- Home

- »

- Automotive & Transportation

- »

-

Intelligent Traffic Management System Market Report, 2033GVR Report cover

![Intelligent Traffic Management System Market Size, Share & Trends Report]()

Intelligent Traffic Management System Market (2026 - 2033) Size, Share & Trends Analysis Report By Solution (Traffic Monitoring System, Traffic Signal Control System, Traffic Enforcement Camera, Integrated Corridor Management), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-2-68038-907-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intelligent Traffic Management System Market Summary

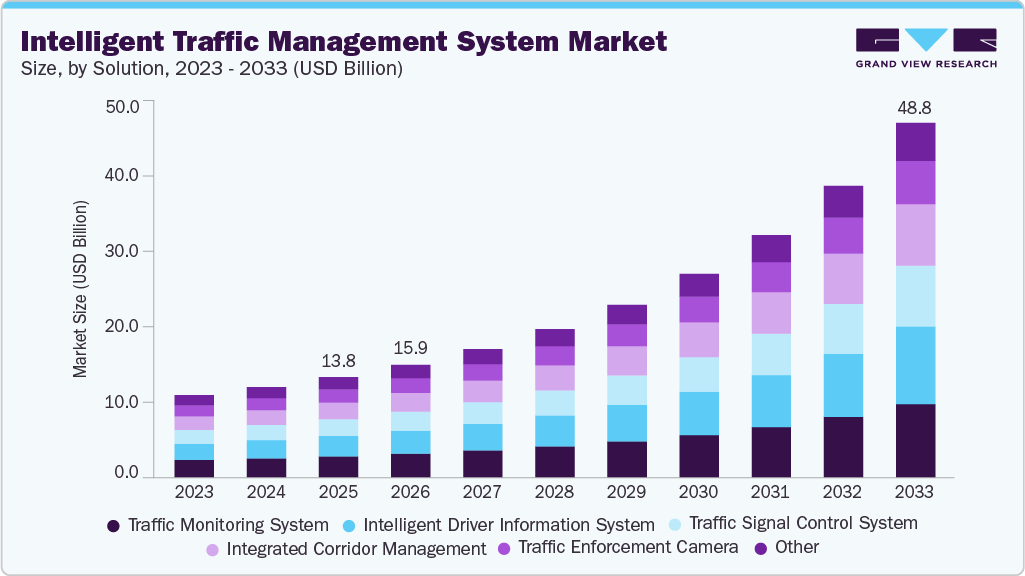

The global intelligent traffic management system market size was estimated at USD 13.77 billion in 2025 and is projected to reach USD 48.67 billion by 2033, growing at a CAGR of 17.8% from 2026 to 2033. The growth of the market can be attributed to the rising demand for real-time traffic information for passengers and drivers, along with an increased number of vehicles on the road.

Key Market Trends & Insights

- North America dominated the intelligent traffic management system industry and accounted for a share of 38.2% in 2025.

- The U.S. intelligent traffic management system market held a dominant position in the region in 2025.

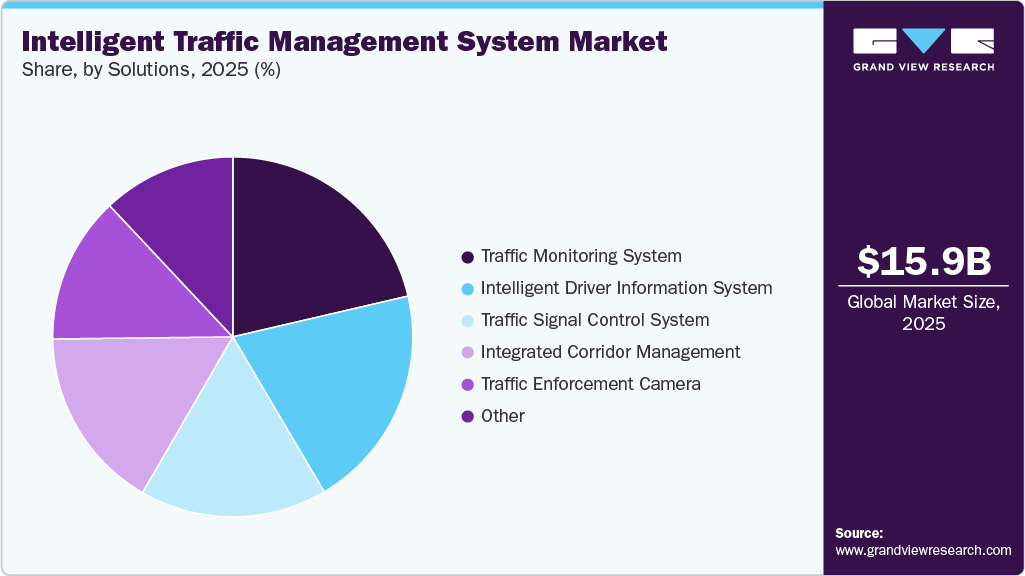

- By solution, the traffic monitoring system segment dominated the market in 2025 and accounted for the largest share of 21.4%.

- The intelligent driver information system segment is expected to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 13.77 Billion

- 2033 Projected Market Size: USD 48.67 Billion

- CAGR (2026-2033): 17.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

An intelligent traffic management system ensures traffic flow, road safety, and mobility. One of the key factors driving demand for intelligent traffic management systems is the growing development of smart cities. Improved traffic efficiency allows transportation authorities to respond to emergencies faster. Furthermore, the increased use of public transportation can aid in the reduction of carbon dioxide emissions and airborne pollutants for developing smart cities. Moreover, these traffic management solutions also provide real-time data for the analysis and response to emergencies on an immediate basis. These benefits offered by ITMS would further supplement the market growth.

Countries across the globe are putting effort into modifying their traffic management infrastructure to reduce traffic congestion. Moreover, the adoption of telematics services in vehicles has a significant impact on security and safety. These services enhance driver safety, reduce fuel consumption, improve driver behavior, and enable cost reduction. Telematics tracking systems are widely deployed in cars, which include accessing and activating vehicles remotely using Radio Frequency Identification (RFID). These factors are estimated to fuel growth opportunities in the market.

The growing urban population and rapid industrialization have increased the number of vehicles on the road, causing heavy traffic congestion. As a result, safety concerns for urban planners and high levels of CO2 emissions are expected to have a significant impact on the growth of the intelligent traffic management system market. According to the European Joint Research Centre (JRC), road congestion in Europe costs around 1% of the region's Gross Domestic Product (GDP). Most urban infrastructure development and management bodies in the region have made mitigation their top priority. Further, the intelligent traffic management system also facilitates smart mobility solutions, which can play an important role in addressing all of these issues and solutions while also promoting the growth of the ITMS market.

The high costs involved in developing, installing, and maintaining intelligent traffic management systems continue to limit market growth. Implementing effective ITMS requires a centralized and advanced traffic management center capable of processing real-time traffic data. It must also be seamlessly connected to system operators, transportation authorities, and emergency response agencies. In addition, the overall ITMS network relies on multiple components, such as CCTV cameras, mobile data terminals, advanced traveler information systems, and highway advisory radio, which must be deployed across numerous locations to function effectively. These extensive infrastructure needs demand substantial investment, posing financial challenges for governments in developing nations.

Solution Insights

The traffic monitoring system segment dominated the market in 2025 and accounted for the largest share of 21.4%. Inadequate signal controls can lead to road congestion and increase the overall travel time to a large extent. The favorable government initiatives to develop traffic infrastructures, the emergence of smart city projects, and the growth of adaptive intelligent traffic controls & analytics are key factors in deploying traffic monitoring systems. Furthermore, rising traffic congestion and vehicle pollution have accelerated the need for Mobility as a Service (MaaS), which is anticipated to drive market growth over the forecast period.

The intelligent driver information system segment is expected to grow at the fastest CAGR over the forecast period. The segment’s growth is driven by the rising need to enhance road safety and reduce accident rates. Increasing traffic congestion in urban areas has created strong demand for real-time navigation support, hazard warnings, and adaptive route guidance that help drivers make informed decisions. The growth of connected vehicles and the integration of in-car infotainment systems further support the adoption of IDIS, as automakers increasingly incorporate advanced driver assistance features into both premium and mid-range models.

Regional Insights

North America intelligent traffic management system industry dominated the respective global market and accounted for a share of 38.2% in 2025. The market growth can be attributed to the growing focus of the U.S. and Canadian governments on improving the overall transportation infrastructure to help reduce accidents and congestion on highways and cities.Advances in communication technologies and addressing vehicular congestion for improved transport capacity effectiveness through real-time exchange are predicting a revolution in the region's transportation network. Further, the growing adoption of mobile and radio devices featuring short-range dedicated technology enables drivers across the region, driving the demand for ITMS solutions during the forecast period.

U.S. Intelligent Traffic Management System Market Trends

The U.S. intelligent traffic management system market held a dominant position in the region in 2025.The United States Department of Transportation (DOT) is aggressively investing in research and development, implementation, and adoption of intelligent traffic management systems across the country. The U.S. ITMS market is experiencing significant growth, driven by increasing investments in smart city initiatives and advanced transportation infrastructure. Rising urbanization and traffic congestion have led to the adoption of adaptive traffic control systems and IoT-based solutions that optimize traffic flow and enhance safety.

Europe Intelligent Traffic Management System Market Trends

Europe intelligent traffic management system market is expected to register a moderate CAGR from 2026 to 2033.The Europe ITMS market is growing rapidly, fueled by stringent government regulations aimed at reducing carbon emissions and improving road safety. The region’s focus on smart city development and sustainable transportation has driven the adoption of advanced traffic management solutions, such as adaptive signal control and real-time monitoring. Additionally, significant investments in IoT and AI-based traffic technologies are enhancing the efficiency of urban mobility across Europe.

The UK intelligent traffic management system market is expected to grow at a notable CAGR from 2026 to 2033. The market is expanding due to the government’s emphasis on reducing traffic congestion and achieving net-zero carbon emissions by 2050. Initiatives such as the rollout of smart motorways and investments in AI-powered traffic control systems are driving the adoption of advanced solutions.

Intelligent traffic management system market in Germany held a substantial market share in 2025. Germany’s ITMS market is driven by the country’s focus on sustainable transportation and its leadership in automotive innovation. With increasing urbanization and traffic congestion, there is growing adoption of adaptive traffic signal control systems, smart sensors, and AI-powered analytics to optimize traffic flow. Government initiatives, such as investments in smart city projects and emission reduction targets, are further accelerating the deployment of advanced traffic technologies.

Asia Pacific Intelligent Traffic Management System Market Trends

The Asia Pacific intelligent traffic management system market is expected to grow at the fastest CAGR of 21.3% during the forecast period. The demand for intelligent traffic management system is expected to increase significantly in key countries including China, Japan, South Korea, and India, which are anticipated to lead the ITMS market. Furthermore, the initiatives undertaken by government bodies in the region are expected to fuel the growth of the market.

Intelligent traffic management system market in China held a substantial market share in 2025. China’s ITMS market is expanding rapidly due to large-scale urbanization and government-backed smart city initiatives. The country is investing heavily in adaptive traffic control systems and IoT-enabled technologies to manage traffic in its sprawling metropolitan areas.

The Japan intelligent traffic management system market is expected to grow rapidly in the coming years due to the increasing adoption of intelligent traffic management system in the corporate. Japan's ITMS market is driven by the country’s commitment to innovation and efficient urban mobility. Advanced technologies, such as AI-powered traffic signal control and real-time monitoring systems, are being widely adopted to address rising congestion in densely populated cities.

Key Intelligent Traffic Management System Company Insights

Some of the key companies in the intelligent traffic management system industry include Siemens AG, Cubic Corporation, Inc., and Kapsch TrafficCom Market players are investing aggressively in research & development activities, improving their internal processes, actively engaging in new product development, and improving their existing products and services as part of their efforts to acquire new customers and increase their respective market shares.

-

Siemens AG holds a significant market share in the ITMS market, with its broad portfolio of traffic management solutions, including adaptive traffic control systems, real-time monitoring, and integrated mobility platforms. As a global leader, Siemens benefits from strong market penetration in Europe, North America, and Asia Pacific, driven by government-backed smart city initiatives and the rising demand for sustainable transportation. The company's focus on innovation, such as its mobility-as-a-service (MaaS) platform, positions it well for continued growth in the ITMS sector, especially as cities adopt more advanced, data-driven traffic solutions.

-

Cubic Corporation has established itself as a key player in the ITMS market, particularly in traffic management solutions related to tolling, transit management, and real-time data analytics. With a strong presence in North America and expanding operations globally, Cubic focuses on integrating its systems with connected vehicle technologies and IoT-based platforms. Their solutions are widely adopted in urban centers aiming to optimize traffic flow, reduce congestion, and improve public transit efficiency.

Key Intelligent Traffic Management System Companies:

The following are the leading companies in the intelligent traffic management system market. These companies collectively hold the largest market share and dictate industry trends.

- Cubic Corporation

- SNC-Lavalin Group (Atkins)

- Thales Group

- International Business Machines Corporation

- General Electric Company

- Siemens AG

- Kapsch TrafficCom

- TomTom International BV

- Q-Free ASA

- TransCore

Recent Developments

-

In August 2025, Sensys Networks, Inc. unveiled its MultiSens Intersection solution at the ITS World Congress, marking the debut of the industry’s first unified traffic detection platform that seamlessly integrates video AI and wireless sensor technologies into one system. This innovative solution eliminates the traditional compromise between achieving comprehensive intersection analysis and ensuring dependable advance detection.

-

In June 2025, Kapsch TrafficCom AG announced that it has secured contracts from the New York State Department of Transportation to operate two Traffic Management Centers (TMCs) in New York State. The two centers, located in Rochester and Hornell, will enhance regional traffic operations and support efficient transportation management.

Intelligent Traffic Management System Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.48 billion

Revenue forecast in 2033

USD 48.67 billion

Growth rate

CAGR of 17.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; KSA; UAE; Kuwait; South Africa

Key companies profiled

Cubic Corporation; SNC-Lavalin Group (Atkins); Thales Group; International Business Machines Corporation; General Electric Company; Siemens AG; Kapsch TrafficCom; TomTom International BV; Q-Free ASA; TransCore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intelligent Traffic Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global intelligent traffic management system market report based on solution and region:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Traffic Monitoring System

-

Traffic Signal Control System

-

Traffic Enforcement Camera

-

Integrated Corridor Management

-

Intelligent Driver Information System

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intelligent traffic management system market size was estimated at USD 13.77 billion in 2025 and is expected to reach USD 15.48 billion in 2026.

b. The global intelligent traffic management system market is expected to grow at a compound annual growth rate of 17.8% from 2026 to 2033 to reach USD 48.67 billion by 2033.

b. North America dominated the intelligent traffic management system industry and accounted for a share of 38.2% in 2025. This is attributed to the growing need for real-time data among drivers and passengers, as well as the rapid adoption of IoT and Industry 4.0 in the region.

b. Some key players operating in the ITMS market include Cubic Corporation; SNC-Lavalin Group (Atkins); Thales Group; International Business Machines Corporation; General Electric Company; Siemens AG; Kapsch TrafficCom; TomTom International BV; Q-Free ASA; TransCore

b. The rising demand for presenting real-time traffic information to drivers and passengers is one of the key factors driving the demand for an intelligent traffic management system.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.