- Home

- »

- Next Generation Technologies

- »

-

Intermodal Freight Transportation Market Size Report, 2030GVR Report cover

![Intermodal Freight Transportation Market Size, Share & Trends Report]()

Intermodal Freight Transportation Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Road-rail, Road-water, Road-air), By Operation, By Services (Fleet Management, Intermodal Terminals), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-362-6

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intermodal Freight Transportation Market Summary

The global intermodal freight transportation market size was estimated at USD 42.9 billion in 2023 and is projected to reach USD 93.51 billion by 2030, growing at a CAGR of 12.1% from 2024 to 2030. Intermodal freight transportation is the movement of goods using multiple modes of transportation (such as trucks, trains, and ships) in a single journey, without handling the freight itself when changing modes.

Key Market Trends & Insights

- North America held the largest share of 35.6% in the intermodal freight transportation market in 2023.

- The U.S. held the largest share in North America in 2023 in the intermodal freight transportation market.

- By type, the road-rail segment dominated the target market and accounted for the largest revenue share of 45.8% in 2023.

- By operation, the domestic intermodal segment held the largest market share of 52.3%.

- By services, the transportation & warehousing services segment held the largest market share of 35.6%.

Market Size & Forecast

- 2023 Market Size: USD 42.9 Billion

- 2030 Projected Market Size: USD 93.51 Billion

- CAGR (2024-2030): 12.1%

- North America: Largest market in 2023

The market is growing significantly due to the need for a more reliable, safe, efficient transportation system, containerization permitting easy handling of goods, growth in the domestic intermodal transportation market, and free trade agreements. The intermodal freight transportation market emphasizes the need for a more reliable transportation system due to the increasing demand for timely and secure delivery of goods. Reliability in transportation ensures that goods arrive at their destination without damage, reducing losses and improving customer satisfaction. Safety is a paramount concern, particularly when transporting hazardous materials, necessitating robust safety protocols and infrastructure. Efficient transportation systems reduce transit times and operational costs, enhancing overall supply chain efficiency. Technological advancements such as real-time tracking and predictive analytics contribute significantly to improving the reliability and efficiency of intermodal transportation. Investments in infrastructure, such as modernizing ports and railways, are critical to meeting these demands and supporting market growth.

Containerization revolutionizes the handling of goods by standardizing cargo units, which simplifies loading, unloading, and transfer processes across different transportation modes. This standardization allows for seamless integration between ships, trucks, and trains, reducing the risk of damage and loss during transit. The use of containers enhances security by minimizing the need for manual handling and providing robust, tamper-proof units. Containers also optimize space utilization, allowing for efficient stacking and storage, which maximizes cargo services and reduces transportation costs. The versatility of containers enables them to carry a wide range of goods, including perishable items and hazardous materials, making them essential in the global supply chain. Overall, containerization significantly enhances the efficiency and reliability of the intermodal freight transportation system.

The domestic intermodal transportation market is experiencing significant growth due to the increasing demand for efficient, and cost-effective transportation solutions. This growth is driven by the rising volume of e-commerce and the need for faster delivery times to meet consumer expectations. Intermodal transportation offers a competitive advantage by combining the strengths of different transport modes, such as the flexibility of trucks and the cost-efficiency of rail. Environmental concerns also play a role, as intermodal solutions typically have a lower carbon footprint than traditional road transport alone. Infrastructure investments, such as the expansion of rail networks and the modernization of ports, further support the growth of the domestic intermodal market. Additionally, government policies and incentives aimed at promoting intermodal transportation contribute to its increasing adoption and market expansion.

Free trade agreements (FTAs) significantly impact the intermodal freight transportation market by facilitating the seamless movement of goods across borders. FTAs reduce or eliminate tariffs and trade barriers, making it more cost-effective for businesses to engage in international trade. These agreements encourage economic cooperation and integration, leading to increased trade volumes and the need for efficient transportation solutions. The market benefits from FTAs as they streamline customs procedures, reducing delays and enhancing the predictability of transit times. Additionally, FTAs promote investment in transportation infrastructure, such as ports and railways, to support the growing trade demands.

Type Insights

The road-rail segment dominated the target market and accounted for the largest revenue share of 45.8% in 2023 due to its versatility and cost-effectiveness. It combines the flexibility of road transport with the efficiency and long-distance capabilities of rail, making it suitable for a wide range of cargo types and distances. Road-rail solutions offer significant cost savings compared to purely road-based transport, particularly for long-haul shipments, while also reducing environmental impacts through lower carbon emissions per ton-mile. Moreover, infrastructure investments in intermodal terminals that facilitate seamless transfer between road and rail modes further enhance the segment's attractiveness to logistics providers and shippers alike.

The road-water segment registered the fastest compound annual growth rate of 12.9% in the target market primarily due to its ability to handle large volumes of cargo efficiently over long distances. This mode of transport leverages the cost-effectiveness of water transportation for bulk goods and the flexibility of road transport for first and last-mile connectivity. The segment benefits from increasing globalization and trade, where water routes provide economical solutions for international shipping. Additionally, advancements in intermodal terminals and logistics networks that integrate road and water transport seamlessly have further spurred growth in this segment.

Operation Insights

The domestic intermodal segment held the largest market share of 52.3% in the intermodal freight transportation market primarily because of its critical role in supporting regional economies and supply chains. It offers a cost-effective alternative to long-haul trucking by integrating multiple modes of transportation, such as rail and road, optimizing efficiency and reducing transportation costs. This segment benefits from increasing urbanization, e-commerce growth, and sustainability initiatives that favor environmentally friendly transport options. Moreover, investments in infrastructure development and improvements in intermodal terminals have further strengthened the segment's dominance by enhancing operational efficiency and service reliability.

The international intermodal segment registered the fastest compound annual growth rate of 12.3% in the target market primarily due to expanding global trade and supply chain complexities. This segment offers efficient and cost-effective solutions for transporting goods across international borders, leveraging multiple modes of transport such as road, rail, sea, and air. Increasing demand for just-in-time delivery and the need to optimize logistics costs are driving businesses to adopt international intermodal solutions. Furthermore, advancements in technology and infrastructure, along with favorable trade policies and agreements, are facilitating smoother cross-border movements, contributing to the segment's rapid growth.

Services Insights

The transportation & warehousing services segment held the largest market share of 35.6% in the intermodal freight transportation market due to its comprehensive offerings, such as logistics management, warehousing, and transportation solutions. This segment integrates various intermodal transport modes such as road, rail, sea, and air to provide end-to-end supply chain solutions tailored to diverse customer needs. Businesses benefit from the segment's ability to streamline operations, optimize freight costs, and enhance supply chain efficiency through integrated logistics services. Additionally, the segment's capability to handle complex shipping requirements, including specialized handling and storage, further solidifies its position as a preferred choice in the market.

The intermodal terminals segment is experiencing the fastest compound annual growth rate (CAGR) of 12.7% in the intermodal freight transportation market due to increasing demand for seamless connectivity between different transport modes. These terminals facilitate the efficient transfer and handling of goods between road, rail, sea, and air transport, reducing transit times and operational costs. The segment growth is attributable to investments in modernizing existing terminals and building new ones to accommodate larger freight volumes and improve logistics efficiency. Moreover, technological advancements, such as automated handling systems and real-time tracking, are enhancing terminal capabilities and attracting more users seeking reliable and integrated logistics solutions.

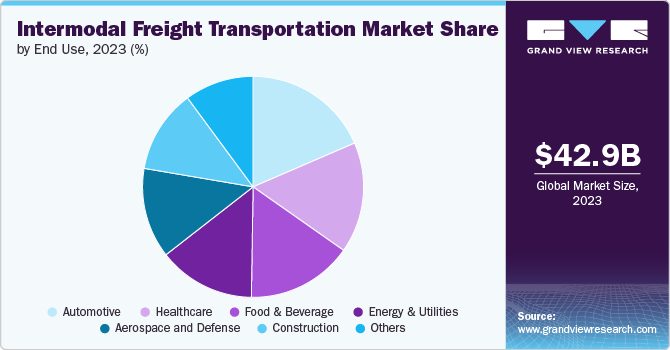

End Use Insights

The automotive segment held the largest share of 18.5% in the intermodal freight transportation market due to its extensive global supply chains and high-volume transportation needs. Automakers and suppliers benefit from intermodal solutions that combine road, rail, and sea transport to move vehicles and components across long distances efficiently. This segment leverages intermodal terminals equipped with specialized handling facilities tailored for automotive logistics, ensuring safe and efficient transport. Additionally, stringent delivery schedules and just-in-time manufacturing practices in the automotive industry drive demand for reliable and cost-effective intermodal transportation solutions, further solidifying its dominance in the market.

The aerospace and defense segment registered the fastest CAGR of 12.9% in the intermodal freight transportation market due to increasing global defense spending and aerospace manufacturing activities. These industries require specialized logistics solutions that integrate multiple transport modes to ensure the timely delivery of sensitive and high-value goods, such as aircraft parts and military equipment. Intermodal transportation offers flexibility and security features necessary for transporting these goods across long distances and varying terrains. Moreover, advancements in intermodal infrastructure, including specialized handling facilities and secure transportation routes, are further supporting the segment's growth by enhancing efficiency and reliability in logistics operations.

Regional Insights

North America held the largest share of 35.6% in the intermodal freight transportation market in 2023 primarily due to its robust infrastructure, extensive network of intermodal terminals, and strong integration of transport modes. The region benefits from a mature logistics industry that leverages intermodal capabilities to efficiently move goods across vast distances. Economic growth, particularly in sectors such as manufacturing, retail, and automotive, drives demand for reliable and efficient transportation solutions. Additionally, favorable government policies and trade agreements further support market growth by facilitating smoother cross-border movements and enhancing logistics efficiency.

U.S. Intermodal Freight Transportation Market Trends

The U.S. held the largest share in North America in 2023 in the intermodal freight transportation market due to its extensive transportation infrastructure, including a well-developed network of railways, highways, and ports. Additionally, the U.S. benefits from a strong economy and high demand for efficient logistics solutions across various industries, driving the dominance of its intermodal freight transportation sector in the region.

Asia Pacific Intermodal Freight Transportation Market Trends

In the intermodal freight transportation market, Asia Pacific registered the fastest CAGR of 13.0% in 2023, driven by rapid industrialization, urbanization, and expanding trade activities across the region. The demand for efficient and cost-effective logistics solutions, capable of integrating diverse transport modes like road, rail, sea, and air, has fueled this growth. Investments in infrastructure development, including modernizing ports and expanding rail networks, further supported the robust expansion of the market in Asia Pacific.

Europe Intermodal Freight Transportation Market Trends

Europe held a significant market share in the intermodal freight transportation market in 2023 due to its well-established logistics infrastructure and strong emphasis on sustainability in transportation. For instance, the region's intermodal terminals are equipped with advanced handling facilities that cater to diverse cargo types, enhancing operational efficiency. Additionally, Europe's strategic location and extensive network of railways and waterways facilitate seamless intermodal transport across the continent and beyond, supporting its competitive position in the global logistics landscape.

Key Intermodal Freight Transportation Company Insights

Some of the key companies operating in the intermodal freight transportation market include Oracle Corporation, Blue Yonder, Inc., among others.

-

Blue Yonder Group, Inc., formerly known as JDA Software, is a leading provider of end-to-end supply chain solutions, including those for the intermodal freight transportation market. The company's innovative logistics and transportation management systems optimize route planning, improve asset utilization, and enhance visibility across multiple transportation modes. By leveraging advanced AI and machine learning capabilities, the company enables businesses to streamline their intermodal operations, reduce costs, and improve service levels. Their solutions are widely adopted by global enterprises seeking to achieve greater efficiency and resilience in their supply chain operations.

WiseTech Global and Transplace, Inc. are some of the emerging market companies in the target market.

- WiseTech Global is a prominent provider of software solutions for the logistics industry, with a strong focus on the intermodal freight transportation market. The company's flagship product, CargoWise, offers comprehensive end-to-end logistics and supply chain management, including capabilities for managing intermodal transportation. By integrating various modes of transport, WiseTech Global's solutions enhance visibility, efficiency, and control across the entire supply chain, allowing businesses to optimize their operations and reduce costs. Their technology-driven approach and commitment to innovation have made them a key player in the global logistics software market, supporting enterprises in navigating complex intermodal transportation challenges.

Key Intermodal Freight Transportation Companies:

The following are the leading companies in the intermodal freight transportation market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle Corporation

- Cognizant Technology Solutions Corp

- HighJump (Körber AG)

- Blue Yonder, Inc.

- Transplace, Inc.

- GE Transportation (Wabtec Corporation)

- The Descartes Systems Group Inc. (Descartes Aljex)

- Motorola Solutions, Inc.

- Elemica (Eyefreight BV)

- WiseTech Global

Recent Developments

-

In March 2024, Blue Yonder, Inc. announced an agreement to acquire One Network Enterprises for around USD 839 million. The company aimed to create a unified, end-to-end supply chain platform that enhances real-time optimization, collaboration, and resilience across the supply chain ecosystem. This acquisition, along with previous investments, positions Blue Yonder to offer comprehensive solutions from planning to execution, leveraging advanced AI and multi-enterprise capabilities to address modern supply chain challenges.

-

In April 2024, WiseTech Global acquired Aktiv Data, a Finnish provider of electronic customs and freight forwarding solutions, to enhance its global customs capabilities through the integration of Aktiv Data's nTrax system into CargoWise. This acquisition aimed to simplify customs operations for international freight forwarders by offering a sophisticated solution tailored to Finland's cross-border requirements.

Intermodal Freight Transportation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 47.20 billion

Revenue forecast in 2030

USD 93.51 billion

Growth Rate

CAGR of 12.1% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, operation, services, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Oracle Corporation, Cognizant Technology Solutions Corp, HighJump (Körber AG), Blue Yonder, Inc., Transplace, Inc., GE Transportation (Wabtec Corporation), The Descartes Systems Group Inc. (Descartes Aljex), Motorola Solutions, Inc., Elemica. (Eyefreight BV), and WiseTech Global.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intermodal Freight Transportation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global intermodal freight transportation Market report based on type, operation, services, end use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Road-rail

-

Road-water

-

Road-air

-

Others

-

-

Operation Outlook (Revenue, USD Million, 2017 - 2030)

-

Domestic Intermodal

-

International Intermodal

-

-

Services Outlook (Revenue, USD Million, 2017 - 2030)

-

Fleet Management

-

Intermodal Terminals

-

Transportation & Warehousing Services

-

Freight Routing & Scheduling

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace and Defense

-

Healthcare

-

Energy & Utilities

-

Food & Beverage

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key players in the intermodal freight transportation market include Oracle Corporation, Cognizant Technology Solutions Corp, HighJump (Körber AG), Blue Yonder, Inc., Transplace, Inc., GE Transportation (Wabtec Corporation), The Descartes Systems Group Inc. (Descartes Aljex), Motorola Solutions, Inc., Elemica. (Eyefreight BV), and WiseTech Global.

b. The Intermodal Freight Transportation Market is growing significantly due to factors such as the need for a more reliable, safe, and efficient transportation system, containerization permitting easy handling of goods, growth in the domestic intermodal transportation market, and free trade agreements.

b. The global intermodal freight transportation market size was valued at USD 42.91 billion in 2023 and is expected to reach USD 47.20 billion in 2024.

b. The global intermodal freight transportation market is expected to witness a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 93.51 billion by 2030.

b. The domestic intermodal segment held the largest market share of 52.3% in the intermodal freight transportation market primarily because of its critical role in supporting regional economies and supply chains. It offers a cost-effective alternative to long-haul trucking by integrating multiple modes of transportation, such as rail and road, optimizing efficiency and reducing transportation costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.