- Home

- »

- Medical Devices

- »

-

Interactive Wound Dressing Market Size & Share Report, 2030GVR Report cover

![Interactive Wound Dressing Market Size, Share & Trends Report]()

Interactive Wound Dressing Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Semi-permeable Films Dressing, Hydrogel Dressing), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-048-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global interactive wound dressing market size was valued at USD 4.14 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. This is attributed to factors such as the increasing prevalence of chronic wounds and the growing geriatric population. Additionally, technology advancements in wound dressings and the rising awareness of advanced wound care products are also driving market growth. As per the report published by the National Library of Medicine, chronic wounds affect approximately 6.5 million people in the US, with an estimated annual cost of USD 5 billion. According to a report by the United Nations, the global geriatric population is expected to reach 1.5 billion by 2050, which represents a significant increase from the 703 million elderly people recorded in 2019. This growth in the geriatric population is expected to have a significant impact on the market as elderly people are more susceptible to chronic wounds due to age-related changes in skin structure and reduced mobility.

Moreover, according to a report by the World Health Organization, chronic wounds affect approximately 9.7 million people worldwide each year, and this number is expected to increase due to the aging population, rising incidence of diabetes, and the increasing prevalence of obesity. Elderly people are also more likely to have comorbidities, such as diabetes and peripheral artery disease, which further increases the risk of developing chronic wounds.

Therefore, the increasing geriatric population is likely to be a significant driver of the global interactive wound dressing market in the coming years as the demand for advanced wound care products that can improve healing outcomes, reduce the risk of infection, and improve patient comfort is expected to rise. The development of new and innovative interactive wound dressings that cater to the specific needs of the geriatric population is also expected to contribute to the growth of the market.

The COVID-19 pandemic had a significant impact on the interactive wound dressing market. The pandemic has caused a decrease in demand due to the postponement of non-essential medical procedures, including elective surgeries, which require wound care products. This has resulted in reduced revenue for manufacturers and suppliers of wound care products. Additionally, the pandemic has disrupted global supply chains, leading to a shortage of wound care products and increased costs. This has further affected the market by limiting the availability of wound care products and leading to price hikes for both healthcare providers and patients.

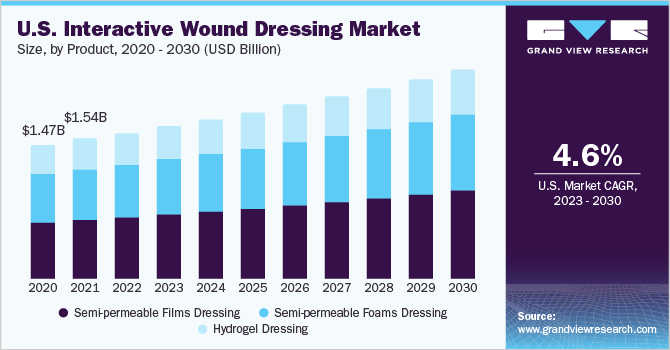

Product Insights

Based on the product, the market is segmented into semi-permeable film dressings, semi-permeable foam dressing, and hydrogel dressing. The semi-permeable film dressings accounted for the highest revenue share of 42.0% in 2022 and it is also expected to witness the fastest growth over the forecast period. This is attributed to increasing in the prevalence of chronic wounds. As per the CDC, approximately 2.5 million population in the U.S. suffers from chronic venous insufficiency which leads to venous leg ulcers thus, driving the demand for the industry. Semi-permeable film dressings are thin, flexible dressings that allow oxygen and moisture to pass through while preventing bacteria and other contaminants from entering the wound. These dressings are ideal for managing chronic wounds that require a moist wound-healing environment to facilitate the healing process.

Hydrogel dressings are advanced wound care dressings designed to provide a moist wound-healing environment. These dressings are made of a gel containing a high percentage of water and can be applied to the wound bed to provide a moist environment that promotes healing. Hydrogel dressings are commonly used for the management of dry or necrotic wounds, such as burns, pressure ulcers, and surgical wounds. As per the estimates WHO surgical site infections occur in up to 5% of the patient undergoing surgery, this is further driving the segment growth.

Application Insights

Based on application, the market is segmented into chronic wounds and acute wounds. Chronic wounds accounted for the highest revenue share of 59.8% in 2022. This is attributed to several factors such as the increasing prevalence of diabetes, aging populations, and lifestyle changes leading to a rise in risk factors for foot ulcers. These wounds often result from underlying conditions such as diabetes, peripheral artery disease, or venous insufficiency. As per the estimates of the Australian medical association chronic wounds are a significant health issue, affecting 450 million population. Similarly, according to a report by the World Health Organization, chronic wounds affect approximately 4-5 million people in the United States alone and are a major cause of morbidity and mortality. The increasing prevalence of chronic wounds is driving demand for advanced wound care products, including interactive wound dressings.

The acute wounds segment is expected to witness the fastest CAGR of 4.7% in the forecast period. This is attributed to the increasing prevalence of injuries such as cuts, abrasions, and burns. According to data from the (CDC), there were approximately 31 million emergency department visits for injuries in 2018, with falls being the leading cause of nonfatal injuries. Moreover, according to the National Surgical Quality Improvement Program, approximately three million surgical procedures are performed in the United States each year, and the incidence of surgical site infection ranges from 2% to 5% contributing to the growth of the segment.

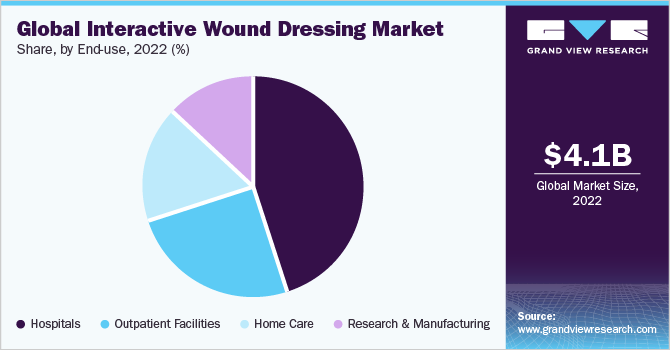

End-use Insights

Based on the end-use, the market is segmented into hospitals, outpatient facilities, home care, research & manufacturing. The hospital segment accounted for the highest market share at 45.3%. This is attributed to the increase in government expenditure post-pandemic and the increasing prevalence of the chronic disease is influencing the growth of this sector. As per the estimates of the American health association, in 2020 there were approximately 6,146 hospitals in the U.S. Thus due to the above reasons the hospital segment is expected to grow.

The homecare segment is expected to witness the fastest CAGR of 5.2% in the forecast period. The prevalence of chronic wounds increases with age, with up to 15% of older adults over 65 years of age affected by chronic wounds. This can include pressure ulcers, diabetic foot ulcers, and venous leg ulcers. As per the estimates of WHO in 2020, there were an estimated 703 million people aged 65 years or over worldwide. By 2050, this number is expected to nearly triple by 1.5 billion. Thus due to the aforementioned factors, the homecare segment is expected to grow.

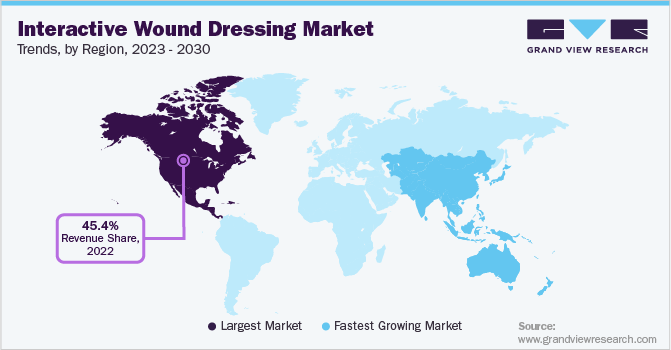

Regional Insights

North America dominated the global market and accounted for a revenue share of 45.4% in 2022. The region has a significant prevalence of chronic wounds, including diabetic foot ulcers and venous leg ulcers, creating a high demand for effective wound management solutions. According to a report by the United States Census Bureau, the elderly population (65 years and older) in the United States is expected to grow from 54 million in 2019 to 73 million in 2030. As the elderly population is more susceptible to chronic wounds, this is expected to drive demand for advanced wound care products, including interactive wound dressings. Moreover, the rapidly aging population in the region has led to an increase in chronic diseases and injuries, further driving the demand for wound care products, including interactive wound dressings.

Asia Pacific is expected to attain the fastest CAGR of 5.2% owning to government initiatives such as the Ministry of Health and Family Welfare in India, the Ministry of Health in Singapore, and the National Health Commission in China are actively promoting the use of advanced wound care products, including interactive wound dressings, to improve patient outcomes and reduce healthcare costs. For instance, the Indian government has launched the National Program for Prevention and Management of Burn Injuries, which aims to provide comprehensive care to burn victims, including the use of advanced wound care products. Additionally, the growing trend of medical tourism is also contributing to the growth of the market as patients from other countries seek medical treatment in the region.

Key Companies and Market Share Insights

The market is highly fragmented with several players competing for market share, major market participants are implementing a variety of business tactics, such as creating strategic alliances, collaborations, and mergers. Some of the prominent players operating in the global interactive wound dressing market:

-

B. Braun SE

-

3M

-

Cardinal Health, Inc.

-

Smith & Nephew

-

Coloplast

-

McKesson Corporation

-

Medline Industries

-

PAUL HARTMANN AG

-

MediWound

-

Mölnlycke Health Care AB.

-

ConvaTec Group PLC

Interactive Wound Dressing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.3 billion

Revenue forecast in 2030

USD 5.9 billion

Growth rate

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

B. Braun SE; 3M; Cardinal Health, Inc.; Smith & Nephew; Coloplast; Mölnlycke Health Care AB.; ConvaTec Group PLC; McKesson Corporation; Medline Industries; PAUL HARTMANN AG; MediWound

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase option

Avail customized purchase options to meet your exact research needs. Explore purchase options

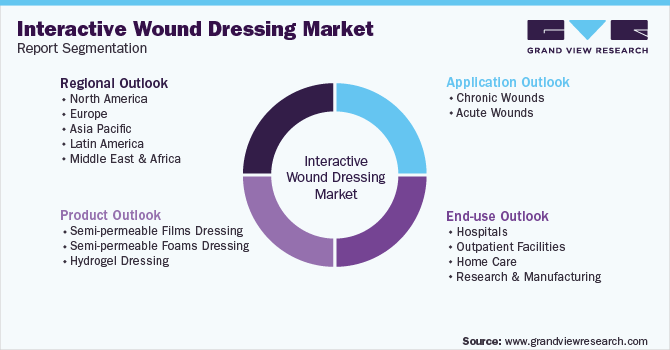

Global Interactive Wound Dressing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global interactive wound dressing market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-permeable films dressing

-

Semi-permeable foams dressing

-

Hydrogel dressing

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic foot ulcers

-

Pressure ulcers

-

Venous leg ulcers

-

Other chronic wounds

-

-

Acute Wounds

-

Surgery & trauma

-

Burn injuries

-

-

-

End-use outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home care

-

Research & manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global interactive wound dressing market size was estimated at USD 4.1 billion in 2022 and is expected to reach USD 4.3 billion in 2023.

b. The global interactive wound dressing market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 5.9 billion by 2030.

b. The semipermeable film dressing in product segment dominated the overall interactive wound dressing market, commanding over 41.9% revenue share in 2022.

b. Some key players operating in the interactive wound dressing market include B. Braun SE, 3M, Cardinal Health, Smith+Nephew, Coloplast Corp., Molnlycke Health Care AB, ConvaTec Group PLC, McKesson Corporation, Medline Industries, PAUL HARTMANN AG, MediWound

b. Key factors that are driving the interactive wound dressing market growth include increasing prevalence of chronic diseases and conditions affecting wound healing capabilities, introduction of innovative and advanced wound products, increasing number of accidents.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.