- Home

- »

- Next Generation Technologies

- »

-

Intelligent Power Module Market Size, Industry Report, 2033GVR Report cover

![Intelligent Power Module Market Size, Share & Trends Report]()

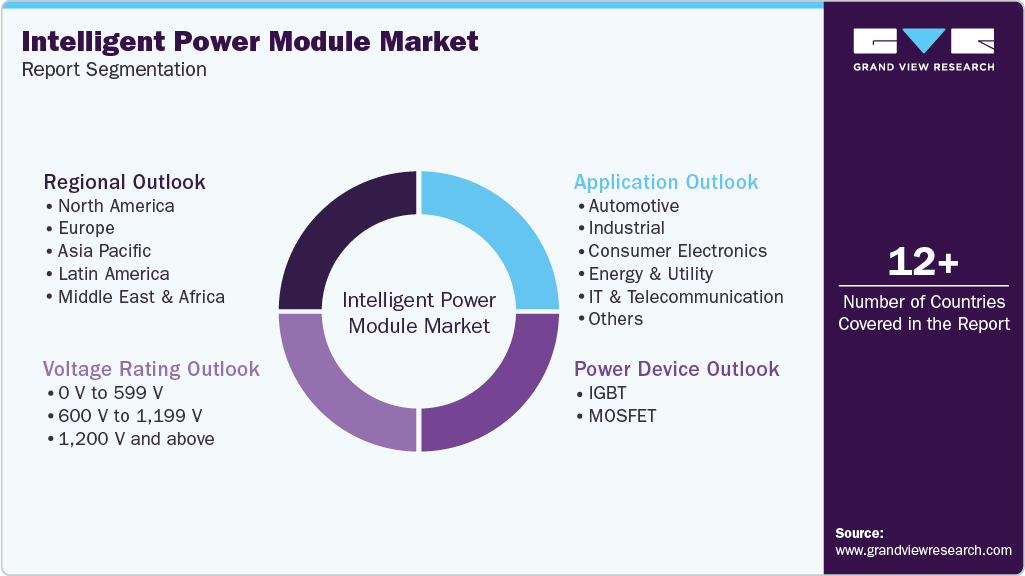

Intelligent Power Module Market (2026 - 2033) Size, Share & Trends Analysis Report By Power Device (IGBT, MOSFET), By Voltage Rating (0 V To 599 V, 600 V To 1,199 V), By Application (Automotive, Industrial, Consumer Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-158-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intelligent Power Module Market Summary

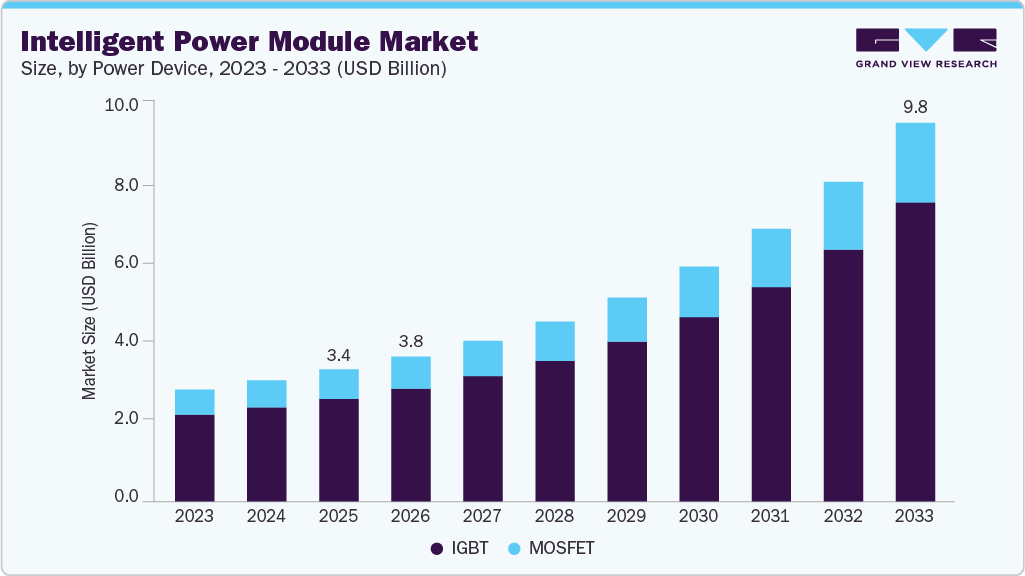

The global intelligent power module market size was estimated at USD 3,430.8 million in 2025 and is projected to reach USD 9,854.4 million by 2033, growing at a CAGR of 14.7% from 2026 to 2033. The industry is expanding due to the growing adoption of industrial automation.

Key Market Trends & Insights

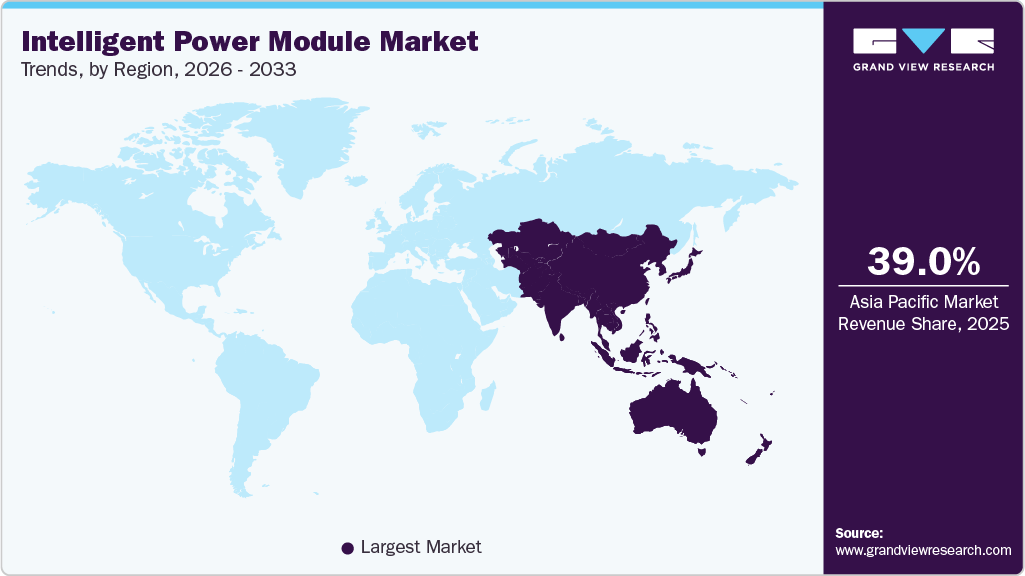

- Asia Pacific intelligent power module dominated the global market with the largest revenue share of 39.0% in 2025.

- The China intelligent power module market is experiencing steady growth driven by rising demand for energy‑efficient power electronics in industrial and automotive applications.

- By power device, the IGBT led the market and held the largest revenue share of 77.8% in 2025.

- By voltage rating, the 600 V to 1,199 V segment held the dominant position in the market and accounted for the largest revenue share of 48.8% in 2025.

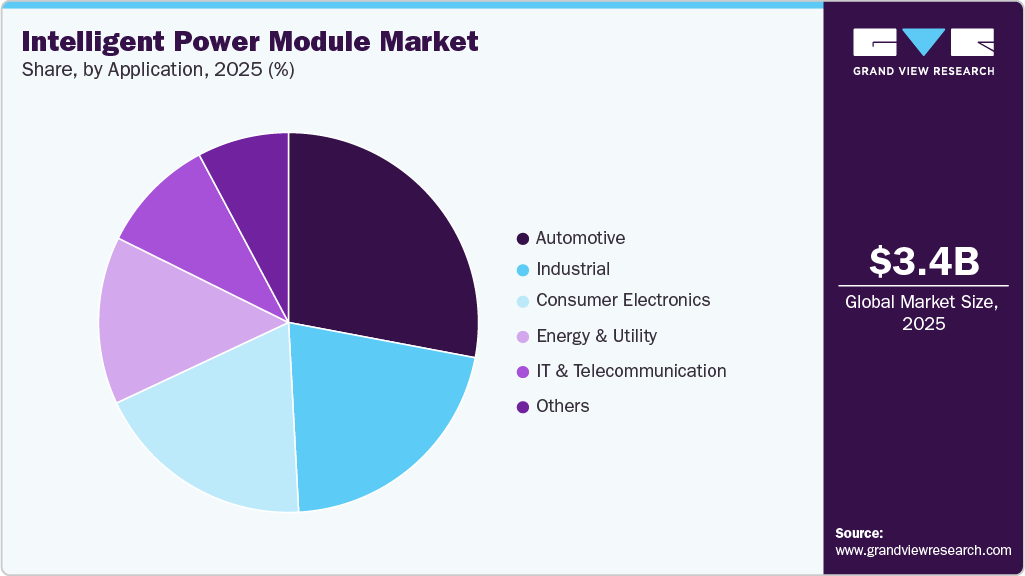

- By Application, the automotive segment dominated the intelligent power module market due to the rapid global electrification of vehicles.

Market Size & Forecast

- 2025 Market Size: USD 3,430.8 Million

- 2033 Projected Market Size: USD 9,854.4 Million

- CAGR (2026-2033): 14.7%

- Asia Pacific: Largest market in 2025

Factories are increasingly deploying automated equipment and advanced motor drive systems to improve productivity and process control. This shift is increasing demand for IPMs that support precise power management and higher energy efficiency. Rising deployment of robotics and CNC machines is further strengthening IPM adoption across industrial facilities.The adoption of silicon carbide-based intelligent power modules is supporting strong market growth. These modules enable higher energy efficiency, which reduces power losses in industrial systems. Improved power density allows more compact and lightweight designs for motor drive applications. This capability is driving increased demand across various sectors that utilize advanced industrial equipment. As efficiency standards tighten, silicon carbide IPMs see wider acceptance. For instance, in March 2025, onsemi, a U.S.-based semiconductor company, launched a 1200 V silicon carbide (SiC) MOSFET-based IPM series called EliteSiC SPM 31, designed to deliver high energy efficiency, high power density, and a compact form factor for inverter motor drives in industrial applications such as HVAC, robotics, pumps, and data-center cooling systems.

The intelligent power module market is expanding as manufacturers focus on compact and energy-efficient power solutions. These modules help reduce power losses and improve overall energy efficiency in motor drive systems. Smaller form factors allow integration into space-constrained inverter designs. Improved thermal management enhances performance and prevents overheating. Built-in protection features increase system reliability and operational lifetime. Higher efficiency and durability make these modules suitable for a wider range of industrial and consumer applications. The adoption of Intelligent Power Modules is steadily increasing across multiple sectors. For instance, in April 2025, Alpha and Omega Semiconductor Limited, a U.S.-based semiconductor company, launched the Mega IPM-7 series Intelligent Power Modules. The series features a compact, high-efficiency design optimized for BLDC motor drives in home appliances and power tools, delivering higher power density and reliable performance.

AI and IoT integration in Intelligent Power Modules (IPMs) is emerging as a key differentiator for high-value industrial applications. These technologies enable real-time monitoring of voltage, current, and temperature within the module. Embedded intelligence helps detect faults early and supports predictive maintenance. IoT connectivity allows remote diagnostics and performance tracking across industrial systems. AI-based algorithms can optimize power usage and improve operational efficiency. This reduces unplanned downtime and extends equipment lifespan. Smart IPMs support Industry 4.0 and digital factory initiatives. Demand is rising for intelligent, connected IPMs in advanced industrial environments.

Power Device Insights

The IGBT segment dominated the global market with a revenue share of 77.8% in 2025. The dominance comes on the back of its proven reliability, cost effectiveness, and mature technology base. IGBT-based IPMs are widely adopted in industrial motor drives, HVAC systems, home appliances, and power tools because they offer stable performance under high-voltage and high-current conditions. Their ease of integration and robust protection features simplify system design for manufacturers. Strong thermal performance and long operational life further support their preference across applications. Compared to newer technologies, IGBTs provide a balanced trade-off between efficiency and cost.

The MOSFET segment is gaining traction in the intelligent power module industry due to its high switching speed and improved efficiency. MOSFET-based IPMs are well-suited for low- to medium-voltage applications. They help reduce switching losses and improve overall power efficiency. Compact designs enable integration into space-constrained systems. MOSFET IPMs are widely used in consumer electronics and home appliances. Their performance supports quieter and smoother motor operation. These benefits are driving increased adoption of MOSFET-based IPMs across multiple applications.

Voltage Rating Insights

The 600 V to 1,199 V segment dominated the global market with revenue share of 48.8% in 2025. This voltage range is widely used across industrial and commercial applications. It is well-suited for motor drives, HVAC systems, and industrial automation equipment. Strong demand from manufacturing and processing industries supported its leadership. The segment offers a balanced combination of efficiency, performance, and reliability. It also supports compact and energy-efficient inverter designs. Manufacturers prefer this range due to its broad application compatibility. Its ability to handle moderate to high power requirements makes it highly versatile.

The 1,200 V and above segment is growing due to rising demand for high-power applications. This voltage range is increasingly used in electric vehicles and fast-charging infrastructure. It also supports heavy industrial motor drives and railway systems. Higher voltage capability enables improved power efficiency and reduced current losses. Advancements in wide-bandgap technologies such as silicon carbide are accelerating adoption. These modules support compact designs even at higher power levels. Strong investments in electrification and renewable energy are further driving growth. The 1,200 V and above segment is expected to expand steadily in the market.

Application Insights

The automotive segment dominated the intelligent power module market due to the rapid global electrification of vehicles. Increasing adoption of electric and hybrid vehicles has driven demand for high-efficiency power electronics. IPMs are extensively used in traction inverters, onboard chargers, and DC-DC converters. They enhance energy efficiency, improve driving range, and support reliable vehicle operation. Advanced driver assistance systems and in-vehicle comfort applications also rely on IPMs. Regulatory pressure on emissions and fuel efficiency further boosts their adoption. Automotive manufacturers prioritize compact and high-performance IPMs for system integration. These combined factors have solidified the automotive segment’s leading position in the market.

The consumer electronics segment is growing in the wake of rising demand for energy-efficient and compact devices. IPMs are increasingly used in appliances such as air conditioners, refrigerators, and washing machines. They help improve energy efficiency, reduce power losses, and enable quieter operation. Compact designs allow integration into space-constrained electronic products. Built-in protection features enhance reliability and extend device lifespan. Increasing consumer preference for smart and connected appliances is further supporting growth. These factors are contributing to the steady expansion of IPMs in the consumer electronics sector.

Regional Insights

The Asia Pacific intelligent power module industry dominated the global market with a revenue share of 39.0% in 2025. Rapid industrialization across countries such as China, Japan, South Korea, and India significantly contributed to this growth. The region’s adoption of energy-efficient solutions and advanced motor drives fueled demand for IPMs. Silicon carbide-based modules, offering high energy efficiency and compact designs, became increasingly preferred in industrial applications. Government policies promoting sustainable manufacturing and automation further supported market expansion. Strong local manufacturing capabilities and robust supply chains ensured the timely production and delivery of high-performance modules.

China Intelligent Power Module Market Trends

The China intelligent power module market is experiencing steady growth driven by rising demand for energy‑efficient power electronics in industrial and automotive applications. Strong investment in renewable energy and electric vehicle infrastructure is expanding adoption of intelligent power modules across key sectors. Domestic manufacturers are increasing production capacity and accelerating innovation to improve performance and reduce costs. Government policies supporting electrification and energy conservation are enhancing market attractiveness for both local and international players.

North America Intelligent Power Module Market Trends

The intelligent power module industry in North America is growing steadily due to increased industrial automation and energy efficiency requirements. The U.S. and Canada are driving demand for high-performance IPMs in manufacturing and renewable energy applications. Silicon carbide-based modules are gaining popularity for their compact design and reduced power losses. Adoption in electric vehicles and data-center cooling systems further supports market growth.

The U.S. intelligent power module market is witnessing steady growth due to increasing demand for energy-efficient industrial systems. Adoption of silicon carbide-based IPMs is rising, driven by their high power density and compact designs. Industrial automation, renewable energy integration, and electric vehicle applications are key factors supporting market expansion. Strong technological innovation and local manufacturing capabilities continue to reinforce the market’s development in the U.S.

Europe Intelligent Power Module Market Trends

The intelligent power module industry in Europe is expanding steadily, driven by the rising adoption of energy-efficient industrial systems. Germany, France, and Italy are leading in industrial automation and advanced manufacturing applications. Silicon carbide-based IPMs are increasingly preferred for high-efficiency and compact motor drive solutions. Growing investments in renewable energy, including wind and solar, are boosting demand for reliable power modules. Regulatory frameworks promoting carbon reduction and energy efficiency further support market growth.

Key Intelligent Power Module Company Insights

Some of the key companies in the intelligent power module industry include ABB, Fuji Electric Co., Ltd., Hitachi, Ltd., Infineon Technologies AG, Mitsubishi Electric Corporation, onsemi, ROHM Co., Ltd., and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Infineon Technologies AG develops a wide range of Intelligent Power Modules based on IGBT and silicon carbide technologies. Its IPMs are used in industrial motor drives, HVAC systems, renewable energy inverters, and electric vehicle applications. The company focuses on improving power density and reducing switching and conduction losses. Integrated protection and gate driver functions enhance system reliability and ease of use. Continuous research and close cooperation with industrial customers support ongoing IPM advancements.

-

Mitsubishi Electric has long-standing experience in designing Intelligent Power Modules for industrial and appliance applications. Its IPMs are widely used in motor drives, elevators, air conditioners, and factory automation systems. The company emphasizes stable performance, thermal efficiency, and built-in protection features. Product development targets higher efficiency and durability under demanding operating conditions. Advanced manufacturing processes support consistent quality in Mitsubishi Electric IPM solutions.

Key Intelligent Power Module Companies:

The following key companies have been profiled for this study on the intelligent power module market.

- Mitsubishi Electric Corporation

- Semiconductor Components Industries, LLC (onsemi)

- Infineon Technologies AG

- Fuji Electric Co., Ltd.

- Semikron Danfoss

- ROHM Co., Ltd.

- STMicroelectronics

- Alpha and Omega Semiconductor.

- Sensitron Semiconductor

- Ideal Power, Inc.

- CISSOID

Recent Developments

-

In December 2025, Mitsubishi Electric India launched its latest power semiconductor technologies, including advanced Intelligent Power Module (IPM) solutions. The launch highlighted new DIPIPM IGBTs with integrated inverter circuits, gate drivers, and protection features designed for HVAC, industrial motor drives, and renewable energy applications.

-

In September 2025, Infineon Technologies AG and ROHM signed an agreement to collaborate on silicon carbide (SiC) power device packaging, enabling each other as second-source suppliers of selected SiC power packages to improve design flexibility and availability for customers. This collaboration supports broader adoption of SiC solutions, which are key for high-efficiency IPMs in automotive and industrial applications.

-

In August 2024, Infineon Technologies AG expanded its IPM portfolio by adding the CIPOS Maxi Intelligent Power Module series to its IGBT product family, enhancing options for low-power motor drive applications. The aim of this expansion was to provide higher energy efficiency, compact system design, and improved reliability for industrial and appliance motor drive solutions.

Intelligent Power Module Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,767.0 million

Revenue forecast in 2033

USD 9,854.4 million

Growth rate

CAGR of 14.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Power device, voltage rating, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Mitsubishi Electric Corporation; Semiconductor Components Industries, LLC (onsemi); Infineon Technologies AG; Fuji Electric Co., Ltd.; Semikron Danfoss; ROHM Co., Ltd.; STMicroelectronics; Alpha and Omega Semiconductor; Sensitron Semiconductor; Ideal Power, Inc.; CISSOID

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intelligent Power Module Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global intelligent power module market report based on power device, voltage rating, application, and region:

-

Power Device Outlook (Revenue, USD Million, 2021 - 2033)

-

IGBT

-

MOSFET

-

-

Voltage Rating Outlook (Revenue, USD Million, 2021 - 2033)

-

0 V to 599 V

-

600 V to 1,199 V

-

1,200 V and above

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Industrial

-

Consumer Electronics

-

Energy & Utility

-

IT & Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the intelligent power module market include Mitsubishi Electric Corporation, Semiconductor Components Industries, LLC (onsemi), Infineon Technologies AG, Fuji Electric Co., Ltd., Semikron Danfoss, ROHM CO., LTD., STMicroelectronics, Alpha and Omega Semiconductor, Sensitron Semiconductor, Ideal Power, Inc., and Cissoid.

b. The global intelligent power module market size was estimated at USD 3,430.8 million in 2025 and is expected to reach USD 3,767.0 million in 2026.

b. The global intelligent power module market is expected to grow at a compound annual growth rate of 14.7% from 2026 to 2033 to reach USD 9,854.4 million by 2033.

b. Asia Pacific dominated the intelligent power module market with a share of over 39.0% in 2025. This is attributable to rapid industrial growth and widespread adoption of advanced electronic and automotive applications in the region.

b. Key factors driving the market growth include the rising adoption of electric vehicles and the expanding deployment of renewable energy applications worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.