant change defining newer and innovative solutions for delivering faster from one point to another. To increase the effectiveness of their delivery supply chains, the service providers are implementing smart technologies such as dynamic route optimization, smart tracking, and advanced analytics.

The dark store model is increasingly used for instant grocery and quick commerce, which is expected to create growth opportunities. To maintain supply chain methods and to stick to their 10–20-minute delivery model, many of the well-known and significant players in the market are choosing or have chosen to use the dark store model.

Dark stores are strategically built in such geographical locations to cater to the needs of the maximum population of a particular area. These stores are designed to facilitate quick commerce, which is anticipated to create a positive growth outlook.

Most hyperlocal delivery relies on pre-existing retail stores. Despite the companies' promises of delivery in 10 to 20 minutes, e-commerce players still face numerous obstacles, such as developing technology that can reliably deliver items in ten minutes and managing a supply chain that can support such a high-touch, high-frequency user case.

Customer dissatisfaction may result from suppliers' failure to provide goods on time and keep their commitments, which could hamper the market growth. However, integration of technology at the point of sale, better internet connectivity to automate processes, and a trustworthy network of delivery personnel might overcome the challenges.

COVID-19 Impact Analysis

Throughout the projection period, the COVID-19 pandemic outbreak is anticipated to significantly impact the market growth. The COVID-19 outbreak has brought a lot of changes in consumer behavior. Most consumers have tried online grocery shopping for the first time due to the pandemic; this transition compelled grocers to emphasize online delivery. Online grocery instant delivery is embraced by consumers owing to the convenience of ordering something with just one click from the comfort of your home and the proximity of physical stores.

Product Insights

The food products segment dominated the market in 2021 and accounted for a share of more than 62% of the global revenue. Grocery shopping has changed over time due to the ease of accessibility through online platforms. People prefer to buy their groceries online these days as it is convenient and provides a wide selection of food goods that can be delivered to consumers' doorsteps within a set time.

Customers can also monitor their spending with the help of this feature. In addition, delivery platforms offer a wide variety of food items, including bakery and dairy, cereals, vegetables, and fruits, all at a single interface. The segment's growth is driven by such advantages offered by instant grocery platforms.

The non-food products segment is anticipated to witness significant growth over the forecast period. Non-food products include bath & body products, cleaning essentials, and others. Increased demand for cleaning supplies and disinfectants during the pandemic is anticipated to support the segment growth.

Moreover, with the advancement in technology and the growing use of the internet, consumers are becoming more aware of the prevailing purchasing trends. Generation Z and Millennials represent the most desirable consumer groups. The increasing adoption of instant grocery platforms by tech-savvy consumers and are willing to spend more to receive things faster is driving the segment’s growth.

Food Products Insights

The staples & cooking essentials segment accounted for the largest revenue share of more than 25% in 2021. The dominance can be attributed to the recurrent purchases of staples such as wheat flour, food grains, and other cooking essentials such as oil, spices, and others. Particularly in Asia Pacific, customers remained reluctant to go out and buy their daily groceries, fueling the demand for instant grocery delivery.

The breakfast & dairy segment is anticipated to witness the fastest growth over the forecast period. The increase in demand for various milk and non-milk products and vendors' facilitation of doorstep delivery of these items, contribute to the growth of the segment.

Customers are more likely to order dairy and breakfast products from online retailers than physical retailers due to their hectic lifestyles. Moreover, these products must be consumed immediately and cannot be stored for a prolonged period, leading to frequent demand; hence, the segment is expected to emerge over the forecast period.

Non-food Products Insights

The cleaning essentials segment dominated the instant grocery industry in 2021 and accounted for a share of more than 32% of the global revenue. Since the outbreak, the emphasis on cleanliness has been surging, increasing the demand for products such as cleaning liquids, disinfectants, and sanitizers.

Additionally, consumers are becoming increasingly willing to pay more for organic items due to the increased need for natural goods such as organic floor cleaners, which is expected to fuel the segment growth. Consequently, the demand is expected to grow as instant grocery platforms offer a dynamic range of cleaning products delivered in a couple of minutes.

The home utilities segment is anticipated to witness significant growth over the forecast period. Home utility products include room fresheners, home decor, storage, batteries, and other products. The rising awareness regarding quick commerce platforms for buying utilities is expected to drive the segment’s growth.

Instant grocery platforms enable consumers to access a broader range of products with a single click and quick availability. As a result, the ease of accessibility attracts consumers to utilize such platforms for ordering household utilities often, which is expected to create a positive outlook for the growth of the industry.

Regional Insights

North America held the largest revenue share of over 26.0% in 2021. The growth can be ascribed to the presence of several prominent players such as Instacart; Amazon.com Inc.; and Uber Technologies Inc. The regional players adopt various strategies to expand their footprint is expected to drive the growth.

For instance, in December 2020, Uber Technologies, Inc. acquired Postmates, Inc. to improve the delivery of food, groceries, necessities, and other commodities, the acquisition combines Uber Technologies, Inc.’s global Mobility and Delivery platform with Postmates, Inc.’s renowned business in the U.S.

Asia Pacific is expected to register the highest CAGR over the forecast period. The growth can be accredited to the rising adoption of instant home delivery grocery platforms in emerging countries such as China and India. Numerous grocery delivery giants offer excellent service throughout Southeast Asia including businesses like AmazonFresh, which lets customers order and have groceries delivered online.

Key Companies & Market Share Insights

Several market players are trying to enhance their product offering to ease the accessibility and quick availability of groceries and essentials integrated onto a single platform. For instance, in August 2020, groceries were added by meal delivery platforms such as Deliveroo and Uber Eats.

In February 2022, Deliveroo planned for the trial of its rapid grocery delivery service “Deliveroo Hop” in collaboration with Waitrose, a supermarket chain. The Hop service will reduce delivery to about 10 minutes for individuals close to the dark store site.

Industry players emphasize business expansion to widen their reach. For instance, in May 2022, India-based quick commerce startup Zepto raised USD 200 million for expanding its 10-minute delivery services and network of dark stores. The surge in the growth of Zepto has proven the increasing demand for instant delivery of groceries. Some prominent participants in the global instant grocery market include:

-

Amazon.com, Inc.

-

Swiggy

-

Ocado Retail Ltd.

-

Blink Commerce Pvt. Ltd.

-

Instacart

-

Uber Technologies, Inc.

-

Walmart, Inc.

-

Delivery Hero SE

-

Target Corporation

-

DoorDash, Inc.

Instant Grocery Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 146.7 billion

Revenue forecast in 2030

USD 588.2 billion

Growth rate

CAGR of 19.0% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2021

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, food products, non-food products, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Netherlands; France; China; India; South Korea; Japan; Brazil

Key companies profiled

Amazon.com, Inc.; Swiggy; Ocado Retail Ltd.; Blink Commerce Pvt. Ltd.; Instacart; Uber Technologies, Inc.; Walmart Inc.; Delivery Hero SE, Target Corporation; DoorDash, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Instant Grocery Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global instant grocerymarket report based on product, food products, non-food products, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Food Products

-

Non-food Products

-

-

Food Products Outlook (Revenue, USD Billion, 2017 - 2030)

-

Breakfast & Dairy

-

Snacks & Beverages

-

Staples & Cooking Essentials

-

Fresh Produce

-

Others

-

-

Non-food Products Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cleaning Essentials

-

Bath & Body

-

Home Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Netherlands

-

France

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global instant grocery market size was estimated at USD 126.4 billion in 2021 and is expected to reach USD 146.7 billion in 2022.

b. The global instant grocery market is expected to grow at a compound annual growth rate of 19.0% from 2022 to 2030 to reach USD 588.2 billion by 2030.

b. North America dominated the instant grocery market with a share of 26.23% in 2021. The region's growth is attributed to the presence of several prominent players such as Instacart, Amazon.com Inc., Uber Technologies Inc. and others.

b. Some key players operating in the instant grocery market include Amazon.com, Inc., Swiggy; Ocado Retail Ltd.;Blink Commerce Pvt. Ltd.; Instacart; Uber Technologies, Inc.; Walmart Inc.; Delivery Hero SE, Target Corporation; DoorDash, Inc.

b. Key factors that are driving the instant grocery market growth include the growing prevalence of e-commerce and proliferation of smartphones & increased internet penetration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.