- Home

- »

- Next Generation Technologies

- »

-

Insurance Fraud Detection Market Size & Share Report, 2030GVR Report cover

![Insurance Fraud Detection Market Size, Share & Trends Report]()

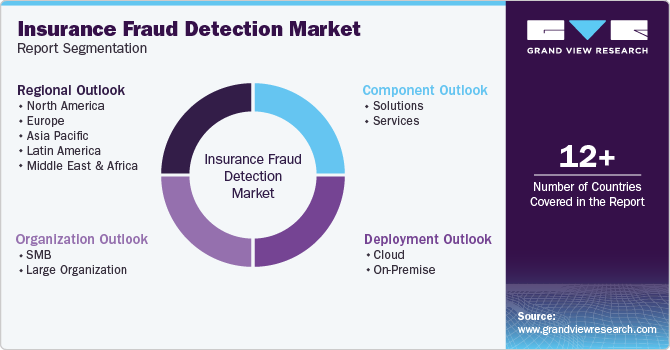

Insurance Fraud Detection Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment (Cloud, On-Premise), By Organization, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-916-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Insurance Fraud Detection Market Trends

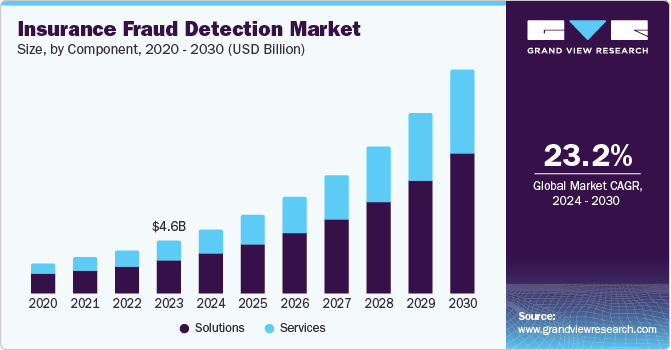

The global insurance fraud detection market size was valued at USD 4.61 billion in 2023 and is projected to grow at a CAGR of 23.2% from 2024 to 2030. Key factors influencing the growth of this industry include the rising focus of organizations on enhanced customer experience, improved operational efficiency, effective supervision of identities, adoption of advanced analytics, and ensuring regulatory compliance. Moreover, increasing adoption of technological advances such as Artificial Intelligence (AI), big data, machine learning, and the Internet of Things (IoT) have increased the vulnerability of cyberattacks and frauds, which is expected to generate upsurge in demand for this industry.

Companies using traditional fraud detection systems may not be equipped to address modern-day tactics to evade standard security measures. This has created an alarming need for efficiently developed and technologically advanced fraud detection solutions. According to the U.S. Department of Justice and Federal Bureau of Investigation, the insurance industry's total cost of fraud each year is estimated at more than USD 40 billion.

Insurance companies are continuously seeking new solutions to improve their fraud detection abilities rather than sticking to outdated methods. Specifically, analytics for detecting fraud, model-based tools, and machine learning have the potential to prevent such occurrences. With the increasing number of identified frauds, these advanced solutions are anticipated to deliver a competitive edge in the fraud detection industry.

Furthermore, insurance companies are increasingly shifting their focus towards digital platforms to introduce new products, strengthen consumer relationships, and expand their share of client financial portfolios, leading to an enhanced implementation of advanced threat solutions. To prevent threats presented by advanced technology tools used during fraudulent activities, multiple organizations and agencies have started embracing innovative fraud detection solutions and robust systems equipped with cutting-edge technology.

In addition, companies are also adopting focused training initiatives to increase awareness regarding deceptive practices recently used during fraud. However, training for managers and staff requires assistance from improved security systems and threat detection technologies, which is expected to develop growth for this industry during the forecast period.

Component Insights

Based on component, the solutions segment dominated the market accounting for a revenue share of 63.7% in 2023. The growth of this segment is mainly driven by increasing adoption of fraud detection software, which potentially helps in understanding the process of reducing false claims, defrauding insurance processes, and quickly responding to suspected fraudulent activities. Ease of availability, installation assistance and training provided by the companies and ease of use also plays vital role in growth of this segment. Insurance companies are implementing authentication solutions to enhance secure communication between customers and companies. Therefore, authentication is anticipated to offer an extra level to confirm payments, account modifications, send authentication messages and customer disclosure or consent concerning policies. Organizations can pinpoint questionable actions, recognize intricate trends, and reveal concealed connections throughout the stages of the claims procedure with the implementation of advanced technology such as artificial intelligence, machine learning, anomaly detection, and automated business. Consequently, it enables an organization to understand the fraud risk completely.

The services segment is expected to experience the fastest CAGR during the forecast period. Insurance companies are anticipated to explore innovative approaches to address emerging challenges in the rising fraudulent environment. This is attributed to rising new cases of manipulation of data, fake beneficiary registrations to open insurance policies, and skim premiums. To prevent such frauds, insurance organizations have been seeking assistance in terms of end-to-end service offerings in the market. The consulting, training, support, and maintenance services are provided under professional services, tailored to help customers identify and reduce fraud risks. The vendors offer consultants with deep expertise in different types of fraud. The detailed knowledge of potential threats, identified process to prevent frauds, in-depth analysis of precedence, and insights offered by these service providers have helped numerous companies to reduce the risk of fraud by substantial amount. These aspects are expected to generate greater demand for this segment in approaching years.

Deployment Insights

The on-premise deployment held the largest revenue share of global industry in 2023. On-premise fraud detection solutions immediately assist businesses in identifying and alerting possible fraudulent risks. The vendors provide a rule-based system, a predictive behavioral scoring model, or both to detect threat patterns. For instance, FICO Falcon Fraud Manager 6.5.2 protects customer data, enhances customer experience, and avoids losses. Nevertheless, automated systems combined with manual intervention are necessary for analyzing certain reports within the organization. Therefore, businesses mainly depend on on-site solutions rather than cloud-based services.

The cloud deployment is anticipated to experience the fastest CAGR over the forecast period. As insurance companies shift towards digital transformation, many are predicted to embrace a fraud detection model based on software-as-a-service. The information these companies store in the cloud offers flexibility and scalability to enhance operations. Therefore, affordable, easily implementable detection solutions that aid in upkeep are anticipated to drive the industry's growth in the forecast years. Furthermore, increased security features combined with the advancement of cloud technology are expected to boost growth in the segment during the forecast period.

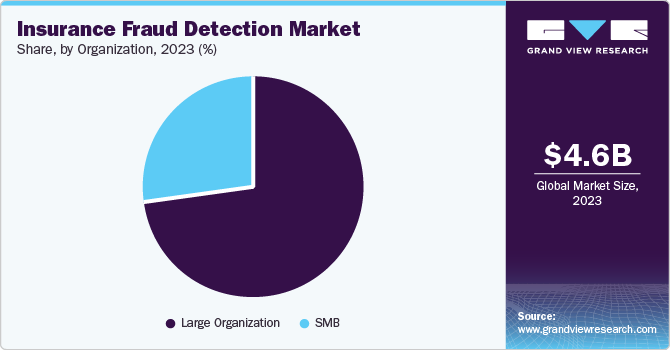

Organization Insights

The large organization segment dominated the global market for insurance fraud detection in 2023. Emergence of Artificial intelligence (AI) and predictive analytics have transformed the future of numerous industries, providing substantial competitive benefits to organizations utilizing these advancements. Therefore, increasing occurrences of frauds such as damage claims, car theft, unnecessary processes, and false health insurance billing have necessitated insurers to implement cutting-edge solutions to combat such deceptive practices. The ability of large organizations to invest greater costs in technology assistance, employee training, risk management and services for fraud detection also plays important role in growth for this segment.

SMB (Small and Medium Businesses) is anticipated to experience the fastest CAGR over the forecast period. These companies generally provide a reasonable amount of insurance coverage to their clients. Limited amount of funds allocated for the fraud detection, comparatively smaller pool of customers, and higher vulnerability and exposure to potential frauds due to absence of advanced technology tools equipped with unmatched features are some of the key growth-driving factor for this segment. In addition, lack of in-house staff or teams dedicated for the fraud detection also develops need for professional services and solutions offered by specialist organizations operating in this industry.

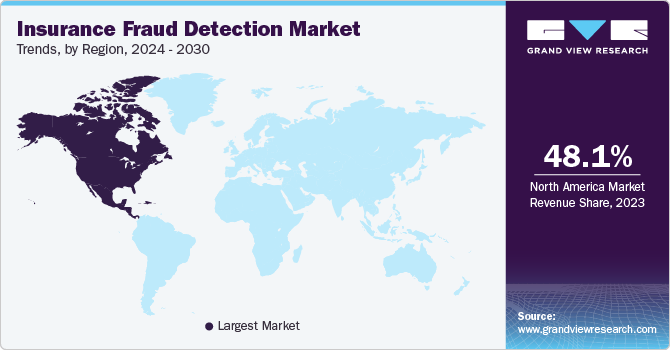

Regional Insights

North America dominated the market with a revenue share of 48.1% in 2023. The presence of organizations such as FICO, IBM, Oracle, and others has a major influence on this market. Moreover, strict regulatory demands and a rising number of frauds are necessitating the adoption of insurance fraud solutions. Insurance companies are dedicating resources to cutting-edge technologies such as machine learning, artificial intelligence, and big data analysis to counter the changing risk of fraud. Moreover, partnerships between insurance firms and tech companies promote creativity and the creation of customized solutions to tackle fraud issues unique to the varied insurance market in North America.

U.S. Insurance Fraud Detection Market Trends

The U.S. insurance fraud detection market dominated the regional industry in 2023. The growth of this market is primarily driven by the rising cases of insurance fraud, growing technology adoption leading to increased threats, and ease of use feature offered by the service and solutions providers. Moreover, the companies are collaborating with insurance organizations to improve customer experiences. For instance, in October 2023, Shippo and Cover Genius teamed up to launch Shippo Total Protection, an innovative solution that offers merchants comprehensive coverage, global protection, and easy claims processing to improve their experience.

Europe Insurance Fraud Detection Market Trends

Europe insurance fraud detection market was identified as a lucrative region in 2023. The prominent insurance fraud detection market includes the UK, Germany, and France, propelled by stringent regulatory compliance and the rising adoption of digital insurance procedures. Moreover, rising cyber-attack concerns due to the rapid adoption of technologies such as AI, machine learning, and cloud computing drive the demand for insurance fraud detection solutions. According to the Munich Re Cyber Risk and Insurance Survey 2024, 34% of global decision-makers are extremely concerned about potential cyber-attacks.

The UK insurance fraud detection market is expected to grow rapidly in the approaching years. The projected growth is attributed to stringent data protection regulations such as the General Data Protection Regulation (GDPR). Compliance with GDPR mandates requires organizations to implement robust fraud detection solutions to protect sensitive data from unauthorized access and breaches. This regulatory environment compels businesses to invest in comprehensive insurance fraud detection solutions that ensure data security while adhering to legal requirements, thereby driving market growth.

Asia Pacific Insurance Fraud Detection Market Trends

Asia Pacific insurance fraud detection market is anticipated to experience the fastest CAGR 26.5% during the forecast period. The companies in the region are being proactive by implementing advanced technologies to decrease insurance fraud occurrences. Moreover, increased investment in enhanced techniques for managing and processing claims to guarantee customer contentment and loyalty is predicted to boost regional growth. Furthermore, the increasing knowledge of fraud detection techniques is anticipated to drive the need for fraud detection solutions. Moreover, the growing life insurance industry in a country such as India necessitates organizations implement insurance fraud detection solutions to prevent any risks. For instance, in the 2022-23 period, the life insurance industry in India reported premium growth with revenue of USD 9327 billion, accounting for 12.9% growth from the previous year.

China insurance fraud detection market held a substantial market share in 2023. The rising awareness of insurance fraud detection solutions among small, medium, and large organizations in the region is driving the growth for this market. Insurance fraud detection industry in the country is expected to experience strong growth resulting from the growing digitization of insurance operations and the rising occurrence of fraudulent activities in insurance processes. In addition, entry of multiple organizations offering solutions and services associated with insurance fraud detection is projected to generate greater growth for this market in approaching years.

Key Insurance Fraud Detection Company Insights

Some of the key companies in the insurance fraud detection market include FICO, DXC Technology Company, FRISS, LexisNexis Risk Solutions, Oracle, and others. To address growing competition in the industry, the key market participants have adopted strategies such as enhanced research and development, embracing technology innovations, new product and service launches, collaborations with other organizations and mergers & acquisitions.

-

FICO, one of the prominent analytics and software company, offers wide range of products and solutions to businesses in more than 90 countries worldwide. The company solutions associated with application fraud, application risk models, card frauds, collection & recovery, consumer credit scores, insurance scores, scams protection and more.

-

LexisNexis Risk Solutions., a prominent company, offers sophisticated fraud prevention solutions designed for insurance providers, employing advanced analytics and data to identify and prevent fraud in companies. The company portfolio includes ThreatMetrix for Insurance, InstantID Q&A for Insurance, LexisNexis Fraud Defense Network, and more.

Key Insurance Fraud Detection Companies:

The following are the leading companies in the insurance fraud detection market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- SAS Institute Inc.

- FICO

- LexisNexis Risk Solutions

- Oracle

- Capgemini

- DXC Technology Company

- FRISS

- BAE Systems

- Experian Information Solutions, Inc.

Recent Developments

-

In May 2024, Solutis, a Brazilian technology organization, announced a strategic partnership with FICO. The collaboration is focused on assisting medium-sized banks and insurance businesses in avoiding fraud and major losses, promoting financial inclusion, and streamlining additional business decisions.

-

In June 2024, ForMotiv, one of the prominent companies in behavioral data science solutions, and FRISS, a preferred partner of multiple insurance industry participants for trust automation solutions, joined forces to offer new insights regarding intent and applicant behaviors, to enhance fraud detection capabilities and risk assessment processes of organizations. Predictive AI models by FRISS and behavioral analytics by ForMotiv are expected to assist insurers to improve their ability to identify potential frauds while attaining greater accuracy and efficiency.

Insurance Fraud Detection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.61 billion

Revenue forecast in 2030

USD 19.6 billion

Growth rate

CAGR of 23.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

IBM; SAS Institute Inc.; FICO; LexisNexis Risk Solutions; Oracle; Capgemini; DXC Technology Company; FRISS; BAE Systems; Experian Information Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insurance Fraud Detection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insurance fraud detection market report based on component, deployment, organization, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Organization Outlook (Revenue, USD Million, 2018 - 2030)

-

SMB

-

Large Organization

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.