- Home

- »

- Semiconductors

- »

-

Instrument Transformer Market Size And Share Report, 2030GVR Report cover

![Instrument Transformer Market Size, Share & Trends Report]()

Instrument Transformer Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Dielectric Medium, By Enclosure, By Voltage, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-383-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Instrument Transformer Market Summary

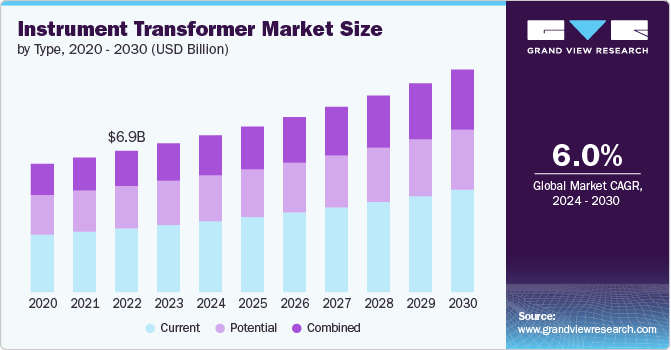

The global instrument transformer market size was estimated at USD 7,310.7 million in 2023 and is projected to reach USD 10,939.0 million by 2030, growing at a CAGR of 5.9% from 2024 to 2030. The rising demand for electricity, particularly in developing regions, is a major factor contributing to the market growth.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, current accounted for a revenue of USD 7,310.7 million in 2023.

- Current is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 7,310.7 Million

- 2030 Projected Market Size: USD 10,939.0 Million

- CAGR (2024-2030): 5.9%

- Asia Pacific: Largest market in 2023

Instrument transformers play a crucial role in the transmission and distribution of electricity by providing accurate measurement and protection. This growing energy demand necessitates the expansion and upgrade of power infrastructure, thereby driving the demand for instrument transformers.

The increasing investments in renewable energy sources are also contributing to the growing demand for instrument transformers. Governments and private sectors worldwide are investing heavily in renewable energy projects to reduce carbon emissions and combat climate change. Wind, solar, and hydropower installations require efficient and precise monitoring systems, where instrument transformers are essential. The shift towards sustainable energy solutions is propelling the demand for instrument transformers that can handle the specific requirements of renewable energy integration into the grid.

The expansion of the industrial sector and the subsequent need for robust power infrastructure are bolstering the instrument transformer market. Industries such as manufacturing, mining, and oil and gas require reliable and uninterrupted power supply for their operations. Instrument transformers are vital for monitoring and protecting electrical systems in these industries, ensuring safety and operational continuity. The growth of these industrial activities necessitates the deployment of advanced instrument transformers, thereby driving market expansion.

The growing focus on energy efficiency and grid reliability is another crucial trend driving market growth. With increasing awareness of energy conservation and the need to minimize power losses, utilities are investing in high-precision instrument transformers. These transformers ensure accurate measurement of electrical parameters, aiding in efficient energy management and reducing losses in the transmission and distribution networks. The emphasis on enhancing grid reliability and operational efficiency is fueling the demand for state-of-the-art instrument transformers, thereby contributing to the growth of the market.

Technological advancements in smart grids and digital substations are also contributing to the growth of the instrument transformer market. Smart grids incorporate advanced technologies for better monitoring, control, and automation of power systems. Digital substations, which replace traditional analog equipment with digital counterparts, offer enhanced efficiency, reliability, and real-time data analysis. Instrument transformers are integral components of these advanced systems, enabling accurate data collection and improved grid management. The push for modernizing power grids is significantly boosting the adoption of advanced instrument transformers.

Type Insights

Based on type, the current segment led the market and accounted for 45.3% of the global revenue in 2023.The demand for current instrument transformers is driven by the increasing need for accurate current measurement in high and ultra-high voltage transmission networks. These transformers play a crucial role in ensuring the efficiency and reliability of relaying, metering, and protection systems. Their application in transformer and circuit breaker bushings is expanding due to the modernization of electrical infrastructure. The growth of renewable energy sources requires precise current monitoring, further boosting their adoption. Additionally, advancements in smart grid technology are propelling the integration of current instrument transformers.

The combined segment is expected to register significant growth from 2024 to 2030. Combined transformers, which provide both current and voltage measurements, are gaining popularity for their efficiency and reduced installation complexity. They are essential in applications requiring comprehensive monitoring and protection of electrical systems. The modernization of power grids and the integration of smart grid technology are driving the adoption of combined transformers. Their ability to enhance operational efficiency and reduce costs is appealing to utilities and industries. As the demand for reliable and accurate electrical measurements grows, combined instrument transformers are becoming increasingly vital.

Dielectric Medium Insights

The liquid segment accounted for the largest market revenue share in 2023. The use of liquid dielectric mediums in instrument transformers is driven by their high-insulating properties and reliability in high-voltage applications. Liquid dielectrics are essential for ensuring efficient energy transmission and preventing electrical faults. Environmental concerns are pushing the industry towards more eco-friendly liquid dielectrics. These mediums are widely used in indoor and outdoor enclosures for their cooling and insulating capabilities. The growth of high-voltage transmission projects is bolstering the demand for liquid dielectric instrument transformers.

The solid segment is expected to grow significantly from 2024 to 2030. Solid dielectric mediums are gaining traction due to their environmental benefits and reliability in various voltage applications. The push for sustainable and eco-friendly solutions is driving the adoption of solid dielectrics in instrument transformers. These mediums offer excellent insulation and are used in both indoor and outdoor enclosures. Their application in modernizing electrical infrastructure and smart grid projects is increasing. Solid dielectric instrument transformers are essential for accurate relaying, metering, and protection in power systems.

Enclosure Insights

The outdoor segment accounted for the largest revenue share in 2023. Outdoor enclosures for instrument transformers are essential for applications requiring robust protection against environmental factors. The demand for these transformers is driven by their use in high-voltage and ultra-high-voltage transmission networks. They are critical for ensuring reliable energy transmission and accurate measurement in harsh outdoor conditions. The expansion of renewable energy projects and infrastructure upgrades are bolstering their market. Outdoor enclosures provide durability and reliability, making them vital for power utilities and railway and metro applications.

The indoor segment is expected to grow significantly from 2024 to 2030. The demand for instrument transformers with indoor enclosures is driven by their application in controlled environments, ensuring protection from external factors. Indoor transformers are essential for accurate measurement and monitoring in sub-transmission and distribution networks. The growth of smart grids and modernization of electrical infrastructure are propelling their adoption. These enclosures provide safety and reliability, critical for relaying, metering, and protection systems. The increasing focus on efficient energy management in industries and OEMs is further driving their demand.

Voltage Insights

The high voltage transmission segment accounted for the largest market revenue share in 2023. High voltage transmission applications drive the demand for instrument transformers capable of handling and accurately measuring high voltage levels. These transformers are essential for ensuring the reliability and efficiency of energy transmission in high voltage networks. The growth of renewable energy projects is propelling their adoption. High voltage transformers are crucial for accurate measurement, ensuring the stability of power systems, thereby contributing to the growth of the segment.

The growth of the ultra-high voltage transmission segment can be attributed to technological advancements and increasing demand for grid modernization activities. Ultra-high voltage transmission applications require instrument transformers that handle the highest voltage levels with exceptional precision and reliability. The global expansion of ultra-high voltage projects and the modernization of power grids are significantly driving the demand for these transformers. Their essential role in efficient energy transmission and accurate measurement is crucial, especially with the integration of renewable energy sources.

Application Insights

The transformer & circuit breaker bushing segment accounted for the largest revenue share in 2023. Instrument transformers used in transformer and circuit breaker bushings are driven by the need for accurate current and voltage measurement in high voltage applications. The modernization of electrical infrastructure and the growth of smart grids are propelling their adoption. These transformers are essential for ensuring reliable relaying, metering, and protection in power systems. The increasing focus on grid stability and efficiency is driving their demand.

The growth of the primary metering units segment can be attributed to the ability of instrument transformers that play a crucial role in primary metering units by providing accurate and reliable measurements of electrical parameters such as voltage, current, and power. These transformers are essential for scaling down high voltage and current levels to safer, more manageable values that can be easily and accurately measured by metering equipment. This ensures the precise monitoring and billing of electrical energy consumption, which is vital for both utility providers and consumers. Additionally, instrument transformers contribute to the protection and control of electrical power systems by enabling the accurate operation of relays and other protective devices, thereby enhancing the overall safety and efficiency of the electrical grid.

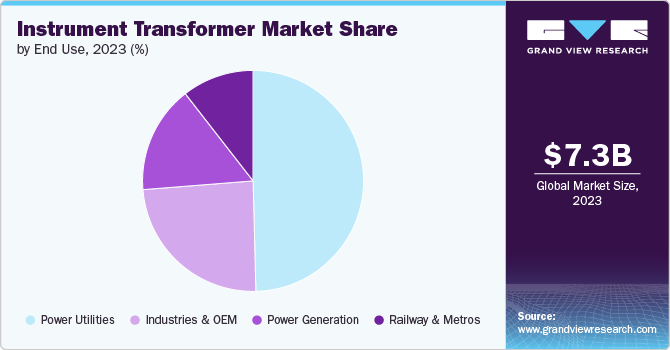

End Use Insights

The power utilities segment accounted for the largest revenue share in 2023 and is expected to retain its dominance. The demand for instrument transformers in power utilities is driven by the need for accurate measurement and monitoring in high voltage applications. In the power utility sector, which encompasses electrical energy generation, transmission, and distribution, instrument transformers play a crucial role. They safeguard power utility equipment against potential damage caused by fluctuations in power quality. Instrument transformers are primarily utilized for accurate current and voltage measurements in revenue metering and other critical applications. These measurements ensure precision in secondary equipment like meters, protection relays, bay computers, and related devices.

The power generation segment is expected to grow significantly from 2024 to 2030. Instrument transformers in power generation are driven by the need for accurate monitoring in high voltage applications. Instrument transformers play a critical role in power generation by facilitating the safe and efficient operation of electrical systems. They are essential for stepping down high voltages and currents to levels suitable for measurement by instruments and protective relays. This capability ensures accurate monitoring of electrical parameters such as voltage, current, and power, enabling precise control and management of power generation processes.

Regional Insights

Asia Pacific instrument transformer market dominated the global market and accounted for 40.3% in 2023. Rapid economic development and population growth in the region are leading to a heightened demand for reliable and uninterrupted power supply. Countries such as China are heavily investing in the expansion and modernization of their electrical transmission and distribution systems to meet the growing electricity needs driven by fast industrialization and urbanization. The region's focus on smart grid technology and renewable energy integration further boosts the demand for advanced instrument transformers. Additionally, government initiatives and regulatory policies aimed at improving grid stability and efficiency are propelling the adoption of these transformers across various applications and industries in Asia-Pacific.

Europe Instrument Transformer Market Trends

The instrument transformer market in Europe is poised for significant growth from 2024 to 2030. The European Union's stringent regulations and policies promoting sustainability and energy efficiency are accelerating the adoption of advanced instrument transformers. Investments in upgrading aging electrical infrastructure and integrating renewable energy sources, such as wind and solar, are key trends contributing to the growth of the market. The focus on smart grid technology and the need for accurate relaying, metering, and protection in high voltage applications further boost the market. Additionally, initiatives aimed at enhancing grid reliability and reducing carbon emissions are significant drivers in the European market.

North America Instrument Transformer Market Trends

North America instrument transformer market in North America is anticipated to register significant growth from 2024 to 2030. The region's push towards smart grid infrastructure and the increasing adoption of renewable energy sources, such as solar and wind, are key trends driving the market. Regulatory mandates for energy efficiency and environmental sustainability are promoting the use of advanced instrument transformers. Furthermore, the need for accurate measurement and monitoring in high voltage applications across various industries is bolstering the market in North America.

The U.S. instrument transformer market is anticipated to register significant growth from 2024 to 2030. In the U.S., there has been a strong push toward grid modernization to improve the reliability, efficiency, and security of the power infrastructure. These modernization efforts frequently include the deployment of advanced instrument transformers required to enhance grid resilience.

Key Instrument Transformer Company Insights

Key players operating in the instrument transformer market include ABB, General Electric, Mitsubishi Electric Corporation, Schneider Electric, ARTECHE., Pfiffner Group, CG Power & Industrial Solutions Ltd, NISSIN ELECTRIC Co., Ltd., RITZ INSTRUMENT TRANSFORMERS GMBH, and Amran Inc. These companies focus on smart grid technologies. Additionally, these players are gaining traction by offering cost-effective and efficient solutions, thereby intensifying competition. This competitive landscape is driving continuous innovation, ensuring high-quality and reliable instrument transformers for various applications.

Many companies in the market are concentrating on introducing instrument transformers with enhanced features. For instance, in June 2023, Straton Electricals Pvt. Ltd., launched their new cycloaliphatic cast resin instrument transformers, designed for outdoor use and offering several benefits over traditional oil type transformers. These transformers comply with the latest IS 16227 and IEC 61869 standards and feature very low partial discharge levels. They are particularly suited for the electricity distribution sector, ensuring reliable and efficient energy transmission and distribution.

Key Instrument Transformer Companies:

The following are the leading companies in the instrument transformer market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- General Electric

- Mitsubishi Electric Corporation

- Schneider Electric

- ARTECHE

- Pfiffner Group

- CG Power & Industrial Solutions Ltd

- NISSIN ELECTRIC Co., Ltd.

- RITZ INSTRUMENT TRANSFORMERS GMBH

- Amran Inc.

Instrument Transformer Market Report Scope

Attribute

Details

Market size value in 2024

USD 7.70 billion

Revenue forecast in 2030

USD 10.94 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, dielectric medium, enclosure, voltage, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ABB; General Electric; Mitsubishi Electric Corporation; Schneider Electric; ARTECHE; Pfiffner Group; CG Power & Industrial Solutions Ltd; NISSIN ELECTRIC Co., Ltd.; RITZ INSTRUMENT TRANSFORMERS GMBH; Amran Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Instrument Transformer Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the instrument transformer market report based on type, dielectric medium, enclosure, voltage, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Current

-

Potential

-

Combined

-

-

Dielectric Medium Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

SF6

-

Solid

-

-

Enclosure Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Voltage

-

Sub-transmission Voltage

-

High Voltage Transmission

-

Extra High Voltage Transmission

-

Ultra-High Voltage Transmission

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transformer & Circuit Breaker Busing

-

Switchgear Assemblies

-

Relaying, Metering & Protection

-

Primary Metering Units

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Utilities

-

Power Generation

-

Railway & Metros

-

Industries & OEM

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global instrument transformer market size was estimated at USD 7.31 billion in 2023 and is expected to reach USD 7.70 billion in 2024.

b. The global instrument transformer market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 10.94 billion by 2030.

b. Asia Pacific dominated the instrument transformer market with a share of 40.3% in 2023. Rapid economic development and population growth in the region are leading to a heightened demand for reliable and uninterrupted power supply.

b. Some key players operating in the instrument transformer market include ABB, General Electric, Mitsubishi Electric Corporation, Schneider Electric, ARTECHE., Pfiffner Group, CG Power & Industrial Solutions Ltd, NISSIN ELECTRIC Co., Ltd., RITZ INSTRUMENT TRANSFORMERS GMBH, and Amran Inc.

b. Key factors that are driving the market growth include the rising demand for electricity and the increasing investments in renewable energy sources.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.